Latin America Floriculture Market Size (2024-2030)

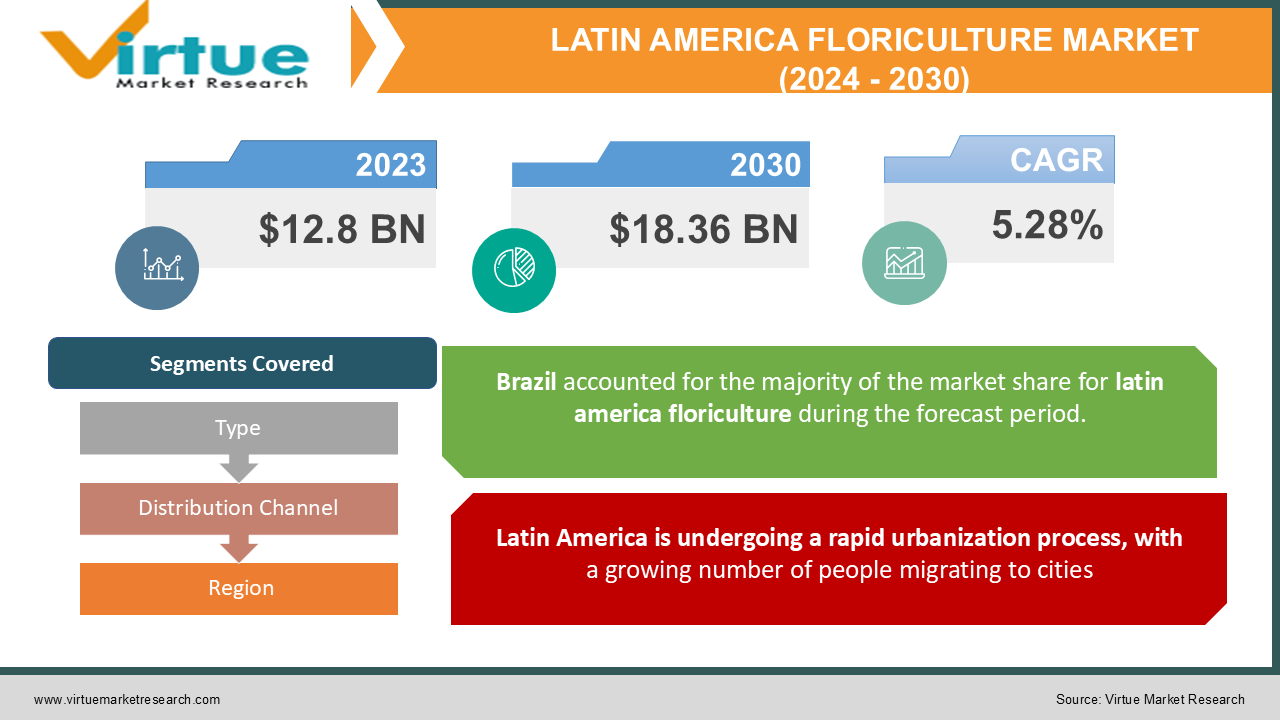

The Latin America Floriculture Market was valued at USD 12.8 Billion and is projected to reach a market size of USD 18.36 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.28%.

The Latin American Floriculture Market is a vibrant and colorful landscape, brimming with growth potential. Cultivating a wide variety of flowers, from classic roses to exotic orchids, the region is a significant player in the global flower trade. The Latin American Floriculture Market offers a diverse range of flowers, catering to various consumer preferences. Roses, carnations, chrysanthemums, lilies, alstroemeria, and gypsophila are some of the most widely cultivated varieties. Additionally, the region boasts a rich selection of native flowers like birds of paradise, heliconias, and Anthuriums, adding a unique touch to the floral repertoire. Latin American countries benefit from a variety of climates, allowing for the cultivation of a wider range of flowers throughout the year. Highland regions with cooler temperatures are suited for roses and lilies, while tropical areas excel in producing vibrant orchids and bromeliads. This climatic diversity allows Latin American growers to cater to a global market with flowers available during different seasons.

Key Market Insights:

The market for cut foliage—such as ferns and greens—is anticipated to grow to $850 million due to its growing use in interior gardening and flower arrangements.

The market for dried and preserved flowers is expected to grow at a compound annual growth rate of 6.9% to $580 million by 2024.

The increased demand for products that are both aesthetically pleasing and functional is expected to propel the Latin American floriculture supplies market, which includes vases, containers, and floral foam, to a projected $1.2 billion.

At a growth rate of 5.6%, the floral preservative and nutrition market is anticipated to reach $480 million by the end of 2024 as growers look to increase the shelf life of their products.

Due to the growing popularity of indoor gardening and biophilic architecture, the market for terrariums and indoor plants is expected to reach $920 million by 2024.

Hydroponic floriculture systems are expected to command a $670 million market share in 2024, growing at a growth rate of 7.4%.

The market for floral-inspired confectionery and baked goods is estimated to be worth $630 million in 2024, driven by the increasing demand for unique and visually appealing desserts and treats.

The demand for floral-inspired wedding favors and accessories is increasing, with the market projected to reach $420 million by the end of 2024, driven by the popularity of incorporating floral elements into wedding celebrations and decor.

The market for floral-inspired wellness and spa products, including essential oils, bath salts, and body care products, is expected to reach $760 million by 2024, with a CAGR of 7.4%

Latin America Floriculture Market Drivers:

Latin America is undergoing a rapid urbanization process, with a growing number of people migrating to cities. This burgeoning urban population is experiencing a rise in disposable income, leading to a shift in spending habits.

Urban living often translates to smaller living spaces with limited access to green spaces. Flowers provide a vibrant and aesthetically pleasing way to bring nature indoors, enhancing the ambiance and creating a sense of well-being in urban apartments or houses. Flowers remain a significant part of Latin American social customs. Birthdays, anniversaries, graduations, and religious holidays all present opportunities for gift-giving, with flowers being a popular and cherished choice. In urban areas, the convenience of online flower delivery services further fuels this gifting trend. Urban customers can show their uniqueness more freely now that they have greater disposable income. Flowers are a fantastic way to celebrate moments, add personality to spaces, or just make someone's day. Numerous tastes and preferences are catered to by the expanding assortment of floral arrangements and the customization options available for bouquets.

Consumer preferences in Latin America are undergoing a significant shift, particularly among younger demographics. This generation is tech-savvy, environmentally conscious, and seeks convenient and personalized shopping experiences.

E-commerce platforms offer consumers a user-friendly and convenient way to purchase flowers. With a few clicks, one can browse a wide selection of floral arrangements, choose a delivery date, and have beautiful blooms delivered to their doorstep or directly to the recipient. Online flower shops offer a wider selection of flowers and arrangements compared to traditional brick-and-mortar stores. Consumers have access to unique and exotic varieties, niche floral designs, and the ability to customize bouquets according to their preferences. E-commerce platforms are particularly popular among younger generations who are comfortable shopping online. This allows flower businesses to tap into a new and growing customer base, fostering a culture of online flower gifting and personal use.

Latin America Floriculture Market Restraints and Challenges:

Ensuring the freshness and quality of flowers is essential when transporting them over great distances. On the other hand, substantial post-harvest losses may result from inadequate cold chain infrastructure, which includes refrigerated storage facilities and vehicles. This damages the reputation of Latin American flowers in foreign markets in addition to decreasing growers' revenue. Shipments of flowers can be greatly delayed by navigating convoluted customs processes, bureaucratic red tape, and restricted air freight capacity. These inefficiencies, especially during times of high demand, increase transportation costs and shorten the window of opportunity for sending fresh flowers to foreign markets. Moving flowers efficiently from farms to processing facilities and airports within Latin American countries can also be a hurdle. Poor road infrastructure and limited access to reliable transportation services in rural areas can cause delays and increase logistical costs.

Latin America Floriculture Market Opportunities:

Expanding production of native flowers like Birds of Paradise, Heliconias, and Alstroemeria can cater to a discerning clientele seeking distinctive floral arrangements. Focusing on seasonal flowers like dahlias, peonies, and ranunculus can create a sense of exclusivity and cater to consumers who appreciate short-lived blooms with peak beauty. The growing interest in gourmet experiences creates an opportunity for cultivating edible flowers like pansies, violas, and nasturtiums. Partnerships with chefs and restaurants can further expand this niche market. Offering online flower shops with a wider selection, competitive prices, and personalized subscription services can attract new customers and build brand loyalty. Offering online flower shops with a wider selection, competitive prices, and personalized subscription services can attract new customers and build brand loyalty.

LATIN AMERICA FLORICULTURE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.28% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile, and Rest of Latin America |

|

Key Companies Profiled |

Dümmen Orange , Esmeralda Farms , Vivero Internacional , Agricola El Capiro , Rosario Farms , Flores El Capiro , Jardines de Los Andes , Selecta |

Latin America Floriculture Market Segmentation:

Latin America Floriculture Market Segmentation: By Type:

- Cut Flowers

- Potted Plants

- Cut Foliage

- Bedding Plants

- Other

Dominating the Latin American Floriculture Market, cut flowers reign supreme. This segment encompasses a dazzling variety of blooms, each with its unique characteristics and symbolic meaning. Roses, carnations, chrysanthemums, lilies, alstroemeria, and gypsophila are some of the most popular cut flower choices. Latin America has a long history of cut flower production, with countries like Colombia and Ecuador establishing themselves as global leaders in rose exports. Favorable climates, skilled labor, and efficient logistics have fueled the success of this segment. The cut flower market faces challenges like competition from other producing regions and fluctuating global flower prices.

The Latin American Floriculture Market is seeing a notable increase in the potted plant category. Popular options for bringing some color and vibrancy indoors are orchids, African violets, bromeliads, and tiny roses. These plants offer enduring beauty and require less care than cut flowers. These drought-tolerant, low-maintenance plants are becoming more and more well-liked because of their distinctive beauty and suitability for urban settings.

Latin America Floriculture Market Segmentation: By Distribution Channel:

- Wholesale

- Direct-to-Consumer (D2C)

- Retail Florists

- Supermarkets

Wholesale remains the dominant distribution channel in the Latin American Floriculture Market. This established system connects flower growers and producers with bulk buyers. In major production centers like Colombia and Ecuador, flower auctions play a significant role. Growers showcase their flowers to wholesalers who bid for specific lots, ensuring efficient and transparent pricing. These companies act as intermediaries, purchasing flowers in bulk from growers and then reselling them to retailers, event planners, and florists. They play a crucial role in logistics, storage, and distribution across the region.

D2C sales are revolutionizing the way flowers are purchased in Latin America. This channel allows flower growers, businesses, and online platforms to sell directly to consumers. These e-commerce platforms offer a wide variety of flowers, convenient ordering options, and same-day or next-day delivery, catering to tech-savvy consumers who prefer the ease of online shopping. D2C businesses leverage social media platforms like Instagram and Pinterest to showcase their floral arrangements, reach a wider audience, and build brand loyalty.

Latin America Floriculture Market Segmentation: Regional Analysis:

- Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

Brazil has a remarkable 38.2% market share as of 2023, making it the most prominent nation in the Latin American floral industry. Numerous elements contribute to its domination, such as the nation's large land area, pleasant climate, and well-established floriculture sector. The floriculture sector in Brazil is strongly anchored in the country's rich cultural heritage, with different regions being recognized for their distinct floral types and styles. The nation is especially well-known for its vivid tropical flowers, including birds of paradise, heliconia, and anthuriums. Due to their great demand in both domestic and international markets, these exotic flowers play a major role in Brazil's floriculture export earnings.

Colombia is becoming the region's fastest-growing nation. Colombia's floral business is expected to develop at an impressive 9.4% annual pace between 2020 and 2024, putting it in a strong position to take market share in the area. Colombia's climate is suitable for growing a wide variety of flowers, especially roses, carnations, and chrysanthemums. It has a variety of microclimates and high-altitude regions. The nation's thriving floriculture business has also been aided by its closeness to the equator and year-round availability of sunlight. Colombia has had tremendous expansion in the floriculture industry, in large part due to its strong emphasis on export-oriented production.

COVID-19 Impact Analysis on the Latin America Floriculture Market:

Strict lockdown measures disrupted established logistics networks. Flower exports from major producers like Colombia and Ecuador plummeted as international air travel became scarce. This led to a significant oversupply of flowers and depressed market prices. Social distancing measures and the cancellation of events like weddings and conferences drastically reduced demand for flowers. The closure of restaurants and hospitality businesses further diminished sales channels for the industry. Flower growers faced financial strain due to unsold inventory, perishable products, and disrupted cash flow. Many small-scale farms struggled to stay afloat, leading to potential consolidation within the industry. The pandemic heightened consumer awareness of sustainability. There's a growing interest in locally sourced, eco-friendly flowers, presenting an opportunity for growers who adopt sustainable practices.

Latest Trends/ Developments:

It is more environmentally friendly and encourages resource conservation by using data analytics and sensors to optimize water use, fertilizer application, and soil health monitoring. By using organic insecticides, natural predators, and close observation, one can lessen the use of toxic chemicals and promote a more robust ecology for beneficial insects and flowers. Investing in greenhouses with climate control systems allows year-round cultivation of specific flower varieties, reducing dependence on weather patterns and extending growing seasons. Implementing blockchain technology can track flowers from farm to consumer, ensuring transparency in the supply chain and attracting ethically conscious consumers who value responsible sourcing. Investing in user-friendly e-commerce platforms and mobile apps facilitates online flower purchases, provides wider product visibility, and streamlines the ordering process for consumers.

Key Players:

- Dümmen Orange

- Esmeralda Farms

- Vivero Internacional

- Agricola El Capiro

- Rosario Farms

- Flores El Capiro

- Jardines de Los Andes

- Selecta

Chapter 1. Latin America Floriculture Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Floriculture Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Floriculture Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Floriculture Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Floriculture Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Floriculture Market– By Type

6.1. Introduction/Key Findings

6.2. Cut Flowers

6.3. Potted Plants

6.4. Cut Foliage

6.5. Bedding Plants

6.6. Other

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Latin America Floriculture Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Wholesale

7.3. Direct-to-Consumer (D2C)

7.4. Retail Florists

7.5. Supermarkets

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Latin America Floriculture Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Latin America

8.1.1. By Country

8.1.1.1. Mexico

8.1.1.2. Brazil

8.1.1.3. Argentina

8.1.1.4. Chile

8.1.1.5. Rest of Latin America

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Latin America Floriculture Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Dümmen Orange

9.2. Esmeralda Farms

9.3. Vivero Internacional

9.4. Agricola El Capiro

9.5. Rosario Farms

9.6. Flores El Capiro

9.7. Jardines de Los Andes

9.8. Selecta

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

A growing middle class in Latin American countries translates to more disposable income. This allows consumers to allocate a larger budget towards discretionary purchases, including flowers for personal enjoyment, home decoration, and special occasions.

Latin American flower producers face stiff competition from established players in other regions like Kenya, Ethiopia, and the Netherlands. These competitors may offer lower production costs or specialize in specific flower varieties, putting pressure on profit margins

Dümmen Orange, Esmeralda Farms, Vivero Internacional, Agricola El Capiro

Rosario Farms, Flores El Capiro, Jardines de Los Andes, Selecta.

Brazil stands out as the most dominant country in the Latin American Floriculture Market, accounting for a staggering 38.2% market share as of 2024.

Colombia is emerging as the fastest-growing country in the region. With a remarkable growth rate of 9.4% from 2020 to 2024, Colombia's floriculture industry is poised to capture an increasing share of the regional market