Global Monoclonal Antibodies Market Size (2024 - 2030)

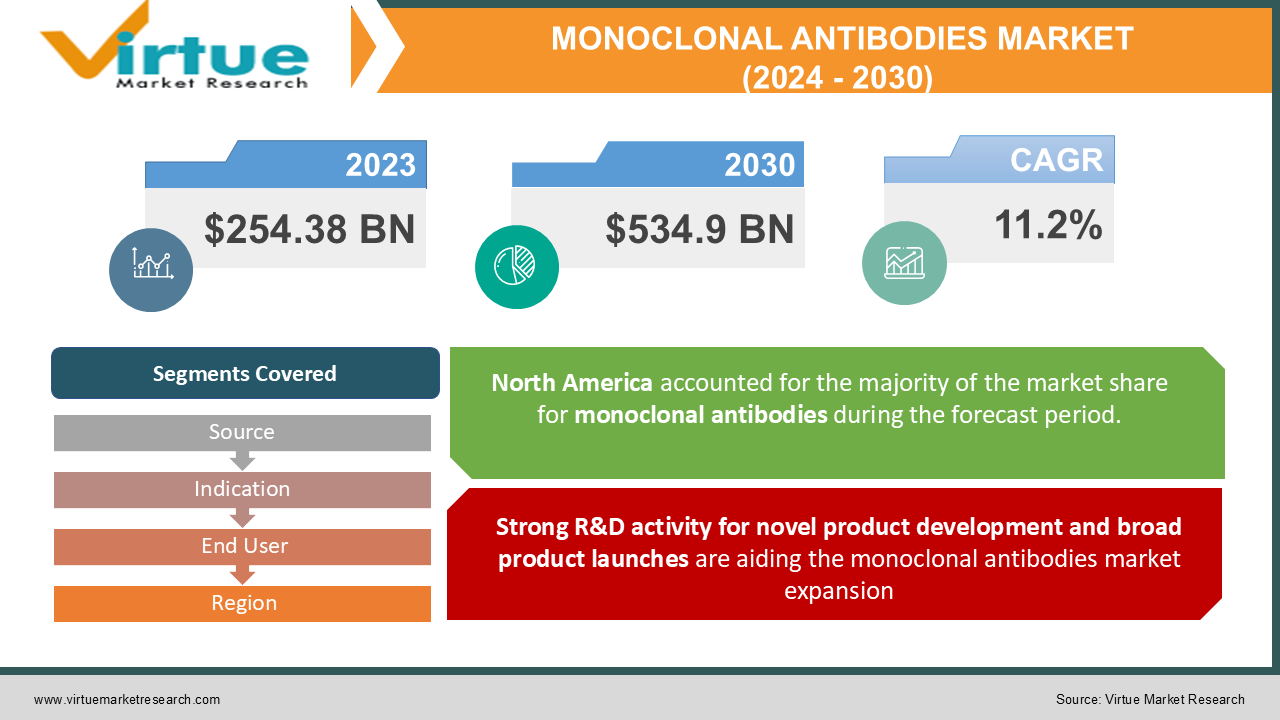

In 2023, the Monoclonal Antibodies Market was valued at $254.38 Billion and is projected to reach a market size of $534.9 Billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.2%.

Monoclonal antibody (mAb) therapy is an immunotherapy that involves the use of monoclonal antibodies to attach to specific cells or proteins. Monoclonal antibodies are identical immune cell clones of a single mother cell. They can bind to a specific antigen when given as these antibodies have a monovalent affinity. Monoclonal antibodies are useful tools for detecting and purifying chemicals owing to their site-specificity and they have a wide range of applications in molecular biology, biochemistry, and medicine. Monoclonal antibodies are used to boost or decrease the immune response in a variety of medical situations and to treat diseases like cancer, heart disease, and stroke. Anti-cancer monoclonal antibodies, which reduce cell proliferation and prevent metastasis, neuropharmacological monoclonal antibodies, immunological monoclonal antibodies, anti-infective monoclonal antibodies, and other MAbs for humans and animals are all part of this industry.

Increased prevalence of cancer and chronic diseases, high demand for biologics, increased demand for cost-effective biosimilar monoclonal antibodies, and increased genomics R&D activities, as well as the introduction of technologically advanced genetic platforms, such as next-generation sequencing, are the major factors driving the market growth. Furthermore, an increase in patient and physician awareness of the applications of monoclonal antibodies (mAb) therapy, an increase in research collaborations for the development of a robust drug pipeline, and the approval of mAbs for various applications all contribute to the market's growth.

MARKET DRIVERS:

Strong R&D activity for novel product development and broad product launches are aiding the monoclonal antibodies market expansion

Monoclonal antibodies market growth potential is boosted by a strong focus on the research and development of novel monoclonal antibody therapeutics to provide highly targeted treatment for complex and severe diseases. Growing government support and regulatory approvals are contributing to the monoclonal antibodies market growth. For instance, the European Commission (EC) authorized Bristol Myers Squibb's OPDIVO and Yervoy combination therapy to treat patients with malignant pleural mesothelioma in June 2021. As a result, the product line's availability in the market will be extended.

Growing applications of monoclonal antibodies and high adoption of mAb therapies in oncology are contributing to the market growth

Monoclonal antibodies have numerous applications, allowing a single mAb to target multiple cancer types. As a result, rising cancer rates are likely to increase product demand in the future. The monoclonal antibodies market is growing owing to the increasing availability of cost-effective biosimilar monoclonal antibodies. The goal of biosimilars is to reduce the cost of medication and enhance access to treatment by addressing rising healthcare costs and dealing with economic pressure from patients and governments. Furthermore, to meet the rising disease burden, prominent market players are engaging in research and development efforts to provide the segment with unparalleled growth potential in the future.

MARKET RESTRAINTS:

The strict regulatory framework for the approval process is likely to hamper the market growth

Despite the positive results of monoclonal antibodies in the treatment of a variety of diseases, the lengthy and demanding requirements for approval and launch of monoclonal antibodies therapy can be a substantial roadblock to market revenue. Many clinical studies fall short of meeting the regulatory bodies' strict requirements and end outcomes. Other issues limiting the monoclonal antibody therapy market's growth include the medications' potential negative effects.

The high manufacturing cost of some monoclonal antibody therapeutics can be a challenge in the market growth

Therapeutic monoclonal antibodies (mAbs) are among the most expensive medications on the market. The current method of producing therapeutic mAbs necessitates the use of very large mammalian cell cultures followed by significant purification steps under GMP conditions, resulting in extremely expensive manufacturing costs. The high cost of mAbs has hampered their development as medicines. Certain novel technologies, such as plant-based mAb manufacturing, may minimize the cost. Plants can be utilized as bioreactors to produce therapeutic antibodies in big quantities at a low cost.

MONOCLONAL ANTIBODIES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.2% |

|

Segments Covered |

By Source, Indication, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AbbVie Inc., Bristol Myers Squibb, Amgen, F. Hoffmann-La Roche, Bristol Myers Squibb, Merck & Co., Inc., Regeneron Pharmaceuticals Inc., AstraZeneca, Johnson & Johnson, Eli Lilly and Company, Takeda Pharmaceutical Company Limited, GlaxoSmithKline plc, Novartis AG among others |

Segmentation Analysis

Monoclonal Antibodies Market – By Source:

- Murine

- Humanized

- Chimeric

- Human

Based on the Source, the Monoclonal Antibodies Market is categorized into Murine, Humanized, Chimeric, and Human. The Human segment is the largest revenue contributor, accounting for more than half of the market share in 2021, and is anticipated to increase significantly throughout the forecast period. The integration of advanced technology such as phage or yeast display, as well as transgenic mice, for the generation of human monoclonal antibodies, is driving the segment. In addition, the use of advanced genetic engineering technology, an increase in the number of product approvals, and government support for infection control and management are the major factors driving the market's growth.

Humanized mAbs accounted for a considerable revenue share owing to their widespread use in the treatment of diseases such as cancer, autoimmune diseases, and inflammatory diseases. Furthermore, the use of advanced genetic engineering technologies in its manufacturing is a significant growth driver for this market.

Monoclonal Antibodies Market – By Indication:

- Oncology

- Inflammatory Diseases

- Infectious Diseases

- Autoimmune Diseases

- Others

Based on Indication, the Monoclonal Antibodies Market is categorized into Oncology, Inflammatory Diseases, Infectious Diseases, Autoimmune Diseases, and Others. The Oncology segment accounts for the largest share in the monoclonal antibodies market. The rise in the prevalence of cancer and the adoption of monoclonal antibodies in cancer treatment is driving the growth of the segment. Furthermore, the increase in the number of drug pipelines, rising patient awareness of cancer treatment processes, and demand for biosimilar monoclonal antibodies all contribute to the market's growth. These have shown to be the greatest cancer treatment option when compared to medications and chemotherapy owing to few side effects connected with their use. Therapeutic monoclonal antibodies (mAbs) have a wide range of applications in cancer treatment. mAbs are being utilized to treat a variety of cancers, including non-small cell lung cancer, breast cancer, brain tumors, ovarian cancer, colorectal cancer, melanoma, gastric cancer, Hodgkin's lymphoma, and others.

Monoclonal Antibodies Market – By End User:

- Research Institutes

- Hospitals

- Others

Based on End User, the Monoclonal Antibodies Market is categorized into Research Institutes, Hospitals, and Others. The Hospitals segment is anticipated to be worth roughly USD 77 billion in 2021 owing to the rising number of patient hospitalizations for a variety of chronic conditions. Patients' preferences have been influenced by the availability of modern medication therapy in institutions. Product demand in hospitals is likely to be driven by highly skilled experts providing specialized treatments such as cancer and autoimmune illnesses. The rising incidence of chronic illnesses is fueling treatment rates, and rising healthcare expenditure levels are factors that are likely to result in hospitals dominating the end-use segment during the forecast period.

Monoclonal Antibodies Market - By Region:

- North America

- Europe

- Asia-Pacific

- Rest of the World

Geographically, the North American Monoclonal Antibodies Market accounted for the largest revenue share of more than 48% in 2021 owing to the strong presence of key market players and an increasing number of product approvals. The demand for monoclonal antibodies in the regional market is likely to be fueled by increased product adoption for effective disease treatment. Furthermore, increased R&D spending by organizations and government backing for cancer research has enabled the development of innovative monoclonal antibody treatments. The availability of well-developed healthcare infrastructure has boosted the population's access to treatment, resulting in increasing product demand.

The Asia Pacific Monoclonal Antibodies Market is anticipated to grow at a rapid pace during the forecast period. Increasing initiatives and government spending for overall R&D of monoclonal antibody therapy, as well as a rise in the number of product approvals, delivers huge growth potential for key players operating in the monoclonal antibodies market. Furthermore, ongoing developments in monoclonal antibodies, the availability of modern healthcare systems, increasing patient knowledge of the therapeutic use of mAbs, and a large increase in demand for advanced healthcare facilities all contribute to the market's growth. Key manufacturers are increasingly focusing on growing their geographical presence in new markets.

Major Key Players in the Market

Some notable players operating in the global monoclonal antibodies market are

- AbbVie Inc.

- Bristol Myers Squibb

- Amgen

- F. Hoffmann-La Roche

- Bristol Myers Squibb

- Merck & Co., Inc.

- Regeneron Pharmaceuticals Inc.

- AstraZeneca

- Johnson & Johnson

- Eli Lilly and Company

- Takeda Pharmaceutical Company Limited

- GlaxoSmithKline plc

- Novartis AG among others

To strengthen their product portfolio and expand their market footprint, these market players are employing a variety of growth tactics. To acquire a competitive advantage, corporations are using competitive strategies such as product launches, mergers and acquisitions, expansion and diversification, and research collaborations.

Notable happenings in the Global Monoclonal Antibodies Market in the recent past:

- Collaboration- In January 2021, Eli Lilly & Company, Vir Biotechnology, Inc., and GlaxoSmithKline plc established a collaboration to test a combination of two COVID-19 medicines in low-risk COVID-19 patients. Lilly has expanded the BLAZE-4 trial to include bamlanivimab (LY-CoV555) 700mg in combination with VIR-7831 500mg, two neutralizing antibodies that bind to distinct epitopes of the SARS-CoV-2 spike protein. This is the first time monoclonal antibodies from different businesses have been brought together to investigate potential results.

- Product Approval- In May 2021, the Central Drugs Standards Control Organisation granted Roche India an Emergency Use Authorization (EUA) for their antibody cocktail (CDSCO). The company has been allowed to expand product availability in the country as a result of this authorization.

- Collaboration- In May 2021, GlaxoSmithKline plc and Vir Biotechnology, Inc. announced receiving FDA approval for Emergency Use Authorization (EUA) for sotrovimab, an investigational single-dose monoclonal antibody, for the treatment of mild-to-moderate COVID-19 in adults and paediatric patients with positive results of SARS-CoV-2 viral testing.

- Collaboration-In June 2021, Amgen and Kyowa Kirin Co. Ltd. agreed to collaborate on the development and commercialization of KHK4083, a completely human monoclonal antibody for the treatment of atopic dermatitis. Such collaborations have aided the company's expansion.

- Product Approval- In July 2021, Roche announced the approval of "Ronapreve" (casirivimab and indevimab) for intravenous infusion treatment of patients with mild to moderate COVID-19. Under Article 14-3 of the Pharmaceuticals and Medical Devices Act, the antibody combination received special approval.

COVID-19 pandemic impact on Monoclonal Antibodies Market

The COVID-19 pandemic has had a favorable impact on the monoclonal antibody market for the development of COVID-19 monoclonal antibody therapy. The sudden increase in the number of individuals infected with COVID-19 prompted the development of viable treatments. The rapid production of a significant number of severe acute respiratory syndrome coronavirus neutralizing monoclonal antibodies has been aided by the urgent need for treatments available on a worldwide scale (mAbs). The Food and Drug Administration (FDA) issued an emergency use authorization (EUA) for three monoclonal antibodies intended for outpatient treatment of symptomatic COVID-19 patients in response to the high transmission and significant fatality rates. The Centers for Medicare and Medicaid Services approved monoclonal antibody therapy with "bamlanivimab," "casirivimab/imdevimab," and "bamlanivimab/etesevimab" in November 2020 and April 2021, respectively. According to a report by the National Center for Biotechnology Information, the US government acquired 2.5 million monoclonal antibody therapies and distributed 1 million to states. Furthermore, according to the South Carolina Department of Health and Environmental Control report, the FDA has approved an mAB treatment for COVID-19 patients only for emergency use after it was found to be effective in reducing hospitalization and death by nearly 70% and shortening the treatment window by an average of four days. Furthermore, during the pandemic, a high number of active clinical trials to create novel pharmacological treatments, as well as a wide spectrum of pharmaceutical approvals for emergency use in COVID-19 treatment, fueled the market expansion

Chapter 1. MONOCLONAL ANTIBODIES MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. MONOCLONAL ANTIBODIES MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. MONOCLONAL ANTIBODIES MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. MONOCLONAL ANTIBODIES MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. MONOCLONAL ANTIBODIES MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MONOCLONAL ANTIBODIES MARKET – By Source

6.1. Murine

6.2. Humanized

6.3. Chimeric

6.4. Human

Chapter 7. MONOCLONAL ANTIBODIES MARKET – By Indication

7.1. Oncology

7.2. Inflammatory Diseases

7.3. Infectious Diseases

7.4. Autoimmune Diseases

7.5. Others

Chapter 7. MONOCLONAL ANTIBODIES MARKET – By End User

8.1. Research Institutes

8.2. Hospitals

8.3. Others

Chapter 9. MONOCLONAL ANTIBODIES MARKET – By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. MONOCLONAL ANTIBODIES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. AbbVie Inc

10.2. Bristol Myers Squibb

10.3. Amgen

10.4. F. Hoffmann-La Roche

10.5. Merck & Co., Inc

10.6. Regeneron Pharmaceuticals Inc

10.7. .AstraZeneca,

10.9. Johnson & Johnson

10.10. Eli Lilly and Company

10.11. Takeda Pharmaceutical Company Limited

10.12. GlaxoSmithKline plc

10.13. Novartis AG

Download Sample

Choose License Type

2500

4250

5250

6900