Middle East & Africa Cold Chain Market Size (2024-2030)

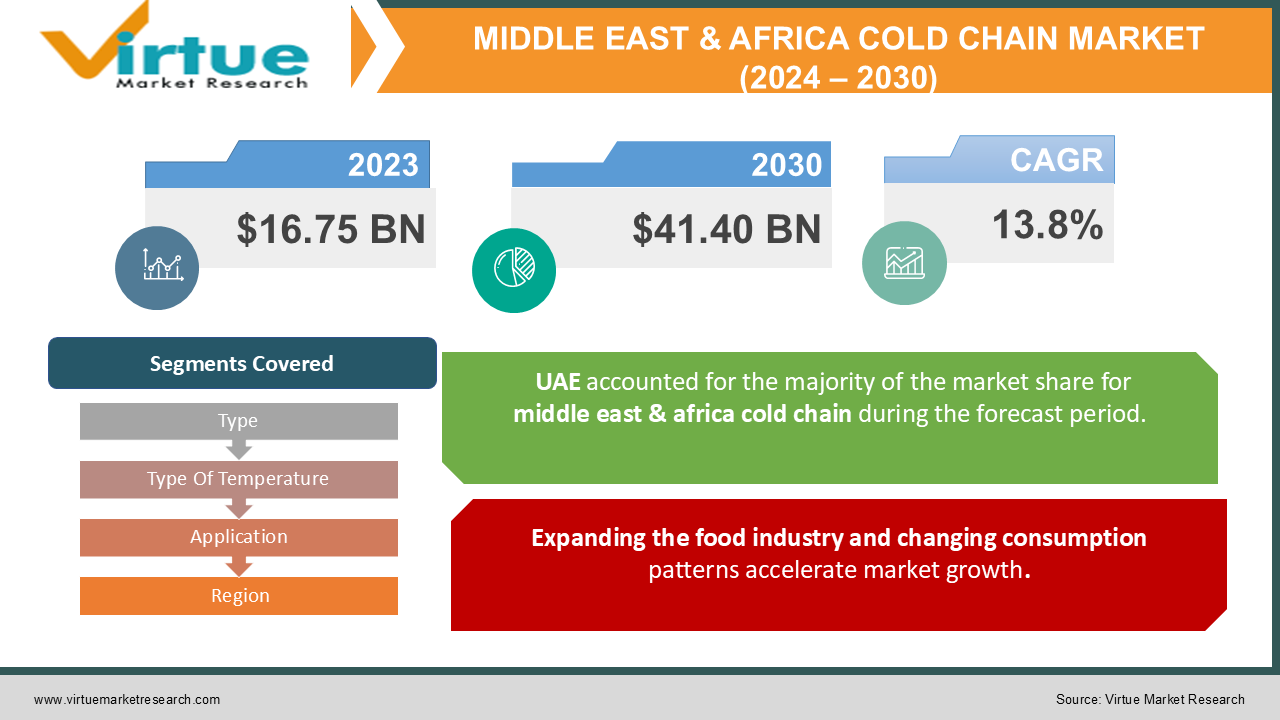

The Middle East & Africa cold chain market was valued at USD 16.75 billion in 2023 and is projected to reach a market size of USD 41.40 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 13.8%.

A cold chain is a temperature-controlled equipment used to control the quality and safety of perishable goods such as food, chemicals, and pharmaceuticals from the point of production to the point of consumption. It involves transporting, storing, and processing these items in a controlled environment to prevent deterioration, contamination, or spoilage. The main components of the cold chain include cold storage, refrigerated trucks, thermometers, and appropriate packaging. It is important to control the temperature throughout the chain, as it can affect product integrity and pose a risk to public health. The cold chain is especially important for industries where quality control and safety are important, such as food and pharmaceuticals. For example, vaccines, blood products, and some medications must be stored and transported at low temperatures to remain effective.

Key Market Insights:

- The Middle East and Africa's (MEA) cold chain market presents a landscape driven by several key market trends. One of the important factors affecting the market is the increase in the food industry in the region and the demand for perishable products. As the urban economy accelerates and consumer preferences change, the need for refrigeration solutions increases to ensure the quality and safety of food from farm to fork. Increasing disposable income and changing eating habits are driving this demand, leading to the growth of the refrigerated market in the Middle East and Africa region.

- In addition, the geographical location of the Middle East and Africa, which serves as a bridge between countries, brings opportunities and challenges to the cold market. The Middle East and Africa region is located next to the major economies of Europe, Asia, and Africa and is an important center in international trade and exports. However, logistics complexity and infrastructure limitations are a challenge for cold chain operators. It requires new solutions and integrated strategies to improve product quality and increase market access.

Middle East & Africa Cold Chain Market Drivers:

Increasing demand for temperature-sensitive pharmaceuticals and healthcare products drives the market forward.

There is a growing demand for heat-sensitive drugs and medical devices in the Middle East and Africa due to an aging population, increasing disease incidence, and evolving healthcare infrastructure. These products, such as vaccines, biologics, and blood products, require temperature control throughout the product to maintain its effectiveness and safety. Consequently, there's a growing need for advanced cold chain solutions, including refrigerated storage facilities, temperature-controlled transport, and monitoring systems, to ensure the integrity of these critical healthcare supplies.

Expanding the food industry and changing consumption patterns accelerate market growth.

The Middle East and Africa region is experiencing rapid growth, demographic changes, and changes in consumer preferences. This leads to the expansion of the food industry and the shift towards perishable food products. As consumers demand fresh, high-quality food items, there's an increasing emphasis on efficient cold chain infrastructure to preserve the freshness and nutritional value of perishable goods from farm to table. This trend is encouraging investment in cold storage, refrigerated transportation, and cold chain logistics services to meet the growing demand for temperature-sensitive foods in the region.

Strategic investments in infrastructure and logistics are boosting the market.

The Middle East and Africa region is making significant investments in infrastructure and transportation to improve cold chain capabilities and keep pace with the growing demand for transportation and storage. The government and private sector are investing in the expansion of cold storage, the development of new transportation systems, and the use of technologies such as temperature sensors and IoT solutions. The investments aim to improve product performance, reduce product losses, and capture opportunities in the fast-growing markets in the Middle East and Africa region.

Middle East & Africa Cold Chain Market Restraints and Challenges:

High initial investment and operational costs prove to be a challenge.

Designing and operating the cold chain requires significant investment in cold storage facilities, temperature-controlled transportation, and maintenance systems. Additionally, ongoing operating costs related to utilities, maintenance, and staff training can be very high, especially for small and medium-sized businesses (SMEs). High capital and operating expenses hinder the entry of new players and may limit the potential expansion of existing cold chain projects in the Middle East and Africa region.

Geographical and climate extremes hinder market growth.

The Middle East and Africa region has a wide range of geography and climate, from deserts to humid coastal areas. These changes make it difficult to control the temperature around the cold chain, especially in hot or humid regions. Operating refrigerators and trucks in such an environment requires good insulation, air conditioning, and electrical equipment to minimize the impact of other heat-sensitive materials. Additionally, climate change and seasonal changes affect the operation of the cooling system, requiring adaptation strategies and contingency plans to ensure product availability and safety.

Environmental impact and carbon footprints restrain market growth.

Cold chain operations use a lot of energy, mainly for cooling and temperature control. In regions where access to renewable energy is limited, such as parts of the Middle East and Africa, cooling systems often rely on fossil fuels, leading to greenhouse gas emissions and environmental damage. Increasing regional concerns about the environmental impact and carbon footprint of cold chain operations have led stakeholders to seek alternative, sustainable solutions. However, the transition to new technologies and applications in MEA's cold storage market will be difficult due to infrastructure constraints, rising costs, and limited regulatory restrictions, thus limiting economic growth.

Middle East & Africa Cold Chain Market Opportunities:

MEA's cold chain market has many opportunities for growth and innovation resulting from many factors. One notable opportunity lies in the region's rapidly expanding food industry, fueled by population growth, urbanization, and changing consumer preferences. As the demand for fresh and perishable foods increases, so does the need for cold storage solutions to maintain product quality and safety. Additionally, the focus on healthcare providers and the growth of medical products have opened up other profitable business opportunities. As medical technology advances and healthcare spending increases, the demand for thermosensitive drugs and biologics continues to increase, increasing the need for effective anti-inflammatory drugs. Additionally, investment strategies in infrastructure and technology create opportunities for stakeholders to capitalize on emerging opportunities and meet business needs in the MEA cold chain sector.

MIDDLE EAST & AFRICA COLD CHAIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.8% |

|

Segments Covered |

By Type, Type of temperature, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile, and Rest of Latin America |

|

Key Companies Profiled |

Aramex, Al-Futtaim Logistics, Emirates SkyCargo, DHL Supply Chain, Maersk Line, Saudi Airlines Cargo Company, Bidfood Middle East, Almajdouie Logistics, Fresh Del Monte Produce, RSA Global |

Middle East & Africa Cold Chain Market Segmentation:

Middle East & Africa Cold Chain Market Segmentation by Type

- Refrigerated Storage

- Refrigerated Transport

- Temperature Monitoring and Control

- Packaging Solutions

- Others

The refrigerated storage segment dominates the MEA market, accounting for more than 55% of the market in 2023. This section includes facilities such as cold storage warehouses, cold storage containers, and refrigerated vehicles used to store heat-sensitive products at a certain temperature. Cold storage is important for preserving the quality and safety of perishable products during transportation and storage, especially in industries such as food and pharmaceuticals. Throughout the projection period, the temperature monitoring and control segment is expected to develop at the fastest rate. Technological developments and the increased requirement to guarantee shipping integrity, efficiency, and safety are to blame for this expansion. Both the frontend hardware and the backend IT infrastructure used to gather and report real-time shipment data have made significant strides.

Middle East & Africa Cold Chain Market Segmentation by Type of Temperature:

- Chilled Temperature

- Frozen Temperature

- Ambient Temperature

- Controlled Room Temperature (CRT)

Frozen temperature is the largest growing category. Meat, cakes, and bread, as well as poultry, must be frozen to stay fresh. Because of this, frozen cold chain solutions are required to maintain the quality of pharmaceuticals and perishable food and beverages. The segment's growth is also fueled by the broad availability of cold chain storage and transportation options for freezing temperature ranges. The chilled temperature segment is the fastest-growing. The main reason for this dominance is the region's high demand for non-perishable food products such as fruits, vegetables, dairy products, and beverages, which must be refrigerated and transported to maintain their freshness and quality. There is also a growing demand for temperature-sensitive pharmaceuticals and refrigeration chemicals that fall within the chilled temperature range. The dominance of the chilled temperature segment highlights the importance of maintaining cold storage systems to support the storage, transportation, and distribution of perishable products in the Middle East and Africa region.

Middle East & Africa Cold Chain Market Segmentation by Application:

- Food and Beverages

- Pharmaceuticals and Healthcare

- Chemicals and Industrial Products

- Retail and E-commerce

- Others

Food and beverages share the largest portion of the Middle East and African markets. This section includes perishable foods such as fruits, vegetables, meat, seafood, dairy products, baked goods, and processed foods. Cold storage solutions are essential to maintain the freshness, quality, and safety of these foods throughout the supply chain, from production and processing to distribution and sale of goods. The pharmaceutical sector is the fastest-growing. Cold storage is necessary for pharmaceutical businesses to maintain the effectiveness of their goods and safeguard public health. Numerous pharmaceutical items, including biologics, antibiotics, and vaccines, are susceptible to temperature changes and may deteriorate if exposed to temperatures that are higher than those that are advised. In addition to its business advantages, cold storage provides ethical and sustainability benefits. Respecting temperature guidelines keeps items functional, minimizing waste and environmental damage. It also reduces the requirement for extra chemicals and resource purchases.

Middle East & Africa Cold Chain Market Segmentation: Regional Analysis:

- United Arab Emirates (UAE)

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

The UAE has the largest market in 2023. This is because of the increasing population, high purchasing power, and being very focused on food security. Investments in cold storage, refrigerated transportation, and temperature control have accelerated the growth of the refrigeration sector. Additionally, advancements in technology and regulatory initiatives aimed at enhancing cold chain efficiency and compliance contribute to the development of the cold chain industry. Saudi Arabia is growing at the fastest rate due to the rising need, especially in the food and pharmaceutical industries, for temperature-controlled storage and transportation solutions.

COVID-19 Impact Analysis on the Middle East & Africa Cold Chain Market:

The COVID-19 pandemic has significantly impacted MEA's cold chain market, creating challenges and opportunities. Due to the urgent need for vaccine distribution, demand for transporting the vaccines has increased as countries race to secure the region. Sudden increases in demand put pressure on existing infrastructure and logistics networks, causing bottlenecks and supply chain disruptions. Governments and organizations are increasing cold storage capacity, investing in transportation to control temperatures, and implementing sustainable distribution strategies to ensure vaccine delivery on time and in good condition. In addition, the global pandemic has revealed the importance of a strong and effective cold chain system in protecting public health and reducing the spread of the disease. While the current focus is on vaccine distribution, the pandemic has also increased investment in cold chain operations and technologies, paving the way for future growth and innovation in MEA's cold storage market.

Latest Trends/ Developments:

MEA's cold market has witnessed many trends and developments that have shaped its path. One of the key developments is the increasing use of technology to improve cold chain performance and reliability. This includes deploying IoT-enabled monitoring systems, temperature sensors, and real-time sensors to provide temperature-sensitive devices throughout the supply chain. Another consequence is the increasing demand for eco-friendly and efficient cooling solutions, driven by environmental concerns and regulatory requirements. The company is researching alternative refrigerants, electrical appliances, and green packaging to reduce its carbon footprint and impact on the environment. Additionally, there is an increase in transparency and traceability in the cold chain, with stakeholders using blockchain technology and digital platforms to provide visibility and accountability across equipment. This trend reflects the changing landscape of MEA's refrigerated market. It meets changing market and customer needs by focusing on innovation and sustainability.

Key Players:

- Aramex

- Al-Futtaim Logistics

- Emirates SkyCargo

- DHL Supply Chain

- Maersk Line

- Saudi Airlines Cargo Company

- Bidfood Middle East

- Almajdouie Logistics

- Fresh Del Monte Produce

- RSA Global

- In November 2023, Al-Futtaim Logistics launched its aerospace logistics division in the UAE. The division offers a comprehensive range of services that encompass airside deliveries at major UAE airports, multiple carrier options, Technician Onboard Charters (TOC), and a 24/7 centralized aerospace operations center with global reach. Furthermore, the company provides storage solutions adhering to the stringent standards of The General Civil Aviation Authority (GCAA) and ASA-100.

- In March 2023, Americold announced a strategic investment in Dubai Cold Storage Company (RSA Cold Chain). This partnership will provide a scalable, investable operating platform for market entry and expansion in the Middle East and India.

Chapter 1. Middle East & Africa Cold Chain Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East & Africa Cold Chain Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East & Africa Cold Chain Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East & Africa Cold Chain Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East & Africa Cold Chain Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East & Africa Cold Chain Market– By Type

6.1. Introduction/Key Findings

6.2. Refrigerated Storage

6.3. Refrigerated Transport

6.4. Temperature Monitoring and Control

6.5. Packaging Solutions

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Middle East & Africa Cold Chain Market– By Application

7.1. Introduction/Key Findings

7.2 Food and Beverages

7.3. Pharmaceuticals and Healthcare

7.4. Chemicals and Industrial Products

7.5. Retail and E-commerce

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Application

7.8. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Middle East & Africa Cold Chain Market– By Type of Temperature

8.1. Introduction/Key Findings

8.2. Chilled Temperature

8.3. Frozen Temperature

8.4. Ambient Temperature

8.5. Controlled Room Temperature (CRT)

8.6. Y-O-Y Growth trend Analysis By Type of Temperature

8.7. Absolute $ Opportunity Analysis By Type of Temperature , 2024-2030

Chapter 9 . Middle East & Africa Cold Chain Market, By Geography – Market Size, Forecast, Trends & Insights

9 .1. Middle East and Africa

9 .1.1. By Country

9 .1.1.1. Saudi Arabia

9 .1.1.2. Qatar

9 .1.1.3. UAE

9 .1.1.4. Israel

9 .1.1.5. South Africa

9 .1.1.6. Nigeria

9 .1.1.7. Kenya

9 .1.1.9 . Egypt

9 .1.1.9 . Rest of the Middle East

9.1.2. By Type

9.1.3. By Application

9.1.4. Type of Temperature

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Middle East & Africa Cold Chain Market– Company Profiles – (Overview, Type Type Portfolio, Financials, Strategies & Developments)

10.1. Aramex

10.2. Al-Futtaim Logistics

10.3. Emirates SkyCargo

10.4. DHL Supply Chain

10.5. Maersk Line

10.6. Saudi Airlines Cargo Company

10.7. Bidfood Middle East

10.8. Almajdouie Logistics

10.9. Fresh Del Monte Produce

10.10. RSA Global

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Middle East & Africa cold chain market was valued at USD 16.75 billion in 2023 and is projected to reach a market size of USD 41.40 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 13.8%.

The segments under the Middle East & Africa cold chain market based on type are refrigerated storage, refrigerated transport, temperature monitoring and control, packaging solutions, and others.

The UAE is dominant in the Middle East & Africa cold chain market.

. Aramex, Al-Futtaim Logistics, Emirates SkyCargo, DHL Supply Chain, and Maersk Line are the major players in this market.

The COVID-19 pandemic has significantly impacted MEA's cold chain market, creating challenges and opportunities. Due to the urgent need for vaccine distribution, demand for transporting the vaccines has increased as countries race to secure the region. Sudden increases in demand put pressure on existing infrastructure and logistics networks, causing bottlenecks and supply chain disruptions.