Inventory Management Software Market Size (2025 – 2030)

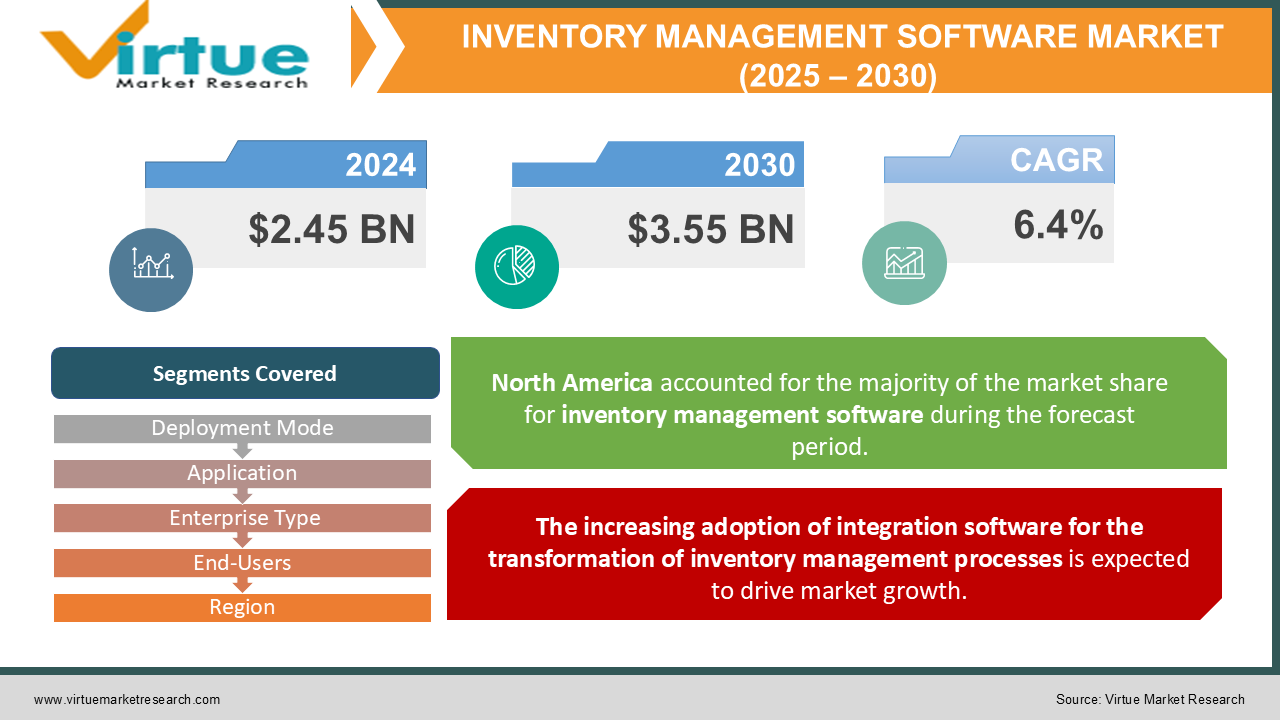

The Inventory Management Software Market was valued at USD 2.45 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 3.55 billion by 2030, growing at a CAGR of 6.4%.

Inventory management software streamlines the process of managing inventories by automating key tasks, including tracking stock levels, handling reorders, and updating financial records. This software is utilized by organizations to reduce instances of overstocking and stockouts. It serves as a modern tool for managing inventory data, replacing traditional storage methods such as paper records or spreadsheets.

The growth of the inventory management software market is anticipated to be driven by several factors, including its seamless integration with other business systems, such as accounting software and Point-of-Sale (POS) systems. The demand for more efficient inventory management systems increased during the pandemic, leading to a surge in investments, which in turn positively impacted the market.

Additionally, in the upcoming years, the rising need for inventory management systems will be further propelled by the growing trend of warehouse automation aimed at improving inventory control. This trend is contributing to the expansion of the global market share.

Key Market Insights:

-

One of the key factors contributing to this growth is the need for manufacturers to optimize their inventory management processes and reduce costs on a global scale. The surging demand for the software can be attributed to its ability to enhance supply chain operations and boost customer satisfaction.

-

A 2023 GS1 study, conducted by a global network of barcode standards organizations, highlighted that barcode usage led to a 76% reduction in medication errors and a 43% decrease in stock levels within the healthcare sector.

Inventory Management Software Market Drivers:

The increasing adoption of integration software for the transformation of inventory management processes is expected to drive market growth.

The inventory management system must be seamlessly integrated with other platforms, such as accounting and e-commerce systems, to enhance operational efficiency and eliminate the need for manual data entry. Organizations are increasingly adopting integrated inventory management solutions to reduce costs, improve cash flow, and increase profitability.

As a result, the market is experiencing substantial growth, driven by the emergence of numerous companies providing solutions that incorporate technologies capable of transforming inventory management processes.

Inventory Management Software Market Restraints and Challenges:

The lack of visibility in inventory management processes is expected to hinder market growth.

Two primary challenges arise from the lack of visibility in inventory management processes. The first is the difficulty of locating items within large spaces, such as warehouses. The second involves identifying ordered products and updating stock levels in outdated systems, such as spreadsheets and paper-based databases. Delays in either scenario can lead to missed orders, dissatisfied customers, or even loss of clientele. Additionally, factors such as high investment costs and limited consumer acceptance of legacy systems are expected to further constrain market growth during the forecast period.

Inventory Management Software Market Opportunities:

The increasing adoption of business process automation for seamless inventory control is set to drive market growth.

Business process automation is increasingly being utilized to streamline warehouse operations with minimal human intervention. This technology focuses on efficiently managing the movement of inventory within, out of, and across warehouses, reducing the risk of human error. To monitor fluctuating supply costs, recalculate stock levels, and gain comprehensive insights into the entire process, end users are increasingly relying on real-time analytics as the most effective solution.

INVENTORY MANAGEMENT SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.4% |

|

Segments Covered |

By Deployment Mode, Application, Enterprise Type, End-Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Zoho Corporation Pvt. Ltd., Oracle Corporation, IBM Corporation , CIN7 Ltd., Lightspeed Intuit Inc. , Linnworks, Fishbowl, Acumatica, Inc., Brightpearl |

Inventory Management Software Market Segmentation: By Deployment Mode

-

On-Premise

-

Cloud

The on-premise deployment model has dominated the market share in 2024. This strategy allows users to monitor their operations via desktops or additional systems, leading to increased adoption of on-premise installations. On-premise inventory management systems offer users complete control and administrative access to their software when installed at company premises.

However, the cloud segment is projected to experience the highest compound annual growth rate (CAGR) during the forecast period. A cloud-based inventory management model enhances an enterprise's backup capacity while providing flexibility and stability to the business. The growth of this segment can be attributed to the rise of e-commerce and various order fulfillment

methods. Many organizations are shifting from traditional on-premise systems to cloud-based models, driven by the growing adoption of Software-as-a-Service (SaaS) and cloud solutions in inventory management.

Inventory Management Software Market Segmentation: By Application

-

Inventory Control and Tracking

-

Order Management

-

Scanning and Barcoding

-

Asset Management

-

Others

The inventory control and tracking segment has led the market in 2024, primarily due to its ability to help organizations maintain optimal stock levels. This minimizes the risk of both overstocking and stock shortages, ensuring more efficient inventory management.

The scanning and barcoding segment is anticipated to experience the highest compound annual growth rate (CAGR) during the forecast period. Barcode scanners are increasingly being used to track inventory movements across the supply chain, as consumers demand more efficient solutions. These scanners allow organizations to process large volumes of goods alongside Point of Sale (POS) systems and directly retrieve data from cash registers.

Inventory Management Software Market Segmentation: By Enterprise Type

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

The large enterprises segment dominated the market in 2024, driven by the challenges associated with managing extensive inventories. For these enterprises, it is crucial to ensure products are always available and not out of stock. The growing and unique customer demands are driving large enterprises to adopt and encourage the development of inventory management software to address these challenges.

The Small and Medium Enterprises (SMEs) segment is expected to experience the highest compound annual growth rate (CAGR) during the forecast period. SMEs typically maintain smaller inventories, which lowers the overall cost of implementing inventory management software. Additionally, there is a growing trend of developing solutions specifically tailored to the needs of SMEs.

For example, in August 2023, BoxHero Inc. introduced two new solution designed to offer greater convenience and integration for SMEs, further supporting their adoption of inventory management tools.

Inventory Management Software Market Segmentation: By End-Users

-

Manufacturing

-

Retail and Consumer Goods

-

Healthcare and Life Sciences

-

Energy and Utilities

-

Automotive

-

Others

The manufacturing segment has dominated the market, as inventory management is a crucial component of modern production processes. It ensures the timely manufacturing of goods and helps businesses accurately forecast inventory levels. The data provided by inventory management software plays a key role in guiding decisions related to purchasing, production, and sales.

The healthcare and life sciences segment is anticipated to experience a higher compound annual growth rate (CAGR) during the forecast period. Hospitals, in particular, rely on managing stock for use by healthcare professionals. Additionally, a simplified inventory management system helps enhance communication between departments, boosts productivity, ensures regulatory compliance, and reduces the time spent on inventory control by medical staff, making it easier to track equipment and supplies.

Inventory Management Software Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America held the largest market share for inventory management systems, driven by the growing demand for efficient supply chain management and the rapid adoption of this technology. The regional market is expected to continue expanding at a steady pace during the forecast period, supported by the increasing presence of key market players and a stronger emphasis on multichannel inventory integration platforms.

The Asia Pacific region has the fastest growth rate during the forecast period. In this region, automation is playing a significant role in enhancing the operations of both governments and businesses. Market growth is also being driven by increasing private and public investments in inventory and supply chain operations, to accelerate the adoption of automation technologies.

The Middle East and Africa are projected to register the second-highest growth rate globally during the forecast period. The widespread adoption of inventory management software in this region has been fueled by lower inventory costs and enhanced cash flow, especially within the healthcare sector.

COVID-19 Pandemic: Impact Analysis

The global inventory management software market, like many other sectors, faced significant disruptions due to the various precautionary lockdowns and restrictions imposed by governments worldwide. Additionally, consumer demand declined as individuals focused on reducing non-essential expenditures due to the economic challenges brought on by the outbreak. These factors are anticipated to hinder the revenue growth of the global inventory management software market throughout the forecast period. However, as governments begin to lift lockdowns and restrictions, the market is expected to recover and regain momentum.

Latest Trends/ Developments:

-

In February 2024, Zoho, launched a new point-of-sale solution named Zakya, aimed at simplifying daily operations for small and medium-sized retail businesses. Zoho claims that the solution can be set up in less than an hour, even for businesses handling thousands of inventory items. Zakya includes a POS billing app that allows retail stores to process transactions offline, and during peak hours, sales staff can concurrently bill customers to reduce checkout queues.

-

In September 2023, Afresh Technologies launched its inventory management platform, aimed at transforming ordering and inventory management within grocers' fresh departments. Corporate teams also benefit from a web portal that provides store-specific inventory guides and facilitates the validation of final inventory results. Customers have reported an average of 31% time savings on their next order after conducting an ending inventory count.

Key Players:

These are top 10 players in the Inventory Management Software Market :-

-

Zoho Corporation Pvt. Ltd.

-

Oracle Corporation

-

IBM Corporation

-

CIN7 Ltd.

-

Lightspeed Intuit Inc.

-

Linnworks

-

Fishbowl

-

Acumatica, Inc.

-

Brightpearl

Chapter 1. Inventory Management Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Inventory Management Software Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Inventory Management Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Inventory Management Software Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Inventory Management Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Inventory Management Software Market – BY DEPLOYMENT MODE

6.1 Introduction/Key Findings

6.2 On-Premise

6.3 Cloud

6.4 Y-O-Y Growth trend Analysis BY DEPLOYMENT MODE

6.5 Absolute $ Opportunity Analysis BY DEPLOYMENT MODE, 2025-2030

Chapter 7. Inventory Management Software Market – BY ENTERPRISE TYPE

7.1 Introduction/Key Findings

7.2 Large Enterprises

7.3 Small & Medium Enterprises (SMEs)

7.4 Y-O-Y Growth trend Analysis BY ENTERPRISE TYPE

7.5 Absolute $ Opportunity Analysis BY ENTERPRISE TYPE, 2025-2030

Chapter 8. Inventory Management Software Market – BY APPLICATION

8.1 Introduction/Key Findings

8.2 Inventory Control and Tracking

8.3 Order Management

8.4 Scanning and Barcoding

8.5 Asset Management

8.6 Others

8.7 Y-O-Y Growth trend Analysis BY APPLICATION

8.8 Absolute $ Opportunity Analysis BY APPLICATION, 2025-2030

Chapter 9. Inventory Management Software Market – By End Use

9.1 Introduction/Key Findings

9.2 Manufacturing

9.3 Retail and Consumer Goods

9.4 Healthcare and Life Sciences

9.5 Energy and Utilities

9.6 Automotive

9.7 Others

9.8 Y-O-Y Growth trend Analysis By End Use

9.9 Absolute $ Opportunity Analysis By End Use, 2025-2030

Chapter 10. Inventory Management Software Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Component

10.1.2.1 By Light Type

10.1.3 By Power System

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Component

10.2.3 By Light Type

10.2.4 By Power System

10.2.5 By By End Use

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Component

10.3.3 By Light Type

10.3.4 By Power System

10.3.5 By By End Use

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Component

10.4.3 By Light Type

10.4.4 By Power System

10.4.5 By By End Use

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Component

10.5.3 By Light Type

10.5.4 By Power System

10.5.5 By By End Use

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Inventory Management Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Zoho Corporation Pvt. Ltd.

11.2 Oracle Corporation

11.3 IBM Corporation

11.4 CIN7 Ltd.

11.5 Lightspeed

11.6 Intuit Inc.

11.7 Linnworks

11.8 Fishbowl

11.9 Acumatica, Inc.

11.10 Brightpearl

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growth of the inventory management software market is anticipated to be driven by several factors, including its seamless integration with other business systems, such as accounting software and Point-of-Sale (POS) systems.

The top players operating in the Inventory Management Software Market are - Zoho Corporation Pvt. Ltd., Oracle Corporation, IBM Corporation, and CIN7 Ltd.

The global inventory management software market, like many other sectors, faced significant disruptions due to the various precautionary lockdowns and restrictions imposed by governments worldwide.

To monitor fluctuating supply costs, recalculate stock levels, and gain comprehensive insights into the entire process, end users are increasingly relying on real-time analytics as the most effective solution.

The Asia Pacific is the fastest-growing region in the Inventory Management Software Market.