Europe Jams and Preserves Market Size (2024-2030)

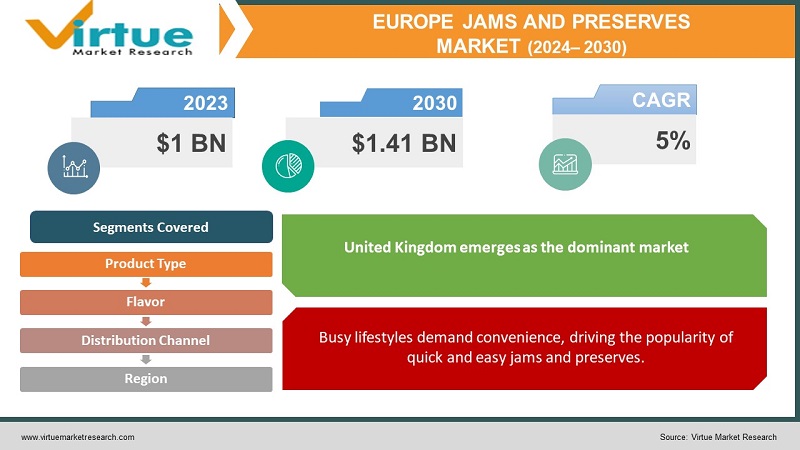

The Europe Jams and Preserves Market was valued at USD 1 billion in 2023 and is projected to reach a market size of USD 1.41 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 5%.

Europe reigns supreme in the global jams and preserves the market, holding a dominant 50% share of imports. Fueled by factors like urbanization, rising disposable income, and growing health consciousness, this market is expected to continue its upward trajectory. Consumers seeking convenient food options are driving demand, while those prioritizing natural ingredients and reduced sugar are influencing product development. Jams remain the most popular type, with supermarkets and hypermarkets dominating sales channels. However, the market faces challenges from alternative breakfast options and concerns about sugar consumption. Key players like Andros and Hero navigate this landscape, and the future seems promising for the European jams and preserves market, provided they adapt to evolving consumer preferences and tackle the competition head-on.

Key Market Insights:

The European jams and preserves market holds a dominant position globally, capturing a whopping 50% share of all imports. This significant market is driven by several key trends. Firstly, the increasing urbanization in Europe fuels the demand for convenient food options, making jams and preserving a popular choice for busy lifestyles. Secondly, a growing health-conscious population is driving a preference for premium products with natural ingredients and reduced sugar. Finally, rising disposable income allows consumers to indulge in these higher-quality options.

Jams remain the undisputed king of product types, with supermarkets and hypermarkets dominating sales channels. However, the market faces some challenges. Alternative breakfast options like yogurt and granola are gaining traction, posing a competitive threat. Additionally, rising concerns about sugar consumption might hinder market growth.

Despite these challenges, the future looks promising for the European jams and preserves market. Key players like Andros and Hero need to adapt to the evolving consumer landscape. Embracing trends like reduced sugar content and tackling competition effectively will be crucial for sustained success in this dynamic market.

The Europe Jams and Preserves Market Drivers:

Busy lifestyles demand convenience, driving the popularity of quick and easy jams and preserves.

With urbanization on the rise across Europe, busy lifestyles crave quick and easy meal solutions. Jams and preserves fit the bill perfectly. They offer a convenient breakfast spread or a hassle-free snack, requiring minimal preparation time – a major advantage for time-pressed consumers.

Rising disposable income fuels a preference for premium jams and preserves with high-quality ingredients.

A Taste for Quality: Rising disposable income in Europe is fueling a desire for premium products. This translates to a demand for jams and preserves made with high-quality ingredients. Consumers are willing to pay more for unique flavor profiles, innovative packaging, and brands that resonate with their values.

Health-conscious consumers seek natural ingredients and reduced sugar in jams and preserves, pushing product reformulation.

A growing health consciousness is sweeping across Europe, impacting the jams and preserves market. Consumers are actively seeking products made with natural ingredients, with a particular focus on reduced sugar content. This trend pushes manufacturers to reformulate products and explore options like organic ingredients to cater to this health-focused market segment.

Evolving tastes crave unique flavor combinations, opening doors for gourmet and artisanal jams and preserves.

European consumer palates are becoming more adventurous. The demand for gourmet and artisanal jams and preserves with unique flavor combinations is on the rise. This presents an exciting opportunity for manufacturers to develop innovative products that cater to a diverse and discerning customer base seeking something beyond the ordinary.

Jams and preserves are popular gifts in Europe, contributing to consistent market demand.

Jams and preserves hold a special place in European culture, often seen as thoughtful and versatile gift options. This cultural aspect contributes to steady year-round demand, with festive seasons witnessing a particular surge in gifting these sweet treats.

The Europe Jams and Preserves Market Restraints and Challenges:

The European jams and preserves market isn’t without its hurdles. While convenient and offering a taste of premium quality, the market faces competition from other breakfast options. Consumers increasingly perceive yogurt, granola, and the like as healthier and more convenient alternatives, especially for busy mornings. Additionally, rising concerns about excessive sugar consumption are impacting purchasing decisions. Traditional jams and preserves, known for their sweetness, might see reduced demand as a result.

Furthermore, the seasonal nature of many fruits used in these products creates challenges. Availability fluctuates, potentially leading to price hikes and impacting production consistency. The perishability of jams and preserves also adds complexity, as spoilage can increase waste and affect profit margins.

Regulatory hurdles further complicate the picture. The European Union enforces strict food safety and labeling regulations, which can be particularly challenging for smaller manufacturers. Compliance can be both expensive and time-consuming, impacting production costs and potentially hindering market entry for new players. Finally, economic fluctuations pose a risk, as economic downturns can lead to reduced consumer spending, particularly on discretionary purchases like jams and preserves.

Despite these challenges, the European jams and preserves market holds promise. Manufacturers who innovate, adapt to evolving preferences and navigate these limitations effectively will be well-positioned for continued success in this dynamic landscape.

The Europe Jams and Preserves Market Opportunities:

While challenges exist, the European jams and preserves market presents exciting growth opportunities. Manufacturers can capitalize on the health trend by offering sugar-conscious alternatives, incorporating superfoods, and exploring organic options. Innovation is key, with unique flavor combinations, ethnic influences, and seasonal offerings appealing to diverse palates. Additionally, single-serve portions, on-the-go packaging, and convenient formats cater to busy lifestyles.

Premiumization presents another avenue for growth. High-quality ingredients, unique flavors, and premium packaging can elevate the brand image and attract customers seeking an indulgent experience. Building a strong brand identity that aligns with consumer values can further create loyalty and command premium prices.

Beyond traditional channels, leveraging e-commerce and direct-to-consumer (D2C) channels opens doors to new customer segments and personalized shopping experiences. This approach can be particularly beneficial for artisanal and specialty producers. Finally, as consumers become more environmentally and socially conscious, implementing sustainable practices, ethical sourcing, and highlighting fair trade certifications can resonate with this growing segment and create a competitive edge. By embracing these opportunities and adapting to the changing landscape, European jams and preserves manufacturers can unlock the full potential of this dynamic market.

EUROPE JAMS AND PRESERVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Product Type, Flavors, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy, Spain, Russia, Germany, UK, France, Rest of Europe |

|

Key Companies Profiled |

B&G Foods Inc., The J.M. Smucker Company, Andros Group, Zuegg, Dale Carnegie & Sons, Delacre, Rigoni di Asiago, Tiptree, Monti SpA |

The Europe Jams and Preserves Market Segmentation:

Europe Jams and Preserves Market Segmentation: By Product Type:

- Jams

- Jellies

- Marmalades

- Preserves

- Spreads

The European jams and preserves market is segmented by product type, with jams reigning supreme, capturing over 50% of the market share. These classic fruit spreads cater to various preferences. However, the nut butter segment is experiencing the fastest growth, driven by the increasing popularity of healthy and protein-rich breakfast options. This trend highlights a shift towards health-conscious choices within the European market.

Europe Jams and Preserves Market Segmentation: By Flavor:

- Fruits

- Nuts

- Chocolate

The dominant segment in the European jams and preserves market by flavor is Fruits, accounting for over 80% of the market share. This segment includes popular options like strawberry, raspberry, and apricot jams. However, the fastest-growing segment is Nuts, driven by increasing consumer demand for protein and flavor combinations. This segment includes nut butter like peanut butter and almond butter, which are gaining popularity as breakfast and snack options.

Europe Jams and Preserves Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retailers

- Specialty Stores

The European jams and preserves market is segmented by distribution channel, with Supermarkets and Hypermarkets holding the dominant share, exceeding 70% of the market. This segment offers a wide variety of brands and types at competitive prices, catering to a broad consumer base. However, Online Retailers are emerging as the fastest-growing segment, driven by convenience and wider product selection. This channel is particularly beneficial for premium and niche products, attracting consumers seeking unique offerings.

Europe Jams and Preserves Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

UK: The UK market for jams and preserves is a mature and well-established one. Consumers here have a strong cultural affinity for jams and preserves, often enjoying them for breakfast and afternoon tea. This historical context, coupled with relatively high disposable income, contributes to the UK's significant share of the European market. Additionally, the presence of well-known domestic and international brands like Tiptree and Bonne Maman further strengthens the market presence.

Germany: Germany boasts a large and economically strong population, translating into a substantial market for jams and preserves. While traditional breakfast preferences might lean towards Savory options, increasing urbanization and busy lifestyles are leading to a rise in convenient breakfast solutions, potentially benefiting the jams and preserves market. Additionally, a growing health-conscious segment might drive demand for sugar-free and natural ingredient options.

France: France is a dominant player in the European jams and preserves market, renowned for its established brands like Andros and Bonne Maman. The French culinary tradition heavily incorporates jams and preserves, contributing to a strong consumer base and a diverse product range. Additionally, a focus on high-quality ingredients and artisanal production methods further distinguishes the French market.

Spain: Like other Southern European countries, Spain boasts a strong culinary tradition that incorporates jams and preserves. This, coupled with a growing tourism sector, potentially fuels demand for unique and high-quality products. However, compared to Western European countries, disposable income levels might be slightly lower, which could influence consumer preferences and purchasing behavior.

Rest of Europe: Presents a diverse and complex landscape for the jams and preserves market. While Eastern Europe shows promise for future growth due to rising disposable income, Nordic countries offer a niche market for health-conscious consumers seeking natural and sugar-free options. Central European countries like Poland and Austria might have established traditions, and individual characteristics and growth trajectories will vary across the remaining nations. A nuanced and market-specific approach, focused on research and understanding individual country dynamics, is crucial for identifying opportunities and tailoring strategies for success in this diverse and evolving region.

COVID-19 Impact Analysis on the Europe Jams and Preserves Market:

The COVID-19 pandemic left its mark on the European jams and preserves market. While initial disruptions due to supply chain issues and shifting consumer behavior presented challenges, the market also witnessed unexpected opportunities.

Lockdowns led to panic buying and stockpiling, initially boosting demand for shelf-stable items like jams. However, a subsequent focus on health potentially reduced the demand for sugary spreads. Additionally, with restaurants and cafes closed, the food service sector, a key distribution channel, saw a significant drop in demand.

On the other hand, the rise of home cooking due to social distancing measures potentially increased demand for jams and preserves for breakfast and snacks. Furthermore, the e-commerce boom provided new avenues for manufacturers to reach consumers directly, reducing reliance on traditional retail channels. Additionally, heightened health consciousness during the pandemic might drive future demand for products with natural ingredients, lower sugar content, and functional benefits.

Overall, while the initial COVID-19 impact might have been negative, the long-term outlook seems mixed. The food service sector's recovery might be slow, but opportunities exist in the rising home cooking trend, e-commerce adoption, and a potential shift towards healthier options. Manufacturers who adapt their products and strategies to cater to these evolving preferences are well-positioned to thrive in the post-pandemic European jams and preserves market.

Latest Trends/ Developments:

The jams and preserves market is buzzing with innovation, driven by evolving consumer preferences. Health and wellness are key, with sugar-reduced options, functional ingredients, and organic offerings gaining traction. Unique flavor exploration thrives through ethnic influences, seasonal ingredients, and creative fusions. Busy lifestyles demand convenience, with single-serve portions, squeeze pouches, and ready-to-eat breakfast combinations emerging. Sustainability and ethical sourcing are crucial, with manufacturers adopting eco-friendly packaging, fair-trade practices, and responsible agricultural methods. Finally, the rise of e-commerce and D2C channels offers manufacturers wider reach, personalized experiences, and valuable consumer data. By embracing these trends and adapting their products and strategies, manufacturers can ensure they stay ahead of the curve in the ever-evolving jams and preserves market.

Key Players:

- B&G Foods Inc.

- The J.M. Smucker Company

- Andros Group

- Zuegg

- Dale Carnegie & Sons

- Delacre

- Rigoni di Asiago

- Tiptree

- Monti SpA

Chapter 1. Europe Jams and Preserves Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Jams and Preserves Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Jams and Preserves Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Jams and Preserves Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Jams and Preserves Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Jams and Preserves Market– By Product Type

6.1. Introduction/Key Findings

6.2. Jams

6.3. Jellies

6.4. Marmalades

6.5. Preserves

6.6. Spreads

6.7. Y-O-Y Growth trend Analysis By Product Type

6.8. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Europe Jams and Preserves Market– By Flavor

7.1. Introduction/Key Findings

7.2 Fruits

7.3. Nuts

7.4. Chocolate

7.5. Y-O-Y Growth trend Analysis By Flavor

7.6. Absolute $ Opportunity Analysis By Flavor , 2024-2030

Chapter 8. Europe Jams and Preserves Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets and Hypermarkets

8.3. Convenience Stores

8.4. Online Retailers

8.5. Specialty Stores

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Jams and Preserves market Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Product Type

9.1.3. By Flavor

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Jams and Preserves market Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 B&G Foods Inc.

10.2. The J.M. Smucker Company

10.3. Andros Group

10.4. Zuegg

10.5. Dale Carnegie & Sons

10.6. Delacre

10.7. Rigoni di Asiago

10.8. Tiptree

10.9. Monti SpA

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Whole Grain Foods Market was valued at USD 1 billion in 2023 and is projected to reach a market size of USD 1.41 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 5%.

Convenience Reigns Supreme, Premiumization, Health Takes Center Stage, Beyond Basic: Evolving Tastes, and the Gift that Keeps on Giving.

Supermarkets and Hypermarkets, Convenience Stores, Online Retailers, Specialty Stores.

While specific data on regional dominance may not be readily available, France is likely the most significant market in Europe for jams and preserves, due to its high consumption rate and established brands like Andros and Bonne Maman

B&G Foods Inc., The J.M. Smucker Company, Andros Group, Zuegg, Dale Carnegie & Sons, Delacre, Rigoni di Asiago, Tiptree, Monti SpA