Immunotherapy Drugs Market Size (2025-2030)

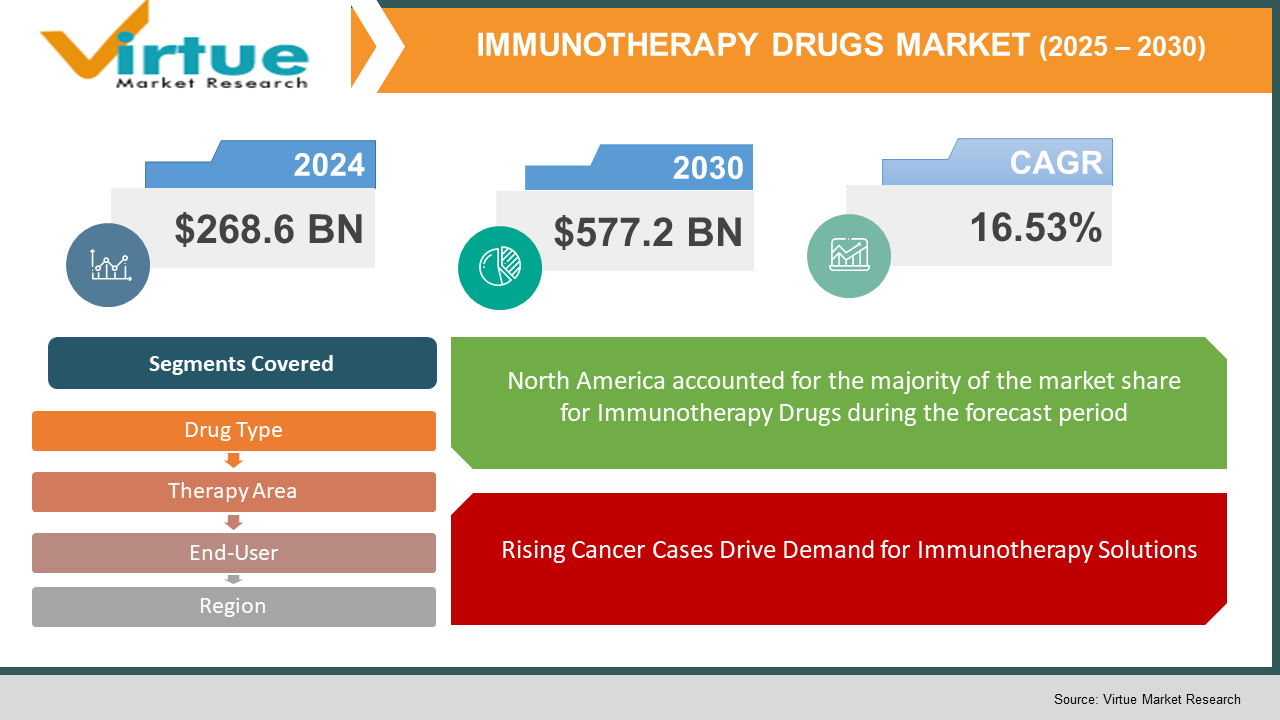

The Immunotherapy Drugs Market was valued at $268.6 billion and is projected to reach a market size of $577.2 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 16.53%.

The market for immunotherapy drugs is growing strongly, supported by advances in technology in antibody engineering, the increasing incidence of chronic diseases like cancer, and the growing demand for targeted therapies. Monoclonal antibodies are a leading segment, due to their success in the treatment of several chronic diseases. Geographically, North America dominated the market with a large market share in 2023 due to well-developed healthcare infrastructure and high immunotherapy adoption rates. The Asia-Pacific region is expected to have the highest growth rate over the forecast period, driven by growing healthcare investments and a growing incidence of target diseases. Overall, the market for immunotherapy drugs is set to make huge strides based on ongoing innovations in medical science and increasing interest in successful solutions for long-term illnesses.

Key Market Insights:

- The market for immunotherapy drugs is seeing substantial developments, especially in cell therapy breakthroughs. AstraZeneca's recent buyout of EsoBiotec for as much as $1 billion reflects a strategic move towards in-vivo CAR-T cell therapies, with the aim of making cancer treatment more straightforward through direct injections, thus increasing accessibility and affordability.

- Likewise, AbbVie's work in developing antibody-drug conjugates (ADCs), including Teliso-V in non-small-cell lung cancer, is part of a larger trend towards precision oncology, and the ADC market is expected to hit $19.8 billion by 2030.

- Yet, the increasing price of these new therapies is putting pressure on health budgets, as worldwide oncology drug spending has reached $223 billion and is predicted to reach $409 billion by 2030. The constant U.S.-EU tariff controversies also present possible threats to the affordability and availability of one of the most important immunotherapy medicines, Merck's Keytruda, revealing the sector's susceptibility to geopolitical pressures. Together, these trends point to a dynamic market environment with high-speed innovation, strategic mergers and acquisitions, and new challenges in cost management and global trade policies.

Immunotherapy Drugs Market Key Drivers:

Rising Cancer Cases Drive Demand for Immunotherapy Solutions

- Growing Incidence of Target Diseases: The increasing incidence of different cancers due to changes in lifestyle and the environment has increased the demand for immunotherapy as an advanced treatment option. Early detection and the necessity of personalized therapies are promoting the use of these new-generation treatments.

- Adoption of Personalized Medicines: The transition towards personalized medicine, driven by sophisticated diagnostic techniques like next-generation sequencing and biomarker analysis, enables accurate identification of patients appropriate for individual

immunotherapies. The focused approach maximizes the effectiveness of treatment and minimizes adverse side effects.

- Governmental and Regulatory Assistance: Ongoing assistance from governments and regulatory authorities, such as financial support for research and development, has spurred the development of immunotherapy medications. Public-private partnerships have sped up the development and availability of innovative immunotherapy treatments.

Immunotherapy Drugs Market Restraints and Challenges:

The market for immunotherapy drugs is confronted with some major challenges that can hinder its growth and accessibility. One of the main issues is the prohibitive cost of treatments, as some of them are more than $100,000 per patient per year, which puts tremendous pressure on healthcare budgets and restricts patient access, especially in resource-constrained environments.

Furthermore, reimbursement and market access issues constitute major hurdles since payers and healthcare systems demand extensive proof of clinical benefit and cost-effectiveness to approve coverage. In a 2024 report from the American Society of Clinical Oncology, it was noted that just approximately 60% of new cancer immunotherapies were granted favorable reimbursement decisions by significant markets within two years after receiving regulatory approval. In addition, geopolitical considerations, like the persistent U.S.-EU trade wars over tariffs, pose the risk of raising prices and limiting access to critical immunotherapy medicines, such as Merck's Keytruda, demonstrating the sector's exposure to global trade tensions. Together, these issues point to the necessity for strategic interventions to improve affordability, simplify regulatory channels, and stabilize global trade relationships to make life-saving immunotherapy therapies more widely available to patients.

Immunotherapy Drugs Market Opportunities:

The market for immunotherapy drugs is set to register substantial growth fueled by a number of opportunities. One such area is the creation of novel delivery systems, e.g., nanoparticles and implantable devices, that improve drug stability as well as targeting, increasing the efficacy of treatment and compliance in patients.

Moreover, expansion into developing markets, specifically in Asia-Pacific, Latin America, and the Middle East regions, also has tremendous potential as healthcare infrastructures are strengthening and healthcare expenditure is rising. In addition, combinations of immunotherapy with other therapies, i.e., chemotherapy or radiation, can offer scope to strengthen patient outcomes by evading resistance and offering holistic treatment options. Together, these opportunities highlight a vibrant future for immunotherapy drugs, with future growth being driven by improvements in delivery technologies, strategic market expansion, and combination therapies.

IMMUNOTHERAPY DRUGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

16.53% |

|

Segments Covered |

By drug Type, therapy area, end use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AbbVie Inc., Amgen Inc., AstraZeneca, Bayer AG, Boehringer Ingelheim, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, and Genmab A/S, |

Immunotherapy Drugs Market Segmentation:

Immunotherapy Drugs Market Segmentation By Drug Type:

- Monoclonal Antibodies

- Checkpoint Inhibitors

- Interferons Alpha & Beta

- Interleukins

- Adult Vaccines

- Others

Within the industrial protective footwear industry, leather footwear is the leading segment, with a share of about 66% of the whole market as of 2024. The reason for this preference lies in the fact that leather has better durability, insulation quality, and efficiency in reducing electrical hazards, which makes it a preferred material in many industries such as construction and manufacturing. In parallel, the rubber footwear market is also witnessing tremendous growth, set to grow at a Compound Annual Growth Rate (CAGR) of around 6% during the 2024-2029 period. This growth is fuelled by the enhanced use of nitrile rubber, which boasts superior oil and hydrocarbon resistance, as well as the inherent qualities of rubber such as light construction, water resistance, and great shock absorption. Although plastic shoes possess a significant share of the market, their development trend is relatively moderate. Waterproof shoes, commonly including rubber and treated leather as specialized materials, serve particular industrial demands but never dominate the market.

Immunotherapy Drugs Market Segmentation By Therapy Area:

- Cancer

- Autoimmune and Inflammatory Diseases

- Infectious Diseases

- Others

Of these, the cancer segment is not only the largest but also the most rapidly expanding one, with a share of more than 94.10% in the year 2024. This is fueled by the rising incidence of different types of cancers and the development of new immunotherapies for such malignancies. For example, the FDA approval of Opdivo (nivolumab) with chemotherapy for the treatment of gastric cancer in April 2021 illustrates the progress being made in cancer immunotherapy. On the other hand, the autoimmune diseases segment is expected to experience the highest growth rate over the forecast period driven by the growing prevalence of autoimmune diseases and local approvals of immunotherapy drugs. Of particular note, GSK's Benlysta (belimumab) gained approval in February 2022 from China's National Medical Products Administration for the treatment of active lupus nephritis, indicating the growing use of immunotherapies outside oncology.

Immunotherapy Drugs Market Segmentation By End-User:

- Hospitals

- Clinics

- Others

Hospital emerges as the dominant end-user segment in the market for immunotherapy drugs, fueled mainly by the ability of such institutions to manage complex treatments as well as related side effects optimally. As of 2024, hospitals accounted for the largest share of the market for immunotherapy drugs. This domination is due to hospitals' heavy adoption of monoclonal antibodies (mAbs) for targeted therapy, diagnostics at high speeds, and therapeutic success in curing multiple disease indications such as cancer, autoimmune diseases, and infectious diseases. Clinics and other end-users, e.g., specialty care facilities, also play an important role in the use of immunotherapy drugs. Cancer clinics and infusion centers offer specialized outpatient services, making treatments and supportive care more readily accessible to patients outside of hospitals. These facilities typically work in collaboration with hospitals and academic medical centers to take part in clinical trials and provide new immunotherapy therapies, thus extending patient access to new therapies. Although hospitals now have the largest share of the market, clinics and other outpatient institutions are on the rise, motivated by the burgeoning need for cost-effective and highly specialized cancer treatments. The spread of these facilities helps decentralize the administration of immunotherapy and bring treatments more within reach for a larger segment of patients.

Immunotherapy Drugs Market Regional Analysis:

The market for immunotherapy drugs is characterized by divergent regional patterns, and the leader here is North America based on its superior healthcare system and high levels of research and development investments. In 2024, the global market share is estimated to be held by North America at 49.9%. Europe ranks second thanks to the improvement in biotechnology and positive reimbursement policies with a share of 25%. The Asia-Pacific region is seeing fast growth with rising cancer incidence and healthcare investment and currently has a 15% market share. South America and Middle East & Africa have smaller existing market shares but are showing emerging opportunities with developing healthcare infrastructures and growing awareness of immunotherapy therapy.

COVID-19 Impact Analysis on the Immunotherapy Drugs Market:

The COVID-19 pandemic has impacted the market for immunotherapy drugs in a complex way. On one hand, the pandemic caused interruptions in clinical trials and diverted health resources, causing drug development and approval to be delayed. On the other hand, the crisis hastened the development of immunotherapies, especially the speedy development of mRNA vaccines by BioNTech and Moderna. These developments have created interest in using similar technologies for cancer treatment, which could revolutionize oncology treatment. In addition, the pandemic underscored the need for resilience in supply chains and pandemic preparedness, impacting the strategic priorities of pharmaceutical firms. The immunotherapy drugs market has weathered the initial onslaught and incorporated new technologies and strategies to build resilience in the face of impending global health crises.

Recent Trends/Developments:

The immunotherapy drug market is witnessing tremendous progress and strategic changes. AstraZeneca's buyout of EsoBiotec for as much as $1 billion is a reflection of a trend towards in-vivo CAR-T cell therapies to reduce cancer therapy to a straightforward direct injection, making it more accessible and cost-effective. Strategic partnerships are also gaining momentum, with the likes of CohBar, Inc. and Morphogenesis, Inc. joining forces to create new immuno-oncology drugs that focus on cancer immunotherapy resistance. Moreover, biotech advances like CAR-T cell therapy and checkpoint inhibitors are transforming personalized medicine, providing more targeted and effective treatments. Geopolitical events, including possible U.S.-EU tariff wars, complicate matters by potentially driving up prices and limiting access to life-saving immunotherapy medicines like Merck's Keytruda. Together, these trends point to a dynamic environment in the immunotherapy drugs market, marked by fast-paced innovation, strategic alliances, and new challenges associated with cost control and global trade policies.

Key Players in the Immunotherapy Drugs Market:

- Merck & Co., Inc.

- F. Hoffmann-La Roche Ltd.

- Bristol-Myers Squibb Company

- AstraZeneca

- Novartis AG

- Pfizer Inc.

- Johnson & Johnson Services, Inc.

- Amgen Inc.

- Gilead Sciences, Inc.

- Sanofi

Chapter 1. Immunotherapy Drugs Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Immunotherapy Drugs Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Immunotherapy Drugs Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Type Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Immunotherapy Drugs Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Immunotherapy Drugs Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Immunotherapy Drugs Market – By Drug Type

6.1 Introduction/Key Findings

6.2 Monoclonal Antibodies

6.3 Checkpoint Inhibitors

6.4 Interferons Alpha & Beta

6.5 Interleukins

6.6 Adult Vaccines

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Drug Type:

6.9 Absolute $ Opportunity Analysis By Drug Type:, 2025-2030

Chapter 7. Immunotherapy Drugs Market – By Therapy Area

7.1 Introduction/Key Findings

7.2 Cancer

7.3 Autoimmune and Inflammatory Diseases

7.4 Infectious Diseases

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Therapy Area

7.7 Absolute $ Opportunity Analysis By Therapy Area , 2025-2030

Chapter 8. Immunotherapy Drugs Market – By End-User

8.1 Introduction/Key Findings

8.2 Hospitals

8.3 Clinics

8.4 Others

8.5 Y-O-Y Growth trend Analysis End-User

8.6 Absolute $ Opportunity Analysis End-User , 2025-2030

Chapter 9. Immunotherapy Drugs Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Therapy Area

9.1.3. By End-User

9.1.4. By Drug Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Therapy Area

9.2.3. By End-User

9.2.4. By Drug Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Therapy Area

9.3.3. By Mode of Operation

9.3.4. By Drug Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Mode of Operation

9.4.3. By Therapy Area

9.4.4. By Drug Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Mode of Operation

9.5.3. By Therapy Area

9.5.4. By Drug Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Immunotherapy Drugs Market – Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

10.1 Merck & Co., Inc.

10.2 F. Hoffmann-La Roche Ltd.

10.3 Bristol-Myers Squibb Company

10.4 AstraZeneca

10.5 Novartis AG

10.6 Pfizer Inc.

10.7 Johnson & Johnson Services, Inc.

10.8 Amgen Inc.

10.9 Gilead Sciences, Inc.

10.10 Sanofi

Download Sample

Choose License Type

2500

4249

5250

6900

Frequently Asked Questions

The market is expected to grow from US $268.6 billion in 2025 to US $577.2 billion by 2030, at a CAGR of 16.53%.

As of 2024, North America holds the largest share of the immunotherapy drugs market, attributed to advanced healthcare infrastructure and high adoption rates of immunotherapeutic approaches.

Major companies in the immunotherapy drugs market include AbbVie Inc., Amgen Inc., AstraZeneca, Bayer AG, Boehringer Ingelheim, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, and Genmab A/S, among others.

Key drivers include the rising incidence of cancer, unmet medical needs, increased awareness of cancer immunotherapy, higher adoption rates of immunotherapeutic approaches, and rising investments by pharmaceutical companies.

Challenges include the high cost of immunotherapy treatments, which can strain healthcare budgets, and the need for more extensive clinical data to support the efficacy of new immunotherapeutic approaches.