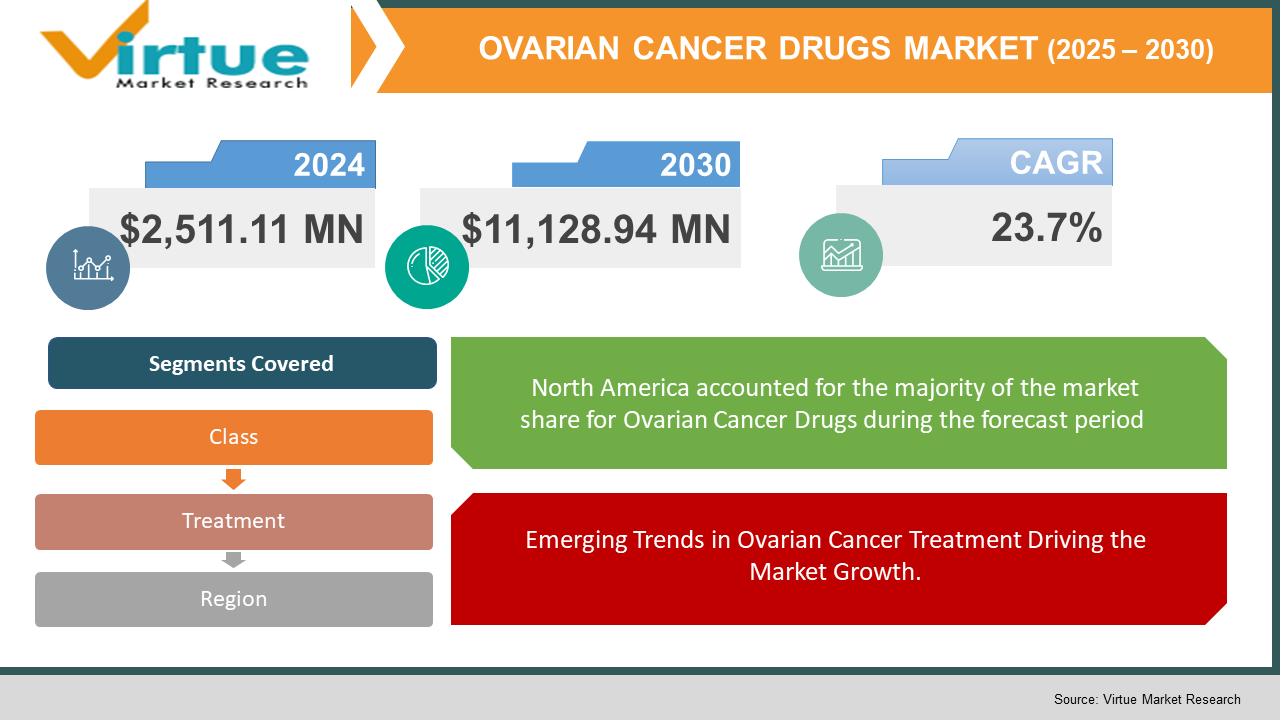

Ovarian Cancer Drugs Market Size (2024 – 2030)

Global Ovarian Cancer Drugs Market was valued at USD 2,511.11 Million and is projected to reach a market size of USD 11,128.94 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 23.7%. with the United States leading the way. One of the primary trends driving market expansion is the rising incidence of ovarian cancer due to an ageing population and bad lifestyles.

MARKET OVERVIEW

Ovarian cancer is caused by the growth of mutational cells or tissues in the female reproductive organs known as the ovaries. Cancer goes undiagnosed until the mutation spreads to the stomach and pelvis, resulting in a deadly stage of ovarian cancer. Ovarian cancer claims the lives of a significant number of women around the world. Women with ovarian cancer may experience pain in the belly, exhaustion, indigestion, bloating, and nausea, among other symptoms.

Ovarian cancer is the seventh most frequent cancer in women globally, according to the World Malignancy Research Fund International (WCRF), and it kills more people each year than any other gynaecological cancer. This condition affects mostly older women, with a peak age of 63. Over the last decade, the global mortality rate has decreased, and this trend is expected to continue in the United States, Europe, and, to a lesser extent, Japan during the forecast period. The usage of contraceptives is on the rise, while hormonal therapies are on the decline, resulting in a lower cancer-related mortality rate.

PARP inhibitors are expected to account for the bulk of market share in 2022, owing to the sustained consumption of authorised medications and their higher efficacy. The market's growth is expected to be aided by the increasing use of checkpoint inhibitors.

COVID-19 impact on Ovarian Cancer Drugs Market

The pandemic of COVID-19 has had a negative influence on healthcare systems and the market. As the world grapples with the coronavirus sickness catastrophe of 2020, the oncology community faces unprecedented problems. During this challenging time, patients with ovarian cancer (OC) have experienced delays in diagnosis, surgery, chemotherapy, radiation therapy, and oncology follow-ups conducted via telemedicine rather than in-person appointments. COVID-19 and cancer treatment risks are weighed against the benefits of delaying cancer therapy by OC patients and their doctors. Due to the delay in treatment therapy, women with OC have reported greater levels of cancer fear, anxiety, and despair.

MARKET DRIVERS

The growing prevalence of ovarian cancer and the rise in the number of elderly women are both driving the global ovarian cancer market forward.

The rise of healthcare is being driven by the growing economies of both developed and developing countries. As a result, they are helping to drive the worldwide ovarian cancer market forward. The global ovarian cancer market is expected to grow in response to the growing geriatric population of women, the growth in ovarian cancer incidence, the ease of use of novel medicines and therapies, and rising healthcare spending. In addition, the market's rise is being aided by increased government funding.

Emerging Trends in Ovarian Cancer Treatment Driving the Market Growth.

As the female population has gotten older, ovarian cancer has become more common. Rising ovarian cancer prevalence, the introduction of new drugs and therapies, increased healthcare expenditure, and more government financing are some of the other major factors propelling the ovarian cancer market forward. Furthermore, the ovarian cancer industry is being propelled ahead by rising healthcare awareness. As a result, medications like Bevacizumab (Avastin) and Pazopanib (Votrient) are likely to grow in popularity, replacing generics like paclitaxel and carboplatin, which currently dominate the market. Furthermore, the discovery of new treatments to treat this type of cancer is projected to have a substantial impact on the market.

MARKET RESTRAINTS

The market's expansion is being stifled by a lack of awareness.

The symptoms of ovarian cancer are frequently overlooked and easily mistaken with those of other disorders, resulting in a lack of early detection and accurate diagnosis. The market for ovarian cancer diagnostics and therapies in Asia-Pacific is being hampered by this. Other organs affected by ovarian cancer include the abdominal cavity, pelvis, and abdominal lymph nodes, as well as the bones, liver, brain, and the sac around the lymph nodes. Furthermore, the worldwide market is being hindered by the expiration of key pharmaceutical patents. The market may face difficulty when it develops increasingly effective medications.

The market's expansion is being stifled by a lack of skilled professionals and technology.

Furthermore, the lack of suitable technology for identifying ovarian cancer in its early stages is a major issue impeding the worldwide ovarian cancer market's growth. Furthermore, the shortage of experienced individuals is posing a challenge to the market's growth. In addition, the ovarian cancer market's growth is being hampered by a shortage of funding for research and development operations.

OVARIAN CANCER DRUGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

23.7% |

|

Segments Covered |

By Class, Treatment, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AstraZeneca, Roche, Tesaro, and Clovis Oncology, Pfizer, AbbVie, ImmunoGen, Johnson & Johnson, Boehringer Ingelheim, Oasmia Pharmaceuticals |

Ovarian Cancer Drugs Market - by Class

-

PARP

-

PD-L1

-

Angiogenesis Inhibitors

AstraZeneca was the only player in the PARP inhibitors market for two years. Rubraca from Clovis Oncology was authorised as a third-line therapy for indication in 2020. Tesaro's Zejula was approved by the FDA in March 2021 as a maintenance medication for individuals with BRCA mutations. Both Zejula and Rubraca, PARP inhibitors, have shown promising outcomes in early trials and compete directly with AstraZeneca's Lynparza.

The use of innovative treatments such as immunotherapy, targeted therapy, and, most significantly, combination regimens are the focus of current ovarian cancer research. Immuno-oncologic drugs have shown encouraging outcomes in terms of increased survival and reduced toxicity. However, the single-agent response rate of PD-1/PD-L1 drugs like Opdivo and Keytruda for the treatment of ovarian cancer is less than 20%.

Ovarian Cancer Drugs Market - by Treatment

-

Chemotherapy

-

Radiation Therapy

-

Hormonal Therapy

-

Surgery

-

Immunotherapy

-

Targeted Therapy

Immunotherapy dominates the market in terms of treatment type. It is expected to develop rapidly throughout the forecast period, owing to the rising adoption rate of immunotherapy treatments and the growth of healthcare, which has increased the number of patients diagnosed with ovarian cancer who are undergoing immunotherapy.

The market for targeted therapies is growing at a rapid rate of CAGR. Due to the increasing popularity of targeted therapies and the rising prevalence of women affected by ovarian cancer, this trend is expected to continue during the projection period.

Ovarian Cancer Drugs Market - by region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

In terms of geography, North America held the largest proportion of the global ovarian cancer market in 2020. Due to the increasing prevalence of ovarian cancer and the growing geriatric population, the trend is expected to continue during the forecast period. The United States has the largest share of the ovarian cancer diagnostics and therapies market and has greatly increased its share. In the United States, ovarian cancer is the ninth most frequent cancer and the fifth greatest cause of cancer death among women. Furthermore, the United States is home to the majority of the world's top ovarian cancer diagnostics companies. As a result, it is likely to be a substantial advantage for the area, driving the market.

Demand from Asia-Pacific accounts for a considerable portion of the company's sales. . Due to the rising incidence of the elderly population and the growing economy of countries such as China and India, it is expected to rise at a high CAGR throughout the forecast period. Due to rising healthcare spending, more government assistance, and an expanding target patient pool, India and China are the fastest emerging countries in the Asia Pacific. According to the World Health Organization, more than 7 million new cancer cases are discovered in Asia each year (WHO). China and India are two of the most promising countries in the world, with significant market potential. Rising ovarian cancer incidence, favourable medical care reforms, improved health awareness, a low-cost base, and the absence of legal and cultural restrictions all contribute to the market's rise in India and other developing countries. As a result, the ovarian cancer diagnostics market in Asia-Pacific is rapidly expanding.

Ovarian Cancer Drugs Market - by company

-

AstraZeneca

-

Roche

-

Tesaro

-

Clovis Oncology

-

Pfizer

-

AbbVie

-

ImmunoGen

-

Johnson & Johnson

-

Boehringer Ingelheim

-

Oasmia Pharmaceuticals

Avastin's market share is expected to be impacted by patent expiration and increased competition from PARP inhibitors. In the second-line platinum-sensitive scenario, Roche's Tecentriq-based combination therapy is projected to gain traction as the preferred treatment option. For advanced-stage patients with BRCA mutations, PARP inhibitors are expected to become the recommended maintenance therapy. When compared to current standard-of-care chemotherapy, the medication class is expected to significantly enhance progression-free survival (PFS).

NOTABLE HAPPENINGS IN THE OVARIAN CANCER DRUGS Market IN RECENT PAST.

RESEARCH AND DEVELOPMENT:

-

In February 2021, GlaxoSmithKline plc has developed a new treatment for advanced ovarian cancer in women the FDA authorised a medicine named zejula, with the FDA aiming for a quick review procedure to make it available to patients.

-

In August 2020, Researchers from The George Washington University School of Medicine and Health Sciences in the United States discovered an ovarian cancer medication resistance protein that needs to be blocked for the treatment of platinum-resistant ovarian cancer patients.

MERGERS AND ACQUISITIONS:

-

In January 2020, Tesaro was purchased by GlaxoSmithKline (GSK), a UK-based pharmaceutical company, for $5.1 billion. With Tesaro's Zejula, a PARP inhibitor, and other Tesaro products, GSK will be able to grow its product portfolio and boost its pharmaceutical company by speeding the development of GSK's pipeline and commercial capacity in oncology.

Chapter 1.Ovarian Cancer Drugs Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.Ovarian Cancer Drugs Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.Ovarian Cancer Drugs Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.Ovarian Cancer Drugs Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.Ovarian Cancer Drugs Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.Ovarian Cancer Drugs Market – By Class

6.1. PARP

6.2. PD-L1

6.3. Angiogenesis Inhibitors

Chapter 7.Ovarian Cancer Drugs Market – By Treatment

7.1.Chemotherapy

7.2. Radiation Therapy

7.3. Hormonal Therapy

7.4. Surgery

7.5. Immunotherapy

7.6. Targeted Therapy

Chapter 8.Ovarian Cancer Drugs Market – By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9.Ovarian Cancer Drugs Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9. 1. AstraZeneca

9.2. Roche, Tesaro

9.3. Clovis Oncology

9.4. Pfizer

9.5. AbbVie

9.6. ImmunoGen

9.7. Johnson & Johnson

9.8. Oasmia Pharmaceuticals'

Download Sample

Choose License Type

2500

4250

5250

6900