Europe Protective Footwear Market Size (2024-2030)

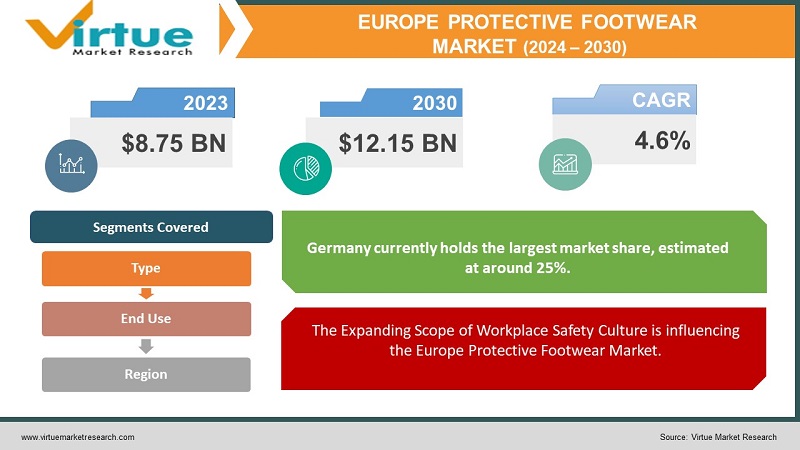

The Europe Protective Footwear Market was valued at USD 8.75 Billion in 2023 and is projected to reach a market size of USD 12.15 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.6%.

The European Protective Footwear Market encompasses a wide range of specialized footwear designed to safeguard workers in various industries exposed to workplace hazards. Strict European and country-specific regulations mandate the use of protective footwear in hazardous industries, creating a strong baseline demand. Increased awareness among both employers and employees about workplace safety fuels the need for reliable protective equipment, including footwear. New materials, ergonomic designs, and enhanced features expand the protective capabilities of footwear beyond basic safety requirements. Growth in sectors like construction, manufacturing, logistics, and energy often translates to increased demand for protective footwear solutions. Beyond core protection, emphasis on long-wear comfort, breathability, and designs that reduce fatigue. Single pairs protect against multiple risks (impact, electrical, slip) for greater versatility.

Key Market Insights:

European workplace safety regulations mandate protective footwear in numerous industries, directly fueling market growth. The obligation to provide safe working conditions creates a sustained need for reliable protective footwear. As workplace hazards are better understood and new technologies emerge, standards update – creating demand for footwear incorporating the latest protective features. Infrastructure investments and housing demand contribute to a robust construction market, supporting a significant segment for protective footwear. While some manufacturing relocates, Europe retains a strong base in fields like automotive and heavy industries, requiring specialized safety footwear. Growing industries like logistics, warehousing, and healthcare have increasing needs for protective footwear with features like slip resistance. Footwear designed for multiple risks (e.g., impact, puncture, electrical) minimizes the need to switch footwear and appeals to industries with varied hazards. An emerging trend with potential – integrating sensors to track worker location, biometrics (for fatigue detection), or fall alerts. An increasing "do-it-yourself" trend drives demand for protective footwear beyond traditional industrial users. A general safety awareness shift makes protective footwear appealing to broader consumer groups concerned about potential hazards beyond the designated workplace. Protective footwear often moves through dedicated distributors focused on safety equipment, serving industrial clients with specific needs. Distribution channels cater to both large-scale business procurement and individual consumers through e-commerce platforms, safety stores, and workwear retailers.

Europe Protective Footwear Market Drivers:

EU-wide directives and country-specific legislation set comprehensive occupational safety standards, often mandating the use of appropriate protective footwear in various industries.

EU-wide directives and country-specific legislation set comprehensive occupational safety standards, often mandating the use of appropriate protective footwear in various industries. Increased regulatory scrutiny and workplace inspections ensure compliance with safety standards, driving a constant demand for protective footwear. As workplace hazards are analyzed and new risks emerge, protective footwear standards evolve. This requires innovations in footwear design, materials, and the range of protection offered (e.g., enhanced slip-resistance, composite materials replacing steel). Government focus on reducing workplace injuries and associated costs puts pressure on employers to invest in preventative measures, of which protective footwear is a major component. In many sectors, protective footwear is not optional. This creates a baseline demand less affected by economic fluctuations compared to consumer fashion-related footwear. Evolving standards and wear and tear necessitate the replacement of protective footwear, fueling recurring demand. As industries and job types diversify, the range of protective footwear needed expands. It's no longer just steel-toe boots but encompasses footwear tailored for high-voltage environments, food production facilities, and more.

The Expanding Scope of Workplace Safety Culture is influencing the Europe Protective Footwear Market.

Progressive companies and industries move beyond simply meeting minimum safety regulations and embracing a proactive safety culture where risk prevention is prioritized. Workers are more likely to consistently wear protective footwear if it is comfortable, functional, and aligns with their style to some degree. Providing high-quality, modern protective footwear can be part of an employer's positive image-building efforts and assist in attracting and retaining a skilled workforce. Industries, where a degree of self-employment or subcontracting is common (construction, trades), see an increasing sense of personal responsibility towards safety among workers, encouraging investment in proper protective gear. A strong safety culture drives protective footwear use even in situations where it might not be strictly mandated by regulation. Demand rises not only for basic protective footwear but also for versions offering superior comfort, durability, and perhaps customizable features – translating to higher price points. Design elements from sports footwear and outdoor performance gear are adapted into protective footwear, making it more appealing and likely to be worn consistently. Manufacturers of protective footwear can position themselves as partners in promoting workplace safety, aligning their brand with a proactive safety mindset.

Europe Protective Footwear Market Restraints and Challenges:

Historically, heavily protective footwear often sacrificed a degree of comfort. Advances in materials and design aim to bridge this gap, but finding optimal solutions remains a challenge.

While worker safety is a priority, price remains a major factor in purchasing decisions for safety footwear. Small and medium-sized enterprises, in particular, might be acutely cost-sensitive. The influx of lower-cost protective footwear, particularly from Asian manufacturing hubs, exerts downward pricing pressure. European manufacturers must either compete on price, which can compromise margins, or differentiate based on innovation and quality. Finding the sweet spot between incorporating high-performance safety features and maintaining competitive pricing is an ongoing challenge with implications for product design and material choices. European protective footwear must comply with comprehensive regulations and standards (EN ISO 20345, etc.). These standards can be complex to navigate, and updates or additions add a layer of adaptation for manufacturers. As workplace safety understanding evolves, regulations might become stricter, requiring manufacturers to redesign products or invest in new technologies to maintain compliance. Obtaining and maintaining certifications for protective footwear incurs costs for manufacturers, potentially impacting pricing or the feasibility of developing niche products. While there are overarching European standards, some specific nuances or additional requirements might exist within individual countries, adding complexity for manufacturers operating across borders.

Europe Protective Footwear Market Opportunities:

European nations are continually updating and refining occupational safety regulations. This includes raising the bar for providing and mandating appropriate personal protective equipment (PPE), including protective footwear. Growing emphasis on proactive enforcement of safety regulations, rather than a reactive approach after workplace incidents. This compels employers to prioritize compliance and can lead to replacing outdated or inadequate equipment. While industries like construction and manufacturing have traditionally been large consumers, regulations are expanding to prioritize worker safety in sectors like logistics, warehousing, and even some retail environments. This broadens the potential market. The evolution beyond simply protective footwear towards designs that prioritize better ergonomics, long-term wearability, and tailored fit. This addresses worker health concerns like foot strain and musculoskeletal problems. Advancements in materials and construction methods are producing protective footwear better suited for diverse working conditions, improving moisture management, and keeping workers more comfortable across temperature extremes. Addressing the trend that even in safety-first environments, workers desire more stylistically appealing and less overtly 'industrial' looking protective footwear options, particularly in roles that involve client interactions.

EUROPE PROTECTIVE FOOTWEAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024- 2030 |

|

CAGR |

4.6% |

|

Segments Covered |

By Type, End Use, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Honeywell International Inc., Wolverine Worldwide Inc., VF Corporation , Dunlop Protective Footwear, Bata Corporation, Uvex Group, ELTEN GmbH |

Europe Protective Footwear Market Segmentation:

Europe Protective Footwear Market Segmentation: By Type

- Leather

- Synthetics

- Rubber

- Emerging Materials

Leather (45%): The traditional workhorse, valued for durability, breathability, and a degree of adaptability to various hazards. Cowhide (most common), full grain (superior quality), split leather (more economical), and various specialty types of leather (e.g., extra heat resistant). Durable, breathable, forms to the foot over time, repairable in some cases offers good impact, puncture, and abrasion resistance. Different coatings provide water resistance or chemical resistance. Synthetics (40%): A broad category offering immense flexibility in design, performance specialization, and affordability. PU-coated fabrics, nylon, engineered mesh, microfiber synthetics, and advanced composite materials for toe caps. Design versatility allows for lighter-weight footwear, breathability innovation, and the potential for incorporating recycled materials, often more affordable than leather. Rubber (10%): Primarily for fully waterproof footwear, and for creating highly slip-resistant outsole compounds. Typically heavier, less breathable than leather or synthetics, and limited design flexibility compared to other materials. Emerging Materials (5%): A smaller but rapidly evolving segment, including lightweight knits with integrated protection, sustainable materials, and 3D printed components.

Europe Protective Footwear Market Segmentation: By End Use

- Direct to Business (B2B)

- Specialty Retailers

- Online Retailers

- General Retail

Direct to Business (B2B): (55%) Manufacturers or large distributors sell directly to industrial clients, construction companies, and other organizations with significant protective footwear needs. Often involves contracts, bulk orders, and potentially customized solutions. Suitable for large-scale, predictable demand. Facilitates a close relationship between supplier and end-user for specialized requirements. Specialty Retailers: (30%) Brick-and-mortar stores focused on personal protective equipment (PPE), workwear, and safety supplies. Often staff have expertise in fitting and advising customers on appropriate footwear choices. Offer a curated selection across brands, the ability to try on products and personalized advice. Important for workers needing tailored solutions or those less familiar with safety standards. Online Retailers: (10%) E-commerce platforms ranging from large multi-category retailers to niche safety equipment suppliers. Offer convenience, potential price advantages, and often a wider selection than physical stores. General Retail: (5%) Supermarkets, general merchandise stores, or DIY chains carrying a limited selection of basic protective footwear, often alongside other workwear. Highly convenient for consumers already shopping at these locations. Appeals to the casual or occasional use market.

Europe Protective Footwear Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany (25%): A dominant player with a large manufacturing base and strict workplace safety regulations. Germany's large manufacturing sector across various industries creates a substantial demand for protective footwear. France (18%): This significant market is driven by construction and industrial sectors, known for prioritizing worker safety. Stringent adherence to workplace safety regulations and a proactive stance on ensuring worker well-being drive the adoption of high-quality protective footwear. UK (15%): A mature market with well-established safety guidelines and a diverse industrial landscape. The UK has a long history of prioritizing workplace safety, resulting in a mature protective footwear market with steady demand. The growing service and logistics sectors contribute to the need for protective footwear beyond traditional heavy industrial applications. Italy (12%) Strong demand from manufacturing, particularly fashion and automotive industries, balanced with a focus on style. Italy is renowned for high-end manufacturing, particularly in industries like fashion, automotive, and precision engineering, many of which require specialized protective footwear. Spain (10%): Growing market influenced by expanding construction and logistics sectors. The modernization and growth of the logistics sector increase the need for protective footwear suited for warehouse and distribution environments. Rest of Europe (20%): Encompasses developing markets with significant potential for growth as safety regulations align with EU standards. This region includes countries with varying levels of industrial development, economic growth, and maturity of safety regulations.

COVID-19 Impact Analysis on the Europe Protective Footwear Market:

European Union directives mandated the use of personal protective equipment (PPE) in workplaces, including footwear that shields against chemical spills, slips, falls, and electrical hazards. The rise of robotics and automated guided vehicles in industries like manufacturing increased the demand for footwear with features like puncture resistance and anti-slip soles. Lockdowns and travel restrictions across Europe significantly hampered the import and export of raw materials and finished footwear products. This led to shortages and price fluctuations. Many factories producing protective footwear were forced to temporarily halt operations due to lockdowns or workforce limitations arising from health concerns. This resulted in a decline in overall production and a disrupted supply chain. As healthcare became the central focus during the pandemic, resources were diverted away from other sectors, potentially leading to temporary neglect of safety protocols and reduced investment in protective gear, including footwear. The shift towards online shopping witnessed during lockdowns could translate to a long-term increase in e-commerce sales of protective footwear. Manufacturers may need to adapt their distribution channels to cater to this growing online demand. The heightened awareness of hygiene practices during the pandemic could lead to a demand for protective footwear with features like antimicrobial materials and easily cleanable surfaces.

Latest Trends/ Developments:

While protection remains paramount, manufacturers are now prioritizing comfort and ergonomic design. Modern protective footwear increasingly utilizes lightweight materials, breathable fabrics, and advanced cushioning systems. This shift caters to workers who spend long hours on their feet, reducing fatigue and potential long-term musculoskeletal issues. Environmental consciousness is driving the integration of sustainable materials in protective footwear. Recycled polymers, natural fibers, and bio-based components are finding greater use in footwear construction. This aligns with both corporate sustainability goals and the growing consumer demand for eco-friendly products. Protective footwear is becoming smarter. Manufacturers are embedding sensors, RFID tags, and connectivity features into their products. These technologies allow real-time monitoring of wear and tear, facilitate inventory management, and even provide data on worker location and activity for enhanced safety analytics. The market is witnessing a move away from a one-size-fits-all approach. Protective footwear is now offered with a greater degree of customization, including personalized fittings, tailored insoles, and the ability to choose from a wider range of safety features and styles. This caters to the diverse needs and preferences of different workers.

Key Players:

- Honeywell International Inc.

- Wolverine Worldwide Inc.

- VF Corporation

- Dunlop Protective Footwear

- Bata Corporation

- Uvex Group

- ELTEN GmbH

Chapter 1. Europe Protective Footwear Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type

1.5. Secondary Product Type

Chapter 2. Europe Protective Footwear Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Protective Footwear Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Protective Footwear Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Protective Footwear Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Protective Footwear Market– By Type

6.1. Introduction/Key Findings

6.2. Leather

6.3. Synthetics

6.4. Rubber

6.5. Emerging Materials

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Protective Footwear Market– By End User

7.1. Introduction/Key Findings

7.2 Direct to Business (B2B)

7.3. Specialty Retailers

7.4. Online Retailers

7.5. General Retail

7.6. Y-O-Y Growth trend Analysis By End User

7.7. Absolute $ Opportunity Analysis By End User , 2024-2030

Chapter 8. Europe Protective Footwear Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By End User

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Protective Footwear Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Honeywell International Inc.

9.2. Wolverine Worldwide Inc.

9.3. VF Corporation

9.4. Dunlop Protective Footwear

9.5. Bata Corporation

9.6. Uvex Group

9.7. ELTEN GmbH

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The EU maintains rigorous workplace safety regulations outlined in directives like the Personal Protective Equipment (PPE) Regulation (EU) 2016/425. These standards mandate the use of protective footwear in various hazardous industries.

. Low-quality, counterfeit, or uncertified protective footwear flooding the market puts workers at risk of injury since these products often don't adequately meet safety standards.

Honeywell International Inc., Wolverine Worldwide Inc., VF Corporation,

Dunlop Protective Footwear, Bata Corporation, Uvex Group, ELTEN GmbH.

Germany currently holds the largest market share, estimated at around 25%.

Several nations in Eastern Europe, like Poland, Hungary, Romania, etc., are experiencing economic expansion. This generally translates to increasing disposable incomes and evolving consumption patterns, which often include a rise in packaged and processed food consumption.