Lithium-Ion Battery Recycling Market Size (2025-2030)

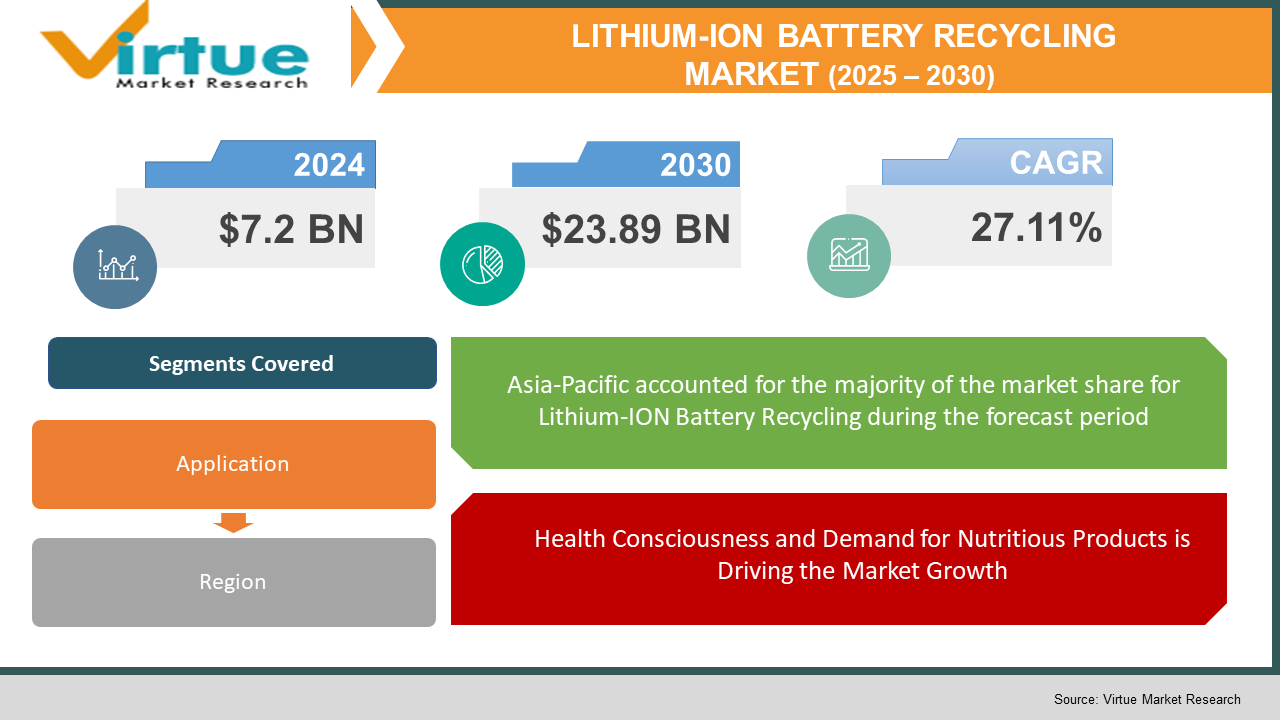

The Global Lithium-ION Battery Recycling Market was valued at USD 7.2 billion in 2024 and is projected to reach a market size of USD 23.89 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 27.11%.

The Lithium-Ion Battery Recycling Market is gaining significant traction as the need for electric vehicles (EVs), consumer electronics, and renewable energy storage solutions continues to rise. With lithium-ion batteries being widely used due to their high energy density and long lifespan, the need for sustainable disposal and resource recovery has become critical. Recycling these batteries helps recover valuable metals such as lithium, cobalt, and nickel, reducing dependence on mining and minimizing environmental impact. Governments and industries worldwide are implementing stringent regulations and investing in advanced recycling technologies to create a circular economy for battery materials. The rising concern over battery waste, coupled with the rising costs of raw materials, is driving innovations in efficient and eco-friendly recycling processes. This market is poised for rapid growth, supported by technological advancements, increasing awareness, and regulatory initiatives promoting sustainability in the energy storage ecosystem.

Key Market Insights:

- The Lithium-Ion Battery Recycling Market is witnessing rapid expansion, driven by the growing adoption of electric vehicles (EVs) and the rising demand for energy storage solutions. According to industry estimates, over 15 million metric tons of lithium-ion batteries are expected to reach the end of their lifecycle by 2030, creating an urgent need for sustainable recycling solutions. In addition, more than 95% of key materials, such as lithium, cobalt, and nickel, can be recovered from recycled batteries, significantly reducing the dependency on mining and lowering production costs.

- Government regulations and sustainability initiatives are playing a pivotal role in accelerating the recycling industry. The European Union’s Battery Directive mandates a minimum recycling efficiency of 50%, while China has introduced strict guidelines requiring battery manufacturers to be responsible for proper disposal and recycling. Meanwhile, the U.S. Department of Energy has launched funding programs to develop advanced battery recycling technologies, further fueling market growth.

- Technological advancements in battery recycling are making the process more efficient and cost-effective. Hydrometallurgical methods, which offer a recovery efficiency of up to 98%, are gaining traction because of their ability to extract high-purity materials with minimal environmental impact. Additionally, the emergence of direct recycling methods that refurbish battery cathodes without breaking down individual elements is expected to revolutionize the market, reducing energy consumption and processing costs.

Lithium-ION Battery Recycling Market Drivers:

Increasing Adoption of Electric Vehicles (EVs) is Driving the Demand for Lithium-Ion Battery Recycling

The rapid global shift towards electric mobility has remarkably increased the consumption of lithium-ion batteries, leading to a growing need for sustainable recycling solutions. With EV adoption surging, millions of batteries will reach end-of-life in the coming years, necessitating efficient recycling processes to recover valuable materials like lithium, cobalt, and nickel. Governments worldwide are implementing strict regulations on battery disposal and promoting recycling initiatives, further fueling market growth.

Rising Concerns Over Environmental Pollution and Resource Depletion are Encouraging Battery Recycling Efforts

The extraction of lithium and other critical minerals poses severe environmental challenges, including water depletion, land degradation, and carbon emissions. Recycling lithium-ion batteries reduces the need for mining, significantly lowering the ecological footprint associated with battery production. Additionally, improper disposal of used batteries leads to hazardous waste accumulation, creating risks of soil and water contamination. As awareness about these environmental hazards grows, industries and policymakers are emphasizing the importance of battery recycling.

Government Regulations and Incentives are Boosting the Lithium-Ion Battery Recycling Industry

Governments across North America, Europe, and Asia-Pacific are introducing stringent policies to regulate battery disposal and encourage recycling. Many countries have imposed mandatory recycling targets for battery manufacturers, ensuring a closed-loop system for material recovery. Incentives such as tax benefits, subsidies, and funding for recycling infrastructure are further motivating companies to invest in advanced battery recycling technologies. These regulations are not only reducing environmental impact but also strengthening domestic supply chains for critical battery materials.

Technological Advancements in Battery Recycling are Enhancing Efficiency and Profitability

The lithium-ion battery recycling market is witnessing remarkable technological innovations, improving the efficiency and cost-effectiveness of material recovery processes. Advanced hydrometallurgical and direct recycling techniques allow for higher recovery rates of lithium, cobalt, and nickel while reducing energy consumption. Companies are also investing in AI-driven sorting systems and automation to enhance the scalability of recycling operations. These advancements are making battery recycling a commercially viable and environmentally sustainable solution for meeting the growing demand for raw materials in the energy storage industry.

Lithium-ION Battery Recycling Market Restraints and Challenges:

High Recycling Costs and Complex Processes Pose Significant Challenges for Market Growth

One of the key restraints in the lithium-ion battery recycling market is the high cost associated with the recycling process, making it less economically viable compared to raw material extraction. The complex composition of lithium-ion batteries, which varies across manufacturers, requires advanced separation and processing techniques, increasing operational expenses. Additionally, the lack of standardized recycling infrastructure and collection networks in many regions limits the efficiency of battery recovery. Safety concerns related to handling and transporting used batteries, including fire hazards and toxic chemical exposure, further complicate the recycling process. Addressing these challenges will require significant investments in research, automation, and regulatory support to create a more efficient and cost-effective recycling ecosystem.

Lithium-ION Battery Recycling Market Opportunities:

The growing global push for sustainability and circular economy practices presents a major opportunity for the lithium-ion battery recycling market, as governments and industries focus on reducing reliance on virgin raw materials such as lithium, cobalt, and nickel. With the rapid expansion of electric vehicles (EVs) and renewable energy storage systems, the need for efficient battery disposal and material recovery is becoming critical, driving investments in advanced recycling technologies. Supportive policies, such as extended producer responsibility (EPR) regulations and government incentives for recycled battery materials, further enhance market potential. Additionally, advancements in direct cathode recycling and hydrometallurgical processes are improving efficiency and profitability, making battery recycling a key component in securing a stable and sustainable battery supply chain.

LITHIUM-ION BATTERY RECYCLING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

27.11% |

|

Segments Covered |

By application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Umicore , Li-Cycle Holdings Corp. , Redwood Materials, Inc. , Glencore , Retriev Technologies , American Battery Technology Company (ABTC) , GEM Co., Ltd. , ACCUREC Recycling GmbH , TES-Amm , Fortum Oyj |

Lithium-ION Battery Recycling Market Segmentation:

Lithium-Ion Battery Recycling Market Segmentation: By Application:

- Transportation

- Consumer Electronics

- Industrial

The transportation sector is the dominant segment in the lithium-ion battery recycling market, primarily because of the rapid growth of electric vehicles (EVs) and hybrid electric vehicles (HEVs), which consume a significant portion of lithium-ion batteries worldwide. With governments and automakers pushing for EV adoption to meet sustainability goals, a substantial number of EV batteries are reaching the end of their lifecycle, creating a strong demand for efficient recycling solutions. These batteries contain valuable materials such as lithium, cobalt, and nickel, which can be recovered and reused to produce new batteries, reducing reliance on raw material mining and promoting a circular economy.

The fastest-growing segment is consumer electronics, fueled by the increasing global usage of smartphones, laptops, tablets, smartwatches, and other portable devices that rely on lithium-ion batteries for power. The constant innovation in consumer electronics has led to shorter product life cycles, resulting in a significant rise in discarded batteries that require proper recycling to prevent hazardous waste accumulation. Governments and environmental agencies are enforcing strict e-waste management policies, take-back programs, and recycling initiatives to manage the rising volume of used batteries. Additionally, advancements in recycling technologies are enabling the efficient extraction of high-purity materials from small-format batteries, ensuring their reuse in manufacturing new devices, thereby reducing costs and minimizing environmental impact. As technology continues to evolve, this segment is expected to witness exponential growth, with a focus on enhancing collection methods and improving material recovery efficiency.

Lithium-Ion Battery Recycling Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia-Pacific dominates the lithium-ion battery recycling market, contributing approximately 45% of the global share. This leadership is largely because of the presence of major battery-producing nations such as China, Japan, and South Korea, which have established robust recycling ecosystems. China, in particular, has implemented stringent policies to regulate battery waste, ensuring that lithium, cobalt, and nickel are efficiently recovered and reused in new battery production. Additionally, the presence of large-scale battery manufacturers and electric vehicle (EV) giants has accelerated the adoption of recycling technologies in the region. Companies are actively investing in advanced battery recycling plants, leveraging automation and AI to improve recovery efficiency. The growing demand for electric vehicles and government initiatives aimed at achieving a sustainable energy ecosystem further support the region’s dominance in this sector.

Europe is emerging as the fastest-growing region in the lithium-ion battery recycling market, driven by strict environmental regulations, carbon neutrality goals, and a shift toward a circular economy. The European Union has enforced aggressive recycling policies, compelling automakers and battery producers to integrate sustainable battery management into their supply chains. Countries like Germany, France, and the UK are at the forefront, establishing dedicated battery recycling facilities and investing in cutting-edge recovery processes. The rising adoption of electric vehicles, coupled with the EU’s push to reduce reliance on raw material imports, has further accelerated growth. With major automotive brands committing to sustainable battery disposal and reuse, the region is witnessing a surge in technological advancements, including hydrometallurgical and direct cathode recycling methods.

COVID-19 Impact Analysis on the Global Lithium-ION Battery Recycling Market:

The COVID-19 pandemic had a mixed impact on the global lithium-ion battery recycling market. In the initial phase, supply chain disruptions, lockdown restrictions, and reduced industrial activities led to a decline in battery waste collection and recycling operations. Many recycling facilities faced temporary shutdowns, while delays in new EV production reduced the short-term demand for recycled materials. However, the pandemic also reinforced the importance of supply chain resilience and resource security, prompting governments and companies to invest more in localized battery recycling infrastructure. The surge in the need for electric vehicles and energy storage solutions post-pandemic, coupled with stricter environmental regulations, has accelerated the adoption of advanced recycling technologies, driving long-term growth in the market.

Latest Trends/ Developments:

The lithium-ion battery recycling market is experiencing significant advancements, driven by innovations in sustainable recovery technologies and increasing environmental regulations. One of the most notable trends is the development of direct recycling methods, which allow the recovery of cathode materials with minimal chemical processing, reducing costs and energy consumption. Additionally, companies are focusing on closed-loop recycling systems, enabling manufacturers to reuse recovered materials directly in new battery production, ensuring a more sustainable and cost-effective supply chain. Governments worldwide are also enforcing stricter policies, such as extended producer responsibility (EPR) programs, compelling battery manufacturers to take accountability for end-of-life battery disposal and recycling.

Another key development is the growing role of strategic partnerships and investments in battery recycling facilities. Major automakers, technology firms, and recycling companies are collaborating to establish large-scale recycling plants, ensuring a steady supply of critical battery materials such as lithium, cobalt, and nickel. The rise in electric vehicle (EV) adoption has further accelerated the demand for efficient recycling solutions, with companies exploring automation and AI-driven sorting technologies to enhance the efficiency of material recovery. Additionally, the push toward second-life applications for used batteries in energy storage solutions is gaining traction, extending battery life cycles and reducing waste.

Key Players:

- Umicore

- Li-Cycle Holdings Corp.

- Redwood Materials, Inc.

- Glencore

- Retriev Technologies

- American Battery Technology Company (ABTC)

- GEM Co., Ltd.

- ACCUREC Recycling GmbH

- TES-Amm

- Fortum Oyj

Chapter 1. LITHIUM-ION BATTERY RECYCLING MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. LITHIUM-ION BATTERY RECYCLING MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. LITHIUM-ION BATTERY RECYCLING MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. LITHIUM-ION BATTERY RECYCLING MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. LITHIUM-ION BATTERY RECYCLING MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. LITHIUM-ION BATTERY RECYCLING MARKET – By Application

6.1 Introduction/Key Findings

6.2 Transportation

6.3. consumer electronics

6.4. industrial

6.5 Y-O-Y Growth trend Analysis By Application

6.6 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. LITHIUM-ION BATTERY RECYCLING MARKET - By Geography – Market Size, Forecast, Trends & Insights

7.1. North America

7.1.1. By Country

7.1.1.1. U.S.A.

7.1.1.2. Canada

7.1.1.3. Mexico

7.1.2. By Application

7.1.3. Countries & Segments - Market Attractiveness Analysis

7.2. Europe

7.2.1. By Country

7.2.1.1. U.K.

7.2.1.2. Germany

7.2.1.3. France

7.2.1.4. Italy

7.2.1.5. Spain

7.2.1.6. Rest of Europe

7.2.2. By Application

7.2.3. Countries & Segments - Market Attractiveness Analysis

7.3. Asia Pacific

7.3.1. By Country

7.3.1.1. China

7.3.1.2. Japan

7.3.1.3. South Korea

7.3.1.4. India

7.3.1.5. Australia & New Zealand

7.3.1.6. Rest of Asia-Pacific

7.3.2. By Application

7.3.3. Countries & Segments - Market Attractiveness Analysis

7.4. South America

7.4.1. By Country

7.4.1.1. Brazil

7.4.1.2. Argentina

7.4.1.3. Colombia

7.4.1.4. Chile

7.4.1.5. Rest of South America

7.4.2.By Application

7.4.3. Countries & Segments - Market Attractiveness Analysis

7.5. Middle East & Africa

7.5.1. By Country

7.5.1.1. United Arab Emirates (UAE)

7.5.1.2. Saudi Arabia

7.5.1.3. Qatar

7.5.1.4. Israel

7.5.1.5. South Africa

7.5.1.6. Nigeria

7.5.1.7. Kenya

7.5.1.7. Egypt

7.5.1.7. Rest of MEA

7.5.2. By Application

7.5.3. Countries & Segments - Market Attractiveness Analysis

Chapter 8. LITHIUM-ION BATTERY RECYCLING MARKET – Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

8.1 Umicore

8.2 Li-Cycle Holdings Corp.

8.3 Redwood Materials, Inc.

8.4 Glencore

8.5 Retriev Technologies

8.6 American Battery Technology Company (ABTC)

8.7 GEM Co., Ltd.

8.8 ACCUREC Recycling GmbH

8.9 TES-Amm

8.10 Fortum Oyj

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Lithium-ION Battery Recycling Market was valued at USD 7.2 billion in 2024 and is projected to reach a market size of USD 23.89 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 27.11%.

Increasing demand for electric vehicles (EVs) and sustainable battery disposal solutions is driving the global lithium-ion battery recycling market.

Based on Application, the Global Lithium-ION Battery Recycling Market is segmented into Transportation, Consumer Electronics, and Industrial.

Asia-Pacific is the most dominant region for the Global Lithium-ION Battery Recycling Market.

Umicore, Li-Cycle Holdings Corp., Redwood Materials, Inc., and Glencore are the leading players in the Global Lithium-ION Battery Recycling Market.