Latin America Jams and Preserves Market Size (2024-2030)

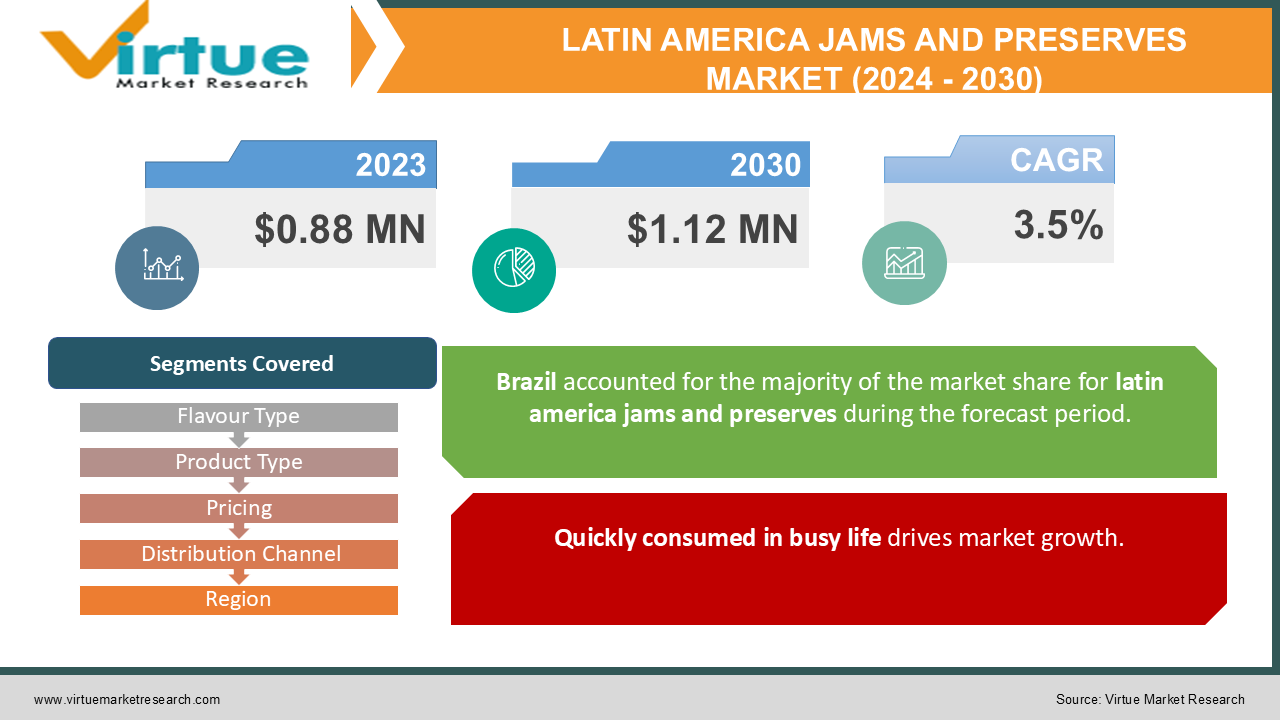

The Latin America Jams and Preserves Market was valued at USD 0.88 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1.12 million by 2030, growing at a CAGR of 3.5%.

Jams and preserves are crafted by melding together fruits, along with pectin and sugar. They serve as popular breakfast accompaniments, typically spread over slices of white or brown brea

Key Market Insights:

Jams incorporate crushed fruit bits alongside fruit purée or juice, while preserves feature larger fruit chunks or whole pieces. The resultant jelly-based products, categorized as sweet spreads, boast clarity or translucency, derived solely from fruit juices.

Jam falls under FDA regulation, stipulating that it must be crafted from a singular fruit source and contain a minimum of 45% fruit content, balanced with 55% sugar.

Latin America Jams And Preserves Market Drivers:

Quickly consumed in busy life drives market growth.

Currently, young individuals are frequently incorporating bread and jam into their diets, particularly for breakfast, owing to the minimal preparation time required. This trend holds significant importance during periods when many of them lead sedentary lifestyles due to their hectic schedules. Consequently, there may be an upsurge in demand for fruit jams, jellies, and preserves in the foreseeable future. The shift in lifestyles has also resulted in heightened consumption of ready-to-eat foods, which commonly utilize jams and preserves to enrich flavor profiles and extend shelf life.

Healthier snacks and new flavors attract consumers which increases the demand.

Healthcare experts are now advocating for the consumption of jams due to their nutritional value. These products are intended to serve as rich sources of essential nutrients such as Vitamin C, natural fiber, probiotics, Vitamin A, and antioxidants. Moreover, incorporating jams into one's diet can help reduce the risk of cardiovascular diseases and improve skin texture. In recent times, jams, jellies, and preserves have been reformulated to contain lower amounts of fats and sugar, appealing to health-conscious consumers.

Manufacturers are responding to consumer preferences by introducing a variety of flavors in jams and jellies, particularly targeting school-going children. This strategy is primarily aimed at product innovation and diversification, aiming to enhance acceptance among the intended audience.

Latin America Jams And Preserves Market Restraints and Challenges:

The market growth of fruit jam, jelly, and preserves is expected to face challenges due to fluctuations in raw material prices, particularly fruits and sugar. Additionally, manufacturers are grappling with sustainability concerns, driven by the increasing demand from environmentally conscious consumers for products with low environmental footprints. Balancing the need for attractive and practical packaging with environmental goals poses a persistent challenge for companies in this sector. Moreover, government regulations and norms related to food safety and labeling exert additional influence on market dynamics, with compliance being crucial for gaining and maintaining customer trust.

Furthermore, there is a growing emphasis on reducing sugar content in food products, presenting both challenges and opportunities for producers to develop healthier alternatives without compromising on flavor. Adaptation to these evolving consumer preferences and regulatory requirements will be essential for companies to remain competitive in the market.

Latin America Jams And Preserves Market Opportunities:

The burgeoning consumer preference for natural and fruit-based products stands as a key driver propelling the growth of the Global Jam, Jelly, and Preserves Market. The surge in demand for jams, jellies, and preserves made from natural fruits reflects a shift among health-conscious consumers towards alternatives devoid of artificial sweeteners and chemicals. This trend aligns with the broader movement towards clean-label products, where consumers increasingly prioritize simplicity and transparency in ingredient lists. In response, manufacturers are diversifying their offerings by introducing unique fruit flavors and combinations, catering to a variety of consumer preferences, and driving product innovation within the market.

Moreover, there is a growing emphasis on incorporating distinct textures and whole fruit pieces into these spreads, enhancing the overall sensory experience for consumers. This focus on texture enhancement further underscores the market's commitment to meeting evolving consumer expectations and preferences.

LATIN AMERICA JAMS AND PRESERVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

|

Market Size Available |

2023 - 2030 |

|

|

Base Year |

2023 |

|

|

Forecast Period |

2024 - 2030 |

|

|

CAGR |

3.5% |

|

|

Segments Covered |

By Flavour Type, Product Type,Pricing , Distribution Channel and Region |

|

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

|

Regional Scope |

|

|

|

Key Companies Profiled |

F. Duerr & Sons Ltd, Rochak Agro Food Products Pvt Ltd, B&G Foods, Conagra Brands, Inc., W.T. Lynch Foods Limited, Murphy Orchards, Bonne Maman, The J.M. Smucker Company, The Hain Celestial Group, The Nashville Jam Co |

Latin America Jams And Preserves Market Segmentation:

Latin America Jams And Preserves Market Segmentation By Product Type

- Jams And Marmalade

- Honey

- Sweet Spreads

- Others

During the forecast period, the jams and jellies segment is anticipated to maintain its position as the dominant market leader. Heightened awareness regarding healthy eating habits, coupled with a growing inclination towards convenience foods, is poised to drive further growth in this segment. Additionally, the increasing availability and popularity of organic products are contributing to the expanded consumption of fruits and jellies, as consumers exhibit a heightened trust in organic offerings.

Furthermore, the growth of complementary industries such as bakery products and confectionery is expected to contribute to the increased adoption of jams and jellies. As these industries flourish, the demand for jams and jellies as key ingredients or accompaniments is likely to experience a corresponding surge, bolstering market growth even further.

Latin America Jams And Preserves Market Segmentation By Flavour Type

- Strawberry

- Grape

- Raspberry

- Blackberry

- Apricot

- Others

The strawberry jam and preserves segment reigns supreme in the market, owing to the widespread popularity of strawberries. Renowned for their rich antioxidant content, particularly vitamin C, strawberries offer remarkable health benefits by combating oxidative stress and inflammation in the body. Thus, our strawberry jam not only tantalizes the taste buds but also provides exceptional nutritional value.

Similarly, raspberry jam enjoys significant popularity due to its enticing combination of tartness and sweetness, along with its vibrant red hue. Widely utilized on toast, scones, and desserts, raspberry jam is a favored choice among consumers.

Additionally, blueberry jam emerges as another sought-after flavor, appreciated for its distinctive taste profile and associated health benefits. Abundant in antioxidants, blueberry jam complements a variety of foods including yogurt, oatmeal, and baked goods.

Furthermore, apricot jam holds favor among consumers for its delicate and subtle flavor profile. Commonly incorporated into pastries, cakes, and tarts, apricot jam adds a touch of sweetness and enhances the overall taste experience.

Latin America Jams And Preserves Market Segmentation By Pricing:

- Economic

- Premium

- Others

The economic segment holds a dominant position in the market due to its affordability, making it accessible to a wide range of consumers who incorporate jam into their daily routines.

Conversely, premium quality jams, such as Artisanal jam, command higher prices. This is primarily attributed to their production in small quantities, often in locations distant from major fruit-growing regions, necessitating the importation of fruit. Without the benefits of economies of scale, production costs are elevated. Additionally, labor costs tend to be higher, and overhead expenses abound, including licensing, permits, insurance, as well as fees for kitchen facilities and equipment rental. These factors collectively contribute to the premium pricing of Artisanal jam.

Latin America Jams And Preserves Market Segmentation By Distribution Channel:

- Supermarkets

- Grocery Stores

- Wholesale

- Others

supermarkets/hypermarkets accounted for the largest market share of 48.88%, with a market value of USD 4,541.80 Million, and are projected to experience the highest Compound Annual Growth Rate (CAGR) of 4.39% during the forecast period. Convenience/Departmental Stores followed as the second-largest market segment in 2023, valued at USD 2,787.04 Million, and are projected to grow at a CAGR of 3.37%.

Supermarkets/hypermarkets are expected to maintain their dominance in market share throughout the forecast period. This is attributed to consumers' desire for a tangible shopping experience before committing to a purchase decision, which is often fulfilled through visits to such establishments. Additionally, these stores often have partnerships with specific brands, resulting in a wider variety of products available. Moreover, the upselling techniques employed in these stores are anticipated to further boost the market share of fruit jams and preserves.

Latin America Jams And Preserves Market Segmentation- By Region

- Brazil

- Argentina

- Colomba

- Chile

- Rest of Latin America

Brazil holds the distinction of being the largest strawberry producer in Latin America. Strawberries cultivated in Brazil constitute a highly lucrative crop, with consumption patterns spanning fresh, frozen, or processed forms such as pulp (frozen or dehydrated). Renowned for their rich antioxidant content, particularly vitamin C, strawberries offer remarkable health benefits by combating oxidative stress and inflammation in the body. Therefore, beyond their delightful taste, strawberry jam also provides significant nutritional value.

Following Brazil, Argentina ranks as the second-largest strawberry producer in South America. The cultivation of strawberries in Argentina occurs throughout the year, facilitated by their planting across a diverse range of latitudes spanning from 24°S to 42°S. This geographical diversity results in a spectrum of climates, ranging from cold-temperate conditions in the province of Rio Negro to tropical climates in Jujuy.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic had a positive impact on the market, especially during the initial two quarters of 2020. This can be attributed to the heightened reliance of consumers on convenient and easy-to-consume food products, driven by the emerging work-from-home culture.

Latest Trends/ Developments:

- In February 2023, B&G Foods issued a voluntary allergy alert for Back to Nature Fudge Mint Cookies due to undeclared peanuts found in the product.

- In December 2022, the Ferrero Group announced the acquisition of Wells Enterprises, renowned for its ice cream brands Blue Bunny and Bomb Pop.

Key Players:

These are the top 10 players in the Latin America Jams And Preserves Market: -

- F. Duerr & Sons Ltd

- Rochak Agro Food Products Pvt Ltd

- B&G Foods

- Conagra Brands, Inc.

- W.T. Lynch Foods Limited

- Murphy Orchards

- Bonne Maman

- The J.M. Smucker Company

- The Hain Celestial Group

- The Nashville Jam Co

Chapter 1. Latin America Jams And Preserves Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Jams And Preserves Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Jams And Preserves Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Jams And Preserves Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Jams And Preserves Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Jams And Preserves Market– By Product Type

6.1. Introduction/Key Findings

6.2. Jams And Marmalade

6.3. Honey

6.4. Sweet Spreads

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Latin America Jams And Preserves Market– By Flavour Type

7.1. Introduction/Key Findings

7.2 Strawberry

7.3. Grape

7.3. Raspberry

7.4. Blackberry

7.5. Apricot

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Flavour Type

7.8. Absolute $ Opportunity Analysis By Flavour Type, 2024-2030

Chapter 8. Latin America Jams And Preserves Market– By Pricing

8.1. Introduction/Key Findings

8.2. Economic

8.3. Premium

8.4. Others

8.5. Y-O-Y Growth trend Analysis Pricing

8.6. Absolute $ Opportunity Analysis Pricing , 2024-2030

Chapter 9. Latin America Jams And Preserves Market– By Distribution Channel

9.1. Introduction/Key Findings

9.2. Supermarkets

9.3. Grocery Stores

9.4. Wholesale

9.5. Others

9.6. Y-O-Y Growth trend Analysis Distribution Channel

9.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 10. Latin America Jams And Preserves Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. Latin America

10.1.1. By Country

10.1.1.1. Mexico

10.1.1.2. Brazil

10.1.1.3. Argentina

10.1.1.4. Chile

10.1.1.5. Colombia

10.1.1.6. Rest of Latin America

10.1.2. By Product Type

10.1.3. By Pricing

10.1.4. By Distribution Channel

10.1.5. BY Flavour Type

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Latin America Dairy Alternatives Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 F. Duerr & Sons Ltd

11.2. Rochak Agro Food Products Pvt Ltd

11.3. B&G Foods

11.4. Conagra Brands, Inc.

11.5. W.T. Lynch Foods Limited

11.6. Murphy Orchards

11.7. Bonne Maman

11.8. The J.M. Smucker Company

11.9. The Hain Celestial Group

11.10. The Nashville Jam Co

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Young individuals are frequently incorporating bread and jam into their diets, particularly for breakfast, owing to the minimal preparation time required

The top players operating in the Latin America Jams And Preserves Market are - F. Duerr & Sons Ltd, Rochak Agro Food Products Pvt Ltd, B&G Foods, Conagra Brands, Inc., W.T. Lynch Foods Limited, Murphy Orchards, Bonne Maman, The J.M. Smucker Company, The Hain Celestial Group, The Nashville Jam Co.

The COVID-19 pandemic had a positive impact on the market, especially during the initial two quarters of 2020.

The surge in demand for jams, jellies, and preserves made from natural fruits reflects a shift among health-conscious consumers towards alternatives devoid of artificial sweeteners and chemicals. This trend aligns with the broader movement towards clean-label products, where consumers increasingly prioritize simplicity and transparency in ingredient lists.

Argentina is the fastest-growing region in the Latin America Jams And Preserves Market.