Europe Cold Chain Market Size (2024-2030)

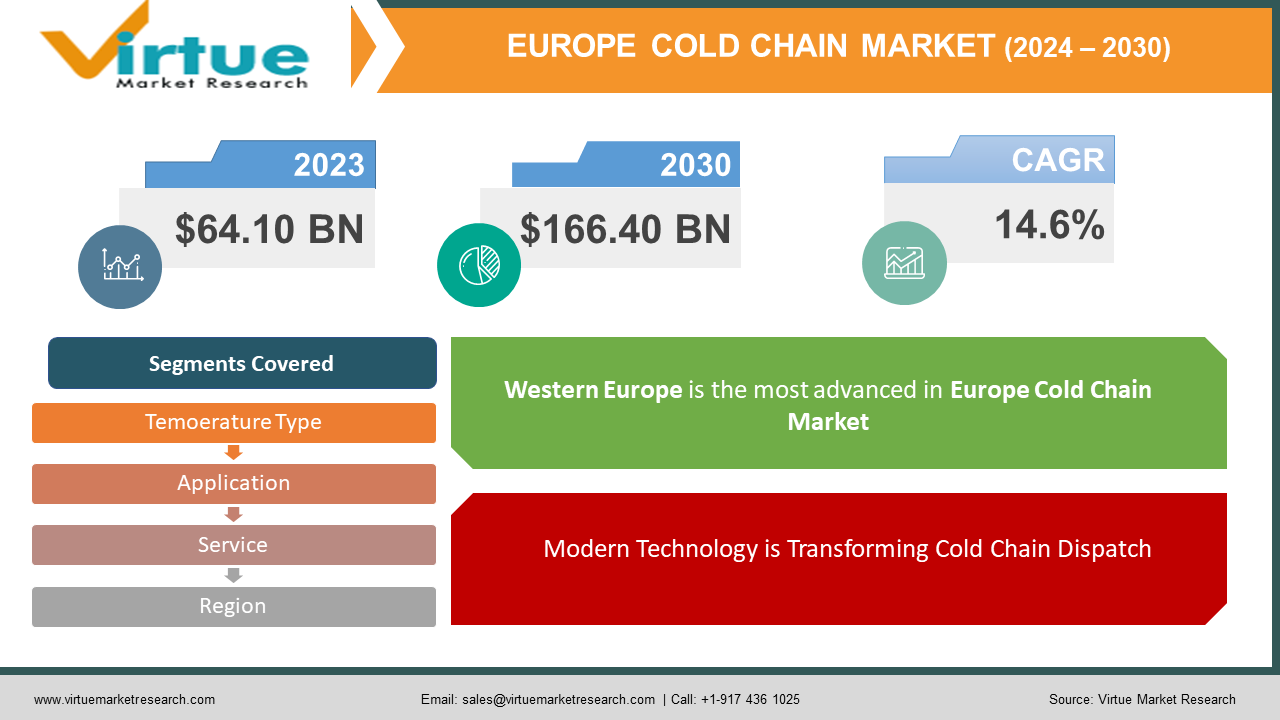

The Europe Cold Chain Market was valued at USD 64.10 billion in 2023 and is projected to reach a market size of USD 166.40 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 14.6%.

Food and medication must be kept fresh, which is why the tens of billions of dollars European cold chain business is expected to continue expanding. This extensive network, which is being driven by growing urbanisation and consumer expectations, must contend with issues like food spoiling, energy consumption, and complicated laws, but ongoing innovation should be able to fulfil the growing need for effective cold chain logistics.

Key Market Insights:

- Thanks in large part to the growth of e-commerce, Europe's cold chain is seeing a recent surge. In 2022 alone, the European Union imported almost $7 billion worth of fruits, vegetables, and nuts, demonstrating the growing need for cold chain logistics for fresh products.

- The pharmaceutical industry is a key driver, and demand for cold chains is expected to increase as it grows. Stricter laws governing the temperature-controlled storage of medications fuel industry growth.

- Cold chain is being impacted by concerns about sustainability. Investment in environmentally friendly and energy-efficient refrigeration systems is growing.

- The Europe cold chain market is changing because of technological innovations including RFID tagging, automation software, and IT solutions. This lowers expenses and lead times while also opening doors for industry participants that provide these cutting-edge solutions.

Europe Cold Chain Market Drivers:

The Cold Chain Industry Faces a Chilling Challenge Amidst Europe's Online Grocery Boom

The surge in European online grocery shopping is drawing attention to the necessity of having a strong cold chain infrastructure. Online grocery orders require a well-managed cold chain from farm to fridge, unlike traditional brick-and-mortar stores where temperature control is maintained throughout the shopping experience. Guarantees that until they arrive at the customer's door, fresh fruit, meat, and dairy items are transported and stored at the ideal temperatures. The convenience of online grocery shopping is drawing more and more European customers, which is driving up demand for dependable cold chain logistics. Correlates to the requirement for effective transportation networks, well-stocked warehouses including temperature-controlled areas, and creative packaging ideas to preserve food quality and safety throughout delivery. The capacity of the cold chain infrastructure to keep up with this expanding trend is critical to the success of online grocery shopping in Europe.

Modern Technology is Transforming Cold Chain Dispatch

Technological innovations are revolutionising the cold chain business by changing the tracking, storage, and delivery of temperature-sensitive goods. When temperatures change, real-time temperature monitoring systems give continuous information on the state of vehicles and warehouses, enabling prompt action. This reduces spoiling and gives businesses the ability to improve their routes and storage procedures. By using robots and artificial intelligence (AI) to perform duties like product retrieval and sorting within temperature-controlled zones, automated warehouses are optimising operations. Delivery times are accelerated because of improved efficiency and a decrease in human error. Lastly, RFID tagging provides unmatched supply chain visibility. Products may be RFID-tagged to track their position and temperature in real-time, which helps businesses maintain responsibility and lowers the chance of spoiling or product loss.

Europe Cold Chain Market Restraints and Challenges:

Even if the European cold chain is expanding, there are still chilly spots. Budgets are strained by high operating costs brought on by a lack of labour and growing energy prices. The persistence of food rotting emphasises the need for better temperature management. Efficiency may be hampered by the fragmented market with several small competitors, and logistical challenges may arise from Europe's intricate regulatory framework. Certain places have limited cold storage capacity, which leads to bottlenecks, and conventional methods give rise to sustainability problems. However, the European cold chain can overcome these obstacles and guarantee a bright future with the support of innovation in automation, logistical optimisation, and eco-friendly technology.

Europe Cold Chain Market Opportunities:

The cold chain sector in Europe is a hive of potential rather than merely a place to keep goods cold. The growth of e-commerce, especially in the grocery sector, necessitates the purchase of cold chain solutions for the delivery of fresh food. The thriving pharmaceutical sector is in dire need of trustworthy partners for vaccines and medications that are temperature-sensitive. Concerns about sustainability are growing, which is driving demand for eco-friendly refrigeration and waste minimization. Furthermore, businesses have an opportunity to create comprehensive cold chain management systems because of developments in automation, real-time monitoring, and data analysis. Lastly, an increasing requirement can be met by regional growth in places with inadequate cold storage capacity. The European cold chain can guarantee that its future is bright and, more crucially, fresh by seizing these chances.

EUROPE COLD CHAIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14.6% |

|

Segments Covered |

By temoerature Type, application, service, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profile, |

Bomi Group, C.H. Robinson, Carrier Global Corporation, CELH Freezer Services, DB Schenker, DHL Supply Chain, Fridge Logistics, Frigoscandia, Honeywell, Instacart |

Europe Cold Chain Market Segmentation:

Europe Cold Chain Market Segmentation: By Service

- Storage

- Transportation

- Value-added services

Even though transportation and storage are essential, value-added services are probably leading the cold chain industry in Europe due to the increased complexity of cold chain management. These services are the most sought-after and fastest-growing sector in this industry because they meet consumer demands for convenience, effectiveness, and less waste. Examples of these services include temperature-controlled packaging, real-time tracking, and route optimisation.

Europe Cold Chain Market Segmentation: By Temperature Type

- Chilled

- Frozen

When the cold chain market in Europe is divided into temperature-related segments, chilled items dominate because they can accommodate a greater range of commodities, such as dairy and fruits. However, the frozen food market is seeing a sharp increase in demand due to trends in convenience food, the growth of online grocery stores, and the impact of ethnic cuisine. Given its quick rise, frozen temperatures may soon overtake other temperature types as the fastest growing in the cold chain business in Europe.

Europe Cold Chain Market Segmentation: By Application

- Food & Beverages

- Pharmaceuticals

- Other Applications

Food and Beverages has the top position in the European cold chain market because of the wide range of temperature-sensitive products it handles. The market is segmented based on application. Pharmaceuticals, however, are expected to increase at the quickest rate. Strong cold chain solutions are becoming more and more necessary in the pharmaceutical industry due to factors including an ageing population, the increase of biologics that need storage, and tighter restrictions.

Europe Cold Chain Market Segmentation: By Region:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The cold chain market in Europe is not a one-size-fits-all scenario. The infrastructure in Western Europe is the most advanced, whilst Central and Eastern Europe is rapidly expanding. While this is going on, Southern Europe concentrates on maintaining a robust cold chain for fruits, vegetables, and other produce to preserve its agricultural wealth. The requirement for customised solutions to meet the various needs of the European cold chain business is shown by this geographical segmentation.

Germany has a significant cold chain market due to a robust pharmaceutical sector and high demand for processed and frozen foods. The UK has strong market growth and is driven by the pharmaceutical industry and a rise in e-commerce grocery deliveries. France and Italy are significant due to their large food and beverage sectors, with a growing demand for high-quality and organic products. Spain has a strong emphasis on fresh fruits, vegetables, and seafood. Advanced logistics and transportation networks support efficient cold chain operations. The rest of Europe has a significant market share due to rising demand for fresh and frozen food products due to health consciousness and changing dietary habits. Also, the expansion of online grocery shopping and home delivery services boosted the demand for efficient cold chain solutions.

COVID-19 Impact Analysis on the Europe Cold Chain Market:

A chilly shock was sent to the European cold chain by COVID-19. The business was compelled to adjust due to disrupted supply chains and a change in customer behaviour from restaurants to grocery shops. Lack of labour created even another level of difficulty. There was one benefit to the epidemic, though. The rise in online grocery shopping has increased demand for cold chain systems that can deliver fresh food. The distribution of vaccines and medications relies heavily on cold chain infrastructure, which emphasises its significance. It is anticipated that this renewed understanding and greater investment in the industry will melt the obstacles and drive the European cold chain market towards a more inventive and resilient future.

Recent Trends and Developments in the Europe Cold Chain Market:

In addition to keeping items cold, Europe's cold chain sector is always coming up with new ideas to stay ahead of the curve. With environmentally friendly options like green packaging and refrigerants, sustainability is gaining prominence. Robots are automating warehouses, and self-driving vehicles are travelling great distances. Automation is on the rise. When it comes to making decisions, planning routes, and anticipating maintenance requirements, data analysis is crucial. Grocery e-commerce is receiving special treatment, including quick pick-up alternatives and temperature-controlled packaging. Express delivery options are putting medications on the fast track as well. These patterns show that the cold chain logistics sector in Europe is a dynamic, ever-evolving one, dedicated to effective and sustainable operations.

Key Players:

- Bomi Group

- C.H. Robinson

- Carrier Global Corporation

- CELH Freezer Services

- DB Schenker

- DHL Supply Chain

- Fridge Logistics

- Frigoscandia

- Honeywell

- Instacart

Chapter 1. Europe Cold Chain Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Cold Chain Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Cold Chain Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Cold Chain Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Cold Chain Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Cold Chain Market– By Service

6.1. Introduction/Key Findings

6.2. Storage

6.3. Transportation

6.4. Value-added services

6.5. Y-O-Y Growth trend Analysis By Service

6.6. Absolute $ Opportunity Analysis By Service , 2024-2030

Chapter 7. Europe Cold Chain Market– By Temperature Type

7.1. Introduction/Key Findings

7.2 Chilled

7.3. Frozen

7.4. Y-O-Y Growth trend Analysis By Temperature Type

7.5. Absolute $ Opportunity Analysis By Temperature Type , 2024-2030

Chapter 8. Europe Cold Chain Market– By Application

8.1. Introduction/Key Findings

8.2. Food & Beverages

8.3. Pharmaceuticals

8.4. Other Applications

8.5. Y-O-Y Growth trend Analysis Application

8.6. Absolute $ Opportunity Analysis Application , 2024-2030

Chapter 9. Europe Cold Chain Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Application

9.1.3. By Temperature Type

9.1.4. By Service

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Cold Chain Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Bomi Group

10.2. C.H. Robinson

10.3. Carrier Global Corporation

10.4. CELH Freezer Services

10.5. DB Schenker

10.6. DHL Supply Chain

10.7. Fridge Logistics

10.8. Frigoscandia

10.9. Honeywell

10.10. Instacart

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Cold Chain Market size is valued at USD 64.10 billion in 2023.

The worldwide Europe Cold Chain Market growth is estimated to be 14.6% from 2024 to 2030.

Europe Cold Chain Market segmentation covered in the report is By Service (Storage, Transportation, Value-added services); By Temperature Type (Chilled, Frozen); By Application (Food & Beverages, Pharmaceuticals, Other Applications) and by region.

Future developments in e-commerce food and medicines, together with themes like automation and sustainability, are expected to propel the growth of the cold chain industry in Europe.

In addition to creating supply chain problems and altering customer behaviour, the COVID-19 pandemic increased demand for online grocery shopping and brought attention to the cold chain's role in vaccine delivery while also disrupting Europe's cold chain market.