Flock Adhesives Market Size (2025 – 2030)

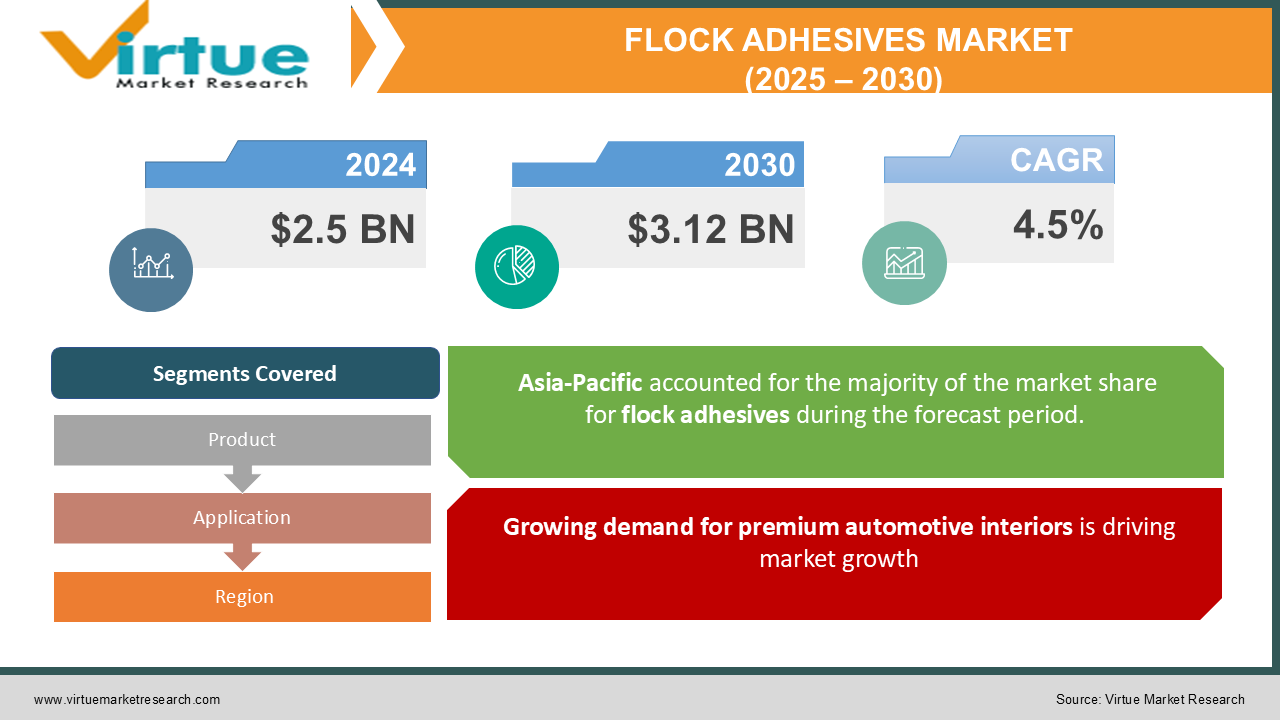

The Global Flock Adhesives Market was valued at USD 2.5 billion in 2024 and will grow at a CAGR of 4.5% from 2025 to 2030. The market is expected to reach USD 3.12 billion by 2030.

The Flock Adhesives Market focuses on adhesives used to bond flock fibers to various substrates, providing a textured and decorative finish. These adhesives are commonly used in automotive, textiles, packaging, and consumer goods industries. The market is experiencing significant growth due to the rising demand for aesthetically appealing and durable surface finishes, particularly in luxury automotive interiors, high-quality garments, and premium packaging. Additionally, advancements in adhesive formulations, including water-based and eco-friendly alternatives, are expected to further drive market expansion.

Key Market Insights

-

The automotive sector remains the largest end-user of flock adhesives, accounting for approximately 40% of total market revenue in 2024, driven by the increasing demand for premium interior finishes.

-

Water-based flock adhesives are gaining traction, with a projected market share of 35% by 2030, due to their eco-friendly properties and compliance with stringent environmental regulations.

-

The Asia-Pacific region is expected to witness the highest growth, with a CAGR of 7.2% from 2025 to 2030, fueled by expanding automotive and textile manufacturing industries in China and India.

-

The packaging industry is emerging as a key application area, with an anticipated market growth of 6.8% annually, as brands invest in premium, flocked packaging for luxury products.

-

Solvent-based adhesives continue to dominate the market with a 55% share, although regulatory restrictions on VOC emissions are prompting manufacturers to develop low-emission alternatives.

-

Europe remains a significant player in the market, holding a 30% share, driven by stringent quality standards in the automotive and textile industries.

Global Flock Adhesives Market Drivers

Growing demand for premium automotive interiors is driving market growth:

The automotive industry has been a major driver of the flock adhesives market, with premium and luxury car manufacturers increasingly incorporating flocked surfaces in vehicle interiors. Flock adhesives are used to attach soft-touch fibers to dashboards, glove compartments, door panels, and center consoles, providing a luxurious and aesthetically appealing finish. The rise in disposable income and shifting consumer preferences toward high-end vehicles have significantly increased the demand for flocked automotive components. Additionally, the push for noise reduction and improved comfort inside vehicles has further fueled the adoption of flock adhesives, as they help reduce squeaks and rattles in interior components. The expansion of electric vehicles (EVs) has also played a role in market growth, as EV manufacturers focus on enhancing interior aesthetics to differentiate their products. With automotive OEMs continually investing in design innovation, the flock adhesives market is expected to benefit from sustained demand in the coming years.

Rising use of flock adhesives in packaging is driving market growth:

The packaging industry has emerged as a crucial application area for flock adhesives, particularly in the production of high-end and luxury packaging solutions. Brands in cosmetics, jewelry, electronics, and premium food & beverage sectors are leveraging flocked packaging to enhance product appeal and create a tactile consumer experience. Flock adhesives enable the application of soft, velvety coatings to packaging surfaces, making products stand out on retail shelves. Moreover, e-commerce growth has intensified competition among brands, leading to increased investments in visually appealing and protective packaging solutions. In addition to aesthetics, flocked packaging provides functional benefits such as improved grip and scratch resistance, ensuring product longevity. As sustainable packaging gains traction, manufacturers are also developing bio-based and water-based flock adhesives to cater to environmentally conscious brands. The continued expansion of luxury markets and branding strategies focused on differentiation are expected to sustain the demand for flock adhesives in packaging applications.

Technological advancements in adhesive formulations is driving market growth:

Innovation in adhesive technologies has been a key factor driving market expansion, particularly in response to evolving regulatory and performance requirements. Traditional solvent-based flock adhesives, while offering superior adhesion, have come under scrutiny due to their high VOC emissions. To address environmental concerns, manufacturers have developed water-based and UV-curable flock adhesives that provide comparable performance with minimal environmental impact. Hybrid formulations combining the durability of solvent-based adhesives with the eco-friendliness of water-based variants are gaining popularity, particularly in markets with stringent regulations such as Europe and North America. Additionally, advancements in nanotechnology have enabled the development of adhesives with enhanced durability, flexibility, and resistance to environmental factors such as humidity and temperature fluctuations. These innovations are expanding the application scope of flock adhesives across industries, further driving market growth.

Global Flock Adhesives Market Challenges and Restraints

Stringent environmental regulations on VOC emissions is restricting market growth: One of the primary challenges facing the flock adhesives market is the increasing stringency of environmental regulations regarding volatile organic compound (VOC) emissions. Traditional solvent-based flock adhesives, which dominate the market, emit VOCs that contribute to air pollution and pose health risks to workers. Regulatory bodies such as the Environmental Protection Agency (EPA) in the United States and the European Chemicals Agency (ECHA) have imposed strict limits on VOC emissions, compelling manufacturers to reformulate their products. While water-based and bio-based adhesives offer sustainable alternatives, they often require modifications in application processes and may not achieve the same level of adhesion as solvent-based variants. Compliance with these regulations adds to production costs and necessitates investments in R&D to develop low-emission yet high-performance adhesives. This regulatory landscape poses a significant challenge for manufacturers, particularly smaller players with limited resources.

Fluctuations in raw material prices is restricting market growth: The flock adhesives market is highly dependent on raw materials such as polyurethane, acrylics, and epoxy resins, which are derived from petrochemical sources. The volatility in crude oil prices directly impacts the cost of these raw materials, leading to fluctuations in adhesive pricing. Supply chain disruptions, geopolitical tensions, and changes in trade policies further exacerbate price instability, making it challenging for manufacturers to maintain stable profit margins. Additionally, the shift toward sustainable and bio-based adhesives has increased the demand for alternative raw materials, which are often more expensive than conventional petrochemical-based components. These cost pressures may be passed on to end-users, potentially impacting demand, especially in price-sensitive markets. To mitigate these challenges, manufacturers are exploring cost-effective sourcing strategies and investing in alternative formulations that reduce reliance on volatile raw materials.

Market Opportunities

The growing emphasis on sustainability and regulatory compliance presents significant opportunities for manufacturers of flock adhesives. With increasing awareness of environmental concerns, industries are actively seeking sustainable alternatives to traditional adhesives. Water-based, UV-curable, and bio-based flock adhesives are gaining traction due to their lower environmental impact and regulatory compliance. The expansion of the electric vehicle market is another key opportunity, as EV manufacturers prioritize interior aesthetics and material innovation to enhance consumer appeal. Additionally, the booming e-commerce sector has driven demand for premium and protective packaging solutions, positioning flock adhesives as a preferred choice for luxury brands. Emerging markets in Asia-Pacific and Latin America present untapped growth potential, with rising disposable income and urbanization fueling demand for flocked textiles, automotive interiors, and decorative applications. Companies investing in research and development to enhance adhesive performance, expand application versatility, and develop cost-effective, sustainable solutions are well-positioned to capitalize on these market opportunities.

FLOCK ADHESIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Henkel, Sika AG, H.B. Fuller, Bostik, Dow Inc., 3M Company, Kissel + Wolf GmbH, Covestro AG, Lord Corporation, BASF SE |

Flock Adhesives Market Segmentation - By Product

-

Water-Based Flock Adhesives

-

Solvent-Based Flock Adhesives

-

UV-Curable Flock Adhesives

-

Epoxy-Based Flock Adhesives

Solvent-based flock adhesives remain the most dominant product type. Their superior adhesion properties and durability make them the preferred choice in high-performance applications such as automotive interiors and industrial textiles. However, with growing environmental concerns and stringent regulations, the demand for water-based and UV-curable alternatives is expected to rise

Flock Adhesives Market Segmentation - By Application

-

Automotive

-

Textiles

-

Packaging

-

Consumer Goods

-

Electronics

-

Medical

The increasing preference for premium vehicle interiors and the expansion of electric vehicle production have driven the demand for flock adhesives in the automotive segment. The need for noise reduction, improved aesthetics, and durability continues to propel market growth in automotive applications.

Flock Adhesives Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific’s dominance is attributed to the rapid expansion of the automotive, textile, and packaging industries in countries such as China, India, and Japan. China, in particular, has emerged as a leading manufacturer of flocked textiles and automotive components, driving the demand for high-performance adhesives. Additionally, the growing middle-class population and increasing disposable income levels in the region have fueled consumer demand for luxury and aesthetically appealing products, further boosting market growth. Government initiatives promoting industrial development and foreign investments in manufacturing sectors have also contributed to the expansion of the flock adhesives market in Asia-Pacific.

COVID-19 Impact Analysis on the Flock Adhesives Market

The COVID-19 pandemic had a notable impact on the global flock adhesives market, affecting supply chains, manufacturing activities, and demand across multiple industries. In the initial months of the pandemic, lockdowns and restrictions led to factory shutdowns, labor shortages, and disruptions in raw material supply. The automotive and textile industries, two major consumers of flock adhesives, witnessed significant slowdowns due to reduced consumer demand and production halts. This decline in industrial activity resulted in lower demand for flock adhesives, leading to revenue losses for manufacturers and suppliers. However, certain applications of flock adhesives saw increased demand during the pandemic. The medical and healthcare industry utilized flocked surfaces in diagnostic test kits, medical devices, and personal protective equipment (PPE), ensuring a steady requirement for specialty adhesives in this sector. Additionally, as consumer goods packaging witnessed a surge due to the rise in e-commerce sales, the packaging industry remained a stable market for flock adhesives. As global economies gradually reopened and industrial activities resumed, the flock adhesives market started recovering in 2021. The automotive sector, which had experienced a sharp decline in production, began regaining momentum with increased vehicle manufacturing and rising demand for high-quality interior materials. Moreover, the textile industry saw a revival as consumer spending on fashion and home furnishings increased post-pandemic. Another significant impact of COVID-19 was the acceleration of sustainability initiatives in manufacturing industries. Many companies started prioritizing eco-friendly adhesives, leading to a growing demand for water-based and low-VOC (volatile organic compound) adhesives. The pandemic highlighted the importance of resilient supply chains, prompting manufacturers to invest in localized production and reduce dependence on global suppliers. Overall, while COVID-19 posed short-term challenges for the flock adhesives market, the post-pandemic recovery, coupled with advancements in sustainable adhesive technologies, is expected to drive long-term growth in the industry.

Latest Trends/Developments

The flock adhesives market is evolving with new trends and technological advancements, driven by increasing demand for high-performance adhesives, sustainability concerns, and the expanding applications of flocking technology. One of the most notable trends is the shift toward eco-friendly and sustainable adhesives. As regulatory bodies impose stricter environmental regulations, manufacturers are focusing on developing water-based and solvent-free adhesives that reduce VOC emissions and improve workplace safety. This shift is particularly evident in the automotive and textile industries, where companies are seeking greener alternatives to traditional solvent-based adhesives. Another significant development is the increasing use of flock adhesives in the automotive sector for premium interior finishes. With rising consumer demand for luxury and comfort in vehicles, automakers are incorporating flocked surfaces in dashboards, glove compartments, door panels, and center consoles. Flock adhesives play a crucial role in ensuring durability, smooth texture, and aesthetic appeal in automotive interiors. Additionally, advancements in adhesive formulations have led to improved heat and chemical resistance, enhancing the performance of flocked components in harsh environments. The packaging industry is also driving innovation in flock adhesives. High-end product packaging for cosmetics, perfumes, jewelry, and premium consumer goods increasingly incorporates flocked textures to enhance the tactile experience and brand value. This trend is pushing adhesive manufacturers to develop specialized formulations that offer strong adhesion on diverse substrates such as paper, plastic, and glass. The rise of e-commerce has further fueled demand for aesthetically appealing and protective packaging solutions, supporting market growth. Technological advancements are also shaping the flock adhesives market. The integration of nanotechnology in adhesive formulations is leading to improved bonding strength, faster curing times, and enhanced durability. Additionally, UV-curable flock adhesives are gaining traction due to their rapid drying properties, making them ideal for high-speed production lines in industries like textiles and automotive manufacturing.

Key Players

-

Henkel

-

Sika AG

-

H.B. Fuller

-

Bostik

-

Dow Inc.

-

3M Company

-

Kissel + Wolf GmbH

-

Covestro AG

-

Lord Corporation

-

BASF SE

Chapter 1. Flock Adhesives Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Flock Adhesives Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Flock Adhesives Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Flock Adhesives Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Flock Adhesives Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Flock Adhesives Market – By Product

6.1 Introduction/Key Findings

6.2 Water-Based Flock Adhesives

6.3 Solvent-Based Flock Adhesives

6.4 UV-Curable Flock Adhesives

6.5 Epoxy-Based Flock Adhesives

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Flock Adhesives Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Textiles

7.4 Packaging

7.5 Consumer Goods

7.6 Electronics

7.7 Medical

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Flock Adhesives Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Flock Adhesives Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Henkel

9.2 Sika AG

9.3 H.B. Fuller

9.4 Bostik

9.5 Dow Inc.

9.6 3M Company

9.7 Kissel + Wolf GmbH

9.8 Covestro AG

9.9 Lord Corporation

9.10 BASF SE

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Flock Adhesives Market was valued at USD 2.5 billion in 2024 and will grow at a CAGR of 4.5% from 2025 to 2030. The market is expected to reach USD 3.12 billion by 2030.

Key drivers include the rising demand for premium automotive interiors, increasing use in luxury packaging, and advancements in eco-friendly adhesive formulations, particularly water-based and UV-curable adhesives.

The market is segmented by product (water-based, solvent-based, UV-curable, epoxy-based) and by application (automotive, textiles, packaging, consumer goods, electronics, medical).

Asia-Pacific dominates the market with a 35% share in 2024, driven by rapid industrialization, growing automotive production, and increasing demand for flocked textiles and premium packaging solutions.

Leading players include Henkel, Sika AG, H.B. Fuller, Bostik, Dow Inc., 3M Company, Kissel + Wolf GmbH, Covestro AG, Lord Corporation, and BASF SE.