Gelatin Market Size (2025 – 2030)

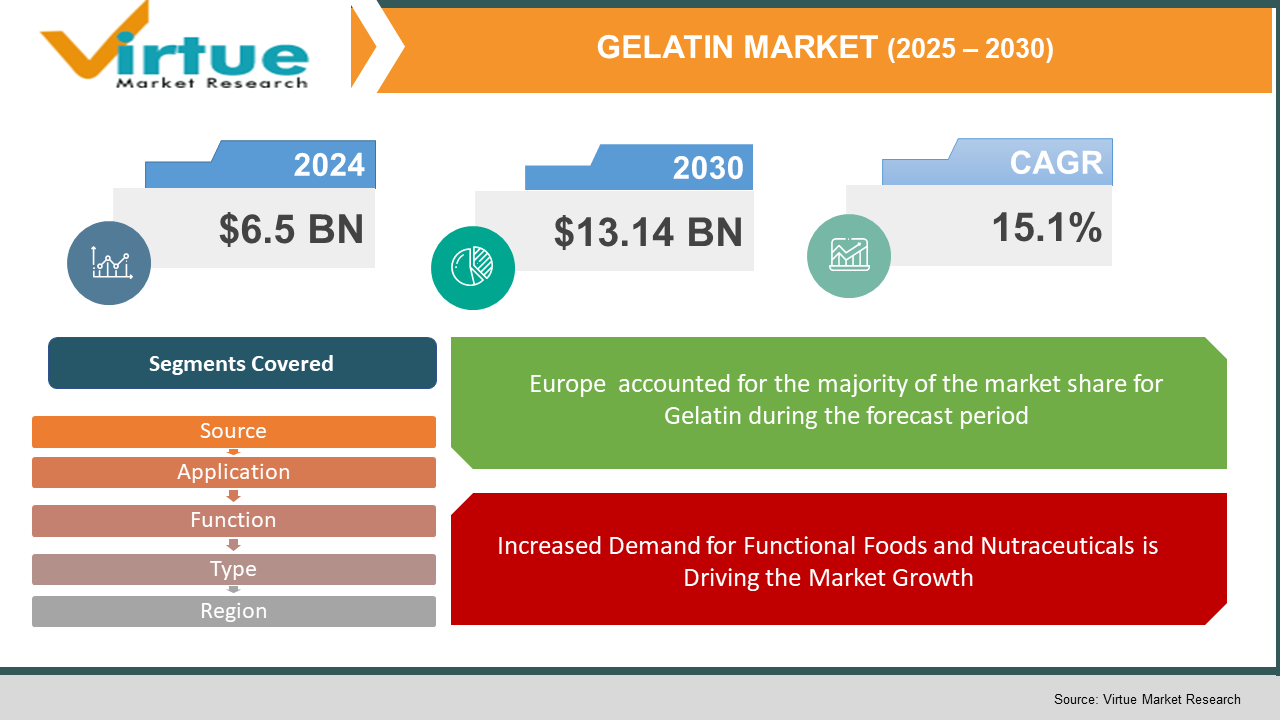

The Gelatin Market was valued at $6.5 billion and is projected to reach a market size of $13.14 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.1%.

Gelatin is a protein derived naturally from collagen, obtained from the bones and skin of animals such as pigs and cows, and mostly obtained from slaughterhouses. High in amino acids, it is extensively used in food, drinks, pharmaceuticals, and cosmetics. Edible gelatin is the most widely available commercially, additive-free and preservative-free, while others are utilized in photography and industrial uses. Prices of gelatin are influenced by raw material prices and the geographical location of production. With an increase in demand from food & beverages and healthcare industries, raw material prices have been moderately increasing. Nevertheless, new production units in regions such as the U.S. and India, and supply chain improvements, are likely to stabilize prices over the next few years. The world gelatin market is being propelled by increasing health awareness and the need for functional foods, clean-label products, and cosmetic uses. The special gelling, stabilizing, and foaming characteristics of gelatin are making it increasingly sought after in foods such as yogurt, pasta, jams, and jellies. Home cooking and baking during the pandemic also helped to fuel its increasing demand. In the pharmaceutical sector, gelatin is an important component of soft capsules as it promotes dissolution and inhibits cross-linkage reactions. It is easily bioavailable and maintains the purity of active ingredients. Gelatin is also widely used in anti-aging creams and collagen supplements because it has positive effects on skin, hair, nails, joints, and bones. Since it acts as an appetite suppressor, it also helps control weight, which is of interest to modern health-conscious consumers.

Key Market Insights:

- In August 2020, PB Leiner introduced Textura Tempo Ready, a novel gelatin type with special characteristics. It is a clean-label product with no additives, 100% gelatin, an alternative to the conventional leaf form that saves 50% of the preparation time.

- The market for food-grade gelatin is seeing a consistent increase due to its widespread application in food products. More than 60% of gelatin use is found in confectionery and dairy applications, where it serves as a stabilizer and gelling agent. Growing consumer demand for sugar-free and functional confectionery, especially in North America and Europe, is fueling the market. The dairy sector is also utilizing gelatin in yogurts and desserts to enhance texture and shelf life, which is contributing to its universal acceptance.

- The wellness and health trend has significantly impacted the food-grade gelatin industry, with more than 30% of its international demand being supplied by the dietary supplement industry. Gelatin finds extensive application in protein supplements and collagen products as a result of its high content of amino acids, which can help maintain joints, skin, and muscles during recovery. Increased demand for high-purity food-grade gelatin is also spurred by the enhanced popularity of nutraceuticals, particularly across the Asia-Pacific region.

- The sector is also experiencing a trend towards sustainable and ethical sourcing. Over 25% of gelatin producers are now turning towards fish-based gelatin as a substitute for classical bovine and porcine sources, addressing dietary needs and religious requirements. Furthermore, advances in gelatin processing technologies have optimized extraction efficiency, minimizing loss and the overall quality of food-grade gelatin.

- The 21st Century Cures Act was signed into law in the United States of America in December 2016. The act established a new designation for Regenerative Medicine Advanced Therapy. This also entailed the establishment of procedures for accelerated regenerative medicine approval. R&D activities by companies aimed at developing new regenerative medicine products rose consequently

Gelatin Market Key Drivers:

Increased Demand for Functional Foods and Nutraceuticals is Driving the Market Growth

People are looking more and more for foods that provide health benefits over and above normal nutrition. Gelatin, which is high in amino acids and collagen, maintains skin elasticity, joint function, and gastrointestinal health. As a result, it has found its way into many health-oriented products, such as dietary supplements and fortified foods. The phenomenon is also enhanced by social media websites, where gelatin-containing recipes that promise health benefits have become popular.

Growing Applications in Pharmaceuticals and Biomedical Sectors.

The biocompatibility and biodegradability of gelatin make it a perfect constituent in pharmaceuticals, including the production of capsules and drug delivery systems. Hydrogel formation supports its application in tissue engineering and regenerative medicine, promoting cell adhesion and proliferation. Research in gelatin-based biomaterials is revealing new directions in medical research and treatment protocols.

Consumer Trend Towards Clean-Label and Natural Ingredients.

Today's consumers are demanding more transparency and natural ingredients in their food and personal care products. Gelatin, as a naturally occurring protein, fits the clean-label trend. Its multi-functionalities as a gelling agent, stabilizer, and emulsifier render it a top choice in developing products that satisfy consumer needs for simplicity and authenticity.

Gelatin Market Restraints and Challenges:

Confronting Ethical, Supply Chain, and Regulatory Issues.

The gelatin market is confronted with several key issues that may affect its growth. One such main issue is the ethical and religious considerations of consuming products of animal origin. Gelatin, which is derived from animal bones and skin, is not acceptable for some restrictive diets, such as vegan, vegetarian, halal, and kosher diets, and therefore restricts its acceptability among varied consumer groups. The other challenge is raw material supply volatility. The use of animal by-products exposes the industry to the risk of fluctuation based on disease outbreaks, regulatory fluctuations, and changes in livestock production. These cause inconsistencies in the availability and pricing of gelatin, which compromise manufacturers' capacity to have consistent production and keep up with market demand. Moreover, the market is facing more competition from plant-based and synthetic options. Consumers looking for sustainable and ethical alternatives are increasingly turning to alternatives such as agar-agar, pectin, and carrageenan. Although these alternatives meet some of the consumer's concerns, they tend to be lacking in matching gelatin's specific functional attributes, including its gelling and stabilizing characteristics. Compliance with regulations is also a major barrier. Gelatin manufacturing and use are regulated by strict food safety and quality regulations, which differ by region. Handling such intricate regulations necessitates heavy investment in quality assurance and control, which may strain resources, particularly for small producers.

Gelatin Market Opportunities:

Gelatin Market: Unlocking Growth Through Innovation and Sustainability.

The gelatin market is expected to witness strong growth based on emerging opportunities in different sectors. One such sector is the creation of plant-based and cell-cultured gelatin substitutes, to cater to the growing demand for vegan and ethically sourced solutions. Developments in this direction are expected to match the functional properties of conventional gelatin while responding to the concerns of consumers regarding animal welfare and sustainability. For example, businesses are looking at lab-grown collagen to create gelatin without depending on animal farming, possibly decreasing greenhouse gas emissions and gaining support from green-minded consumers. In biomedical applications, the biocompatibility and biodegradability of gelatin render it a superior material for use in tissue engineering, wound healing, and drug delivery systems. Its cell growth-supporting and drug-delivery properties make gelatin a worthwhile ingredient in sophisticated medical treatments, particularly with the rising incidence of chronic illnesses worldwide. The expanding health and wellness trend also opens doors for gelatin in the nutraceutical industry. Customers looking for products that support joint, skin, and bone health are gravitating toward collagen supplements, many of which use gelatin as an active ingredient. This demand is being further boosted by the aging populace and the heightened emphasis on preventive medicine. Moreover, the migration towards clean-label and natural trends in the food and beverage markets further increases gelatin's demand as a multipurpose additive. Its application for enhancing the texture, stability, and shelf-life of products coincides with consumers' preference for minimal processing. In pursuing these needs, manufacturers find the flexibility and biogenic nature of gelatin valuable to them in the formulation of their products.

GELATIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

15.1% |

|

Segments Covered |

By Type, source, application, function, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GELITA AG (Germany), Darling Ingredients Inc. (USA), Nitta Gelatin Inc. (Japan), Weishardt (France), Tessenderlo Group (Belgium), Sterling Biotech Ltd. (India), Lapi Gelatine S.p.a. (Italy), elnex (Brazil), Juncà Gelatines SL (Spain), Trobas Gelatine B.V. (Netherlands)

|

Gelatin Market Segmentation:

Gelatin Market Segmentation: By Source

- Porcine (Pig Skin)

- Bovine (Cow Skin and Bones)

- Fish and Poultry

- Plant-Based

Bovine-derived gelatin, sourced from cow hides and bones, is the leading market for gelatin globally. Its strength lies in its better gel strength, versatility, and extensive availability, for which it is the first choice across many applications such as food, pharmaceuticals, and personal care. The wide availability of raw materials from the cattle sector and established processing methods also strengthen its market position. Moreover, bovine gelatin is commonly preferred over porcine gelatin in areas where there are dietary restrictions against eating pork.

Gelatin derived from fish is becoming the fastest-growing segment of the gelatin market. The reason for this growth is the rising demand for non-mammalian and environmentally friendly gelatin sources among consumers who have dietary restrictions against the consumption of pork and beef. Fish gelatin provides distinct properties, such as reduced melting points and greater clarity, which are favorable for certain food and pharmaceutical uses. Its use in kosher and halal diets also adds to its value in various markets. Even with challenges such as increased production expenses and reduced availability of raw materials, the growing interest in marine-derived ingredients and the sustainability factor of using fish by-products are major drivers of the market growth for the fish gelatin segmen

Gelatin Market Segmentation: By Application

- Food & Beverages

- Pharmaceuticals

- Nutraceuticals

- Cosmetics & Personal Care

- Industrial & Photographic

Food & Beverages is the largest application segment in the gelatin market, with nearly 55% of the total gelatin used worldwide. Due to its inimitable functional properties like gelling, stabilizing, and texturizing, gelatin is a requirement in numerous food products like confectioneries, dairy products, desserts, and meat products. Its role in boosting mouthfeel, and product stability, and as a fat replacer is in line with the consumer trend for low-fat and clean-label food products. The diversity of gelatin in food preparation has cemented its place as a food industry staple.

The Nutraceuticals market is becoming the fastest-growing area for the use of gelatin, fueled by growing consumer interest in health and well-being. Gelatin with its high concentration of collagen can aid in supporting joint health, skin elasticity, and general health, and because of this reason, it's a widely consumed ingredient in foods and dietary supplements. The age-old population growth and the inclination towards preventive health care have further driven the need for collagen-high products. Coupled with rising fitness and aesthetic trends, increasing consumption of anti-aging as well as high-protein intake supplements has pushed the demand further for gelatin in the nutraceutical space.

Gelatin Market Segmentation: By Function

- Stabilizer

- Thickener

- Gelling Agent

Stabilizer application is becoming the most rapidly expanding segment of the gelatin industry. The stabilizing abilities of gelatin are becoming more widely used in food and beverage applications to preserve texture and enhance shelf life through structural functionality. This trend is spurred by the growing popularity of clean-label and natural ingredients, as consumers look for products with fewer additives. In the drug industry, gelatin as a stabilizer plays an important function in the formulation of drugs, which improves the bioavailability of active ingredients. The increasing application of gelatin as a stabilizer in many products supports its high growth in the market. The gelling agent function has the largest market share in the gelatin market.

Gelatin's superior gelling characteristics place it in a strategic position within the food business, especially where the manufacture of confectionery, desserts, and dairy is involved. Gelatin gels with any form of texture or consistency contribute to its strength in this industry. The sustenance of demand for gelatin within conventional food items, on top of the element of convenience it offers, means that gelatin remains on top as the best gelling agent in business.

Gelatin Market Segmentation: By Type

- Type A

- Type B

Type B gelatin, which is extracted from bovine bones and hides by alkaline hydrolysis, is at present the most dominant market in the world of gelatin. Its popularity stems from its robust gelling, high purity, and flexibility which make it the first choice for a range of applications like capsules, gummy supplements, and confectioneries. The extensive application of Type B gelatin in the food, pharmaceutical, and nutraceutical industries, combined with improvements in extraction methods, has cemented its market-leading status.

Type A gelatin, which is derived from pig skin via acid hydrolysis, is witnessing the highest growth in the market for gelatin. The growth is being propelled by its high storage stability and functional properties, which render it very favorable for use in food applications, especially in confectionery foods such as marshmallows and gummy candies. Type A gelatin's growth is also spurred by its expanding applications in medical devices, pharmaceuticals, and cosmetics, particularly in emerging economies.

Gelatin Market Segmentation: By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Europe was the largest in the world gelatin market, holding around 40% of the overall share. This dominance is due to the advanced food processing technologies, high-quality standards, and the dominance of top gelatin manufacturers in the region. The excessive use of protein-rich foods and the need for clean-label products further support Europe's dominance. Asia-Pacific is becoming the fastest-growing region, with an estimated market share of around 35%. The expansion is spurred by growing economies, enhanced health consciousness, and rising demand in industries such as pharmaceuticals, food and beverages, and cosmetics. China and India are leading the charge, with a burgeoning middle class and health and wellness consciousness driving demand for gelatin products. North America accounts for a major portion of around 20%, led by the advanced pharmaceutical sector in the region and increasing demand for natural and clean-label ingredients. The U.S. market alone is experiencing a rise in demand for gelatin in dietary supplements and functional foods. Latin America accounts for around 5% of the world's gelatin market. Its growth is driven by mounting demand for processed foods, beverages, and health supplements, especially in countries like Brazil and Mexico. The Middle East & Africa region constitutes about 5% of the market. Although with a lower percentage at present, the region offers scope for growth with increasing health consciousness and desire for halal products.

COVID-19 Impact Analysis on the Gelatin Market:

The pandemic of COVID-19 greatly affected the gelatin industry, with both challenges and benefits. At first, lockdowns and bans derailed supply chains, resulting in raw material shortages such as animal by-products needed to make gelatin. Manufacturing units were either closed or run at lower capacities, impacting gelatin-based product availability. The food service industry, which is a prime user of gelatin in desserts and confectioneries, suffered due to restaurant shutdowns and falling consumer spending. The pandemic, on the other hand, accelerated demand for wellness and health products, such as dietary supplements and functional foods, wherein gelatin is a major component. Consumers' increased attention to immunity and self-care resulted in the growth of gelatin-based products such as collagen supplements. In addition, the demand for gelatin capsules from the pharmaceutical sector increased due to the requirements for efficient drug delivery systems. Home cooking conditions during lockdowns also increased the consumption of gelatin in do-it-yourself recipes. Overall, though the pandemic created daunting challenges, it also opened new horizons for expansion in the market for gelatin, especially in health-oriented and do-it-yourself consumption segments.

Trends/Developments:

Darling Ingredients Inc., a primary gelatin manufacturing company, had secured a patent for its highly specialized formulation product StabiCaps in December of 2023. This state-of-the-art gelatin facilitates greater stability of soft gel capsules and is accordingly available for a diverse range of applications in pharmaceutical use. The grant of patent will enable Darling Ingredients Inc. to strengthen itself within the domain of the pharmaceutical industry by introducing products that guarantee better shelf life as well as performance

In July 2022, Perfect Day, an alternative dairy startup in the U.S., bought Sterling Biotech, an Indian manufacturer, as part of its plan to expand its presence in the domestic market. With this acquisition, Perfect Day can tap into Sterling Biotech's manufacturing scale and local know-how to enhance its supply chain. With this, the company is in a good position to address the growing demand for plant-based dairy substitutes in the region

On 4 March 2022, The new supplement, Pura Collagen Protect, produced by U.K.-based company Pura Collagen and featuring Bioactive Collagen Peptides Immupept, was launched to give consumers an immune system boost. The product, bolstered by strong vitamins and minerals and immunological support, is designed to enhance cognitive function and combat fatigue.

March 2023: Darling Ingredients Inc. (NYSE: DAR), a worldwide business chief, an industry trailblazer in transforming sustenance into viable things, and a leading manufacturer of sustainable energy, has finalized its acquisition of Gelnex. Gelnex can be a leading global manufacturer of gelatin and collagen products.

September 2023: Bengaluru-based Strides Pharma Science will begin spinning off its contract development and manufacturing (CDMO) and soft gelatin business into a new entity called OneSource and now Stelis Biopharma. The reason behind this is OneSource's IPO in the next 12 to 15 months. The intention is to enhance synergy and unlock the company's intrinsic value.

Key Players:

- GELITA AG (Germany)

- Darling Ingredients Inc. (USA)

- Nitta Gelatin Inc. (Japan)

- Weishardt (France)

- Tessenderlo Group (Belgium)

- Sterling Biotech Ltd. (India)

- Lapi Gelatine S.p.a. (Italy)

- Gelnex (Brazil)

- Juncà Gelatines SL (Spain)

- Trobas Gelatine B.V. (Netherlands)

Chapter 1. GELATIN MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. GELATIN MARKET– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GELATIN MARKET– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GELATIN MARKET- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GELATIN MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GELATIN MARKET– By Type

6.1 Introduction/Key Findings

6.2 Type A

6.3 Type B

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. GELATIN MARKET– By Function

7.1 Introduction/Key Findings

7.2 Stabilizer

7.3 Thickener

7.4 Gelling Agent

7.5 Y-O-Y Growth trend Analysis By Function

7.6 Absolute $ Opportunity Analysis By Function , 2025-2030

Chapter 8. GELATIN MARKET– By Source

8.1 Introduction/Key Findings

8.2 Porcine (Pig Skin)

8.3 Bovine (Cow Skin and Bones)

8.4 Fish and Poultry

8.5 Plant-Based

8.6 Y-O-Y Growth trend Analysis Source

8.7 Absolute $ Opportunity Analysis Source , 2025-2030

Chapter 9. GELATIN Market– By Application

9.1 Introduction/Key Findings

9.2 Food & Beverages

9.3 Pharmaceuticals

9.4 Nutraceuticals

9.5 Cosmetics & Personal Care

9.6 Industrial & Photographic

9.7 Y-O-Y Growth trend Analysis Application

9.8 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 10. GELATIN MARKET, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Type

10.1.3. By Source

10.1.4. By Function

10.1.5. Application

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Type

10.2.3. By Source

10.2.4. By Function

10.2.5. Application

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Type

10.3.3. By Application

10.3.4. By Function

10.3.5. Source

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Application

10.4.3. By Function

10.4.4. By Type

10.4.5. Source

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Source

10.5.3. By Application

10.5.4. By Function

10.5.5. Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. GELATIN MARKET– Company Profiles – (Overview, Service Application Product Type Portfolio, Financials, Strategies & Developments)

11.1 GELITA AG (Germany)

11.2 Darling Ingredients Inc. (USA)

11.3 Nitta Gelatin Inc. (Japan)

11.4 Weishardt (France)

11.5 Tessenderlo Group (Belgium)

11.6 Sterling Biotech Ltd. (India)

11.7 Lapi Gelatine S.p.a. (Italy)

11.8 Gelnex (Brazil)

11.9 Juncà Gelatines SL (Spain)

11.10 Trobas Gelatine B.V. (Netherlands)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Gelatin is predominantly used in the food and beverage industry for products like gummy candies, marshmallows, and yogurt. Additionally, it plays a crucial role in pharmaceuticals for capsule production and cosmetics for its skin benefits.

Gelatin is mainly derived from bovine and porcine sources. Religious dietary laws, such as halal and kosher practices, influence consumer preferences and can affect market demand in different regions

Traditional gelatin production involves animal farming, raising concerns about greenhouse gas emissions and animal welfare. However, innovations like cell-based gelatin are emerging as sustainable alternatives

The pandemic disrupted supply chains and reduced demand in certain sectors. However, it also led to increased interest in health supplements and home cooking, boosting the demand for gelatin in these areas.

The market is expected to grow due to rising health consciousness, demand for clean-label products, and innovations like plant-based and lab-grown gelatin alternatives catering to diverse consumer needs.