Footwear Market Size (2025 – 2030)

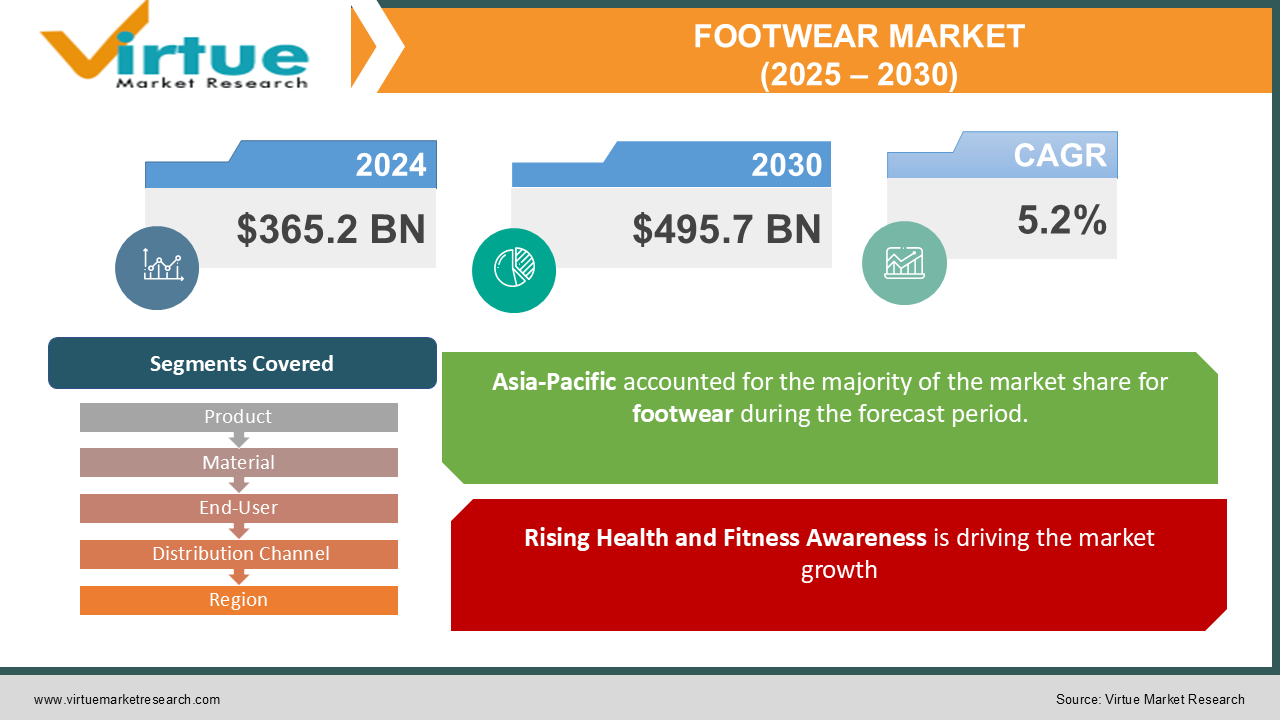

The Global Footwear Market was valued at USD 365.2 billion in 2024 and is projected to reach USD 495.7 billion by 2030, growing at a CAGR of 5.2% during the forecast period (2025–2030).

DOWNLOAD FREE SAMPLE REPORT NOW

Footwear, an essential part of daily apparel, continues to evolve with changing consumer preferences, technological advancements, and growing awareness of foot health. The increasing demand for sustainable and comfortable footwear, coupled with rising disposable income and fashion trends, is driving the market's expansion globally.

Key Market Insights

-

Non-athletic footwear accounted for over 65% of the market share in 2024, driven by demand for casual and formal footwear.

-

Leather footwear remains a premium choice, contributing approximately 40% of market revenue in 2024.

-

Asia-Pacific emerged as the dominant region, holding a 37% market share in 2024, attributed to population growth and rising disposable income.

-

Growing preference for online shopping is reshaping the distribution landscape, with the segment growing at a CAGR of 7.8%.

Global Footwear Market Drivers

Rising Health and Fitness Awareness is Driving the Market Growth

The increasing emphasis on health and fitness has led to a surge in demand for athletic footwear. Consumers are prioritizing shoes that offer comfort, durability, and functionality for sports and fitness activities.

The global fitness trend, driven by growing awareness of lifestyle diseases, has prompted individuals to adopt active lifestyles, further boosting the athletic footwear segment. Innovations like breathable materials, cushioned soles, and ergonomic designs are enhancing user experience and driving sales.

Fashion Trends and Changing Consumer Preferences is driving the market growth

Fashion trends significantly influence the footwear market, with consumers seeking stylish and versatile products. The rise of fast fashion and the influence of social media platforms have accelerated the adoption of trendy footwear.

The younger demographic, in particular, is driving demand for unique and aesthetically appealing designs. Collaborations between footwear brands and celebrities or designers are also fueling market growth by creating high-value, limited-edition products.

Growth in E-commerce and Digital Platforms is driving the market growth

The rapid expansion of e-commerce has transformed the retail landscape for footwear. Online platforms offer consumers a wide variety of options, competitive pricing, and the convenience of shopping from home.

Brands are leveraging digital tools, such as virtual try-ons and AI-driven recommendations, to enhance the online shopping experience. The integration of seamless return policies and secure payment gateways is further boosting consumer confidence in online footwear purchases.

Unlock Market Insights: Get A FREE Sample Report Today!

Global Footwear Market Challenges and Restraints

High Competition and Price Sensitivity is restricting the market growth

The footwear industry is highly competitive, with numerous players operating in the market. The presence of counterfeit products and price-sensitive consumers poses significant challenges for premium brands.

To remain competitive, manufacturers must balance quality, cost, and innovation, which can strain profit margins. Additionally, brand loyalty is diminishing as consumers become more inclined to experiment with new and affordable options.

Environmental Concerns and Regulatory Pressures is restricting the market growth

The production of footwear, particularly leather shoes, has faced criticism for its environmental impact. Issues such as water pollution, waste generation, and carbon emissions associated with manufacturing are driving regulatory pressures on the industry.

Brands are being compelled to adopt sustainable practices, such as using recycled materials or biodegradable alternatives, which can increase production costs. Non-compliance with environmental regulations can lead to reputational damage and financial penalties.

Market Opportunities

The global footwear market is poised for significant growth, driven by evolving consumer demands and emerging trends. Sustainability is a key driver, with consumers increasingly seeking eco-friendly footwear made from recycled materials, vegan leather, and other sustainable alternatives. Brands that prioritize ethical manufacturing practices and circular fashion models are gaining traction and attracting environmentally conscious consumers.

Customization and personalization are reshaping the footwear industry, with advancements in 3D printing and digital manufacturing enabling brands to offer tailored products that cater to individual preferences. This trend fosters customer loyalty and drives brand differentiation. Emerging markets, particularly in Asia-Pacific, Africa, and Latin America, present substantial growth opportunities. Rising disposable incomes, urbanization, and a growing middle class are fueling demand for both functional and fashionable footwear. As these regions continue to develop, the footwear market is expected to expand significantly.

Technological innovation is also shaping the future of the footwear industry. Smart footwear, equipped with features like fitness tracking, GPS, and pressure sensors, is gaining popularity among tech-savvy consumers. These innovative products cater to the growing demand for wearable technology and enhance the overall footwear experience. As the global footwear market continues to evolve, brands that embrace sustainability, personalization, emerging markets, and technological advancements will be well-positioned to capitalize on future growth opportunities.

GLOBAL FOOTWEAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Product, Material, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nike, Inc., Adidas AG, Puma SE, Skechers USA, Inc., Under Armour, Inc., ASICS Corporation, VF Corporation, Wolverine World Wide, Inc., New Balance Athletics, Inc., Crocs, Inc. |

CUSTOMIZE THIS FULL REPORT AS PER YOUR NEEDS

SEGMENTATION ANALYSIS

Footwear Market Segmentation - By Product

-

Athletic Footwear

-

Non-Athletic Footwear

Non-athletic footwear dominated the market in 2024, accounting for over 65% of the market share. This segment's growth is driven by demand for casual, formal, and fashion-oriented footwear.

Footwear Market Segmentation - By Material

-

Leather

-

Non-Leather

Leather footwear remains a premium choice due to its durability, comfort, and aesthetic appeal. However, the non-leather segment is growing rapidly, driven by increasing demand for cruelty-free and eco-friendly alternatives.

Footwear Market Segmentation - By End-User

-

Men

-

Women

-

Children

The women's footwear segment has emerged as the leader in the global footwear market, driven by a combination of diverse product offerings, evolving fashion trends, and growing consumer consciousness about style and comfort. This segment caters to a wide array of preferences, ranging from casual sneakers to elegant formal wear and functional athletic shoes. The continuous introduction of innovative designs and materials has significantly boosted its appeal.

Moreover, women are increasingly valuing footwear as an essential element of self-expression and personal style, prompting brands to deliver creative collections tailored to various occasions, from workwear to leisure. The rise of social media and influencer culture has further amplified the visibility of women's footwear trends, influencing purchasing decisions and accelerating market growth. Luxury and premium footwear brands, in particular, have capitalized on this demand by offering exclusive, high-quality products that appeal to the growing base of affluent female consumers. Meanwhile, the expansion of the athleisure trend has fostered the popularity of stylish yet functional athletic shoes, seamlessly blending fashion and performance.

The availability of footwear in inclusive sizes, customizable options, and sustainable materials has also contributed to heightened consumer interest. Online shopping platforms play a pivotal role by offering convenience and variety, enabling women to explore extensive catalogs and make informed purchases. With increasing disposable incomes and heightened fashion awareness, the women's footwear segment is poised for sustained growth, solidifying its dominance in the global footwear market.

Footwear Market Segmentation - By Distribution Channel

-

Online

-

Offline

The online footwear market is experiencing rapid growth, driven by the increasing convenience of digital platforms, competitive pricing, and advancements in logistics and delivery services. Online shopping platforms offer a vast array of footwear options from various brands, allowing consumers to compare prices, read reviews, and make informed purchasing decisions. The ability to shop from the comfort of one's home, coupled with the convenience of doorstep delivery, has significantly contributed to the surge in online footwear sales.

Additionally, e-commerce platforms often offer competitive pricing strategies, including discounts, coupons, and loyalty programs, further incentivizing online purchases. The rapid advancements in logistics and delivery services have played a crucial role in the growth of the online footwear market. Efficient delivery networks and reliable tracking systems ensure that consumers receive their orders promptly and hassle-free.

Furthermore, the integration of technology, such as AI-powered recommendation engines and virtual try-on tools, enhances the online shopping experience, allowing consumers to visualize products and make informed choices. As the online retail landscape continues to evolve, the footwear industry is well-positioned to capitalize on these trends and further solidify its position in the digital marketplace.

Footwear Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

What's Next for Your Market? Get a Snapshot with FREE Sample Report

Asia-Pacific led the market in 2024, accounting for 37% of the global revenue, driven by a large population base, rapid urbanization, and increasing disposable income. Countries like China, India, and Vietnam are major manufacturing hubs, further supporting regional growth.

North America is another key market, driven by high consumer spending on premium and branded footwear. The presence of established brands and strong e-commerce penetration contribute to the region's significant market share.

Europe is characterized by a strong demand for luxury footwear, with countries like Italy and France being prominent players in design and craftsmanship.

Latest Trends/Developments

The footwear industry is undergoing a significant transformation, driven by a confluence of sustainability, technology, and changing consumer preferences. A growing number of brands are prioritizing eco-friendly materials and sustainable production practices. Recycled materials, vegan leather, and biodegradable components are increasingly being used to create stylish and environmentally conscious footwear. These sustainable initiatives resonate with consumers who are seeking ethical and responsible brands.

Technological advancements are also revolutionizing the footwear industry. Smart footwear, equipped with fitness tracking, heart rate monitoring, and ergonomic designs, is gaining popularity among health-conscious consumers. These innovative products offer a seamless blend of fashion and function, enhancing the overall wearer experience. Celebrity collaborations have become a powerful tool for brands to boost visibility and drive sales. By partnering with influential celebrities, brands can tap into their massive fan bases and generate significant buzz. These collaborations often result in limited-edition releases, creating a sense of exclusivity and driving consumer demand.

The luxury footwear segment continues to experience strong growth, particularly in Europe and North America. Consumers in these regions are willing to invest in high-quality, premium footwear that reflects their personal style and status. As a result, luxury brands are focusing on innovative designs, high-quality materials, and exceptional craftsmanship to cater to this discerning market.

Direct-to-consumer (DTC) models are gaining traction in the footwear industry, allowing brands to bypass traditional retail channels and connect directly with consumers. By eliminating intermediaries, brands can offer competitive prices, personalized experiences, and exclusive products. DTC models also provide valuable customer insights, enabling brands to tailor their offerings to specific preferences and trends. As the footwear industry continues to evolve, these trends will shape the future of the market, driving innovation, sustainability, and consumer satisfaction

Key Players

-

Nike, Inc.

-

Adidas AG

-

Puma SE

-

Skechers USA, Inc.

-

Under Armour, Inc.

-

ASICS Corporation

-

VF Corporation

-

Wolverine World Wide, Inc.

-

New Balance Athletics, Inc.

-

Crocs, Inc.

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Chapter 1. Footwear Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Footwear Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Footwear Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Footwear Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Footwear Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Footwear Market – By Product Type

6.1 Introduction/Key Findings

6.2 Athletic Footwear

6.3 Non-Athletic Footwear

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Footwear Market – By Material

7.1 Introduction/Key Findings

7.2 Leather

7.3 Non-Leather

7.4 Y-O-Y Growth trend Analysis By Material

7.5 Absolute $ Opportunity Analysis By Material, 2025-2030

Chapter 8. Footwear Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Online

8.3 Offline

8.4 Y-O-Y Growth trend Analysis By Distribution Channel

8.5 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 9. Footwear Market – By End User

9.1 Introduction/Key Findings

9.2 Men

9.3 Women

9.4 Children

9.5 Y-O-Y Growth trend Analysis By End User

9.6 Absolute $ Opportunity Analysis By End User, 2025-2030

Chapter 10. Footwear Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.2.1 By Material

10.1.3 By By Distribution Channel

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product Type

10.2.3 By Material

10.2.4 By By Distribution Channel

10.2.5 By By End User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product Type

10.3.3 By Material

10.3.4 By By Distribution Channel

10.3.5 By By End User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product Type

10.4.3 By Material

10.4.4 By By Distribution Channel

10.4.5 By By End User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product Type

10.5.3 By Material

10.5.4 By By Distribution Channel

10.5.5 By By End User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Footwear Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Nike, Inc.

11.2 Adidas AG

11.3 Puma SE

11.4 Skechers USA, Inc.

11.5 Under Armour, Inc.

11.6 ASICS Corporation

11.7 VF Corporation

11.8 Wolverine World Wide, Inc.

11.9 New Balance Athletics, Inc.

11.10 Crocs, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 365.2 billion in 2024 and is projected to reach USD 495.7 billion by 2030, growing at a CAGR of 5.2%.

Key drivers include rising health awareness, fashion trends, and the growth of e-commerce platforms.

Segments include Product (Athletic, Non-Athletic), Material (Leather, Non-Leather), End-User (Men, Women, Children), and Distribution Channel (Online, Offline).

Asia-Pacific dominates the market, holding a 37% share in 2024, driven by population growth and increasing disposable income.

Major players include Nike, Inc., Adidas AG, Puma SE, Skechers USA, Inc., and Under Armour, Inc.