European floriculture Market Size (2024-2030)

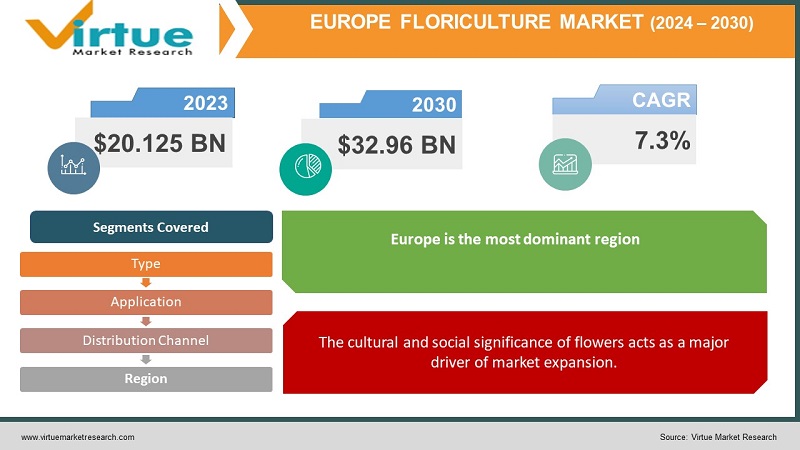

The global European floriculture market was valued at USD 20.125 billion and is projected to reach a market size of USD 32.96 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.3%.

The science of cultivating and selling flowers and foliage plants is known as floriculture. It is a field of horticulture and agriculture where flowers are grown and sold. The growing, preparing, selling, and distributing of flowers are all included in the field of floriculture. Europe has a rich heritage in the floricultural sector. In the past, many European countries had good local production. This contributed to the domestic supply. Presently, with a lot of diversity in the products, this market has undergone notable expansion. In the future, with a growing focus on sustainability practices, this market is anticipated to witness considerable growth.

Key Market Insights:

In 2022, cut flowers made up 3.1 billion euros of the ornamental plant market volume in Germany.

The floriculture market in the Netherlands is projected to be valued at USD 4.89 billion in 2024 and USD 6.15 billion by 2029.

With 10% of the world's total land and 44% of the world's output of flowers and pot plants, the EU has one of the greatest concentrations of floral production per hectare in the world.

Italy's exports of dried or fresh-cut flowers and flower buds for bouquets reached 134.9 million euros in 2022, which was a rise of 5.34%.

Post-harvest losses in this industry can be up to 35%, impacting the floriculture industry and the environment. To tackle this, companies in the market have been emphasizing supply chain management and cold chain facilities and improvising the existing packaging techniques.

Europe Floriculture Market Drivers:

The cultural and social significance of flowers acts as a major driver of market expansion.

Flowers hold special prominence in many societies and cultures. They are used as a wide gift-giving choice on many occasions. Motivaction's study shows that 49% of Germans pick flowers on International Women's Day, 37% in the Netherlands, 34% in France, and 34% in the United Kingdom. Additionally, they are used in many events like wedding celebrations, birthday parties, funerals, and other ceremonies. They are given to express the individual's emotions that may depict their love, care, joy, gratitude, sympathy, apology, appreciation, happiness, and affection towards one another. Flowers are known to make people happy. Over the years, there have been an enormous number of varieties, colors, shapes, and fragrances that have been discovered or created. Therefore, flowers are associated with a happy, emotional atmosphere that promotes the best possible psychological and, therefore, physical health. The aesthetic encounter becomes connected and socially rooted. Apart from this, they are a popular choice as decorative items as they provide pleasing views. The position and demand of flowers in our society therefore increase the demand for the market.

Extending applications have been contributing to the development.

Flowers are employed in a wide range of industries. They are primarily known for their fragrance. This property is beneficial, as many flowers are used in perfumes, essential oils, creams, colognes, and serums. Flowers like rose, jasmine, narcissus, and lavender are often used in perfumes. Secondly, traditional medicine has always had a dominant position in societies because it follows a sustainable approach and has no major side effects. Few flowers are known exceptionally for their medicinal properties. For instance, calendula, which is native to Southern Europe, is known for its medicinal properties like healing wounds, soothing eczema, and reliving rashes, due to which it is used in skincare and cosmetics. Furthermore, a few flowers, like chives, are used in the food and beverage industry as flavoring agents because of their aroma profile.

Floriculture Market Restraints and Challenges:

Seasonal demand, limited shelf life, weather conditions, and competition from artificial alternatives are the main issues that the market is currently experiencing.

Flowers may be in high demand only during certain periods. This can mean specific occasions, like the wedding season and holidays. This can cause a lot of losses to the market because of this inconsistency. Secondly, their longevity can be a hurdle. This can be a barrier while transporting across long distances and other international borders. Proper practices like cold chain infrastructure and efficient supply chain management techniques need to be implemented to prevent this. Thirdly, they require certain environmental factors for healthy growth. This can include a moderate temperature, sufficient sunlight, and water facilities. Crop failure can be an outcome if there is any sort of adversity in these conditions. Besides this, synthetic flowers have gained prominence due to their advantages, like low maintenance and longer duration. A greater percentage of the population can rely on these choices affecting the industry.

Floriculture Market Opportunities:

Rising interest in indoor farming has been providing many possibilities for the market. A lot of people tend to grow plants on their terraces and gardens because of the pleasing views and pure oxygen that they provide. Usually, people prefer short-grown plants since they won’t take up much space. Additionally, plants that yield colorful flowers are prioritized. Floriculture businesses can utilize this trend to sell a lot of plants that align with the demand. Innovations in product development can aid the market. By introducing new varieties, rearranging the flower arrangements, and choosing exotic ones, a broader consumer base can be achieved. Conducting workshops and seminars about medicinal properties, agricultural hacks, floral care, etc. can enhance customer engagement. Apart from this, import-export trade can help the market by creating better revenue. Strong distribution channels can be made by researching the needs and demands of different countries and continents.

FORTICULTURE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.3% |

|

Segments Covered |

By Type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profile |

Dümmen Orange, Royal FloraHolland, Syngenta Flowers, Florensis, Selecta One, Ball Horticultural Company, Beekenkamp Plants, Oserian Development Company, MPS (More Profitable Sustainability), Karuturi Global Limited |

Floriculture Market Segmentation:

Floriculture Market Segmentation: By Type:

- Cut Flowers

- Potted Plants

- Bedding Plants

- Others

Based on type, cut flowers emerge as the largest segment in this market, with a share exceeding 65% in 2023. Roses, tulips, hydrangea, sunflowers, delphinium, carnation, and orchids are the most common ones. They are mainly used for decorations, floral arrangements, and flower bouquets. This is the most prominent choice for most occasions, like weddings and parties, since they are easy to arrange. Besides, they provide an aesthetic view. They can be mixed and matched with other combinations to enhance the look. Potted plants are the fastest-growing category. They help brighten the look of the place. They are known to promote a calm feeling. Particularly in urban areas with low air quality, potted plants can raise humidity and oxygen levels. Research has indicated that plants have the power to elevate emotions, foster creativity, and lessen stress. This creates an upsurge in demand.

Floriculture Market Segmentation: By Application:

- Industrial

- Personal Use

- Gift

- Others

The gift segment is the largest, with a share exceeding 50% in 2023. Flowers are frequently used as a token of affection and love. Receiving flowers may give someone a sense of happiness and appreciation. Their scent, vibrant colors, and heartfelt sentiment can create positive effects. Industrial is the fastest-growing category. Wellness products are a popular category in this section. The demand for flowers and plants in items that support mental and emotional well-being has expanded as a result of the wellness movement. This covers goods like aromatherapy, essential oils, and other wellness-focused products with flower themes. This market is expanding because of the healing and stress-relieving effects of flowers.

Floriculture Market Segmentation: By Distribution Channel:

- Offline

- Retail

- Florist

- Supermarkets/Hypermarkets

- Specialty Stores

- Online

Based on distribution channels, the offline segment is the largest growing. This is because people who buy them can visually inspect the flowers, asses the quality, and hand-pick the ones they like. They can interact with the shopkeeper and have all their doubts cleared. Besides, this channel is present in every colony, making the availability simpler. However, the online segment is the fastest-growing. E-commerce brands have started to guarantee the freshness of flowers that are placed through online retail. This channel gives many discounts for the customers making it a budget-friendly option. Furthermore, customers can order flowers from the convenience of their homes and get them delivered to their doorstep which makes this option an attractive choice.

Floriculture Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Based on region, the rest of Europe is the most dominant region, with an approximate market share of 31% in 2023. This mainly consists of the Netherlands. This area is one of the top exporters in the European Union for this market. The nation is a major player in the flower industry due to its well-established worldwide trade connections. This is an important hub for commerce, particularly in the Aalsmeer region. The nation uses airplanes to ship its blooms to far-off places. The Netherlands is renowned for its cutting-edge horticulture techniques and colorful tulip fields. The nation produces more than 12 billion blooms annually. Most of the prestigious companies in this region are involved in bulk manufacturing, product innovations, and diversity. Key players include Royal FloraHolland, Dümmen Orange, Hilverda Florist, and Anthura. They have a global presence and are involved in import-export activities. Germany is one of the fastest-growing regions, with a rough share of 21%. Germany is the biggest importer of flowers worldwide. 14.1% of the cut flowers valued at 1.3 billion dollars were imported by Germany in the year 2022, as per TrendEconomy. This is also one of the biggest markets for cut roses. Germans usually purchase a lot of bouquets as a popular gift. Germany's soil and temperature provide the perfect circumstances for a wide range of native flowers. The striking common yarrow, elder, and bigleaf hydrangea are a few of them. These flowers are important to the ecology, have deep symbolic meaning, and enhance the attractiveness of the surrounding areas.

COVID-19 Impact Analysis on the European Floriculture Market:

The outbreak of the virus hurt the market. Lockdowns, social isolation, and movement restrictions were the new norm. This created a lot of disruptions in the supply chain, transportation, and logistics. Most of the companies were temporarily shut down to prevent the spread of the virus. All social events were canceled or postponed because of the guidelines. The demand for flowers declines tremendously. Most of the major investments were shifted towards healthcare applications that included vaccine development, arranging necessities like ventilators, oxygen tanks, PPE kits, masks, and R&D activities. This halted all the launches and collaborations. Financial restraints were prevalent during this period. Moreover, there wasn't enough labor to carry out the end-to-end operations due to uncertainty. According to a report by Scielo. br, the most notable effects, according to the data, were the decline in client base, which decreased revenue for the business relative to pre-pandemic sales values, and the average 45.3% decrease in financial transactions brought about by the pandemic scenario. Post-pandemic, the market has begun to recover owing to the upliftment of rules and relaxation of regulations.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Companies are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

Sustainable practices have gained a lot of prominence. Floral businesses can capitalize on this trend by implementing eco-friendly practices. This can include using recyclable or biodegradable materials for packaging. Apart from this, cultivational practices can be incorporated by preventing the use of fertilizers and other harmful compounds.

Key Players:

- Dümmen Orange

- Royal FloraHolland

- Syngenta Flowers

- Florensis

- Selecta One

- Ball Horticultural Company

- Beekenkamp Plants

- Oserian Development Company

- MPS (More Profitable Sustainability)

- Karuturi Global Limited

- In February 2023, Fluence declared that it would assist high-end Dutch floriculture firms with sustainability and operational cost-effectiveness. Fluence is a global supplier of LED lighting systems that use less energy for food production, medical cannabis, and floriculture. Sustainable growth is Fluence's top priority across the board. This includes ethical sourcing procedures, promoting a fair and secure work environment, and reducing its carbon footprint.

- In November 2022, the 70th edition of International Statistics Flowers and Plants 2022 was released by the International Association of Horticultural Producers (AIPH) and the International Flower Trade Association, Union Fleurs. Updated per capita consumption data for Austria, Belgium, Denmark, France, Germany, Italy, Switzerland, Spain, the United Kingdom, Japan, and the United States are included in the 2022 Statistics Yearbook. A synopsis of sales and marketing for the best-selling pot plants and flowers for wholesale marketplaces is also included.

- In April 2022, MyFiora, a new order entry platform that allows clients to make orders whenever it's convenient for them, was launched by Syngenta Flowers. MyFiora is an online platform that is easy to use and highly effective for producers. It's simple to place a direct order and verify product availability for the next five weeks with myFiora. The option to download a product overview and submit an order request for the next season is another added feature.

Chapter 1. Europe Floriculture Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Floriculture Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Floriculture Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Floriculture Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Floriculture Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Floriculture Market– By Type

6.1. Introduction/Key Findings

6.2. Cut Flowers

6.3. Potted Plants

6.4. Bedding Plants

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Floriculture Market– By Application

7.1. Introduction/Key Findings

7.2 Industrial

7.3. Personal Use

7.4. Gift

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe Floriculture Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Offline

8.2.1. Retail

8.2.2. Florist

8.2.3. Supermarkets/Hypermarkets

8.2.4. Specialty Stores

8.3. Online

8.4. Y-O-Y Growth trend Analysis Distribution Channel

8.5. Absolute $ Opportunity Analysis Distribution Channel, 2024-2030

Chapter 9. Europe Floriculture Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Application

9.1.3. By type

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Floriculture Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Dümmen Orange

10.2. Royal FloraHolland

10.3. Syngenta Flowers

10.4. Florensis

10.5. Selecta One

10.6. Ball Horticultural Company

10.7. Beekenkamp Plants

10.8. Oserian Development Company

10.9. MPS (More Profitable Sustainability)

10.10. Karuturi Global Limited

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The global European floriculture market was valued at USD 20.125 billion and is projected to reach a market size of USD 32.96 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.3%.

The cultural and social significance of flowers and extending applications are the main factors propelling the European floriculture Market.

Based on Type, the European floriculture Market is segmented into Cut Flowers, Potted Plants, Bedding Plants, and Others

The Netherlands is the most dominant region for the European floriculture Market.

Dümmen Orange, Royal FloraHolland, and Syngenta Flowers are the key players operating in the European floriculture Market