Floriculture Market Size (2024 – 2030)

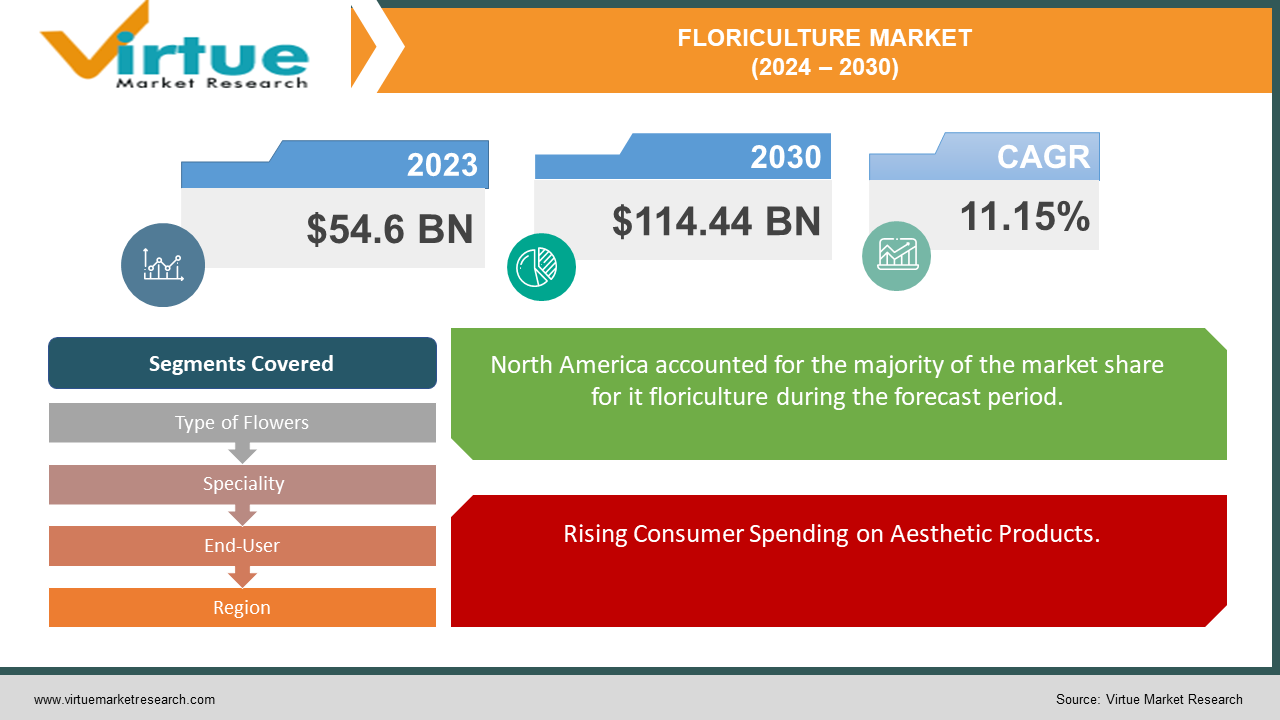

The global floriculture market is projected to grow from an estimated USD 54.6 billion in 2023 to USD 114.44 billion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 11.15% over the forecast period of 2024-2030.

Technological advancements in greenhouse technologies, irrigation systems, and breeding techniques are enhancing productivity and expanding the range of available floral varieties. Moreover, sustainability initiatives and growing awareness of eco-friendly practices are shaping industry practices, influencing consumer preferences for organic and locally sourced flowers. With diverse end-user segments ranging from retail florists to commercial spaces and online platforms, the floriculture market continues to evolve, driven by innovation, changing demographics, and global economic trends.

Key Insights:

Europe and North America are the leading regions in the global floriculture market, collectively accounting for over 50% of the market share. These regions benefit from strong consumer demand for high-quality flowers and well-established distribution networks.

Despite market growth, the floriculture industry faces challenges related to seasonal fluctuations in demand and supply chain disruptions, exacerbated by global economic uncertainties. Implementing diversified production strategies and enhancing storage and logistics infrastructure can help mitigate these challenges and ensure consistent supply throughout the year.

Global Floriculture Market Drivers:

Rising Consumer Spending on Aesthetic Products.

Consumer preferences for enhancing living spaces and occasions with floral decorations and gifts are driving significant growth in the global floriculture market. Increasing disposable incomes worldwide have led to higher expenditures on aesthetic products like fresh flowers and potted plants. This trend is particularly evident in urban areas where consumers seek to personalize their surroundings with floral arrangements, thereby boosting demand across retail and e-commerce channels.

Growing Demand for Event Decorations and Gifting.

The expanding events and hospitality sectors globally contribute substantially to the demand for floriculture products. Weddings, corporate events, and social gatherings increasingly incorporate floral decorations, contributing to a steady rise in bulk purchases of cut flowers and customized floral arrangements. Additionally, flowers remain a preferred choice for gifting purposes, further driving market growth as consumers seek meaningful and decorative gifts for various occasions.

Technological Advancements in Cultivation and Distribution.

Advancements in greenhouse technology, irrigation systems, and breeding techniques are revolutionizing the floriculture industry. These innovations enable growers to enhance crop yields, improve flower quality, and extend the availability of seasonal blooms throughout the year. Moreover, improvements in cold chain logistics and packaging technologies ensure efficient transportation and longer shelf life of flowers, meeting global supply chain demands and reducing post-harvest losses.

Global Floriculture Market Restraints and Challenges:

Seasonal Nature of Production.

Floriculture is inherently seasonal, with production heavily dependent on specific growing conditions and climate cycles. This seasonal nature often leads to fluctuations in supply, affecting market stability and pricing. Growers must contend with challenges such as unpredictable weather patterns, pest outbreaks, and natural disasters that can disrupt production schedules and impact flower quality and availability.

High Vulnerability to External Economic Factors.

The floriculture industry is sensitive to fluctuations in global economic conditions, including currency exchange rates, inflation rates, and consumer spending patterns. Economic downturns can lead to reduced discretionary spending on non-essential items like flowers, affecting demand and profitability for growers and retailers alike. Moreover, trade tariffs and international trade policies can further exacerbate market volatility and hinder market expansion opportunities.

Environmental and Sustainability Concerns.

Increasing awareness of environmental sustainability is shaping consumer preferences and industry practices within the floriculture sector. Growers face pressures to adopt eco-friendly cultivation methods, reduce water usage, and minimize pesticide use to mitigate environmental impact. Compliance with stringent regulations related to pesticide residues and waste management adds operational costs and complexities, posing challenges for smaller growers and new market entrants.

Global Floriculture Market Opportunities:

Seasonal Nature of Production.

Floriculture is inherently seasonal, with production heavily dependent on specific growing conditions and climate cycles. This seasonal nature often leads to fluctuations in supply, affecting market stability and pricing. Growers must contend with challenges such as unpredictable weather patterns, pest outbreaks, and natural disasters that can disrupt production schedules and impact flower quality and availability.

High Vulnerability to External Economic Factors.

The floriculture industry is sensitive to fluctuations in global economic conditions, including currency exchange rates, inflation rates, and consumer spending patterns. Economic downturns can lead to reduced discretionary spending on non-essential items like flowers, affecting demand and profitability for growers and retailers alike. Moreover, trade tariffs and international trade policies can further exacerbate market volatility and hinder market expansion opportunities.

Environmental and Sustainability Concerns.

Increasing awareness of environmental sustainability is shaping consumer preferences and industry practices within the floriculture sector. Growers face pressures to adopt eco-friendly cultivation methods, reduce water usage, and minimize pesticide use to mitigate environmental impact. Compliance with stringent regulations related to pesticide residues and waste management adds operational costs and complexities, posing challenges for smaller growers and new market entrants.

FLORICULTURE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.15% |

|

Segments Covered |

By Type of Flowers, Speciality, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

FloraHolland, Dümmen Orange, Syngenta Flowers, Karuturi Global Ltd., Oserian Development Company, Selecta One, Fides Oro, Beekenkamp Plants, Danziger "Dan" Flower Farm, Ball Horticultural Company, Tagawa Greenhouse Enterprises, Costa Farms |

Floriculture Market Segmentation: By Type of Flowers

-

Cut Flowers

-

Potted Plants

In the global floriculture market, cut flowers represent one of the most effective segments due to their widespread consumer appeal and diverse applications. Cut flowers, including popular varieties such as roses, lilies, tulips, and orchids, are highly sought after for their use in floral arrangements, bouquets, and decorative displays for various occasions such as weddings, birthdays, and corporate events. Their popularity is bolstered by their ability to convey sentiments of love, celebration, and sympathy, making them indispensable in both personal and commercial settings. Moreover, cut flowers have a relatively shorter production cycle compared to potted plants, allowing growers to meet seasonal and event-driven demand more flexibly. This segment benefits from robust distribution networks encompassing retail florists, supermarkets, online platforms, and wholesale markets, ensuring broad market reach and accessibility to consumers globally. As consumer preferences evolve towards convenience and aesthetic appeal, the demand for cut flowers continues to drive innovation in cultivation techniques, packaging solutions, and transportation logistics within the floriculture industry.

Floriculture Market Segmentation: By Speciality

-

Organic and Sustainable Flowers

-

Seasonal Flowers

In the market segmentation of the global floriculture industry by specialty, organic and sustainable flowers emerge as an increasingly effective segment driven by growing consumer awareness and demand for environmentally friendly products. Organic flowers are cultivated without synthetic pesticides and fertilizers, adhering to stringent certification standards that prioritize soil health, biodiversity conservation, and sustainable farming practices. This segment appeals to eco-conscious consumers who prioritize ethical sourcing and environmental stewardship in their purchasing decisions. Furthermore, organic and sustainable flowers cater to a niche market segment that values transparency in production methods and seeks assurance of minimal environmental impact throughout the flower's lifecycle. The rise of organic certification programs and consumer education initiatives further supports the market growth of this segment, encouraging growers to adopt sustainable cultivation practices and differentiate their products in a competitive market landscape. As sustainability continues to shape consumer preferences and industry standards, the demand for organic and sustainable flowers is expected to expand, driving innovation and investment in eco-friendly technologies within the floriculture sector.

Floriculture Market Segmentation: By End-User

-

Retail/Consumer Use

-

Consumer Use

In the market segmentation of the global floriculture industry by end-user, retail/consumer use emerges as the most effective segment, underpinned by widespread consumer demand for floral products across various personal and social contexts. Retail consumers purchase flowers for diverse purposes such as home decoration, gifts for special occasions like birthdays and anniversaries, and expressions of sympathy. The segment benefits from a broad demographic appeal, spanning individuals seeking to enhance living spaces with fresh blooms to gift-givers looking to convey emotions and sentiments through flowers. Retail florists, both traditional brick-and-mortar shops and online platforms, play a crucial role in meeting this demand by offering a wide variety of cut flowers and potted plants, catering to different preferences and budgets. Additionally, the retail/consumer segment thrives on seasonal trends and cultural traditions that drive spikes in flower purchases during peak periods like Valentine's Day and Mother's Day. As consumer lifestyles evolve and online shopping for floral products gains momentum, the retail/consumer segment continues to evolve, leveraging digital platforms and personalized services to enhance customer engagement and satisfaction in the global floriculture market.

Floriculture Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The global floriculture market exhibits varied regional dynamics, with North America leading in market share at 36%. This dominance is attributed to high consumer spending on floral products for both personal use and events, supported by a well-established retail infrastructure and a strong culture of gifting. Europe follows closely with a substantial 26% market share, driven by a tradition of floral decor in homes and public spaces, coupled with a thriving market for luxury flowers. The Asia-Pacific region holds 24% of the market share, fueled by rapid urbanization, increasing disposable incomes, and a growing preference for ornamental plants in landscaping and corporate settings. South America and the Middle East & Africa regions contribute 8% and 7%, respectively, with growing demand for flowers in weddings, festivals, and religious ceremonies. These regional shares underscore diverse consumer behaviors and cultural influences shaping the global floriculture market, prompting industry stakeholders to tailor strategies that resonate with local preferences while navigating economic and logistical challenges across different regions.

COVID-19 Impact Analysis on the Global Floriculture Market:

The COVID-19 pandemic significantly impacted the global floriculture market, introducing unprecedented challenges and reshaping consumption patterns worldwide. Initially, stringent lockdown measures and disruptions in international trade routes led to a sharp decline in floral demand, particularly in key markets reliant on events, weddings, and hospitality sectors. Flower growers faced substantial losses as supply chains faltered, causing widespread perishability issues and financial strain. However, as restrictions eased, there was a notable shift towards online sales and direct-to-consumer models, buoyed by increased demand for home decor and emotional well-being products. Moreover, the pandemic accelerated trends towards sustainability and local sourcing, prompting growers to innovate with eco-friendly practices and diversify product offerings. Looking ahead, the floriculture industry continues to adapt, leveraging digital platforms and resilient supply chains to navigate ongoing uncertainties while emphasizing agility and consumer-centric strategies in a post-pandemic landscape.

Latest Trends/ Developments:

Recent trends and developments in the global floriculture industry reflect a dynamic shift towards sustainability, digital transformation, and evolving consumer preferences. There is a growing emphasis on sustainable practices throughout the flower production and supply chain, driven by increasing consumer awareness of environmental impact and demand for responsibly sourced products. Technological advancements in greenhouse automation, irrigation systems, and genetic engineering are enhancing crop yields and extending the availability of seasonal blooms, catering to year-round demand. Additionally, digital platforms and e-commerce have gained prominence, offering convenience and accessibility to consumers purchasing flowers online for various occasions. The industry is also witnessing innovation in floral design and packaging, with personalized and eco-friendly options becoming increasingly popular. As the market continues to evolve, stakeholders are embracing these trends to foster growth, address challenges, and capitalize on emerging opportunities in the global floriculture sector.

Key Players:

-

FloraHolland

-

Dümmen Orange

-

Syngenta Flowers

-

Karuturi Global Ltd.

-

Oserian Development Company

-

Selecta One

-

Fides Oro

-

Beekenkamp Plants

-

Danziger "Dan" Flower Farm

-

Ball Horticultural Company

-

Tagawa Greenhouse Enterprises

-

Costa Farms

Chapter 1. Floriculture Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Floriculture Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Floriculture Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Floriculture MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Floriculture Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Floriculture Market– By Type of Flowers

6.1 Introduction/Key Findings

6.2 Cut Flowers

6.3 Potted Plants

6.4 Y-O-Y Growth trend Analysis By Type of Flowers

6.5 Absolute $ Opportunity Analysis By Type of Flowers, 2024-2030

Chapter 7. Floriculture Market– By Speciality

7.1 Introduction/Key Findings

7.2 Organic and Sustainable Flowers

7.3 Seasonal Flowers

7.4 Y-O-Y Growth trend Analysis By Speciality

7.5 Absolute $ Opportunity Analysis By Speciality, 2024-2030

Chapter 8. Floriculture Market– By End-User

8.1 Introduction/Key Findings

8.2 Retail/Consumer Use

8.3 Consumer Use

8.4 Y-O-Y Growth trend Analysis By End-User

8.5 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Floriculture Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type of Flowers

9.1.3 By Speciality

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type of Flowers

9.2.3 By Speciality

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type of Flowers

9.3.3 By Speciality

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type of Flowers

9.4.3 By Speciality

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type of Flowers

9.5.3 By Speciality

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Floriculture Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 FloraHolland

10.2 Dümmen Orange

10.3 Syngenta Flowers

10.4 Karuturi Global Ltd.

10.5 Oserian Development Company

10.6 Selecta One

10.7 Fides Oro

10.8 Beekenkamp Plants

10.9 Danziger "Dan" Flower Farm

10.10 Ball Horticultural Company

10.11 Tagawa Greenhouse Enterprises

10.12 Costa Farms

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global floriculture market is projected to grow from an estimated USD 54.6 billion in 2023 to USD 114.44 billion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 11.15% over the forecast period of 2024-2030.

The primary drivers of the global floriculture market include increasing consumer demand for aesthetic products, growth in events and hospitality sectors, and advancements in cultivation and distribution technologies.

The key challenges facing the global floriculture market include seasonal fluctuations in supply, vulnerability to economic downturns, environmental sustainability concerns, and intense market competition.

In 2023, North America held the largest share of the global floriculture market.

FloraHolland, Dümmen Orange, Syngenta Flowers, Karuturi Global Ltd., Oserian Development Company, Selecta One, Fides Oro, Beekenkamp Plants, Danziger "Dan" Flower Farm, Ball Horticultural Company, Tagawa Greenhouse Enterprises, Costa Farms are the main players.