Autonomous Medical Coding Market Size (2024 – 2030)

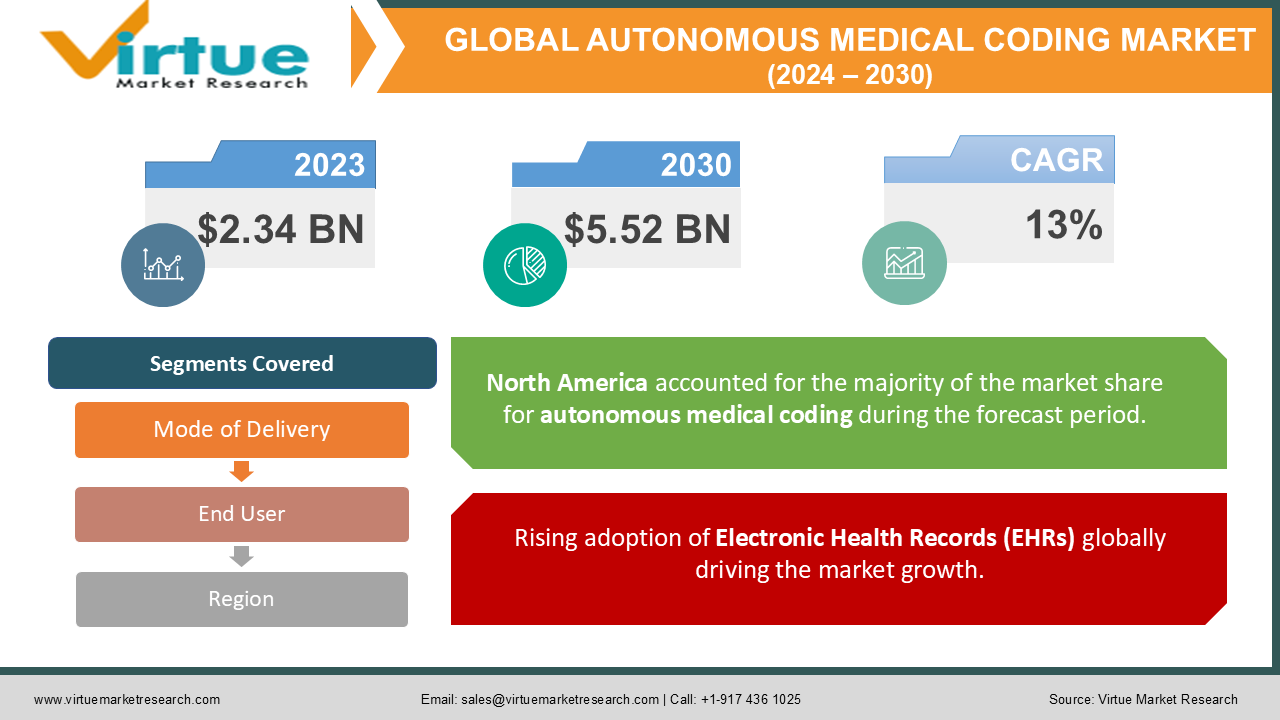

The Global Autonomous Medical Coding Market was valued at USD 2.34 billion in 2023 and is projected to reach a market size of USD 5.52 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 13% between 2024 and 2030.

The Global Autonomous Medical Coding Market is rapidly evolving, driven by the increasing need for efficiency and accuracy in healthcare documentation. Autonomous medical coding leverages advanced technologies such as artificial intelligence (AI) and machine learning to automatically translate clinical data into standardized codes used for billing, reporting, and data analysis. This innovation significantly reduces the manual effort required by human coders, minimizes errors, and accelerates the revenue cycle process.

The market's growth is fueled by the rising adoption of electronic health records (EHRs), the growing volume of healthcare data, and the demand for cost-effective solutions in the healthcare industry. Furthermore, the ongoing advancements in natural language processing (NLP) and AI are enhancing the capabilities of autonomous coding systems, making them more accurate and reliable. As healthcare providers and payers increasingly recognize the benefits of automation in medical coding, the market is expected to expand significantly in the coming years, reshaping the landscape of healthcare administration and paving the way for more streamlined, efficient, and error-free coding processes.

Key Market Insights:

- By 2025, 65% of large healthcare organizations are projected to adopt autonomous coding technology, up from 32% in 2023.

- Autonomous coding systems can reduce coding errors by 85%.

- These systems can reduce the time spent on coding by 60%, allowing healthcare professionals to focus more on patient care.

- Cost savings for healthcare providers can reach 25% through the adoption of autonomous coding, primarily due to reduced labor costs and fewer denied claims.

- The adoption of cloud-based coding solutions is expected to increase by 18% annually.

Global Autonomous Medical Coding Market Drivers:

Rising Adoption of Electronic Health Records (EHRs).

One of the primary drivers of the Global Autonomous Medical Coding Market is the widespread adoption of Electronic Health Records (EHRs) across healthcare facilities worldwide. As healthcare systems transition from paper-based records to digital formats, the volume of data generated has exponentially increased, creating a demand for efficient and accurate coding solutions.

Autonomous medical coding systems, powered by artificial intelligence and machine learning, offer a seamless integration with EHRs, enabling the automatic extraction and coding of clinical data. This not only enhances the accuracy of the coding process but also significantly reduces the time required for manual data entry and coding, thus improving overall operational efficiency.

Additionally, the integration of autonomous coding systems with EHRs supports real-time data analysis and reporting, facilitating better decision-making and resource allocation. As healthcare providers continue to embrace digital transformation, the demand for autonomous medical coding solutions is expected to grow, driving market expansion.

Increasing Need for Cost-Effective Healthcare Solutions.

The growing pressure to reduce healthcare costs while maintaining high-quality patient care is another significant driver of the Global Autonomous Medical Coding Market. Healthcare providers are increasingly looking for ways to optimize their revenue cycles and minimize administrative expenses.

Traditional medical coding, which relies heavily on manual processes, is not only time-consuming but also prone to errors that can lead to claim rejections and delayed reimbursements. Autonomous medical coding addresses these challenges by automating the coding process, thereby reducing the likelihood of errors and ensuring that claims are accurately coded and processed in a timely manner. This automation leads to a reduction in labor costs associated with hiring and training medical coders, as well as a decrease in the financial losses caused by coding errors.

Furthermore, as autonomous coding systems continue to improve in accuracy and efficiency, they are becoming an increasingly attractive option for healthcare providers aiming to streamline operations and reduce costs, thereby driving the market’s growth.

Unlock Market Insights: Get A FREE Sample Report Today!

Global Autonomous Medical Coding Market Restraints and Challenges:

Despite the promising growth of the Global Autonomous Medical Coding Market, several restraints and challenges could impede its expansion. One significant challenge is the high initial cost and complexity associated with implementing autonomous coding systems. These systems require advanced technology, substantial investment in AI and machine learning infrastructure, and the integration with existing Electronic Health Records (EHR) systems, which can be a daunting task for many healthcare providers, especially smaller facilities with limited resources.

Additionally, concerns over data privacy and security pose a substantial barrier, as autonomous coding systems handle vast amounts of sensitive patient information. Ensuring compliance with stringent regulatory standards, such as HIPAA, adds another layer of complexity and cost.

Moreover, while AI-driven systems are continuously improving, there is still a level of skepticism regarding their accuracy and reliability, particularly in handling complex medical cases that require nuanced understanding. The potential for errors, coupled with the need for human oversight, may limit the widespread adoption of fully autonomous coding solutions. Lastly, resistance to change from healthcare professionals accustomed to traditional coding methods may slow the transition to these new technologies, further challenging market growth.

Global Autonomous Medical Coding Market Opportunities:

The Global Autonomous Medical Coding Market presents significant opportunities driven by advancements in artificial intelligence (AI) and machine learning, which are continually enhancing the accuracy and efficiency of coding systems. As healthcare providers strive to optimize their operations, there is a growing demand for more sophisticated and intelligent coding solutions that can handle the increasing complexity of medical data.

The integration of natural language processing (NLP) with autonomous coding systems offers the potential to better understand and interpret unstructured data from clinical notes, thereby improving coding accuracy and reducing the need for human intervention. Additionally, the global shift towards value-based care models emphasizes the importance of accurate and efficient coding in ensuring proper reimbursement and optimizing patient outcomes. This creates a favorable environment for the adoption of autonomous coding systems, particularly in large healthcare organizations and multi-specialty practices.

Moreover, the growing focus on interoperability and data standardization across healthcare systems opens up new avenues for the deployment of autonomous coding solutions on a broader scale, enabling seamless data exchange and collaboration between providers. As these technologies continue to evolve and prove their value in real-world applications, the market is poised to experience substantial growth, offering lucrative opportunities for innovators and early adopters.

GLOBAL AUTONOMOUS MEDICAL CODING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13% |

|

Segments Covered |

By Mode of Delivery, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M Health Information Systems, Optum (a subsidiary of UnitedHealth Group), Nuance Communications, Inc., Cerner Corporation, Artificial Medical Intelligence, Inc., Dolbey Systems, Inc., TruCode (a part of IMO - Intelligent Medical Objects), MModal (a part of 3M), Streamline Health Solutions, Inc., nThrive, Inc., Precyse Solutions, LLC, eCatalyst Healthcare Solutions |

CUSTOMIZE THIS FULL REPORT AS PER YOUR NEEDS

SEGMENTATION ANALYSIS

Global Autonomous Medical Coding Market Segmentation: By Mode of Delivery

-

Web & Cloud-based

-

On-Premises

Cloud-based solutions are increasingly dominating the Global Autonomous Medical Coding Market due to their scalability, accessibility, and cost-effectiveness. These solutions can easily adapt to varying workloads, making them suitable for healthcare organizations of all sizes, and allow remote access, which enhances flexibility and efficiency in coding tasks.

The elimination of on-premise hardware and software reduces upfront costs, while automatic updates ensure users benefit from the latest features and compliance standards. Additionally, robust security measures are often in place to protect sensitive patient information, addressing concerns about data security.

Market trends further support the dominance of web and cloud-based systems. The healthcare industry's growing adoption of cloud technology and the shift towards remote work accelerated by the COVID-19 pandemic underscore the essential role of cloud-based solutions. These systems also facilitate seamless data exchange between providers, aligning with the focus on interoperability.

Flexible pay-per-use pricing models make cloud solutions appealing to organizations with diverse budgets. Although on-premises solutions may still serve specific niche markets or organizations with unique security needs, the overall trend clearly favors the growing preference for web and cloud-based autonomous medical coding systems.

Global Autonomous Medical Coding Market Segmentation: By End-User

-

Hospitals

-

Clinical Laboratories & Diagnostics Centers

-

Others

Hospitals are a key segment in the Global Autonomous Medical Coding Market, driven by their high volume of claims, complex coding requirements, and critical need for efficient revenue cycle management. Processing significantly larger numbers of claims compared to other healthcare providers, hospitals prioritize automation to enhance efficiency and reduce costs.

The intricate nature of hospital coding, which involves complex procedures, diagnoses, and complications, makes automated solutions particularly valuable. Accurate and timely coding is essential for effective revenue cycle management and compliance with stringent regulatory requirements, making autonomous coding a critical asset.

Factors supporting the continued dominance of hospitals in this market include the growing volumes of patients due to an aging population and increased healthcare needs, which drive demand for efficient coding solutions. Additionally, the shift towards value-based care heightens the importance of accurate coding to demonstrate quality and efficiency. Hospitals, as early adopters of new technologies, are likely to continue leading the adoption of autonomous coding systems to improve operational performance. While clinical laboratories and diagnostic centers are also adopting these solutions, hospitals are expected to remain the primary market segment due to their unique challenges and opportunities.

Global Autonomous Medical Coding Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

What's Next for Your Market? Get a Snapshot with FREE Sample Report

North America continues to lead the Global Autonomous Medical Coding Market due to several key factors. The region's history of early adoption of healthcare IT and advanced technologies, including artificial intelligence (AI) and machine learning, is central to the development and deployment of autonomous coding solutions. North America's robust healthcare infrastructure, characterized by a high density of hospitals, clinics, and insurance providers, creates a strong demand for efficient and accurate coding solutions. The region’s focus on interoperability and data standards supports the seamless integration of autonomous coding systems with existing healthcare technologies.

Additionally, significant investments in research and development have spurred innovation in coding technologies, while a favorable regulatory environment has facilitated their growth and adoption. However, challenges to North America's continued dominance include increasing competition from regions like Asia Pacific, which is rapidly advancing technologically, and Europe, where there is a strong emphasis on data privacy and security. These emerging markets could potentially impact North America's leadership position in the long term, necessitating ongoing innovation and adaptation to maintain its competitive edge.

COVID-19 Impact Analysis on the Global Autonomous Medical Coding Market.

The COVID-19 pandemic has had a profound impact on the Global Autonomous Medical Coding Market, acting as both a catalyst for growth and a source of challenges. The sudden surge in patient volumes, coupled with the need for rapid and accurate coding of COVID-19-related cases, underscored the limitations of traditional manual coding processes. This led to an accelerated adoption of autonomous coding systems as healthcare providers sought to streamline operations and manage the overwhelming influx of data.

The pandemic highlighted the importance of efficiency in healthcare administration, pushing many organizations to invest in AI-driven coding solutions to handle the increased workload and reduce the risk of errors. However, the pandemic also exposed challenges, such as the need for these systems to quickly adapt to new and evolving coding guidelines related to COVID-19, which tested the flexibility and accuracy of autonomous systems.

Additionally, budget constraints faced by many healthcare providers during the pandemic slowed down the adoption rate in some regions, particularly in smaller facilities. Nonetheless, the overall impact of COVID-19 on the market has been largely positive, as it has accelerated the digital transformation in healthcare and reinforced the value of autonomous medical coding in improving operational resilience and efficiency.

Latest trends / Developments:

The Global Autonomous Medical Coding Market is witnessing several key trends and developments that are shaping its growth and evolution. One of the most prominent trends is the increasing integration of artificial intelligence (AI) and natural language processing (NLP) into coding systems, enhancing their ability to accurately interpret and code complex clinical data. This has led to improved coding precision and a reduction in the need for human intervention, driving efficiency and cost savings for healthcare providers.

Another significant development is the rise of cloud-based coding solutions, which offer scalability, remote accessibility, and real-time updates, making them particularly attractive in the post-pandemic era where remote work and telehealth are becoming more prevalent.

Additionally, there is a growing emphasis on interoperability and data standardization, allowing autonomous coding systems to seamlessly integrate with various Electronic Health Record (EHR) platforms and other healthcare IT systems. This ensures consistent and accurate data flow across different systems, improving overall healthcare delivery.

Moreover, the market is seeing an increased focus on customization, with coding solutions being tailored to meet the specific needs of different medical specialties and regions, further driving their adoption. These trends indicate a shift towards more sophisticated, adaptable, and user-friendly autonomous medical coding solutions.

Key Players:

-

3M Health Information Systems

-

Optum (a subsidiary of UnitedHealth Group)

-

Nuance Communications, Inc.

-

Cerner Corporation

-

Artificial Medical Intelligence, Inc.

-

Dolbey Systems, Inc.

-

TruCode (a part of IMO - Intelligent Medical Objects)

-

MModal (a part of 3M)

-

Streamline Health Solutions, Inc.

-

nThrive, Inc.

-

Precyse Solutions, LLC

-

eCatalyst Healthcare Solutions

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Chapter 1. Autonomous Medical Coding Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Autonomous Medical Coding Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Autonomous Medical Coding Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Autonomous Medical Coding Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Autonomous Medical Coding Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Autonomous Medical Coding Market – By Mode of Delivery

6.1 Introduction/Key Findings

6.2 Web & Cloud-based

6.3 On-Premises

6.4 Y-O-Y Growth trend Analysis By Mode of Delivery

6.5 Absolute $ Opportunity Analysis By Mode of Delivery, 2024-2030

Chapter 7. Autonomous Medical Coding Market – By End-User

7.1 Introduction/Key Findings

7.2 Hospitals

7.3 Clinical Laboratories & Diagnostics Centers

7.4 Others

7.5 Y-O-Y Growth trend Analysis By End-User

7.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Autonomous Medical Coding Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Mode of Delivery

8.1.3 By End-User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Mode of Delivery

8.2.3 By End-User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Mode of Delivery

8.3.3 By End-User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Mode of Delivery

8.4.3 By End-User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Mode of Delivery

8.5.3 By End-User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Autonomous Medical Coding Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 3M Health Information Systems

9.2 Optum (a subsidiary of UnitedHealth Group)

9.3 Nuance Communications, Inc.

9.4 Cerner Corporation

9.5 Artificial Medical Intelligence, Inc.

9.6 Dolbey Systems, Inc.

9.7 TruCode (a part of IMO - Intelligent Medical Objects)

9.8 MModal (a part of 3M)

9.9 Streamline Health Solutions, Inc.

9.10 nThrive, Inc.

9.11 Precyse Solutions, LLC

9.12 eCatalyst Healthcare Solutions

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

By 2023, the Global Autonomous Medical Coding market is expected to be valued at USD 2.34 billion.

Through 2030, the Global Autonomous Medical Coding market is expected to grow at a CAGR of 13%.

By 2030, the Global Autonomous Medical Coding Market is expected to grow to a value of USD 5.52 billion.

North America is predicted to lead the Global Autonomous Medical Coding market.

The Global Autonomous Medical Coding Market has segments By mode of delivery, End-user, and Region.