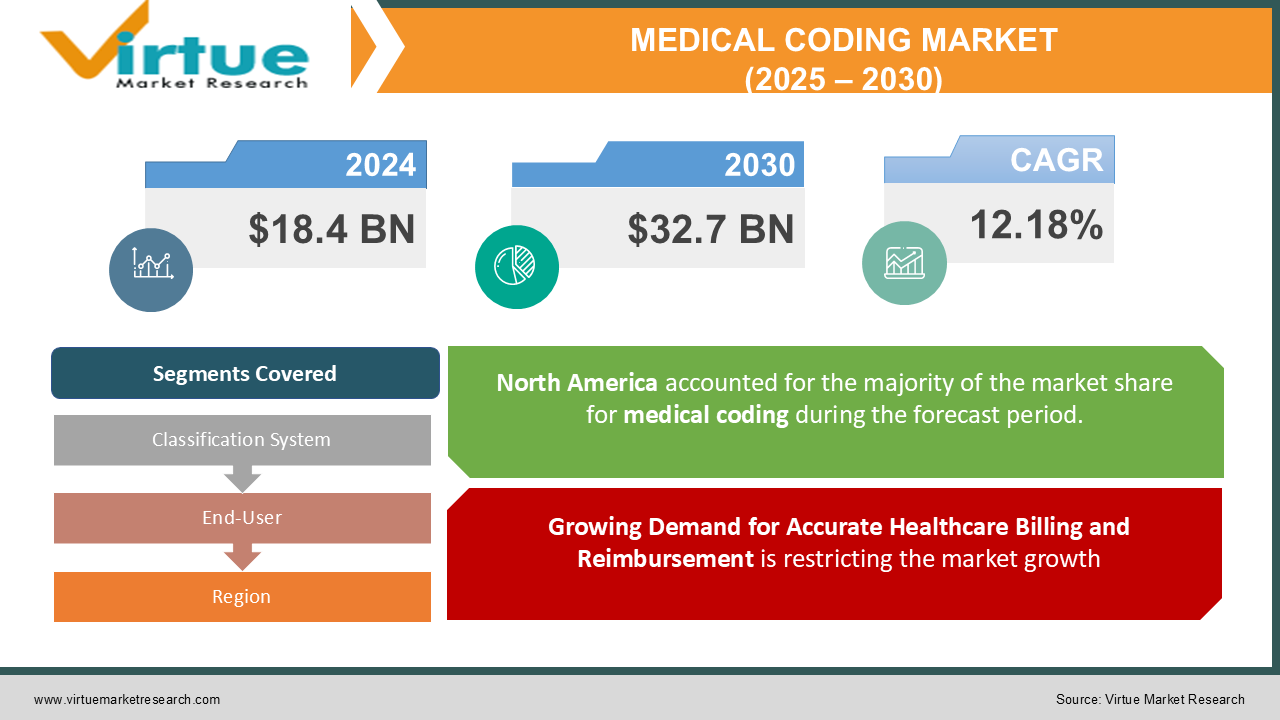

Medical Coding Market Size (2025 – 2030)

The Global Medical Coding Market was valued at USD 18.4 billion in 2024 and is projected to reach USD 32.7 billion by 2030, growing at a CAGR of 12.18% during the forecast period.

Medical coding translates healthcare diagnoses, procedures, medical services, and equipment into standardized codes used for billing, insurance claims, and healthcare analytics. The demand for medical coding is rising due to the increasing adoption of digital health records, stringent regulatory requirements, and the expansion of healthcare services worldwide.

Key Market Insights

-

ICD classification dominates the market, accounting for 45% of the total share, due to its widespread use in disease classification and healthcare reporting.

-

Hospitals are the largest end-users, holding over 50% of the market, driven by high patient volumes and complex billing requirements.

-

North America leads the market with a 40% share, supported by strict healthcare regulations and a growing demand for medical billing outsourcing.

-

Asia-Pacific is the fastest-growing region (CAGR 11.2%), fueled by expanding healthcare infrastructure and rising medical insurance adoption.

-

The shift toward AI-powered coding solutions and automation is improving accuracy and efficiency in medical billing.

-

Shortage of skilled medical coders remains a major challenge, prompting increased demand for outsourcing services.

-

Regulatory changes and coding updates (such as ICD-11 implementation) are reshaping the industry landscape.

Global Medical Coding Market Drivers

1. Growing Demand for Accurate Healthcare Billing and Reimbursement is restricting the market growth

Medical coding ensures error-free billing and insurance claims processing, reducing the risk of fraudulent claims and revenue losses. As healthcare providers expand services and digitalize medical records, the demand for efficient coding solutions continues to grow.

2. Rising Adoption of AI and Automation in Medical Coding is restricting the market growth

- AI-driven medical coding platforms enhance accuracy and speed.

- Machine learning algorithms help detect coding errors and fraud, reducing claim rejections.

- AI-based solutions like Natural Language Processing (NLP) improve the efficiency of Electronic Health Record (EHR) coding.

3. Increasing Outsourcing of Medical Coding Services is restricting the market growth

- Hospitals and insurance companies are outsourcing medical coding to reduce costs and improve operational efficiency.

- India and the Philippines are emerging as major hubs for offshore medical coding services due to their skilled workforce and lower operational costs.

Global Medical Coding Market Challenges and Restraints

1. Shortage of Skilled Medical Coders is restricting the market growth

There is a global shortage of trained medical coders, particularly in developing regions. This has led to higher labor costs and increased demand for automated coding solutions.

2. Frequent Changes in Coding Standards and Regulations is restricting the market growth

The transition from ICD-10 to ICD-11 requires training and adaptation by healthcare providers. Continuous updates in CPT and HCPCS codes lead to compliance challenges for medical coders.

Market Opportunities

The expansion of medical coding services in emerging markets is being fueled by several key factors. Firstly, Asia-Pacific and Latin America are witnessing a rapid increase in the adoption of medical insurance. As more individuals gain access to health coverage, the demand for accurate medical coding to process claims and ensure proper reimbursement is also rising. This creates a significant opportunity for medical coding service providers to support healthcare providers and payers in these regions. Secondly, governments in these emerging markets are increasingly mandating the use of digital health records. This transition to electronic health records necessitates the implementation of standardized medical coding systems to ensure data interoperability and facilitate efficient healthcare delivery. As a result, the need for skilled medical coders who can accurately translate clinical information into standardized codes is growing. Furthermore, the growth of healthcare Business Process Outsourcing (BPO) services is providing new avenues for outsourced medical coding providers. Many healthcare organizations in developed countries are outsourcing their medical coding operations to BPO companies in emerging markets to reduce costs and improve efficiency. This trend is driving the expansion of medical coding services in regions like India, the Philippines, and Latin America, where skilled coders are available at competitive rates. The combination of increased insurance coverage, government mandates for digital health records, and the growth of healthcare BPO is creating a favorable environment for the expansion of medical coding services in emerging markets. This expansion not only improves the efficiency and accuracy of healthcare operations but also contributes to the development of the healthcare industry in these regions.

MEDICAL CODING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

12.18% |

|

Segments Covered |

By Classification System, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M Health Information Systems, Optum, Inc., Dolbey Systems, Inc., Nuance Communications, Inc., TruBridge, LLC, Maxim Healthcare Services, Inc., Cognizant Technology Solutions Corporation, Verisk Analytics, Inc., R1 RCM Inc., GeBBS Healthcare Solutions |

Medical Coding Market Segmentation - By Classification System

-

ICD (International Classification of Diseases)

-

CPT (Current Procedural Terminology)

-

HCPCS (Healthcare Common Procedure Coding System)

While all three coding systems—ICD, CPT, and HCPCS—play crucial roles in the medical coding landscape, ICD codes currently hold the most dominant position. ICD, or the International Classification of Diseases, is primarily used for diagnosing diseases and health conditions. It provides a standardized system for classifying and coding diagnoses, which is essential for tracking morbidity and mortality rates, conducting epidemiological research, and informing healthcare policy decisions. Its widespread adoption by healthcare providers, payers, and researchers globally makes it the cornerstone of medical coding. The sheer volume of diagnoses coded and the fundamental role ICD plays in healthcare data analysis and reporting contribute to its dominance.

Medical Coding Market Segmentation - By End-User

-

Hospitals

-

Clinics

-

Insurance Companies

Hospitals currently represent the most dominant segment in the medical coding market. Hospitals are complex healthcare environments that generate a massive volume of medical records encompassing a wide range of diagnoses, procedures, and treatments. This complexity necessitates a robust and efficient medical coding system to ensure accurate billing, compliance with regulations, and effective data management. Hospitals require coding for everything from inpatient stays and surgical procedures to diagnostic tests and emergency room visits. The sheer volume of coding required, coupled with the intricate nature of hospital care, makes hospitals the largest consumers of medical coding services. They often employ large teams of certified coders or outsource their coding needs to specialized vendors to handle this workload.

Medical Coding Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

The medical coding market is geographically segmented, with North America dominating at 40% share. The US drives this market due to stringent HIPAA regulations and high healthcare expenditure, coupled with a strong presence of major players like Optum and 3M. Europe holds a 30% share, led by Germany, the UK, and France, benefiting from universal healthcare systems. The ongoing transition to ICD-11 is also shaping market dynamics in this region. Asia-Pacific is the fastest-growing market, with a CAGR of 11.2%. India, China, and Japan are experiencing increased healthcare digitalization, and growing medical tourism and insurance adoption are fueling demand for coding services. Latin America, the Middle East, and Africa collectively hold a 10% share. Brazil and Mexico are expanding healthcare outsourcing, but limited awareness and training in medical coding pose challenges in these regions.

COVID-19 Impact Analysis

The COVID-19 pandemic had a profound impact on the medical coding market, creating both challenges and opportunities. The sudden emergence of a novel virus and its rapid spread led to a surge in demand for COVID-19-related coding. Accurate coding was crucial for processing insurance claims, tracking the spread of the virus, and reporting data to government agencies. New codes were developed and implemented quickly to capture the specific diagnoses, treatments, and complications associated with COVID-19. This increased the complexity of the coding process and required coders to stay updated on the latest coding guidelines and regulations. The pandemic also accelerated the adoption of telehealth services, transforming the way healthcare is delivered. This rapid expansion of virtual consultations necessitated the development of new coding standards and guidelines to accurately reflect the services provided remotely. Coders had to adapt to these changes and become proficient in coding for telehealth encounters, which often involved different procedures and documentation requirements compared to in-person visits. Furthermore, the pandemic contributed to a surge in medical billing errors. The increased volume of claims, the complexity of COVID-19 coding, and the rapid shift to telehealth created a challenging environment for medical coders and billers. The pressure to process claims quickly, coupled with the evolving coding landscape, led to a higher incidence of errors, including incorrect coding, missing documentation, and claim denials. This increased the need for coding accuracy and highlighted the importance of quality assurance measures. Healthcare providers had to invest in training and resources to ensure their coding staff were well-equipped to handle the challenges posed by the pandemic. The pandemic underscored the critical role of accurate medical coding in ensuring proper reimbursement, tracking public health data, and facilitating effective healthcare delivery. It also accelerated the adoption of technology and automation in the coding process, as healthcare organizations sought to improve efficiency and reduce errors. The long-term effects of the pandemic on the medical coding market are likely to include a greater emphasis on coding accuracy, increased reliance on technology, and a continued focus on training and education for medical coders.

Latest Trends/Developments

The medical coding industry is undergoing a significant transformation, driven by technological advancements and evolving healthcare practices. One key trend is the increasing adoption of AI-powered coding platforms. Companies like 3M and Optum are leading the way by launching machine learning-driven solutions that automate and streamline the coding process. These platforms can analyze medical records and suggest the appropriate codes, improving efficiency and reducing the risk of errors. This not only speeds up the coding workflow but also helps ensure accurate and consistent coding, which is crucial for proper reimbursement and data analysis. Another major development is the ongoing implementation of ICD-11, the latest version of the International Classification of Diseases. ICD-11 offers a more granular and precise system for classifying diseases and health conditions compared to its predecessor, ICD-10. This enhanced accuracy in disease classification is vital for improving patient care, tracking public health trends, and conducting research. The transition to ICD-11 requires significant effort from healthcare providers, including training staff and updating coding systems, but the long-term benefits are substantial. The integration of medical coding with blockchain technology is also gaining traction. Blockchain's decentralized and secure nature offers a promising solution for ensuring transparency and trust in billing processes. By recording coding and billing information on a blockchain, healthcare providers can create an immutable audit trail, reducing the risk of fraud and errors. This can also streamline claims processing and improve communication between payers and providers. Furthermore, the medical coding industry is experiencing a surge in the growth of remote medical coding jobs. The increasing adoption of work-from-home models has opened up opportunities for certified coders to work remotely, providing greater flexibility and work-life balance. This trend is also beneficial for healthcare organizations, as it can help them access a wider pool of qualified coding professionals and reduce overhead costs. The combination of AI, ICD-11 implementation, blockchain integration, and the growth of remote work is reshaping the medical coding landscape, making it more efficient, accurate, and secure.

Key Players

-

3M Health Information Systems

-

Optum, Inc.

-

Dolbey Systems, Inc.

-

Nuance Communications, Inc.

-

TruBridge, LLC

-

Maxim Healthcare Services, Inc.

-

Cognizant Technology Solutions Corporation

-

Verisk Analytics, Inc.

-

R1 RCM Inc.

-

GeBBS Healthcare Solutions

Chapter 1. Medical Coding Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Medical Coding Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Medical Coding Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Medical Coding Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Medical Coding Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Medical Coding Market – By Classification System

6.1 Introduction/Key Findings

6.2 ICD (International Classification of Diseases)

6.3 CPT (Current Procedural Terminology)

6.4 HCPCS (Healthcare Common Procedure Coding System)

6.5 Y-O-Y Growth trend Analysis By Classification System

6.6 Absolute $ Opportunity Analysis By Classification System, 2025-2030

Chapter 7. Medical Coding Market – By End-User

7.1 Introduction/Key Findings

7.2 Hospitals

7.3 Clinics

7.4 Insurance Companies

7.5 Y-O-Y Growth trend Analysis By End-User

7.6 Absolute $ Opportunity Analysis By End-User, 2025-2030

Chapter 8. Medical Coding Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Classification System

8.1.3 By End-User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Classification System

8.2.3 By End-User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Classification System

8.3.3 By End-User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Classification System

8.4.3 By End-User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Classification System

8.5.3 By End-User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Medical Coding Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 3M Health Information Systems

9.2 Optum, Inc.

9.3 Dolbey Systems, Inc.

9.4 Nuance Communications, Inc.

9.5 TruBridge, LLC

9.6 Maxim Healthcare Services, Inc.

9.7 Cognizant Technology Solutions Corporation

9.8 Verisk Analytics, Inc.

9.9 R1 RCM Inc.

9.10 GeBBS Healthcare Solutions

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The market was valued at USD 18.4 billion in 2024 and is projected to reach USD 32.7 billion by 2030, growing at a CAGR of 12.18%.

Key drivers include the need for accurate billing, growing use of AI in medical coding, and increasing outsourcing of medical coding services.

North America leads with a 40% share, driven by regulatory compliance requirements and advanced healthcare infrastructure.

Medical coding is categorized into ICD, CPT, and HCPCS, with ICD being the dominant system.

Key players include 3M Health Information Systems, Optum, Nuance Communications, and Cognizant Technology Solutions