Electronic Health Records (EHR) Market Size (2024 – 2030)

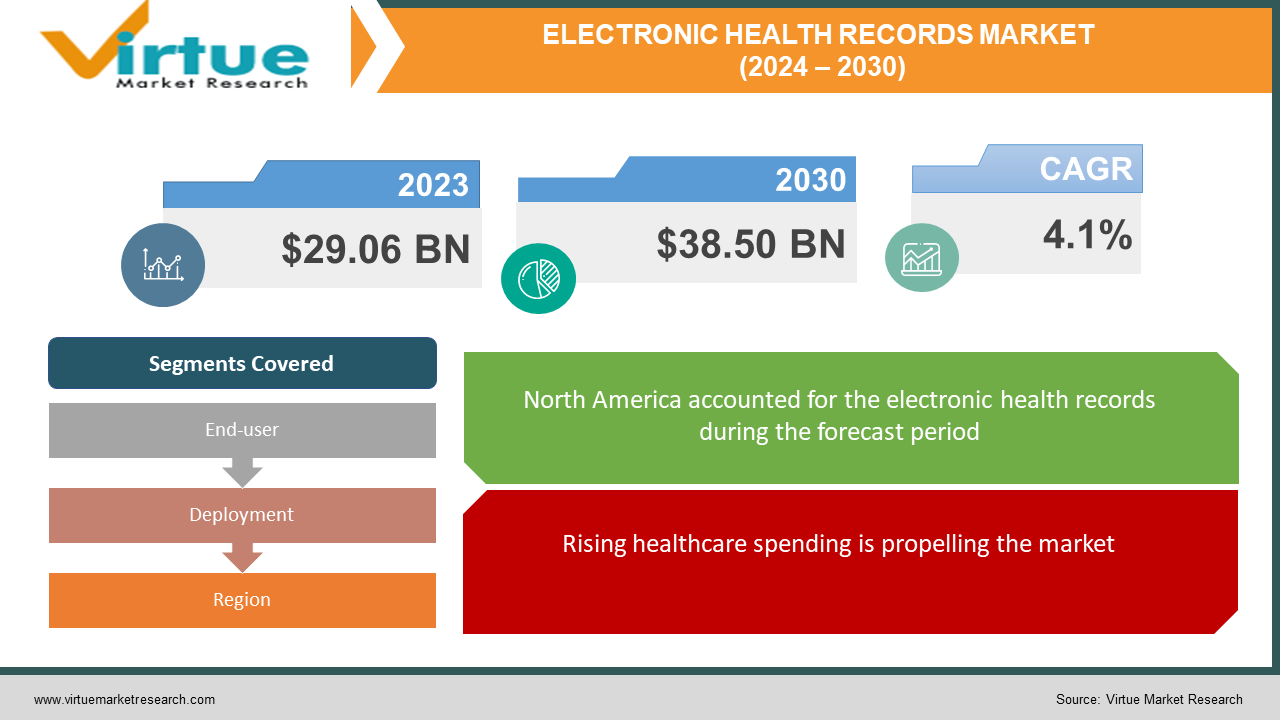

The global electronic health records (EHR) market was valued at USD 29.06 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2024 to 2030, reaching USD 38.50 billion by 2030.

An electronic health record (EHR) is a digital version of a patient's medical history. It's essentially a secure system that stores and manages all your important medical information in one place, accessible by authorized healthcare providers. It typically includes our name, date of birth, address, any medical conditions an individual has been diagnosed with, any allergies regarding medications, food, or other substances, and more.

Key Market Insights:

The EHR market is booming, projected to reach $38.95 billion by 2030. Key drivers include rising healthcare spending, government support, and a shift towards value-based care. Cloud-based solutions are leading the charge with their scalability and affordability.

However, challenges remain. Data privacy, integration complexity, and user-friendliness require careful attention. Additionally, bridging the digital literacy gap is crucial for wider adoption.

Opportunities abound for developers focusing on cloud-based, AI-powered solutions with robust security, seamless interoperability, user-friendly interfaces, and specific functionalities tailored to diverse healthcare needs. By addressing challenges and embracing innovation, the EHR market holds immense potential to transform healthcare delivery and improve patient outcomes.

EHR Market Drivers:

Rising healthcare spending is propelling the market.

As the healthcare sector is expanding, EHRs have become essential. They are essential in healthcare facilities. Simplified workflows, less paperwork, and quicker diagnoses all contribute to efficiency and, in the end, shorter hospital stays and cheaper prices. Better patient outcomes are achieved by more accessible medical histories, precise drug administration, and preventive treatment that can avert future, expensive problems. Cost reduction is achieved by centralized data storage, leading to efficient resource allocation and a reduction in pointless operations. In an era of rising expenses and a focus on better health, EHRs offer a compelling solution for a financially sustainable and effective healthcare system.

The shift towards value-based care is propelling the market.

In the value-based healthcare game, it's all about quality, not quantity. This shift incentivizes providers to prioritize positive patient outcomes, and EHRs become their ultimate teammates. With the aid of this technology, it is possible to track patient data with ease, measure quality metrics accurately, and coordinate care across institutions seamlessly. They empower providers to move beyond simply doing more to demonstrably doing better. By capturing a complete picture of a patient's health journey, from initial diagnosis to treatment outcomes, EHRs provide valuable insights for data-driven decision-making. This translates to personalized care plans, preventive intervention, and ultimately improved patient health, which is the key to earning those value-based rewards. So, in this new era where quality reigns supreme, EHRs are no longer just record-keepers; they're strategic partners for providers navigating the path to better patient outcomes and a healthier bottom line

Integration with other healthcare IT systems has been accelerating the growth rate.

Practice management software holds appointment data, labs store test results, and radiology archives images—all siloed and inaccessible. These advancements have been contributing to the success of the market by translating and transmitting data seamlessly between different systems. Manual data entry and duplicate records have become ancient techniques. Appointment scheduling pulls directly from the EHR, lab results automatically populate patient charts, and radiology images integrate seamlessly, creating a unified view of our health. This streamlined workflow translates to quicker diagnoses, reduced redundancies, and improved communication. Doctors can make informed decisions with all the pieces of the puzzle readily available, saving time and potentially improving patient outcomes.

Market Challenges and Restraints:

High implementation costs have been a major barrier.

Smaller healthcare providers face a steep financial climb when it comes to EHRs. The initial installation cost can be hefty, requiring hardware upgrades, software licenses, and data migration. Customization to fit their specific needs adds another layer of expense. Additionally, smaller practices often lack the economies of scale that larger institutions enjoy, making per-patient costs even higher. This can lead to reluctance to adopt EHRs, potentially hindering their ability to offer the same level of care as larger, well-equipped providers. To bridge this gap, government grants and vendor solutions tailored for smaller practices are emerging, but the affordability challenge remains a significant hurdle for widespread EHR adoption.

Rising cases of data breaches and cyberattacks have been a hindrance.

The specter of data breaches looms large over the EHR market, raising deep concerns about patient privacy and security. They contain sensitive medical information. EHR systems are prime targets for hackers seeking to exploit vulnerabilities. Successful breaches can expose a multitude of personal details, from diagnoses and medications to financial records and social security numbers. The consequences can be devastating, causing emotional distress, identity theft, and even financial losses for patients. Healthcare providers face hefty fines and reputational damage in the wake of breaches, further amplifying the pressure to ensure robust security measures. Stringent regulations like HIPAA mandate compliance, but the ever-evolving tactics of cybercriminals necessitate constant vigilance and investment in advanced security solutions. The race to safeguard patient data is a continuous battle, requiring collaborative efforts from healthcare providers, technology vendors, and policymakers to fortify EHR systems and build a future where patient privacy remains sacrosanct.

Lack of trained personnel has been leading to obstacles.

Implementing and managing these complex systems requires specialized training in areas like data entry, system operation, and security protocols. Yet, in many regions, qualified individuals are hard to come by. This talent gap disproportionately affects smaller and rural healthcare providers who lack the resources to attract and retain trained professionals. The consequences are real: delayed implementations, inefficient workflows, and even potential misuse of the system. Initiatives like online training programs and government-funded skill development are emerging to bridge this gap. However, upskilling the workforce remains a significant challenge, particularly in under-resourced areas. Until a robust pipeline of trained personnel is established, the full potential of EHRs to improve healthcare delivery might remain unrealized for many communities

Market Opportunities:

The EHR market thrives despite challenges, offering exciting opportunities for innovation. Cloud-based solutions and AI integration boost accessibility and efficiency. Seamless data exchange and cybersecurity advancements address key concerns. Mobile health integration and specialty-specific solutions empower patients and providers. Value-based care enablement and patient engagement features optimize care delivery. Open-source options and global expansion fuel further growth. This 10-point landscape underscores the EHR market's potential to transform healthcare.

ELECTRONIC HEALTH RECORDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.1% |

|

Segments Covered |

By End-user, Deployment, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Epic Systems Corporation (USA), Cerner Corporation (USA), Allscripts Healthcare Solutions, Inc. (USA), MEDITECH (Medical Information Technology, Inc.) (USA), Siemens Healthineers AG (Germany), McKesson Corporation (USA), Athenahealth, Inc. (USA), NextGen Healthcare, Inc. (USA), GE Healthcare (USA), eClinicalWorks (USA) |

Electronic Health Records Market Segmentation - by End-user

-

Hospitals

-

Ambulatory care

-

Specialty practices

The EHR market isn't a one-size-fits-all solution. It caters to distinct healthcare players with unique needs: Hospitals, the current frontrunners, require feature-rich solutions like robust analytics, population health management, and specialty integrations to manage their complex operations. Ambulatory care, focusing on efficiency, prioritizes user-friendly and affordable solutions that streamline patient visits and documentation. Meanwhile, specialty practices, experiencing the fastest growth, demand niche functionalities and tailored data capture specific to their medical areas, like cardiology or oncology. This diverse landscape presents a lucrative opportunity for vendors who can address the unique needs of each segment with targeted solutions.

Electronic Health Records Market Segmentation: By Deployment

-

On-premise

-

Cloud-based

-

Hybrid

On-premises deployment mode has the largest share in the market. Large healthcare organizations and those with unique compliance or security requirements that want to keep data within their infrastructure usually opt for this solution. When it comes to control and customization choices, on-premise solutions surpass cloud-based alternatives. Organizations have complete control over updates and upgrades, can easily combine the system with other systems, and may customize it to match their unique needs. However, cloud-based solutions are the fastest-growing. This is mainly because they are affordable. This makes it a convenient option for smaller firms. Besides, they have an automatic upgrade feature that reduces maintenance needs and installation costs. This feature of flexibility makes them an attractive option. Furthermore, they have advanced features that provide data security and ensure privacy, as well as the protection of sensitive data.

Electronic Health Records Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America has the largest market share, holding a rough share of 34% in 2023. Countries like the United States and Canada are at the forefront. The primary reason for this is the well-developed economy. This makes it easier for the region to invest and fund various projects. Besides, this area has some of the most prominent key players who have a global presence. This increases income generation, resulting in greater profits. A few companies include Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare Solutions, Inc., and MEDITECH (Medical Information Technology, Inc.). Asia-Pacific is the fastest-growing region, with an approximate share of 24%. Countries like China, India, and South Korea are at the top. Urbanization is leading to a rising middle class and an increasing disposable income. This area has undergone significant improvements in the economy. This has resulted in technological advancements and early adoption. Furthermore, R&D activities are being prioritized, which has been helping with the expansion. Apart from this, many startups have come up with innovative solutions to tackle problems. Governmental initiatives have been on the rise, fueling growth in this market.

COVID-19 Impact Analysis on the EHR Market

The COVID-19 pandemic caused initial losses for the market. While initial disruptions like clinic closures caused a temporary dip, they ultimately accelerated the need for digital health solutions, propelling the EHR market forward. Telehealth consultations boomed, demanding seamless data exchange and remote access—areas where cloud-based EHRs shone. Governments supported EHR adoption to facilitate virtual care and improve data-driven decision-making. Additionally, the focus on patient engagement grew, with EHRs playing a role in providing patients with easy access to their health information and fostering communication with providers. However, challenges remain. Data privacy concerns around COVID-19 tracking and the increased workload on healthcare systems highlighted the need for robust security measures and user-friendly interfaces. Overall, the pandemic acted as a catalyst for the EHR market, emphasizing its potential to transform healthcare delivery in a post-pandemic world but also demanding continued focus on addressing existing challenges.

Latest trends/Development

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Companies are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

The EHR market is buzzing with innovation. AI is revolutionizing workflows, analyzing data for personalized care, and even answering patient questions through chatbots. Data exchange between systems is breaking down barriers and empowering patients to own and share their information for informed decisions. Cloud-based solutions offer accessibility and affordability, while advanced security measures like blockchain help ensure data privacy. Finally, mobile health integration empowers patients with real-time monitoring, medication reminders, and remote consultations, transforming how we manage our health. This market has immense potential, mainly fueled by AI, interoperability, and patient engagement paint a brighter picture for healthcare.

Key Players:

-

Epic Systems Corporation (USA)

-

Cerner Corporation (USA)

-

Allscripts Healthcare Solutions, Inc. (USA)

-

MEDITECH (Medical Information Technology, Inc.) (USA)

-

Siemens Healthineers AG (Germany)

-

McKesson Corporation (USA)

-

Athenahealth, Inc. (USA)

-

NextGen Healthcare, Inc. (USA)

-

GE Healthcare (USA)

-

eClinicalWorks (USA)

Chapter 1. Electronic Health Records (EHR) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Electronic Health Records (EHR) Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Electronic Health Records (EHR) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Electronic Health Records (EHR) Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Electronic Health Records (EHR) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Electronic Health Records (EHR) Market – By End-user

6.1 Introduction/Key Findings

6.2 Hospitals

6.3 Ambulatory care

6.4 Specialty practices

6.5 Y-O-Y Growth trend Analysis By End-user

6.6 Absolute $ Opportunity Analysis By End-user, 2024-2030

Chapter 7. Electronic Health Records (EHR) Market – By Deployment

7.1 Introduction/Key Findings

7.2 On-premise

7.3 Cloud-based

7.4 Hybrid

7.5 Y-O-Y Growth trend Analysis By Deployment

7.6 Absolute $ Opportunity Analysis By Deployment, 2024-2030

Chapter 8. Electronic Health Records (EHR) Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By End-user

8.1.3 By Deployment

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By End-user

8.2.3 By Deployment

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By End-user

8.3.3 By Deployment

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By End-user

8.4.3 By Deployment

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By By End-user

8.5.3 By Deployment

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Electronic Health Records (EHR) Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Epic Systems Corporation (USA)

9.2 Cerner Corporation (USA)

9.3 Allscripts Healthcare Solutions, Inc. (USA)

9.4 MEDITECH (Medical Information Technology, Inc.) (USA)

9.5 Siemens Healthineers AG (Germany)

9.6 McKesson Corporation (USA)

9.7 Athenahealth, Inc. (USA)

9.8 NextGen Healthcare, Inc. (USA)

9.9 GE Healthcare (USA)

9.10 eClinicalWorks (USA)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global Electronic Health Records (EHR) market was valued at USD 29.06 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2024 to 2030, reaching USD 38.50 billion by 2030.

Rising health consciousness is driving the market; a shift towards value-based care and integration with other healthcare IT systems are the reasons that are driving the market.

Based on end-users, it is divided into three segments: hospitals, ambulatory care, and specialty practices.

North America is the most dominant region in this market.

Epic Systems Corporation, Cerner Corporation, and Allscripts Healthcare Solutions, Inc. are the key players in this market.