Industrial Protective Footwear Market Size (2025-2030)

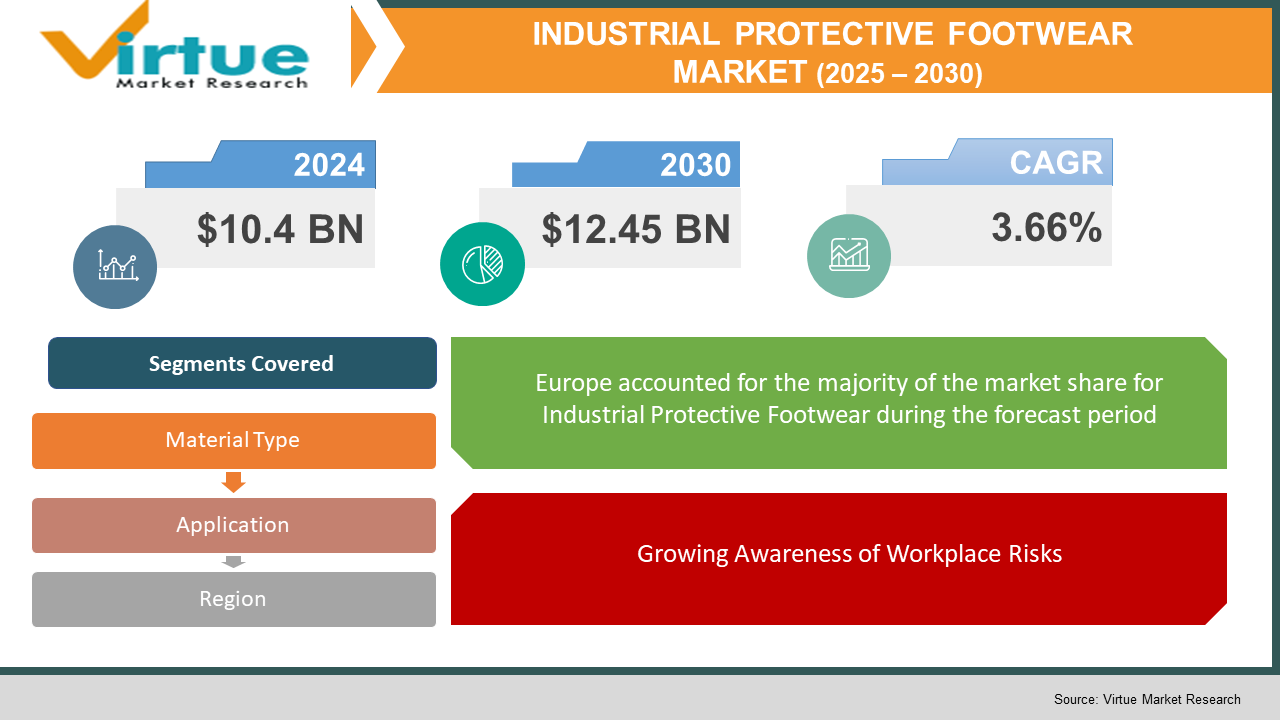

The Industrial Protective Footwear Market was valued at $10.4 billion and is projected to reach a market size of $12.45 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 3.66%.

The market for industrial protective footwear is growing steadily, driven by strict occupational safety standards and increasing awareness of workplace risks in most industries, including construction, manufacturing, oil and gas, and chemicals. The evolution of materials and design technologies in footwear has resulted in products that are lighter, more comfortable, and durable, further enhancing adoption levels. Regionally, North America has a mature market because of stringent safety regulations and an established industrial base. Europe is next, with nations such as Germany taking the lead because of strong manufacturing industries and strict adherence to safety measures. The Asia-Pacific region is experiencing fast growth, fueled by industrialization in nations such as China and India, combined with the rising adoption of workplace safety laws. In general, the world industrial protective footwear market is set to continue growing steadily, as there is a worldwide drive to improve worker safety and keep pace with changing industrial needs.

Key Market Insights:

- In November 2024, Honeywell International signed a deal to divest its protective equipment business, valued at $1.33 billion, to Protective Industrial Products, Honeywell's full withdrawal from the PPE sector.

- Materially, the leather segment holds the most ground, with a market share of about 66% in 2024 due to its toughness and insulating nature. The rubber division is expected to expand at approximately 6% CAGR throughout 2025-2030, fueled using nitrile rubber for oil and hydrocarbon resistance. The end-user break-up indicates construction as a sector with a market share of 20% in 2024, driven by international infrastructure construction and regulatory bodies enforcing strict safety standards. The oil and gas sector is the growtareleader, with a projected CAGR of around 6% over the same period, driven by increased safety consciousness and regulatory requirements.

Industrial Protective Footwear Market Key Drivers:

Industrial Protective Footwear Market Thrives Due to Rising Workplace Safety Standards

- Strict Workplace Safety Regulations: Governments and occupational safety services,

Globally have enacted strict regulations requiring the wearing of protective gear, including shoes, to guarantee the safety of employees. Adherence to organizational standards like OSHA (Occupational Safety and Health Administration) and ISO (International Organization for Standardization) has become the need of the hour for organizations in industries like construction, manufacturing, and oil and gas. These have contributed largely to the growth in demand for industrial protective footwear as organizations seek to comply with regulations and ensure secure working conditions.

- Growing Awareness of Workplace Risks: There is expanding awareness among employers and employees of the significance of workplace safety. Growing awareness of potential risks, including slipping, falling, and exposure to harmful chemicals, has proactive action in embracing protective footwear. Increased consciousness not only minimizes injury levels but also increases productivity and employee morale, which further fuels market expansion.

- Technological Developments in Footwear Technology: The ongoing technological developments in materials and design have enabled the creation of protective footwear that is not only safer but also comfortable. Companies are integrating sophisticated materials such as lightweight composites and slip-resistant bottoms, coupled with ergonomic designs, to enhance the wearing experience. These developments promote increased use of protective footwear across many industries.

Industrial Protective Footwear Market Restraints and Challenges:

The industrial protective footwear industry is challenged by a few significant issues that may hinder its growth path. One of the main restraints is the steep price tag that comes with high-end safety shoes, which proves to be costly for companies, especially small companies with tight budgets. This is a financial pressure that may induce hesitation in upgrading to high-quality protective footwear products, which could compromise the safety of workers. Another major challenge is the fine line between comfort and safety features. Employees usually have an impression that safety footwear is not comfortable, thus leading to non-compliance with safety procedures and less overall effectiveness of the safety measures. Making sure that protective footwear is both safe and comfortable is important to promote consistent use among employees. Uncertainty in the global economy also threatens the market. During times of economic recession, companies can take cost-saving measures, thus possibly decreasing investments in safety equipment such as protective footwear. Such prioritization of short-term financial needs over long-term investment in safety, however, holds back market growth. Resistance to change by conservative industries also makes universal acceptance of industrial protective footwear difficult.

Some employers and employees might be slow to move away from traditional footwear to specialized safety footwear, even if it means not following safety requirements. This hesitation can slow down the implementation of required safety protocols. Moreover, the absence of standardized global regulations for industrial protective footwear creates ambiguity and complicates the universal adoption of standardized safety protocols. Differing regulations by geography may create difficulty for companies and manufacturers in maintaining compliance, possibly resulting in safety oversights. Disruptions in supply chains, such as natural disasters, geopolitical tensions, or other unanticipated disruptions, may affect the supply of materials required for the production of industrial protective footwear. The disruptions may result in delays and higher costs, impacting the timely delivery of safety products to the end-users. Finally, a lack of proper awareness and education about the significance of industrial protective footwear can restrict market expansion. Certain industries might not be aware of the dangers inherent in workplace hazards, thus discouraging them from investing in relevant protection techniques. Solving these challenges demands a multidimensional response, such as creating affordable yet high-quality shoes, improving comfort without sacrificing safety, harmonizing global regulations, making supply chains strong, and raising awareness concerning workplace safety to encourage the uptake of industrial protective footwear.

Industrial Protective Footwear Market Opportunities:

The market for protective footwear in the industrial sector is set to witness strong growth as it follows opportunities in different industries. Among these opportunities is the growing focus on sustainable and environmentally friendly footwear solutions. Companies are embracing green production techniques, employing recycled and bio-based resources to produce long-lasting yet lightweight footwear designs. This change not only responds to increasing consumer demand for eco-friendly products but also meets international environmental efforts, with significant growth opportunities. Advances in technology are another area with great potential. Incorporating intelligent technologies into safety footwear, including sensors that track wearer fatigue or dangerous environmental conditions, is becoming popular. These technologies promote worker safety and efficiency of operation, which makes them appealing to industries that want to enhance the standards of workplace safety. Moreover, the movement towards personalized industrial footwear is opening opportunities for market differentiation. Personalizing shoes to suit the unique requirements of various industries and working environments not only enhances the comfort and safety of workers but also enables manufacturers to target niche markets, hence increasing their client base. The growth of end-use industries, especially in emerging economies, further supports opportunities in the market. Industrialization and infrastructure growth in emerging markets like the Asia-Pacific are boosting demand for safety footwear in construction, manufacturing, and the oil and gas sectors. This is supported further by growing awareness of workplace safety, leading to stricter regulatory enforcement and, in turn, increased adoption of safety footwear.

INDUSTRIAL PROTECTIVE FOOTWEAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

3.66% |

|

Segments Covered |

By material Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International Inc., VF Corporation, COFRA Holding AG, UVEX Safety Group, Wolverine Worldwide, Inc., Bata Corporation, Rahman Group, Dunlop Protective Footwear, ELTEN GmbH, Rock Fall Ltd. |

Industrial Protective Footwear Market Segmentation:

Industrial Protective Footwear Market Segmentation By Material Type:

- Leather Footwear

- Rubber Footwear

- Plastic Footwear

- Waterproof Footwear

Within the industrial protective footwear industry, leather footwear is the leading segment, with a share of about 66% of the whole market as of 2024. The reason for this preference lies in the fact that leather has better durability, insulation quality, and efficiency in reducing electrical hazards, which makes it a preferred material in many industries such as construction and manufacturing. In parallel, the rubber footwear market is also witnessing tremendous growth, set to grow at a Compound Annual Growth Rate (CAGR) of around 6% during the 2024-2029 period. This growth is fuelled by the enhanced use of nitrile rubber, which boasts superior oil and hydrocarbon resistance, as well as the inherent qualities of rubber such as light construction, water resistance, and great shock absorption. Although plastic shoes possess a significant share of the market, their development trend is relatively moderate. Waterproof shoes, commonly including rubber and treated leather as specialized materials, serve particular industrial demands but never dominate the market.

Industrial Protective Footwear Market Segmentation By Application:

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Mining

- Pharmaceuticals

- Transportation

Within the industrial protective footwear industry, the construction industry is the biggest segment, holding around 20% of the market share in 2024. This is because the industry has its inherent dangers, such as heavy equipment and pointed objects, which require strong safety protocols. On the other hand, the oil and gas sector is the most rapidly increasing industry, with a forecasted compound annual growth rate (CAGR) of around 6% between 2025 and 2030. The sector is growing rapidly due to strict safety regulations and greater awareness regarding employee safety in dangerous settings.

Industrial Protective Footwear Market Regional Analysis:

Europe: The market leader with a 35.79% share, Europe's success can be largely attributed to strict safety laws and an established industrial base. North America: Next in line, North America has a 33.33% share, powered by strict safety standards and high industrial activity. Asia-Pacific: With a 16.50% share, the Asia-Pacific region is seeing the most growth due to industry and growing awareness of workplace safety. Middle East & Africa: With a 10.00% market share, the region's share is backed by investments in industries such as oil and gas. South America: With the lowest share of 4.39%, South America's market is slowly increasing with increasing industrialization and urbanization.

COVID-19 Impact Analysis on the Industrial Protective Footwear Market:

The pandemic of COVID-19 severely affected the industrial protective footwear market, causing significant disruptions in many industries. During 2020, the market registered a decline as factories followed country-wide lockdowns, creating a supply and demand mismatch. Export orders for footwear, including industrial protective footwear, also declined by 35% amid the pandemic, accelerating the decline. The market showed strength, however, and is projected to register a recovery and growth pattern. This recovery is thanks to the restart of industrial production, greater focus on the safety of workers, and the imposition of strict safety measures after the pandemic. Though the pandemic created initial challenges, the industrial protective footwear market is expected to experience steady growth over the next few years.

Recent Trends/Developments:

The market for industrial protective footwear is witnessing dramatic changes, driven by technological innovations, changing safety legislation, and tactical industry movements. Companies are investing more in incorporating cutting-edge materials and intelligent technology into products to offer comfort and safety. For example, the advent of light protective shoes is a break from conventional heavy boots, providing enhanced protection and refinement. This development tracks the worldwide movement toward more user-friendly and ergonomic safety equipment. Region-wise, the market trends are different with North America and Europe having mature markets because of stringent workplace safety rules and widespread usage across many industries. On the other hand, the Asia-Pacific region has growth that is occurring at a rapid pace because of industrialization and rising awareness regarding workplace safety. China, in turn, has a commanding hold on the Asia-Pacific market driven by its massive chemical production and manufacturing base. Strategic industry shifts have also informed the market scenario. Interestingly, Honeywell International revealed intentions to divest its protective equipment (PPE) business for $1.33 billion, marking a focus shift within the industry. Also, Portugal's shoe industry, based in the so-called "shoe valley," is upgrading by investing in new, automated equipment to make higher-value products to increase its competitive advantage in the face of shrinking European market share and economic woes.

Key Players in the Industrial Protective Footwear Market:

- Honeywell International Inc.

- VF Corporation

- COFRA Holding AG

- UVEX Safety Group

- Wolverine Worldwide, Inc.

- Bata Corporation

- Rahman Group

- Dunlop Protective Footwear

- ELTEN GmbH

- Rock Fall Ltd.

Chapter 1. INDUSTRIAL PROTECTIVE FOOTWEAR MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. INDUSTRIAL PROTECTIVE FOOTWEAR MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. INDUSTRIAL PROTECTIVE FOOTWEAR MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. INDUSTRIAL PROTECTIVE FOOTWEAR MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. INDUSTRIAL PROTECTIVE FOOTWEAR MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. INDUSTRIAL PROTECTIVE FOOTWEAR MARKET – By Material Type

6.1 Introduction/Key Findings

6.2 Leather Footwear

6.3 Rubber Footwear

6.4 Plastic Footwear

6.5 Waterproof Footwear

6.6 Y-O-Y Growth trend Analysis By Material Type

6.7 Absolute $ Opportunity Analysis By Material Type , 2025-2030

Chapter 7. INDUSTRIAL PROTECTIVE FOOTWEAR MARKET – By Application

7.1 Introduction/Key Findings

7.2 Construction

7.3 Manufacturing

7.4 Oil & Gas

7.5 Chemicals

7.6 Food

7.7 Mining

7.8 Pharmaceuticals

7.9 Transportation

7.10 Y-O-Y Growth trend Analysis By Application

7.11 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. INDUSTRIAL PROTECTIVE FOOTWEAR MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Material Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Material Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Material Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Material Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Material Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. INDUSTRIAL PROTECTIVE FOOTWEAR MARKET – Company Profiles – (Overview, Packaging Material Type Portfolio, Financials, Strategies & Developments)

9.1 Honeywell International Inc.

9.2 VF Corporation

9.3 COFRA Holding AG

9.4 UVEX Safety Group

9.5 Wolverine Worldwide, Inc.

9.6 Bata Corporation

9.7 Rahman Group

9.8 Dunlop Protective Footwear

9.9 ELTEN GmbH

9.10 Rock Fall Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market is expected to grow from US $10.4 billion in 2025 to US $12.45 billion by 2030, at a CAGR of 3.66%.

Europe currently holds the largest market share, followed by North America.

The market's growth is primarily driven by rapid industrialization, increased emphasis on workplace safety, and stringent government regulations mandating the use of protective footwear across various industries.

Prominent companies in this market include Honeywell International Inc., Dunlop Protective Footwear, VF Corporation, Bata Industrial, and UVEX WINTER HOLDING GmbH & Co.

Emerging trends include the integration of lightweight materials, enhanced slip resistance, ergonomic designs, and the adoption of 3D printing technology for customized footwear.