Retail Analytics Market Size (2025 – 2030)

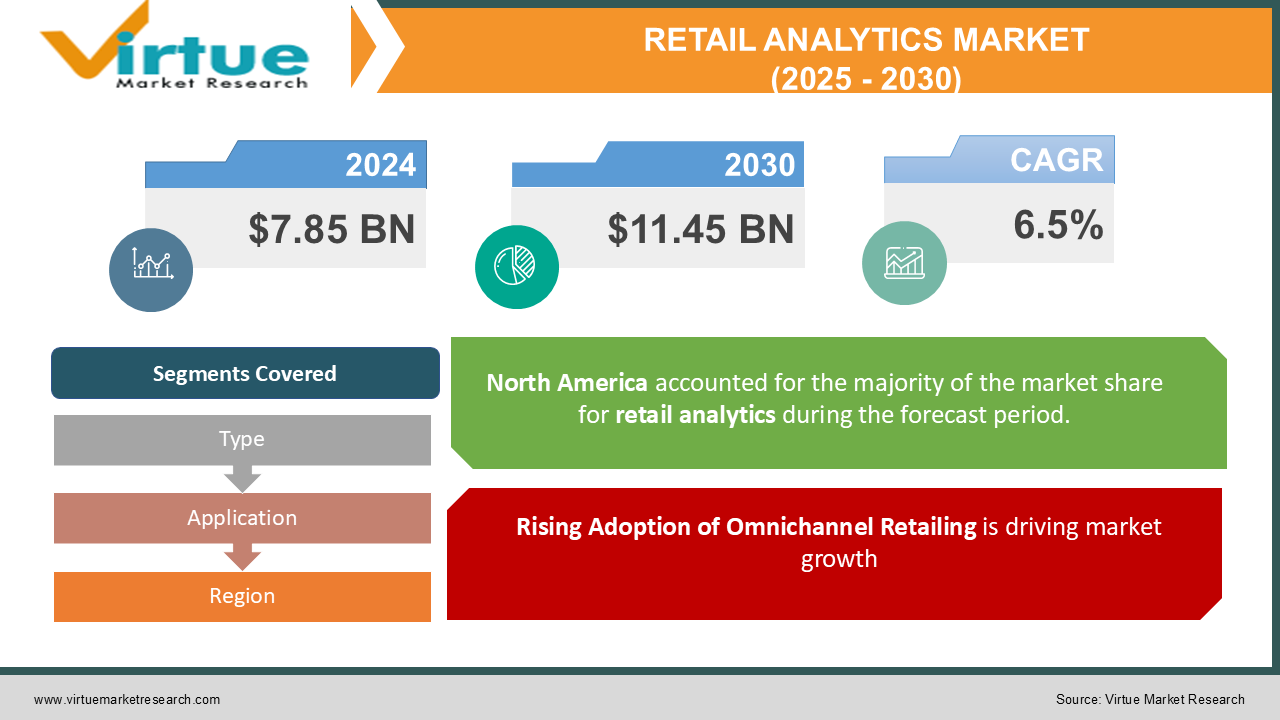

The Global Retail Analytics Market was valued at USD 7.85 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. The market is expected to reach USD 11.45 billion by 2030.

Retail Analytics involves using data-driven tools and techniques to gain actionable insights into consumer behavior, inventory management, sales performance, and operational efficiency in the retail industry. The rising adoption of digital platforms, coupled with the increasing volume of consumer data, has fueled the demand for analytics solutions. Retailers are leveraging analytics to enhance customer experiences, optimize supply chains, and improve overall profitability.

Key Market Insights

-

The integration of artificial intelligence (AI) and machine learning (ML) in analytics tools is revolutionizing retail operations, enabling predictive and prescriptive insights.

-

E-commerce platforms are significant contributors to the growth of retail analytics, as online retailers rely heavily on data to understand consumer behavior and optimize marketing strategies. Retail analytics platforms are increasingly incorporating omnichannel capabilities, enabling retailers to provide a seamless shopping experience across physical and digital touchpoints.

-

Real-time analytics is becoming essential for inventory management, helping retailers minimize stockouts and overstock scenarios.

-

The Asia-Pacific region is emerging as a key growth area, driven by increasing digitization and smartphone penetration in developing markets.

-

Privacy regulations, such as GDPR and CCPA, pose challenges for data collection and utilization, requiring retailers to adopt compliant analytics practices.

-

Advanced customer segmentation tools are helping retailers tailor marketing campaigns, resulting in higher conversion rates and customer loyalty. The use of analytics in fraud detection and prevention is gaining traction, especially in the payments and transaction domain.

Global Retail Analytics Market Drivers

Rising Adoption of Omnichannel Retailing is driving market growth:

The retail industry is undergoing a profound transformation with the shift toward omnichannel retailing. Consumers now demand seamless shopping experiences across online, mobile, and physical stores, compelling retailers to integrate data from multiple sources. Retail analytics tools enable businesses to analyze customer interactions across these channels, providing a unified view of the customer journey. For example, analytics can identify high-value customers who shop both online and in-store, allowing retailers to personalize promotions and improve engagement. As omnichannel retailing becomes the norm, analytics will play an indispensable role in enhancing customer satisfaction and boosting sales.

Technological Advancements in Data Processing and Visualization is driving market growth:

The evolution of data analytics technologies has significantly boosted the adoption of retail analytics solutions. Advanced tools such as AI, ML, and big data technologies allow retailers to process vast amounts of structured and unstructured data in real-time. Visualization tools, including dashboards and heatmaps, provide intuitive insights, making it easier for retailers to identify trends and make data-driven decisions. For instance, AI-driven recommendation engines suggest personalized products to customers, increasing basket sizes and revenue. As these technologies become more accessible and affordable, their adoption across the retail sector is expected to accelerate.

Growing Need for Inventory Optimization and Supply Chain Efficiency is driving market growth:

Retailers face constant pressure to maintain optimal inventory levels to minimize costs and meet customer demand. Retail analytics tools enable real-time inventory tracking and demand forecasting, helping retailers make informed decisions. For example, predictive analytics can anticipate seasonal demand spikes, ensuring adequate stock availability. Moreover, analytics improves supply chain efficiency by identifying bottlenecks, optimizing transportation routes, and reducing lead times. These capabilities are particularly critical in the fast-paced retail environment, where customer satisfaction hinges on timely product availability.

Global Retail Analytics Market Challenges and Restraints

Data Privacy and Regulatory Compliance is restricting market growth:

Retailers collect vast amounts of customer data, including personal preferences, purchasing habits, and payment details, raising significant concerns about data privacy. Stringent regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose strict requirements on data collection, storage, and usage. Additionally, customer trust is a critical factor, with many consumers hesitant to share personal information due to security concerns. Retailers must invest in robust data protection measures and adopt compliant practices to overcome these challenges while leveraging analytics effectively.

High Implementation Costs and Complexity is restricting market growth:

Implementing retail analytics solutions requires substantial investment in technology infrastructure, software, and skilled personnel. Smaller retailers, in particular, may struggle to afford these costs, limiting their ability to compete with larger enterprises. Furthermore, integrating analytics tools with existing systems can be complex and time-consuming, particularly for retailers relying on legacy platforms. The lack of in-house expertise often necessitates external consultation, further increasing costs. These barriers can delay adoption and limit the scalability of analytics solutions, particularly in developing markets.

Market Opportunities

The rapid digitization of the retail sector presents significant growth opportunities for the analytics market. With the proliferation of e-commerce platforms and the increasing use of smartphones, retailers now have access to vast amounts of consumer data. Analytics solutions can harness this data to provide actionable insights into customer preferences, enabling retailers to create personalized shopping experiences. Additionally, the rise of social commerce, where purchases are made directly through social media platforms, offers a new frontier for retail analytics. Retailers can analyze social media interactions to gauge consumer sentiment and refine their marketing strategies. Emerging markets, particularly in Asia-Pacific and Latin America, represent untapped potential due to growing internet penetration and disposable incomes. Governments in these regions are also promoting digital transformation, creating a favorable environment for analytics adoption. Moreover, advancements in technologies such as blockchain and edge computing are poised to revolutionize supply chain analytics, enhancing transparency and efficiency. By capitalizing on these opportunities, the retail analytics market is set to witness robust growth in the coming years.

RETAIL ANALYTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SAS Institute, IBM, Microsoft, Oracle, SAP, Adobe, Salesforce Tableau, Qlik, Manthan Software |

Retail Analytics Market Segmentation - By Type

-

Descriptive Analytics

-

Predictive Analytics

-

Prescriptive Analytics

Predictive Analytics is the leading segment, as its ability to forecast trends and consumer behavior helps retailers make proactive decisions.

Retail Analytics Market Segmentation - By Application

-

Customer Management

-

Inventory Management

-

Supply Chain Management

-

Sales and Marketing Optimization

Sales and Marketing Optimization dominates due to the increasing use of analytics for targeted advertising, pricing strategies, and promotional planning.

Retail Analytics Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the most dominant region in the global retail analytics market. The region benefits from advanced retail infrastructure, widespread adoption of digital technologies, and high consumer spending. The U.S., in particular, leads the market with a strong presence of e-commerce giants and innovative startups. Retailers in North America are increasingly leveraging analytics to enhance customer experiences, optimize operations, and stay ahead in a competitive market. Additionally, the region's focus on data-driven decision-making and the availability of sophisticated analytics tools further contribute to its dominance.

COVID-19 Impact Analysis on the Retail Analytics Market

The COVID-19 pandemic had a significant impact on the retail analytics market, accelerating its adoption as retailers sought to adapt to rapidly changing circumstances. With physical stores facing disruptions and limitations, retailers turned to e-commerce and digital platforms to sustain their operations. Analytics became a crucial tool for understanding shifts in consumer behavior, managing inventory, and optimizing supply chains during the crisis. For example, real-time analytics allowed retailers to predict demand for essential goods, ensuring timely restocking and avoiding shortages. The pandemic also emphasized the need for agility in retail. Retailers leveraged analytics to quickly respond to changes in consumer preferences and purchasing patterns, enabling them to remain competitive in a volatile environment. By continuously analyzing data, businesses could adapt their strategies, optimize their product offerings, and improve their overall operations. Additionally, the rise of online shopping during the pandemic underscored the importance of digital transformation. Retailers utilized analytics to enhance their online presence, offering personalized recommendations, targeted marketing, and tailored promotions to attract and retain customers. This ability to deliver personalized experiences became a key differentiator for many retailers, allowing them to build stronger connections with consumers. Despite the challenges posed by the pandemic, such as supply chain disruptions and reduced consumer spending, it also highlighted the immense value of data-driven insights. Analytics empowered retailers to make informed decisions, navigate uncertainty, and pivot their strategies effectively. As the industry continues to recover, the lessons learned during the pandemic have solidified the role of analytics in shaping the future of retail.

Latest Trends/Developments

Several key trends are currently shaping the retail analytics market, driving innovation and transformation across the industry. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into analytics platforms is one of the most significant trends, enabling advanced capabilities like personalized recommendations, dynamic pricing, and demand forecasting. These technologies allow retailers to deliver tailored experiences, optimize pricing strategies, and predict consumer behavior with greater accuracy. Retailers are also increasingly adopting omnichannel analytics to create a unified view of customer interactions across both physical and digital touchpoints. This approach helps businesses track consumer behavior and preferences seamlessly, enabling more personalized marketing and improving the overall customer experience. By connecting data from in-store visits, online purchases, and mobile app interactions, retailers can gain deeper insights into customer journeys. Sustainability is another growing focus in the retail analytics market, with more companies using analytics tools to monitor and optimize their environmental impact. Retailers are leveraging data to track carbon footprints across their supply chains, helping them reduce waste and improve sustainability efforts. This focus aligns with consumer demand for eco-friendly practices and ethical sourcing. Social commerce analytics is gaining momentum as retailers tap into social media platforms to engage with consumers. By analyzing social media data, retailers can better understand trends, preferences, and consumer sentiment, enabling more effective marketing and sales strategies. Additionally, the adoption of real-time analytics is on the rise, allowing retailers to respond quickly to market shifts, stock levels, and consumer demands. Innovations in augmented reality (AR) and virtual reality (VR) analytics are also emerging, offering new ways to measure consumer engagement with immersive shopping experiences, creating deeper connections with customers in digital environments.

Key Players

-

SAS Institute

-

IBM

-

Microsoft

-

Oracle

-

SAP

-

Adobe

-

Salesforce

-

Tableau

-

Qlik

-

Manthan Software

Chapter 1. Retail Analytics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Retail Analytics Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Retail Analytics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Retail Analytics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Retail Analytics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Retail Analytics Market – By Type

6.1 Introduction/Key Findings

6.2 Descriptive Analytics

6.3 Predictive Analytics

6.4 Prescriptive Analytics

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Retail Analytics Market – By Application

7.1 Introduction/Key Findings

7.2 Customer Management

7.3 Inventory Management

7.4 Supply Chain Management

7.5 Sales and Marketing Optimization

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Retail Analytics Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Retail Analytics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 SAS Institute

9.2 IBM

9.3 Microsoft

9.4 Oracle

9.5 SAP

9.6 Adobe

9.7 Salesforce

9.8 Tableau

9.9 Qlik

9.10 Manthan Software

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Retail Analytics Market was valued at USD 7.85 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. The market is expected to reach USD 11.45 billion by 2030.

Key drivers include the rising adoption of omnichannel retailing, advancements in data processing technologies, and the need for inventory optimization and supply chain efficiency.

The market is segmented by type (descriptive, predictive, and prescriptive analytics) and by application (customer management, inventory management, supply chain management, and sales and marketing optimization).

North America is the most dominant region, driven by advanced retail infrastructure and widespread adoption of digital technologies.

Leading players include SAS Institute, IBM, Microsoft, Oracle, SAP, Adobe, Salesforce, Tableau, Qlik, and Manthan Software.