Jams And Preserves Market Size (2025 – 2030)

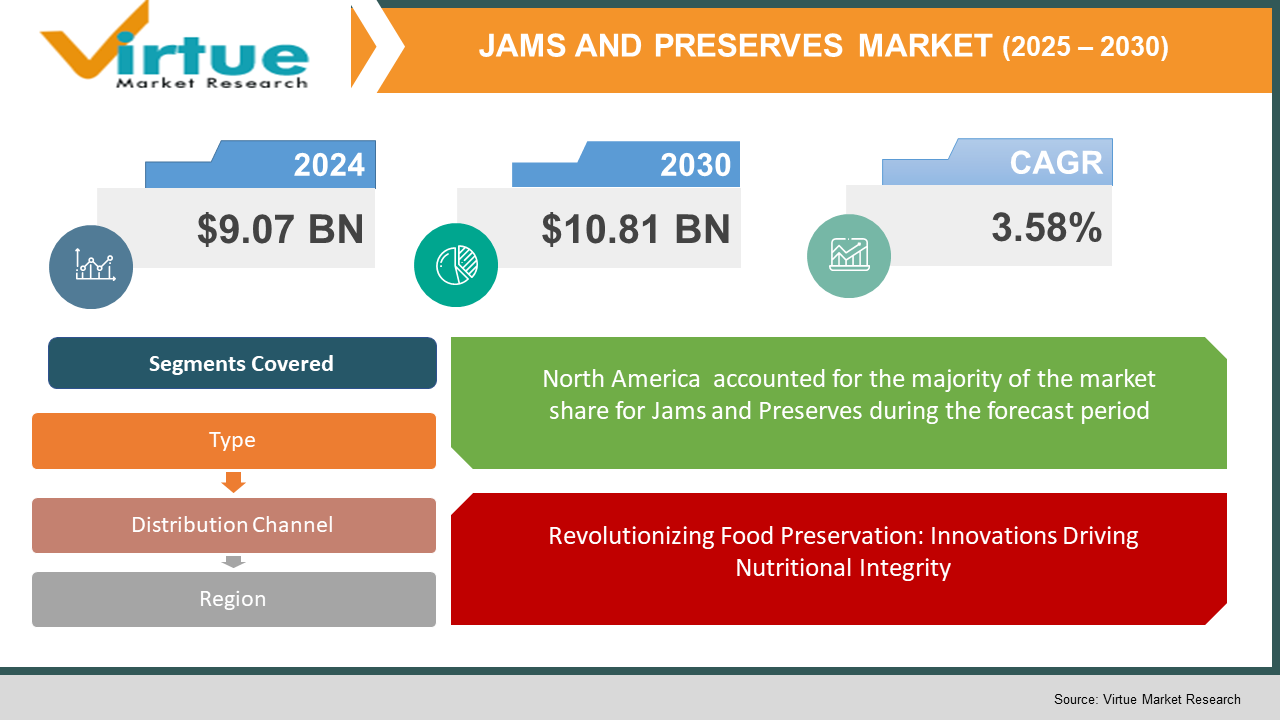

The Jams and Preserves Market was valued at USD 9.07 Billion in 2024 and is projected to reach a market size of USD 10.81 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 3.58%.

The jams and preserves market in 2024 has witnessed a dynamic transformation, blending age-old traditions with modern consumer preferences and innovative production techniques. Over recent years, the market has experienced a notable surge in consumer interest, driven by a renewed focus on artisanal quality, organic ingredients, and healthier alternatives. Manufacturers have invested in research and development to craft products that emphasize natural ingredients while preserving classic flavors. This evolution is fueled by a growing awareness of food provenance and nutritional benefits, prompting brands to innovate with new flavors and sustainable packaging. The market is characterized by an eclectic mix of small-scale producers and large established players, each contributing to a competitive landscape that values both heritage and innovation. While traditional recipes remain popular, contemporary trends are steering production towards bespoke, limited-batch preserves that cater to niche consumer segments. Consumers now seek products that not only satisfy their palates but also reflect their ethical and environmental values. Amid this shift, manufacturers have embraced digital marketing and e-commerce platforms to reach a broader audience, allowing even small artisan brands to compete on a global scale. Retailers have also adjusted their strategies to highlight premium, locally sourced, and preservative-free products, further intensifying market competition. With an eye on quality and authenticity, the industry is redefining its offerings in response to shifting market demands and evolving consumption patterns. This year, the market has been marked by inventive product innovations and a rapid adaptation to new technologies in processing and packaging. As consumer tastes become increasingly refined and health-conscious, the jams and preserves market continues to thrive on a blend of tradition, creativity, and modern technology, making it a vibrant and ever-evolving sector.

Key Market Insights:

- In 2024, the jams and preserves market recorded total sales surpassing USD 4.2 billion; over 35% of consumers now prefer organic varieties.

- More than 60% of new product launches feature reduced-sugar formulations; packaging innovations led to a 25% decrease in plastic use; retail shelf space for premium preserves increased by 15%.

- Over 70% of artisan brands reported double-digit growth; online sales contributed 22% of total revenue.

- Customer loyalty programs enhanced repeat purchases by 18%. Limited-edition flavors accounted for 10% of new market entries. Over 80% of consumers are willing to pay a premium for natural ingredients.

Market Drivers:

Revolutionizing Food Preservation: Innovations Driving Nutritional Integrity

The first market driver is the increasing consumer inclination towards healthier eating habits, a trend that has permeated every aspect of food consumption. In 2024, an overwhelming number of customers actively sought out products that not only delighted their taste buds but also contributed to a balanced lifestyle. This shift in consumer behaviour has encouraged manufacturers to reformulate traditional recipes by reducing artificial additives, lowering sugar content, and incorporating superfoods and natural preservatives. The demand for natural, preservative-free products has grown exponentially, inspiring innovative production techniques that preserve the nutritional integrity of fruits while extending shelf life without compromising quality. As a result, brands have invested in cutting-edge processing technologies and sustainable packaging methods that underscore their commitment to health and wellness. Retailers, too, have reoriented their product placements to highlight healthier options, fostering an environment where premium quality is synonymous with better nutrition. Furthermore, rising awareness about food allergies and dietary restrictions has led companies to develop specialized product lines that cater to niche markets such as gluten-free, vegan, and organic preserves. This holistic shift in consumer preference is not only reshaping product development but also redefining market competition, prompting even the largest players to re-evaluate their traditional offerings in favour of health-conscious alternatives.

Innovation in Product Development and Packaging

Another significant driver in the jams and preserves market is the surge in innovation across product development and packaging design. In the fast-evolving landscape of 2024, brands are leveraging advanced food technology to create novel flavors, textures, and compositions that challenge conventional norms. Innovative blending of fruits, herbs, and spices has resulted in products that offer a unique sensory experience, appealing to adventurous consumers seeking culinary creativity. Packaging innovations have been equally transformative, with sustainable and aesthetically pleasing designs that not only enhance product shelf appeal but also reduce environmental impact. Companies are now prioritizing eco-friendly materials, smart packaging solutions, and improved convenience features to meet the demands of a modern audience. This dual focus on product and packaging innovation has allowed brands to capture new market segments, especially among younger consumers who value both sustainability and novelty. In a competitive market, these innovative approaches serve as key differentiators, allowing companies to command premium pricing and foster strong brand loyalty. The strategic investments in research and development, coupled with a keen understanding of evolving consumer lifestyles, have propelled the market into a new era of creativity and environmental stewardship.

Market Restraints and Challenges:

Despite the robust growth and innovative momentum, the jams and preserves market faces several significant challenges in 2024. The rising cost of raw materials, often exacerbated by global supply chain disruptions, continues to impact profit margins across the industry. Manufacturers struggle with price volatility in key ingredients such as fruits and natural sweeteners, which can lead to increased production costs and ultimately higher retail prices. Additionally, the regulatory landscape is becoming increasingly complex, with tighter food safety and labeling standards that require continuous investments in quality control and compliance. Competition from substitute products, including low-calorie spreads and alternative sweeteners, further intensifies market pressures, as consumers have a growing array of options to choose from. The need for continuous innovation also presents a double-edged sword; while it drives product differentiation, it simultaneously demands substantial R&D expenditures that may not always yield immediate returns. Moreover, market penetration in emerging economies remains challenging due to differing consumer tastes, limited distribution networks, and varying levels of market maturity. This multifaceted scenario underscores the importance of strategic planning and agile business models, as companies strive to maintain their competitive edge while addressing the complexities of cost management, regulatory compliance, and consumer behaviours shifts.

Market Opportunities:

The surge in consumer demand for artisanal, organic, and locally sourced products presents a fertile ground for niche players who can capitalize on the authenticity and quality of their offerings. Companies that invest in sustainable practices and innovative processing techniques stand to gain a competitive advantage, as consumers increasingly prioritize environmental responsibility and health benefits. Furthermore, the rapid expansion of e-commerce and digital marketing platforms has opened new channels for reaching diverse consumer segments, including younger demographics that value convenience and customization. There is also considerable potential for product diversification; by exploring novel flavor combinations and premium packaging, brands can tap into emerging trends and create unique selling propositions. Collaborations with local farmers and suppliers not only ensure a steady supply of high-quality ingredients but also enhance the brand’s story and connection with consumers. Additionally, geographic expansion into untapped or underdeveloped markets offers prospects for significant growth, particularly where traditional preserves are yet to be fully embraced. By aligning product strategies with evolving consumer preferences and leveraging technological advancements, companies can create a robust roadmap for sustained market success.

JAMS AND PRESERVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

3.58% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sunrise Foods, Nature's Delight, Fruitful Harvest, Heritage Preserves, Pure Spread Co., Golden Orchard, Berry Bliss, Orchard Essence, Vintage Jams, Rustic Preserves |

Jams And Preserves Market Segmentation:

Jams And Preserves Market Segmentation by Type:

- Fruit Jams

- Fruit Preserves

- Marmalades

- Jellies

- Fruit Spreads

- Low-Sugar and Sugar-Free Variants

- Organic Preserves

- Exotic and Specialty Preserves

Among these segments, Fruit Jams emerge as the most dominant type, capturing approximately 42.5% of the global market share in 2024. This dominance is attributed to their versatility, traditional appeal, and widespread consumer acceptance across different age groups and cultural backgrounds.

The Organic Preserves segment represents the fastest-growing type, experiencing a remarkable compound annual growth rate (CAGR) of 8.7% during 2025-2030. This explosive growth is primarily driven by increasing health consciousness, rising demand for natural and minimally processed food products, and growing consumer awareness about sustainable and organic food production methods.

Jams And Preserves Market Segmentation by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Retail Channels

- Departmental Stores

- Direct-to-Consumer Platforms

- Foodservice Outlets

- Wholesale Channels

Supermarkets and Hypermarkets remain the most dominant distribution channel, accounting for 47.3% of total market sales in 2024. These large-format retail stores provide consumers with extensive product varieties, competitive pricing, and convenient shopping experiences.

The Online Retail Channels represent the fastest-growing distribution segment, projected to grow at an impressive CAGR of 11.2% during the forecast period. This rapid expansion is fueled by increasing digital penetration, convenient shopping experiences, broader product selections, and the lingering impact of pandemic-induced e-commerce adoption.

Jams And Preserves Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

North America continues to be the most dominant region, driven by established consumer preferences, high disposable incomes, and a robust food processing industry. The region's market is characterized by sophisticated consumer tastes, a strong inclination towards artisanal and premium products, and significant investment in product innovation.

The Asia-Pacific region emerges as the fastest-growing market, with a remarkable CAGR of 9.5% during 2024-2030. This growth is propelled by rapid urbanization, increasing middle-class populations, changing dietary habits, rising disposable incomes, and growing westernization of food preferences.

COVID-19 Impact Analysis:

The COVID-19 pandemic has left an indelible mark on the jams and preserves market, reshaping consumer behaviours and business operations in profound ways. In 2024, the residual effects of the pandemic are still evident as supply chains continue to adapt to the post-COVID environment. Early disruptions in logistics and production forced many companies to re-examine their sourcing strategies, leading to a stronger emphasis on local and regional suppliers. Consumers, having experienced extended periods of home confinement, developed a heightened interest in premium and comfort food products, with jams and preserves becoming a popular choice for both nutritional and nostalgic reasons. Digital transformation accelerated across the board, as brands invested in robust online platforms and direct-to-consumer channels to mitigate in-store limitations. While some challenges, such as workforce constraints and rising operational costs, persist, the market has largely rebounded by embracing technology and fostering stronger supplier relationships. The overall impact of the pandemic has thus been a catalyst for innovation and efficiency, prompting the industry to build more resilient business models that are better equipped to handle future uncertainties.

Latest Trends and Developments:

Innovation remains at the forefront of the jams and preserves market as companies continuously explore creative ways to meet evolving consumer demands in 2024. The industry has seen an influx of products that blend traditional recipes with exotic ingredients, resulting in flavours profiles that offer both nostalgia and a touch of global flair. Manufacturers are increasingly focused on sustainability, not only in sourcing ingredients but also in adopting eco-friendly production methods and recyclable packaging solutions. There is a growing trend towards customization, with several brands offering limited-edition collections and seasonal variants that cater to regional tastes and preferences. Digital marketing and social media have become indispensable tools in launching new products and engaging directly with consumers, fostering a vibrant online community of food enthusiasts. As consumer preferences evolve, companies are also experimenting with health-oriented formulations, integrating superfoods and functional ingredients that provide additional nutritional benefits. These developments are reflective of an industry that is agile, consumer-centric, and keen to balance traditional craftsmanship with modern technological advancements.

Key Players in the Market:

- Sunrise Foods

- Nature's Delight

- Fruitful Harvest

- Heritage Preserves

- Pure Spread Co.

- Golden Orchard

- Berry Bliss

- Orchard Essence

- Vintage Jams

- Rustic Preserves

Chapter 1. JAMS AND PRESERVES MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. JAMS AND PRESERVES MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. JAMS AND PRESERVES MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. JAMS AND PRESERVES MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. JAMS AND PRESERVES MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. JAMS AND PRESERVES MARKET – By Type

6.1 Introduction/Key Findings

6.2 Fruit Jams

6.3 Fruit Preserves

6.4 Marmalades

6.5 Jellies

6.6 Fruit Spreads

6.7 Low-Sugar and Sugar-Free Variants

6.8 Organic Preserves

6.9 Exotic and Specialty Preserves

6.10 Y-O-Y Growth trend Analysis By Type

6.11 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. JAMS AND PRESERVES MARKET – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets and Hypermarkets

7.3 Convenience Stores

7.4 Specialty Food Stores

7.5 Online Retail Channels

7.6 Departmental Stores

7.7 Direct-to-Consumer Platforms

7.8 Foodservice Outlets

7.9 Wholesale Channels

7.10 Y-O-Y Growth trend Analysis By Distribution Channel

7.11 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 8. JAMS AND PRESERVES MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channel

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Distribution Channel

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Distribution Channel

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Distribution Channel

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Distribution Channel

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. JAMS AND PRESERVES MARKET – Company Profiles – (Overview, Packaging Type Type Portfolio, Financials, Strategies & Developments)

9.1 Sunrise Foods

9.2 Nature's Delight

9.3 Fruitful Harvest

9.4 Heritage Preserves

9.5 Pure Spread Co.

9.6 Golden Orchard

9.7 Berry Bliss

9.8 Orchard Essence

9.9 Vintage Jams

9.10 Rustic Preserves

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The jams and preserves market growth is driven by increased consumer demand for organic, natural ingredients, rising health consciousness, product innovation and flavor diversity, eco-friendly packaging, and expanding distribution channels, particularly e-commerce, which collectively boost market dynamics across global markets.

The main concerns include rising raw material costs, supply chain disruptions, and tightening regulatory pressures, compounded by intense competition from substitutes. Evolving consumer tastes, constant innovation demands, and sustainability challenges further complicate market dynamics, ultimately posing significant risks to profitability.

Notable names in this sector include Sunrise Foods, Nature's Delight, Fruitful Harvest, Heritage Preserves, Pure Spread Co., Golden Orchard, Berry Bliss, Orchard Essence, Vintage Jams, Rustic Preserves, Sweet Traditions, Nature's Pantry, Blissful Berries, Artisan Spreads, and Classic Conserve

North America is the most dominant region in the market.

Asia Pacific although currently holding a smaller market share, is the fastest-growing region in the market.