Asia Pacific Cold Chain Market Size (2024-2030)

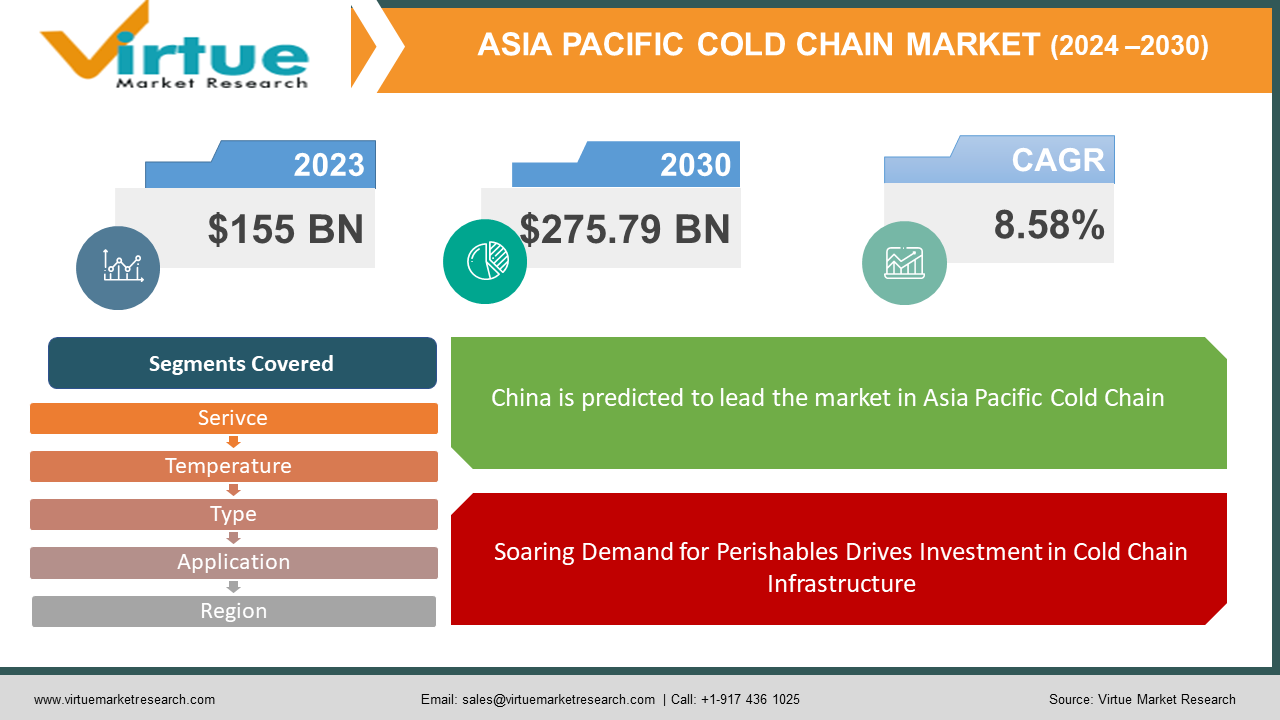

The Asia Pacific Cold Chain Market was valued at USD 155 billion in 2023 and is projected to reach a market size of USD 275.79 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 8.58%.

The Asia Pacific Cold Chain Market is experiencing a surge, driven by several factors. A booming population concentrated in cities is demanding more perishable goods like fresh produce, meat, and dairy. Rising disposable incomes allow consumers to spend more on these items. At the same time, growing awareness of food safety necessitates robust cold chain infrastructure to maintain proper temperatures throughout the supply chain. Governments are also implementing stricter regulations, further pushing investment in compliant cold chain solutions.

Key Market Insights:

- Consumers with more spending power are shifting their preferences towards temperature-sensitive food and medicine, highlighting the importance of maintaining freshness and safety throughout the supply chain.

- Stricter government regulations on food safety are another key driver in the Asia Pacific Cold Chain Market. These regulations are pushing for investment in compliant cold chain solutions across the region. China and India, with their massive populations and booming economies, are at the forefront of this market expansion.

- The Asia Pacific Cold Chain Market is not only growing but also evolving. The e-commerce boom and the expanding pharmaceutical sector are creating new opportunities for innovative cold chain logistics solutions. To navigate this complex and dynamic landscape, technological advancements are becoming increasingly important. Temperature monitoring, real-time tracking, and data analytics are crucial tools for improving the efficiency and effectiveness of cold chain operations, ensuring the timely delivery of perishable goods and temperature-sensitive medicine.

The Asia Pacific Cold Chain Market Drivers:

Soaring Demand for Perishables Drives Investment in Cold Chain Infrastructure

Billions of people across a rapidly urbanizing Asia Pacific region are demanding more perishable goods like fresh produce, meat, and dairy. This, coupled with rising disposable incomes, is leading to a shift towards temperature-sensitive food and medicine, placing a premium on maintaining freshness and safety throughout the supply chain.

Stricter Food Safety Regulations Push for Compliant Cold Chain Solutions

Governments across the region are implementing stricter regulations on food safety. This focus on safety standards is driving investment in compliant cold chain solutions, ensuring proper temperature control, and minimizing spoilage.

China and India's Growth Creates Need for Robust Cold Chain Management

These countries, with their massive populations and booming economies, are at the forefront of the market's expansion. Their significant growth necessitates robust cold chain infrastructure to manage the increasing demand for perishables and minimize food waste.

E-commerce Boom and Tech Advancements Drive Efficient Cold Chain Logistics

The rise of e-commerce creates a demand for efficient cold chain solutions to deliver temperature-sensitive goods directly to consumers. Additionally, advancements like temperature monitoring, real-time tracking, and data analytics are becoming crucial for optimizing efficiency and effectiveness within complex cold chain operations.

The Asia Pacific Cold Chain Market Restraints and Challenges:

While the Asia Pacific Cold Chain Market is experiencing tremendous growth, there are hurdles that slow its unbridled expansion. One major challenge lies in the high costs associated with establishing and maintaining cold chain infrastructure. Building and operating specialized storage facilities, refrigerated transportation units, and efficient cooling systems require significant capital investment. These costs are further exacerbated by high energy prices, which can particularly strain smaller companies. Furthermore, the region struggles with a gap in cold storage capacity compared to more developed markets.

Another roadblock is the lack of standardization across the region. Without consistent protocols for everything from operating procedures and security measures to temperature control and pest management, inefficiencies arise, and product quality can be compromised. The fragmented market landscape also presents challenges. The presence of numerous international and local players fosters competition, but it can also lead to a lack of coordination and inconsistency in service delivery throughout the supply chain. Finally, the talent pool for cold chain management can be limited in certain areas. The specialized skills and knowledge required for efficient cold chain operations, encompassing logistics expertise and technical knowledge of refrigeration systems, are not always readily available. Addressing these challenges will be crucial for the Asia Pacific Cold Chain Market to fully unlock its potential.

The Asia Pacific Cold Chain Market Opportunities:

The burgeoning Asia Pacific Cold Chain Market, fueled by a confluence of factors like rising demand for perishables, stricter food safety regulations, and a booming e-commerce sector, is brimming with lucrative opportunities for a diverse range of players. Cold chain logistics providers stand to benefit significantly as the need for efficient and temperature-controlled transportation, storage, and packaging solutions intensifies. Companies that offer a comprehensive suite of services tailored to specific needs, encompassing first-mile pick-up, long-haul transportation, and final-mile delivery with specialized packaging solutions for temperature-sensitive goods, are perfectly positioned for substantial growth. Warehouse operators have a golden opportunity to capitalize on this surge by investing in the development of modern cold storage facilities equipped with cutting-edge temperature control systems and automation technologies. These facilities will not only bridge the existing gap in storage capacity but also ensure the optimal preservation of perishable goods throughout the supply chain. By implementing policies that incentivize investment in cold chain infrastructure, promoting the adoption of standardized protocols for temperature control and food safety measures, and encouraging the development of skills programs for cold chain management professionals, governments can create a supportive ecosystem that fuels further growth and innovation within this dynamic market. By capitalizing on these diverse opportunities and addressing the existing challenges, the Asia Pacific Cold Chain Market can unlock its full potential, ensuring the safe and efficient delivery of perishable goods and temperature-sensitive products, ultimately contributing to a healthier and more prosperous future for the region.

ASIA-PACIFIC COLD CHAIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.58% |

|

Segments Covered |

By SERIVCE, TEMPERATURE Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, Japan, South Korea, India, Rest of the Asia-Pacific |

|

Key Companies Profiled |

GLP, ESR, Prologis, Sango, Logistics, Honeywell, Siemens, IBM, Microsoft, Cisco |

The Asia Pacific Cold Chain Market Segmentation:

Asia Pacific Cold Chain Market Segmentation: By Service:

- Storage

- Transportation

- Value-added Services

The dominant segment in the Asia Pacific Cold Chain Market by Service is Storage. This is because it forms the backbone of the cold chain, with warehouses acting as crucial hubs for storing perishable goods at consistent temperatures. The fastest-growing segment is Value-added Services. Rising demand for specialized packaging and advanced monitoring technologies to ensure product quality throughout the supply chain is driving significant growth in this area.

Asia Pacific Cold Chain Market Segmentation: By Temperature Type:

- Chilled

- Frozen

The dominant segment by Temperature Type in the Asia Pacific Cold Chain Market is likely Chilled. This is because chilled temperatures are suitable for a wider range of perishable goods, including fruits, vegetables, dairy products, and some pharmaceuticals. The fastest-growing segment is expected to be Pharmaceuticals, Life Sciences & Chemicals. This is due to stricter regulations and the expanding pharmaceutical sector in the region, demanding robust cold chain solutions for temperature-sensitive drugs and vaccines.

Asia Pacific Cold Chain Market Segmentation: By Application:

- Horticulture

- Dairy & Frozen Desserts

- Meats, Fish & Poultry

- Processed Food Products

- Pharmaceuticals, Life Sciences & Chemicals

- Other Applications

The dominance and fastest-growing segments within the Asia Pacific Cold Chain Market by application differ. Horticulture (fresh fruits & vegetables) currently holds the största (Swedish for "largest") market share due to the high perishability of these products. However, the Pharmaceuticals, Life Sciences & Chemicals segment is experiencing the most rapid growth on account of the increasing demand for stringent temperature control throughout the supply chain to maintain the efficacy and safety of these temperature-sensitive products.

Asia Pacific Cold Chain Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

As the economic powerhouse of Asia, China dominates the Cold Chain Market due to its massive population, rising disposable incomes, and a growing emphasis on food safety. Significant investments are being made in modern cold storage facilities and transportation infrastructure to meet the surging demand for perishables like fruits, vegetables, and meat. However, China still faces challenges in bridging the gap between existing cold storage capacity and the ever-increasing demand.

With a well-established and mature cold chain infrastructure, Japan sets the standard for efficiency and technological advancements in the region. However, the market growth is primarily driven by replacement and modernization of existing facilities, as the demand for perishables has reached a certain level of saturation.

India's Cold Chain Market is on a fast-track to growth, driven by its burgeoning population, rising urbanization, and increasing disposable incomes. However, the market is still in its developing stage, with a significant gap in cold storage infrastructure and a fragmented logistics landscape. Investments in building new facilities, upgrading existing ones, and improving overall connectivity are crucial for India to unlock its full cold chain potential.

COVID-19 Impact Analysis on the Asia Pacific Cold Chain Market:

The COVID-19 pandemic's impact on the Asia Pacific Cold Chain Market has been a double-edged sword. Lockdowns and travel restrictions initially disrupted supply chains, leading to a temporary decline in demand for cold chain services, especially for food items used in restaurants and hotels. Trade restrictions further hampered the movement of temperature-sensitive goods. Additionally, the initial focus on essential supplies like medical equipment diverted resources away from cold chain infrastructure for other perishables.

However, the pandemic also presented new opportunities. Increased concern about food safety during lockdowns led to a surge in online grocery shopping and food delivery services. This, in turn, boosted the demand for efficient cold chain solutions to deliver temperature-controlled food directly to consumers. The focus on vaccine development, storage, and distribution during the pandemic also significantly increased the demand for robust cold chain infrastructure for pharmaceuticals and life sciences products. Furthermore, the pandemic accelerated the growth of e-commerce, further propelling the need for efficient cold chain solutions to deliver temperature-sensitive goods across the region.

Latest Trends/ Developments:

The Asia Pacific Cold Chain Market is witnessing a surge in exciting new developments. Labor shortages and a focus on efficiency are driving the adoption of automation and robotics in warehouses, with solutions like automated storage systems and robotic picking/packing gaining traction. Additionally, Artificial Intelligence and Machine Learning are being leveraged to optimize operations through predictive maintenance, real-time route optimization, and improved demand forecasting. Transparency and traceability are being enhanced through the integration of Blockchain technology, providing real-time data on temperature control and product location throughout the supply chain. Sustainability is also a growing concern, with companies exploring energy-efficient refrigeration technologies, renewable energy sources, and green packaging materials. The Cold Chain-as-a-Service (CCaaS) model is gaining popularity, offering businesses a flexible pay-as-you-go solution for their cold chain needs. Recognizing the importance of a skilled workforce, governments are implementing initiatives to develop training programs and certifications for cold chain management professionals. E-commerce giants are also upping their game by investing in cold chain infrastructure or partnering with established providers to ensure efficient delivery of temperature-controlled goods directly to consumers. These advancements highlight the dynamic and evolving nature of the Asia Pacific Cold Chain Market, paving the way for a more secure and prosperous future through efficient and sustainable delivery of perishable goods and temperature-sensitive products.

Key Players:

- GLP

- ESR

- Prologis

- Sango Logistics

- Honeywell

- Siemens

- IBM

- Microsoft

- Cisco

Chapter 1. Asia Pacific Cold Chain Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Cold Chain Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Cold Chain Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Cold Chain Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Cold Chain Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Cold Chain Market– By Service

6.1. Introduction/Key Findings

6.2. Storage

6.3. Transportation

6.4. Value-added Services

6.5. Y-O-Y Growth trend Analysis By Service

6.6. Absolute $ Opportunity Analysis By Service , 2023-2030

Chapter 7. Asia Pacific Cold Chain Market– By Application

7.1. Introduction/Key Findings

7.2. Horticulture

7.3. Dairy & Frozen Desserts

7.4. Meats, Fish & Poultry

7.5. Processed Food Products

7.6. Pharmaceuticals, Life Sciences & Chemicals

7.7. Other Applications

7.8. Y-O-Y Growth trend Analysis By Application

7.9. Absolute $ Opportunity Analysis By Application , 2023-2030

Chapter 8. Asia Pacific Cold Chain Market– By Temperature Type

8.1. Introduction/Key Findings

8.2 Chilled

8.3. Frozen

8.4. Y-O-Y Growth trend Analysis Temperature Type

8.5. Absolute $ Opportunity Analysis Temperature Type , 2023-2030

Chapter 9. Asia Pacific Cold Chain Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Service

9.1.3. By Application

9.1.4. By Temperature Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Cold Chain Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 GLP

10.2. ESR

10.3. Prologis

10.4. Sango Logistics

10.5. Honeywell

10.6. Siemens

10.7. IBM

10.8. Microsoft

10.9. Cisco

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Asia Pacific Cold Chain Market was valued at USD 155 billion in 2023 and is projected to reach a market size of USD 275.79 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 8.58%.

Surging Demand and Evolving Preferences, Regulatory Push for Food Safety, Geographic Powerhouses: China and India, E-commerce Boom and Technological Advancements.

Horticulture, Dairy & Frozen Desserts, Meats, Fish & Poultry, Processed Food Products, Pharmaceuticals, Life Sciences & Chemicals, Other Applications

. China currently reigns supreme as the most dominant region in the Asia Pacific Cold Chain Market, driven by its massive population, surging disposable incomes, and growing emphasis on food safety.

GLP, ESR, Prologis, Sango Logistics, Honeywell, Siemens, IBM, Microsoft, Cisco