Digital Warehouse Solution Market Size (2024 – 2030)

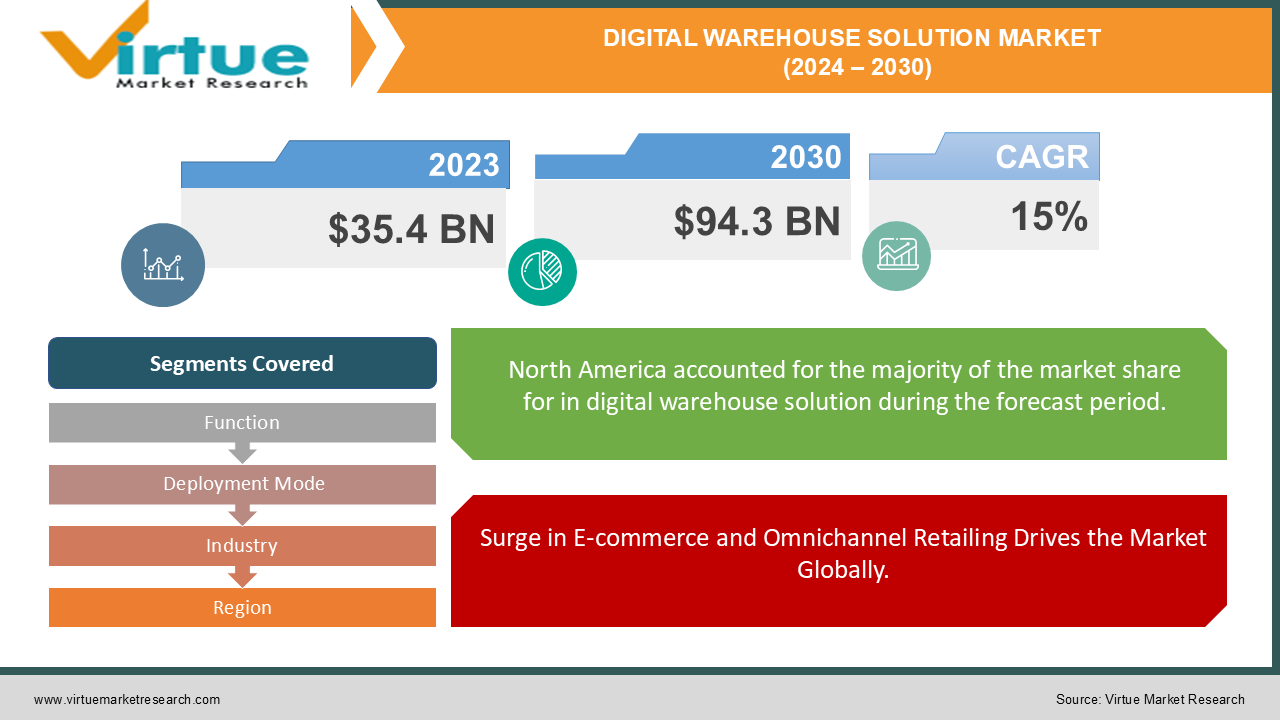

The Global Digital Warehouse Solution Market was valued at USD 35.4 billion in 2023 and is projected to reach a market size of USD 94.3 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 15% between 2024 and 2030.

The Global Digital Warehouse Solution Market is revolutionizing the logistics and supply chain sectors by integrating advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and robotics to enhance warehouse operations. These solutions streamline the management of inventory, optimize storage space, and improve order fulfillment processes, leading to increased efficiency and reduced operational costs. The rise of e-commerce and the growing demand for faster, more accurate delivery services have fueled the adoption of digital warehouse solutions across industries. Businesses are increasingly investing in automated systems to manage large volumes of goods and meet the challenges of modern-day logistics. Cloud-based platforms also play a crucial role in enabling real-time data tracking and analysis, allowing companies to make data-driven decisions that enhance overall productivity. As consumer expectations for seamless shopping experiences continue to rise, the market is expected to witness substantial growth. Moreover, the push for sustainability in supply chain operations is driving the adoption of eco-friendly, energy-efficient solutions within digital warehouses. As a result, the Global Digital Warehouse Solution Market is positioned to experience significant expansion, providing businesses with the tools necessary to stay competitive in an increasingly digital and connected world.

Key Market Insights:

-

Automation boosts efficiency by over 25% in digital warehouses.

-

50% of warehouses are expected to adopt robotics by 2030.

-

Real-time tracking improves inventory accuracy by 30%.

-

IoT integration increases warehouse productivity by 20% annually.

-

Global e-commerce growth drives demand for digital solutions by 35%.

-

AI implementation enhances order processing speed by 40%.

-

Energy-efficient systems lower energy consumption by 15-20%.

-

60% of businesses plan to invest in digital warehouse solutions by 2025.

-

80% of warehouse professionals view automation as critical for future success.

Global Digital Warehouse Solution Market Drivers:

Surge in E-commerce and Omnichannel Retailing Drives the Market Globally.

The rapid growth of e-commerce and omnichannel retailing is a key driver for the Global Digital Warehouse Solution Market. With consumers increasingly turning to online platforms for their purchases, businesses are facing unprecedented demands for faster, more accurate order fulfillment. Traditional warehouse systems struggle to manage the complexity and scale of these operations, leading companies to adopt digital solutions such as automated picking systems, real-time inventory tracking, and AI-powered order processing. These technologies streamline workflows, reduce human error, and enhance the speed of delivery, which is critical in maintaining customer satisfaction in a competitive retail landscape. Additionally, the integration of digital warehouse solutions enables businesses to seamlessly handle returns, manage stock across multiple channels, and anticipate consumer demand through predictive analytics. As e-commerce continues to thrive, driven by changing consumer behaviors and convenience, the adoption of digital warehouse solutions is expected to accelerate, providing companies with the necessary tools to meet evolving market demands.

Emphasis on Supply Chain Optimization and Cost Efficiency Fuels the Market Growth.

Supply chain optimization and the need for cost-efficient operations are significant drivers in the Global Digital Warehouse Solution Market. Businesses are increasingly focused on reducing operational costs while improving productivity, and digital warehouse solutions offer the perfect balance. Automated storage and retrieval systems, robotics, and IoT-enabled devices help companies optimize their use of warehouse space, improve inventory management, and reduce manual labor costs. Real-time data analytics provide insights into operational performance, enabling businesses to make informed decisions that reduce waste and increase overall efficiency. Furthermore, the integration of cloud-based warehouse management systems allows for better coordination between different nodes in the supply chain, improving communication and reducing delays. As businesses seek to enhance profitability in an increasingly complex global market, the adoption of digital warehouse solutions that streamline operations and reduce overheads is becoming a strategic priority, contributing to the growth of the market.

Global Digital Warehouse Solution Market Restraints and Challenges:

One of the major restraints and challenges facing the Global Digital Warehouse Solution Market is the high cost of implementation and maintenance of advanced technologies. While digital warehouse solutions offer substantial long-term benefits such as increased efficiency and reduced operational costs, the initial investment in automation, robotics, AI-powered systems, and IoT integration can be prohibitively expensive for many businesses, particularly small and medium-sized enterprises (SMEs). The cost of acquiring, installing, and maintaining these technologies, coupled with the need for employee training and potential operational disruptions during the transition, creates significant barriers to adoption. Additionally, the integration of various digital solutions into existing infrastructure can be complex, requiring significant customization to meet specific operational needs, which adds further to the cost. Another challenge is the cybersecurity risks associated with connected systems, as increased digitalization exposes warehouses to potential data breaches and cyberattacks. Ensuring data security and maintaining uninterrupted operations while managing these risks requires additional investments in cybersecurity measures. Moreover, the rapid pace of technological advancements means that solutions can quickly become outdated, leading to continuous upgrades. These factors, combined with a lack of skilled labor to manage and maintain these systems, present significant challenges to the widespread adoption of digital warehouse solutions.

Global Digital Warehouse Solution Market Opportunities:

The Global Digital Warehouse Solution Market presents significant opportunities driven by advancements in artificial intelligence (AI), machine learning, and the Internet of Things (IoT). As industries across the globe shift towards automation, there is an increasing demand for AI-powered systems that can optimize warehouse operations, enhance inventory management, and improve order accuracy. The growth of cloud-based warehouse management solutions offers businesses scalable, flexible options to manage complex logistics networks in real time. Additionally, the integration of IoT devices allows for enhanced tracking of goods, improving visibility across the supply chain and enabling predictive maintenance of warehouse equipment, thus reducing downtime. The rise of smart cities and the increasing focus on sustainability also create opportunities for eco-friendly, energy-efficient digital warehouse solutions. Businesses are increasingly seeking solutions that not only optimize operations but also minimize environmental impact, such as automated energy management systems and low-emission machinery. Emerging markets in regions like Asia-Pacific and Latin America present further growth opportunities as businesses in these regions seek to modernize their logistics infrastructure. As digital transformation accelerates across industries, the adoption of innovative digital warehouse solutions is poised to expand, providing companies with the tools to remain competitive in a rapidly evolving marketplace.

DIGITAL WAREHOUSE SOLUTION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15% |

|

Segments Covered |

By Function, Deployment Mode, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International Inc., Siemens AG, SAP SE, Oracle Corporation, IBM Corporation, Manhattan Associates, Inc.6, Swisslog Holding AG, Toshiba Corporation, Zebra Technologies Corporation, Infor Inc. |

Global Digital Warehouse Solution Market Segmentation: By Function

-

Inventory management

-

Order fulfillment

-

Labor management

-

Transportation management

In 2023, based on market segmentation by Function, Inventory management had the highest share of the Global Digital Warehouse Solution Market. Inventory management is a core function of warehousing, playing a critical role in ensuring efficient operations and customer satisfaction. Accurate tracking, storage, and retrieval of inventory are essential to meet the demands of a dynamic supply chain and avoid costly errors such as stockouts or overstocking. With the increasing complexity of supply chains, technological advancements have transformed how businesses manage inventory. The integration of Warehouse Management Systems (WMS) has revolutionized this process, providing real-time visibility into stock levels, automating manual tasks, and delivering data-driven insights for better decision-making. These systems help businesses optimize storage space, improve order accuracy, and enhance overall operational efficiency. The rise of e-commerce and omnichannel retailing has further accelerated the need for advanced inventory management solutions, as businesses must handle larger volumes of orders and ensure fast, precise fulfillment to meet consumer expectations. In addition, the growing emphasis on operational efficiency and cost savings has led companies to adopt digital solutions that minimize errors, reduce labor costs, and enhance inventory control. As a result, the demand for sophisticated inventory management technologies continues to rise, making it a key driver for the digital transformation of warehouse operations globally.

Global Digital Warehouse Solution Market Segmentation: By Deployment Mode

-

Cloud-based

-

On-premises

-

Hybrid

In 2023, based on market segmentation by Deployment Mode, Cloud-based had the highest share of the Global Digital Warehouse Solution Market. Cloud-based solutions have become increasingly popular in the Global Digital Warehouse Solution Market due to their scalability and flexibility, allowing businesses to adjust their capacity seamlessly based on changing demand. This adaptability is particularly advantageous for companies experiencing rapid growth or seasonal fluctuations, as they can scale resources up or down without significant investment in physical infrastructure. Additionally, cloud-based solutions often present a cost-effective alternative to on-premises systems, requiring lower upfront investments since businesses typically pay only for the resources they use. This financial model is especially beneficial for smaller companies or those operating with limited IT budgets. The rapid deployment of cloud solutions further enhances their appeal, as they are often pre-configured and ready for immediate use, enabling businesses to implement new technologies more swiftly and improve their time-to-market. Moreover, cloud service providers manage regular software updates and maintenance, ensuring that customers benefit from the latest features and security enhancements without burdening internal IT teams. This capability not only improves system reliability but also allows businesses to focus on core operations rather than IT management, ultimately driving greater efficiency and productivity within warehouse operations.

Global Digital Warehouse Solution Market Segmentation: By Industry

-

Retail

-

Manufacturing

-

Healthcare

-

Logistics

In 2023, based on market segmentation by Industry, Retail had the highest share of the Global Digital Warehouse Solution Market. The rapid growth of e-commerce has significantly heightened the demand for efficient warehouse operations, as retailers strive to meet consumer expectations for speed and accuracy. With online shopping becoming the norm, businesses require advanced technology to manage complex inventory systems, fulfill orders promptly, and provide real-time tracking information to customers. This demand is further intensified by the rise of omnichannel retail, which integrates online and offline channels, necessitating seamless inventory management across multiple locations. Retailers must ensure timely deliveries not only for online orders but also for in-store pickups, placing greater pressure on warehouse operations to be agile and responsive. In today's highly competitive retail landscape, companies are compelled to deliver exceptional customer experiences to thrive. Efficient warehouse management plays a crucial role in achieving this goal, as it enables fast and accurate order fulfillment. This efficiency directly influences customer satisfaction and loyalty, as consumers increasingly gravitate toward businesses that can consistently meet their delivery expectations. As a result, investing in sophisticated warehouse solutions is no longer just a matter of operational efficiency but a strategic imperative for retailers aiming to succeed in a rapidly evolving marketplace.

Global Digital Warehouse Solution Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, North America had the highest share of the Global Digital Warehouse Solution Market. North America has emerged as a frontrunner in the adoption of digital warehouse solutions, driven by several key factors. One significant aspect is early adoption; the region is home to many leading technology companies and software developers, fostering an environment ripe for innovation and the integration of advanced warehouse technologies. Additionally, North America's advanced infrastructure, characterized by robust broadband connectivity and a network of data centers, provides the necessary support for the implementation of digital solutions. This infrastructure enables efficient data management and real-time communication, critical for modern warehouse operations. The strong e-commerce market in North America further fuels demand for efficient warehouse management, as retailers strive to meet the increasing volume of online orders. As a result, there has been substantial investment in digital warehouse solutions to enhance operational efficiency and order fulfillment capabilities. Furthermore, the region's regulatory environment is generally supportive of technological advancements, creating a conducive atmosphere for businesses to adopt innovative solutions without facing significant barriers. Collectively, these factors position North America as a leader in the Global Digital Warehouse Solution Market, driving continued growth and transformation in warehouse operations.

COVID-19 Impact Analysis on the Global Digital Warehouse Solution Market.

The COVID-19 pandemic had a profound impact on the Global Digital Warehouse Solution Market, accelerating the adoption of automation and digital technologies across the supply chain. With lockdowns and social distancing measures disrupting traditional warehouse operations, businesses faced challenges in managing labor shortages, increased demand for essential goods, and ensuring the safety of workers. This drove the rapid implementation of digital warehouse solutions, such as AI-powered robotics, contactless inventory management, and automated order processing, to maintain operational continuity while minimizing human intervention. E-commerce experienced a massive surge as consumers shifted to online shopping, further straining existing warehouse systems and prompting the need for more efficient digital solutions to handle high order volumes and faster deliveries. Additionally, real-time data tracking, enabled by IoT and cloud-based platforms, became critical for managing supply chain disruptions and ensuring transparency across operations. The pandemic also highlighted the need for flexible, scalable warehouse systems that can quickly adapt to changing market demands. While the initial disruption posed challenges, the increased focus on resilience and efficiency has paved the way for long-term growth in the digital warehouse solution market, as businesses prioritize automation and innovation to mitigate future risks.

Latest trends / Developments:

The Global Digital Warehouse Solution Market is witnessing several key trends and developments, driven by the increasing adoption of advanced technologies to enhance operational efficiency. One of the prominent trends is the growing use of artificial intelligence (AI) and machine learning (ML) for predictive analytics, which helps businesses optimize inventory management, forecast demand, and streamline supply chain operations. Robotics and automation are gaining momentum, with autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) becoming more prevalent in warehouse environments to facilitate faster order picking, packing, and inventory movement. Additionally, the integration of the Internet of Things (IoT) is enabling real-time tracking of goods and assets, providing enhanced visibility and control over warehouse operations. Cloud-based warehouse management systems (WMS) are also becoming increasingly popular, offering scalable, flexible solutions that allow businesses to manage multiple locations and operations remotely. Furthermore, sustainability is a growing focus, with businesses looking to reduce energy consumption and carbon emissions through eco-friendly warehouse technologies, such as automated lighting and energy management systems. The increasing focus on smart warehouses, powered by digital twins and advanced analytics, is also shaping the future of the market, enabling businesses to create virtual replicas of their operations for better decision-making and efficiency improvements.

Key Players:

-

Honeywell International Inc.

-

Siemens AG

-

SAP SE

-

Oracle Corporation

-

IBM Corporation

-

Manhattan Associates, Inc.6

-

Swisslog Holding AG

-

Toshiba Corporation

-

Zebra Technologies Corporation

-

Infor Inc.

Chapter 1. Digital Warehouse Solution Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Digital Warehouse Solution Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Digital Warehouse Solution Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Digital Warehouse Solution Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Digital Warehouse Solution Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Digital Warehouse Solution Market – By Function

6.1 Introduction/Key Findings

6.2 Inventory management

6.3 Order fulfillment

6.4 Labor management

6.5 Transportation management

6.6 Y-O-Y Growth trend Analysis By Function

6.7 Absolute $ Opportunity Analysis By Function, 2024-2030

Chapter 7. Digital Warehouse Solution Market – By Deployment Mode

7.1 Introduction/Key Findings

7.2 Cloud-based

7.3 On-premises

7.4 Hybrid

7.5 Y-O-Y Growth trend Analysis By Deployment Mode

7.6 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 8. Digital Warehouse Solution Market – By Industry

8.1 Introduction/Key Findings

8.2 Retail

8.3 Manufacturing

8.4 Healthcare

8.5 Logistics

8.6 Y-O-Y Growth trend Analysis By Industry

8.7 Absolute $ Opportunity Analysis By Industry, 2024-2030

Chapter 9. Digital Warehouse Solution Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Function

9.1.3 By Deployment Mode

9.1.4 By Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Function

9.2.3 By Deployment Mode

9.2.4 By Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Function

9.3.3 By Deployment Mode

9.3.4 By Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Function

9.4.3 By Deployment Mode

9.4.4 By Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Function

9.5.3 By Deployment Mode

9.5.4 By Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Digital Warehouse Solution Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Honeywell International Inc.

10.2 Siemens AG

10.3 SAP SE

10.4 Oracle Corporation

10.5 IBM Corporation

10.6 Manhattan Associates, Inc.6

10.7 Swisslog Holding AG

10.8 Toshiba Corporation

10.9 Zebra Technologies Corporation

10.10 Infor Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Digital Warehouse Solution market is expected to be valued at US$ 35.4 billion.

Through 2030, the Global Digital Warehouse Solution market is expected to grow at a CAGR of 15%.

By 2030, the Global Digital Warehouse Solution Market is expected to grow to a value of US$ 94.3 billion.

North America is predicted to lead the Global Digital Warehouse Solution market.

The Global Digital Warehouse Solution Market has segments By Function, Deployment Mode, Industry, and Region.