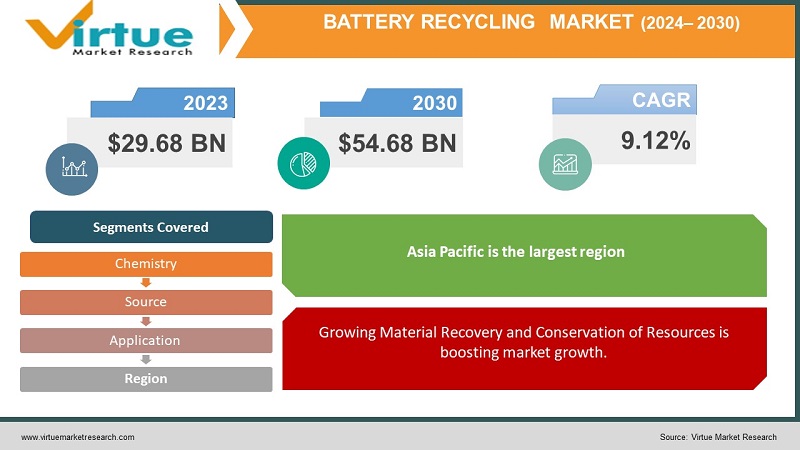

GLOBAL BATTERY RECYCLING MARKET SIZE (2024 - 2030)

The Global Battery Recycling Market was valued at USD 29.68 billion and is projected to reach a market size of USD 54.68 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.12%.

The battery recycling market plays a role, in collecting, processing, and extracting materials from used batteries while minimizing harm to the environment. This encompasses the types of batteries used in vehicles, smartphones, laptops, and renewable energy systems. The primary objective of battery recycling is to prevent the disposal of batteries in landfills or incinerators which can lead to pollution and health risks due to the presence of chemicals and heavy metals. Instead, the focus is on recovering materials such as lithium, cobalt, nickel, lead, and other metals through techniques like smelting, hydrometallurgy, and mechanical separation.

Battery recycling serves purposes beyond conserving resources. It also helps meet the increasing demand driven by the expanding battery industry. By reusing materials from recycled batteries instead of relying on mining new resources, we can contribute to a sustainable circular economy. The battery recycling market involves stakeholders such as battery manufacturers recycling companies, collection centers, government entities, environmental agencies, and consumers. Ensuring efficient recycling practices are implemented successfully requires an established combination of collection infrastructure for used batteries along, with state-of-the-art recycling facilities supported by regulatory frameworks.

Article: Global Battery Recycling & Second-Life Supply Chain Market: What Wins

Key Market Insights:

The demand, for batteries in the United States, is expected to rise as a result of the implementation of policies that promote vehicle (EV) sales, like the Responsible Battery Recycling Act of 2022 in California. Furthermore, the presence of players, in the industry will also contribute to this growth in the coming years.

The 2022 California Responsible Battery Recycling Act requires all battery retailers, in the state to set up a system, for collecting used batteries to recycle and reuse them.

In 2022 the International Energy Association (IEA) reported that 13% of purchased cars were electric leading to a significant global demand, for lithium ion batteries. As a result, there is an increasing need to recycle used batteries to recover cobalt for their use, in vehicles worldwide.

Based on the data, from ACEA (the European Automobile Manufacturers Association) battery electric vehicles (BEVs) achieved results in 2022. They accounted for 12.1 percent of the market share which's a significant increase compared to 9.1 percent in 2021 and just 1.9 percent in 2019. This substantial growth is expected to have an impact on the battery recycling industry, in Europe in the coming years.

Battery Recycling Market Drivers:

Growing Material Recovery and Conservation of Resources is boosting market growth.

Battery recycling plays a role, in reclaiming resources such as lithium, cobalt, nickel, and other metals. Since these resources are limited and extracting them from sources can be costly recycling becomes a solution to both preserve our resources and reduce our reliance on mining. The financial value of these materials serves as a driving force, behind the battery recycling industry.

Expansion of the electric vehicle market is contributing to market expansion.

The increasing preference of consumers, for environmentally friendly transportation options is driving the demand for electric vehicles. Additionally, the adoption of vehicles is on the rise due to their energy efficiency and ability to control pollution. The growth of vehicles is also supported by advancements, in battery technology, energy density improved charging capabilities, and reduced maintenance requirements. As a result of these factors, it is expected that the battery recycling market will continue to expand alongside the increasing use of vehicles.

An acceleration of technological progress is fueling innovation and helping to grow the market.

The market is experiencing growth due, to developments, in battery recycling technologies and procedures. The increased efficiency, cost-effectiveness, and capacity to handle battery chemistries have made battery recycling operations more feasible. Investments are being. The market is being propelled forward by advancements.

Battery Recycling Market Restraints and Challenges:

The battery recycling industry faces challenges due, to the costs involved and the limited availability of advanced technologies. Recycling batteries requires time-consuming and expensive processes, such as collection, sorting, disassembly, and extracting materials like nickel, cobalt, lithium, and rare earth metals. The expenses further rise due to the necessity of handling and disposing of compounds found in batteries. Another issue is the lack of methods for battery recycling. It's crucial to develop effective procedures that can handle types of batteries with varying chemistries. Moreover, recycling techniques need to keep up with advancements in battery technology to ensure the recovery of materials while minimizing waste. Hence investing in research and development, for battery recycling technologies becomes essential to overcome these challenges.

Battery Recycling Market Opportunities:

The renewable energy industry, which includes wind power is experiencing growth. To carry out functions most of the storage systems, for renewable energy rely on batteries like lithium-ion, lead acid, and sodium-sulfur. Consequently, as the number of energy installations increases, there is a requirement, for battery recycling to handle end-of-life batteries and recover valuable materials for reuse.

BATTERY RECYCLING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.12% |

|

Segments Covered |

By Chemistry, Source, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Umicore N.V. , Retriev Technologies Inc. , Exide Technologies , Call2Recycle , Gopher Resource LLC , Aqua Metals Inc. GEM Co., Ltd. , Ecobat Technologies Ltd. , Terrapure Environmental |

Battery Recycling Market Segmentation:

Battery Recycling Market Segmentation: By Chemistry

- Lead-Acid Based Battery

- Lithium-Ion Based Battery

- Nickel-Based Battery

- Other Battery Types

The lead-acid segment was the contributor, to the revenue in the Battery recycling market in 2022 accounting for a share of 85.41%. Lead acid batteries are considered recyclable compared to types of batteries because they contain reusable materials such, as lead and plastics. Companies involved in battery recycling collect used batteries from consumers with the aim of recycling and reusing them. The used batteries undergo a process of breaking them into pieces. The plastic components are then sent to a recycling facility where they are transformed into products through extrusion techniques.

Lithium-ion batteries are primarily used in vehicles (EVs) which are becoming a growing application, for them. The International Energy Association (IEA) states that 13% of cars sold in 2022 were electric leading to a demand for lithium-ion batteries worldwide. Recycling used batteries to extract cobalt is becoming more popular as it enables their reuse in vehicles. Cobalt and lithium are materials in the production of electric vehicle batteries. With the demand for battery manufacturing materials, on the rise companies are implementing strategies to increase their presence in the battery recycling market.

Battery Recycling Market Segmentation: By Source

- Automotive Batteries

- Industrial Batteries

- Consumer & Electronic Appliance Batteries

The industrial batteries segment accounted for the market share of 51.3% throughout the projected timeframe. This is primarily due, to their usage in industrial applications such, as integrating renewable energy, powering forklifts, and supporting UPS systems. As a result, a significant portion of batteries collected for recycling comes from sources.

Battery Recycling Market Segmentation: By Application

- Transportation

- Consumer Electronics

- Industrial

- Others

In terms of generating income, the transportation sector took the lead in 2022. Accounted for the share representing 68.87% of the total revenue. The transportation industry heavily relies on lithium-ion, lead acid, and nickel metal hydride batteries. Specifically, different types of lead acid batteries, like flooded and valve-regulated ones are widely used as batteries. These batteries offer performance-required maintenance come at a low cost resist corrosion effectively and have a long lifespan. Consequently, lead acid batteries find applications compared to battery chemistries available, in the market.

Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In the year 2022, it is expected that the Asia Pacific region will contribute to, more than 40.37% of the revenue. Throughout the forecast period, this region is also projected to experience a compound growth rate (CAGR). Countries like China, India, Australia, and Japan are likely to witness growth due to increased demand in industries such as automotive, consumer electronics, and industrial sectors. North America is also expected to have a share of revenue in 2022 with the United States playing a role in driving industry growth. The market growth in North America is predicted to be fueled by the use of lithium-ion batteries in smartphones, to extend battery life and enhance efficiency over the coming years.

COVID-19 Impact Analysis on the Global Battery Recycling Market:

Because of the COVID-19 pandemic various industries experienced lockdowns that resulted in limitations, on imports, exports, and manufacturing activities. Consequently, there was a decrease in demand for batteries from sectors. This decline had an impact on market growth during the fourth quarter of 2020. Nonetheless, there is optimism that the battery recycling market will recover in the quarter of 2021 due to COVID-19 vaccination efforts and their positive influence, on the global economy.

Latest Trends/ Developments:

Refining mass, through pyro methods includes heating it to a temperature of 1,400°C. At this temperature, the lithium in the mass is lost to the slag making this method unsuitable, for recycling LFP mass. Although pyro refining can be used for NCM and LCO mass it is not commonly used because of the loss of lithium.

On the other hand, hydrometallurgical (hydro) refining is a popular method for recycling black mass, especially in Asia where there are higher recovery rates for lithium. However, its cost ranges from $1,500 to $1,800 per tonne of mass, which makes it quite expensive and impractical for LFP recycling. There are technologies like refining that have lower operational costs and can be used to recycle a wider range of black masses including LFP. Considering the increasing demand for LFP batteries and their popularity in countries like China it is expected that there will be an amount of LFP black mass available, for recycling in the future.

Fast markets introduced indicators, for NCM black mass in the cif South Korea market in May 2023. These indicators are the first of their kind providing mass prices. Fast Markets currently offers a total of 11 mass prices making them the sole price reporting agency that extensively covers import markets, in South Korea, Southeast Asia, and Europe.

Key Players:

- Umicore N.V.

- Retriev Technologies Inc.

- Exide Technologies

- Call2Recycle

- Gopher Resource LLC

- Aqua Metals Inc.

- GEM Co., Ltd.

- Ecobat Technologies Ltd.

- Terrapure Environmental

In May 2023 Fortum Battery Recycling Oy and AMG Lithium GmbH reached an agreement. Signed a memorandum of understanding to collaborate on the recycling of lithium salts and their conversion, into battery-grade lithium hydroxide. As part of this partnership AMG Lithium GmbH is currently constructing a lithium hydroxide production facility, in Bitterfeld, Germany. The primary goal of this facility is to process the lithium salts obtained from Fortums hydrometallurgical recycling plant located in Harjavalta, Finland.

Cirba Solutions and Honda recently entered into a Memorandum of Understanding (MoU) in April 2023. The purpose of this agreement is to gather, handle, and provide recycled battery materials that will be utilized as materials, for Honda’s battery supply chain. These materials will play a role, in the production of electric vehicle (EV) batteries.

Mercedes Benz, Contemporary Amperex Technology C. Limited., and GEM Co. Ltd. Agreed to work on a plan to recycle cobalt, nickel, manganese, and lithium metals from used vehicle (EV) batteries manufactured by Mercedes Benz in February 2023, the aim is to repurpose these materials into battery cathode components.

In January 2023 Aqua Metals, Inc. made an announcement regarding their project to establish a recycling facility, in Nevada (USA) specifically designed for lithium battery recycling. This innovative facility will have the capacity to process, over 20 million pounds of lithium-ion batteries annually.

Chapter 1. Global Battery Recycling Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Battery Recycling Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Global Battery Recycling Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Battery Recycling Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Battery Recycling Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Battery Recycling Market – By Chemistry

6.1. Lead-Acid Based Batter

6.2. Lithium-Ion Based Battery

6.3. Nickel-Based Battery

6.4. Other Battery Types

Chapter 7. Global Battery Recycling Market – By Source

7.1. Automotive Batteries

7.2. Industrial Batteries

7.3. Consumer & Electronic Appliance Batteries

Chapter 8. Global Battery Recycling Market – By Application

8.1. Transportation

8.2. Consumer Electronics

8.3. Industrial

8.4. Others

Chapter 9. Global Battery Recycling Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Chemistry

9.1.3. By Source

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Chemistry

9.2.3. By Source

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Chemistry

9.3.3. By Source

9.3.4. By Application

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By Chemistry

9.4.3. By Source

9.4.4. By Application

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Chemistry

9.5.3. By Source

9.5.4. By Application

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Battery Recycling Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Umicore N.V.

10.2. Retriev Technologies Inc.

10.3. Exide Technologies

10.4. Call2Recycle

10.5. Gopher Resource LLC

10.6. Aqua Metals Inc.

10.7. GEM Co., Ltd.

10.8. Ecobat Technologies Ltd.

10.9. Terrapure Environmental

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Battery Recycling Market was valued at USD 29.68 billion and is projected to reach a market size of USD 54.68 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.12%.

Growing Material Recovery and Conservation of Resources, An increase in the market for electric vehicles, and an acceleration of technological progress.

Based on Source the Global Battery Recycling Market is segmented into Automotive Batteries, Industrial Batteries, and Consumer & Electronic Appliance Batteries

Asia Pacific is the most dominant region for the Global Battery Recycling Market.

Umicore N.V., Retriev Technologies Inc., Exide Technologies, Call2Recycle, Gopher Resource LLC, Aqua Metals Inc., GEM Co., Ltd., Ecobat Technologies Ltd., Terrapure Environmental, and RSR Corporation are the key players operating in the Global Battery Recycling Market.