Food Grade Gelatin Market Size (2025-2030)

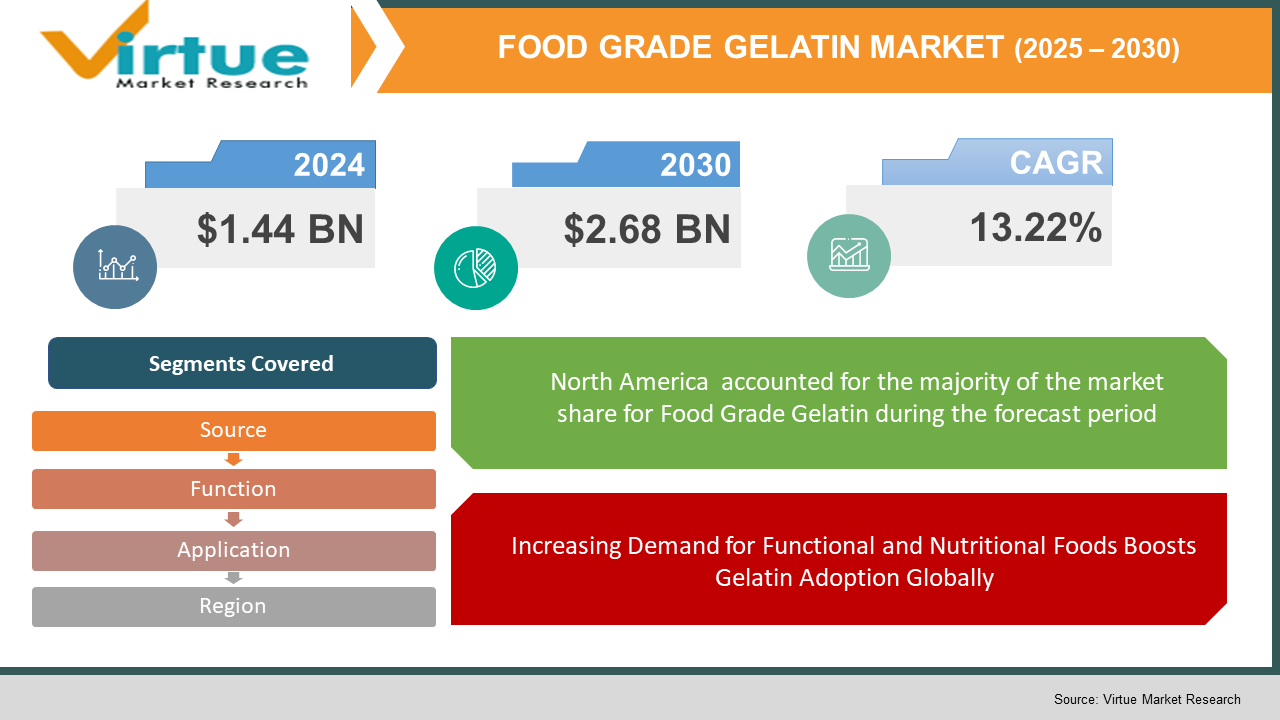

The Global Food Grade Gelatin Market was valued at USD 1.44 billion in 2024 and is projected to reach a market size of USD 2.68 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 13.22%.

Food-grade gelatin is an excessively used protein derived from collagen, primarily sourced from animal by-products such as bovine, porcine, and fish. It is a key ingredient in various food applications, including confectionery, dairy products, meat processing, and dietary supplements, due to its gelling, stabilizing, and thickening properties. The high demand for clean-label and natural ingredients in the food industry, coupled with increasing consumer awareness of health benefits, has significantly contributed to the expansion of the food-grade gelatin market. Additionally, the growing preference for protein-enriched products and functional foods has boosted its adoption worldwide. Innovations in plant-based alternatives and sustainable sourcing practices are also reshaping the market landscape, making gelatin an essential component in modern food formulations.

Key Market Insights:

- The demand for food-grade gelatin is experiencing a steady rise due to its extensive use in various food applications. Over 60% of gelatin consumption is attributed to confectionery and dairy products, where it is used as a gelling and stabilizing agent. The increasing consumer preference for sugar-free and functional confectionery, particularly in North America and Europe, is driving the market. Additionally, the dairy industry is leveraging gelatin in yogurts and desserts to improve texture and shelf life, contributing to its widespread adoption.

- The health and wellness trend has remarkably influenced the food-grade gelatin market, with over 30% of its global demand coming from the dietary supplement sector. Gelatin is widely used in protein supplements and collagen-based products due to its high amino acid content, which supports joint health, skin elasticity, and muscle recovery. The growing popularity of nutraceuticals, especially in Asia-Pacific, is further fueling the demand for high-purity food-grade gelatin.

- The industry is also witnessing a shift towards sustainable and ethical sourcing. More than 25% of gelatin manufacturers are now focusing on fish-derived gelatin as an alternative to traditional bovine and porcine sources, catering to dietary restrictions and religious preferences. Additionally, advancements in gelatin processing technologies have improved extraction efficiency, reducing waste and enhancing the overall quality of food-grade gelatin.

Food Grade Gelatin Market Drivers:

Increasing Demand for Functional and Nutritional Foods Boosts Gelatin Adoption Globally

Consumers are increasingly seeking functional foods with added health benefits, influencing demand for food-grade gelatin due to its high protein content, amino acids, and ability to support gut health and joint care. The rising popularity of fortified dairy products, protein supplements, and collagen-based food products further contributes to the market's growth. Additionally, the aging population and growing awareness of preventive healthcare have increased the consumption of gelatin-enriched dietary products.

Expanding Confectionery and Dairy Industries Drive Market Growth

Gelatin is a key ingredient in confectionery products such as gummies, marshmallows, and chewy candies, as well as in dairy items like yogurts, mousses, and cream-based desserts. The rapid expansion of the confectionery and dairy industries worldwide, majorly in emerging markets, has significantly fueled gelatin consumption. Furthermore, advancements in food processing technologies have enabled manufacturers to enhance gelatin’s functionality, making it more adaptable to a wide range of applications.

Rising Popularity of Clean-Label and Natural Ingredients Strengthens Market Demand

With rising consumer preference for clean-label, minimally processed, and natural food ingredients, gelatin has gained prominence as a natural gelling agent, stabilizer, and emulsifier in food production. The shift away from artificial additives and synthetic thickeners has further propelled the demand for gelatin in food applications. Moreover, regulatory bodies promoting natural and organic ingredients have encouraged food manufacturers to incorporate gelatin in their formulations, ensuring better market penetration.

Growth in Plant-Based and Fish-Derived Gelatin as a Sustainable Alternative

As sustainability concerns rise and vegetarian-friendly alternatives gain traction, the market is experiencing the growth of fish and plant-based gelatin as alternatives to traditional bovine and porcine gelatin. Companies are investing in research and development to enhance the functionality of fish-derived gelatin, particularly in halal and kosher-certified food products. Additionally, advancements in extraction techniques and sourcing innovations have enabled manufacturers to cater to a broader consumer base, including those with dietary restrictions.

Food Grade Gelatin Market Restraints and Challenges:

Regulatory Hurdles, Ethical Concerns, and Supply Chain Instabilities Hamper Market Growth

The food-grade gelatin market faces various challenges, including stringent regulations governing animal-derived ingredients, ethical concerns surrounding the use of bovine and porcine sources, and fluctuating raw material availability. Many consumers are shifting towards vegetarian and vegan alternatives, creating hurdles for traditional gelatin manufacturers. Additionally, religious dietary restrictions, such as halal and kosher compliance, limit market accessibility in certain regions. Supply chain disruptions, disease outbreaks in livestock, and rising production costs further impact the stability of gelatin availability, making it difficult for manufacturers to maintain consistent pricing and supply.

Food Grade Gelatin Market Opportunities:

The food-grade gelatin market is witnessing remarkable opportunities due to the rising consumer preference for clean-label and functional food ingredients. As gelatin is widely used in confectionery, dairy, bakery, and nutraceuticals for its gelling, stabilizing, and texturizing properties, its demand is expected to grow with the increasing consumption of protein-enriched and health-focused products. Moreover, the surge in demand for plant-based and alternative gelatin sources, such as agar-agar and pectin, is creating new revenue streams for manufacturers. Innovations in gelatin production, including bio-engineered and synthetic gelatin, are further opening doors for expansion into vegan-friendly and sustainable food markets.

FOOD GRADE GELATIN MARKET REPORT COVERAGE:

|

REPORT METRIC A |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

13.22% |

|

Segments Covered |

By Source, function, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

. Gelita AG, PB Leiner, Nitta Gelatin Inc., and Tessenderlo Group |

Food Grade Gelatin Market Segmentation:

Food Grade Gelatin Market Segmentation: By Source:

- Animal Source

- Plant Source

Animal-source gelatin, derived primarily from bovine and porcine skin and bones, is the dominant segment in the food-grade gelatin market because of its excellent gelling, emulsifying, and stabilizing properties. It is widely used in confectionery, dairy, bakery, and nutraceutical applications, making it indispensable for food manufacturers. The high availability of animal-derived raw materials and well-established production processes further strengthen its market dominance.

The plant-based gelatin segment is experiencing the fastest growth, driven by the increasing demand for vegan, halal, and kosher-certified food products. Consumers seeking animal-free alternatives are propelling the use of plant-derived hydrocolloids like agar-agar, pectin, and carrageenan, which serve as substitutes for traditional gelatin. The expansion of plant-based food trends, coupled with innovations in alternative gelling agents, is fueling rapid market growth. As food manufacturers continue to explore clean-label and sustainable ingredients, plant-based gelatin is expected to gain a larger market share in the coming years.

Food Grade Gelatin Market Segmentation: By Function:

- Stabilizer

- Thickener

- Gelling Agent

- Others

The gelling agent segment controls the dominant position in the food-grade gelatin market due to its wide-ranging applications across various food products. Gelatin’s unique ability to form stable gels makes it essential in the production of confectionery items, such as gummies, marshmallows, and gelatin desserts, where texture and mouthfeel are crucial. This functionality has made gelling agents indispensable in the food industry, and its demand is further amplified by the growing popularity of gelatin-based products in both traditional and innovative formulations.

The stabilizer function is witnessing significant growth, driven by its essential role in maintaining the consistency, texture, and shelf life of food products. Stabilizers are used in a variety of applications, including dairy products, beverages, and dressings, to prevent phase separation and ensure uniformity in the product. As the food industry increasingly focuses on product quality, long shelf life, and clean-label ingredients, the stabilizer segment is gaining traction. Its growing importance in maintaining product integrity across a broad range of food categories is expected to contribute to its continued growth.

Food Grade Gelatin Market Segmentation: By Application:

- Food & Beverages

- Healthcare

- Cosmetic

- Others

The food and beverages segment remains the dominant application for food-grade gelatin, owing to its excessive use in a variety of products. Gelatin is widely utilized in the production of confectionery, dairy, and desserts, where its gelling, stabilizing, and thickening properties are essential. The growing demand for gelatin-based products like gummies, marshmallows, and yogurt is driving the segment’s dominance.

The healthcare segment is experiencing rapid growth, driven by the increasing demand for gelatin-based capsules, pharmaceutical formulations, and medical products. Gelatin’s role in drug delivery systems, wound care, and as a carrier for active ingredients is expanding, especially with the rise in demand for dietary supplements and personalized medicine. Its biodegradability, safety profile, and versatility make it a preferred choice in healthcare applications.

Food Grade Gelatin Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In the Food Grade Gelatin Market, North America is the dominant region, contributing the largest share of the market. This is because of the growing demand for gelatin-based products in food, beverages, healthcare, and cosmetics. The strong presence of major food manufacturers and the region's focus on health-conscious products, such as plant-based gelatin alternatives, have played a significant role in its market leadership.

Asia-Pacific is the fastest-growing region, primarily due to the rising consumption of processed and packaged food products in countries like China and India. The expanding food industry, along with rising disposable incomes and urbanization, is driving the demand for gelatin in the region, particularly in confectionery, dairy, and nutraceuticals.

COVID-19 Impact Analysis on the Global Food Grade Gelatin Market:

The COVID-19 pandemic significantly impacted the global food grade gelatin market. During the early stages of the pandemic, supply chain disruptions and factory closures affected the production and distribution of food grade gelatin. Therefore, there was a decline in demand from industries like food and beverages, cosmetics, and healthcare due to restrictions on movement and reduced consumer spending. However, as the pandemic progressed, demand for food grade gelatin saw a recovery, majorly in the food and healthcare sectors. Increased health awareness, coupled with growing demand for gelatin in immunity-boosting products and dietary supplements, contributed to market resilience. The pandemic also accelerated the adoption of plant-based alternatives in the food industry, further influencing market dynamics. The market is now rebounding, driven by consumer preference for functional food ingredients and the expanding global demand for plant-based food products.

Latest Trends/ Developments:

The food grade gelatin market has seen various key trends and developments in recent years. One of the prominent trends is the increasing demand for plant-based and vegan gelatin alternatives, driven by growing consumer interest in plant-based diets and ethical consumption. Companies are developing innovative gelatin substitutes made from agar-agar, pectin, and other plant-derived sources to cater to this demand, particularly in the food and beverages sector.

Another major development is the expanding use of gelatin in the pharmaceutical and nutraceutical industries. With rising health consciousness, gelatin is being incorporated into dietary supplements, capsules, and gummy vitamins, which has led to increased demand for high-quality gelatin with functional benefits. Furthermore, there has been an emphasis on clean-label products, prompting manufacturers to offer gelatin with minimal processing and fewer additives. In response to these trends, food and beverage companies are introducing new products that incorporate food grade gelatin for texture enhancement and stability, while aligning with consumer preferences for transparency and natural ingredients.

Key Players:

- Gelita AG

- PB Leiner

- Nitta Gelatin Inc.

- Tessenderlo Group

- Kerry Group

- Jelly Belly Candy Company

- Rousselot

- Integra LifeSciences

- Ewald-Gelatine GmbH

- Weishardt Group

- Trobas Gelatine

- Krehalon

- Shandong Yuwang Pharmaceutical Co. Ltd.

These companies are leading players in the food grade gelatin market and are involved in the production, distribution, and innovation of gelatin products used across various applications, including food and beverages, healthcare, and cosmetics. They focus on expanding their product offerings, improving quality, and addressing consumer demand for clean-label, plant-based, and sustainable gelatin alternatives.

Chapter 1. Food Grade Gelatin Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Food Grade Gelatin Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Food Grade Gelatin Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Function Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Food Grade Gelatin Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Food Grade Gelatin Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Food Grade Gelatin Market – By Source

6.1 Introduction/Key Findings

6.2 Animal Source

6.3 Plant Source

6.4 Y-O-Y Growth trend Analysis By Source

6.5 Absolute $ Opportunity Analysis By Source , 2025-2030

Chapter 7. Food Grade Gelatin Market – By Function

7.1 Introduction/Key Findings

7.2 Stabilizer

7.3 Thickener

7.4 Gelling Agent

7.5 Others Y-O-Y Growth trend Analysis By Function

7.6 Absolute $ Opportunity Analysis By Function , 2025-2030

Chapter 8. Food Grade Gelatin Market – By Application

8.1 Introduction/Key Findings

8.2 Food & Beverages

8.3 Healthcare

8.4 Cosmetic

8.5 Others

8.6 Y-O-Y Growth trend Analysis Application

8.7 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 9. Food Grade Gelatin Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Function

9.1.3. By Application

9.1.4. By Source

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Function

9.2.3. By Application

9.2.4. By Source

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Function

9.3.3. By Application

9.3.4. By Source

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By APPLICATION

9.4.3. By Function

9.4.4. By Source

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By APPLICATION

9.5.3. By Function

9.5.4. By Source

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Food Grade Gelatin Market – Company Profiles – (Overview, Source Portfolio, Financials, Strategies & Developments)

10.1 Gelita AG

10.2 PB Leiner

10.3 Nitta Gelatin Inc.

10.4 Tessenderlo Group

10.5 Kerry Group

10.6 Jelly Belly Candy Company

10.7 Rousselot

10.8 Integra LifeSciences

10.9 Ewald-Gelatine GmbH

10.10 Weishardt Group

10.11 Trobas Gelatine

10.12 Krehalon

10.13 Shandong Yuwang Pharmaceutical Co. Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Food Grade Gelatin Market was valued at USD 1.44 billion in 2024 and is projected to reach a market size of USD 2.68 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 13.22%.

The global food grade gelatin market is driven by increasing demand for processed foods, beverages, and nutraceuticals.

Based on the Source, the Global Food Grade Gelatin Market is segmented into Animal and Plant.

North America is the most dominant region for the Global Food Grade Gelatin Market.

Gelita AG, PB Leiner, Nitta Gelatin Inc., and Tessenderlo Group are the leading players in the Global Food Grade Gelatin Market