Acrylic Film Adhesives Market Size (2024 –2030)

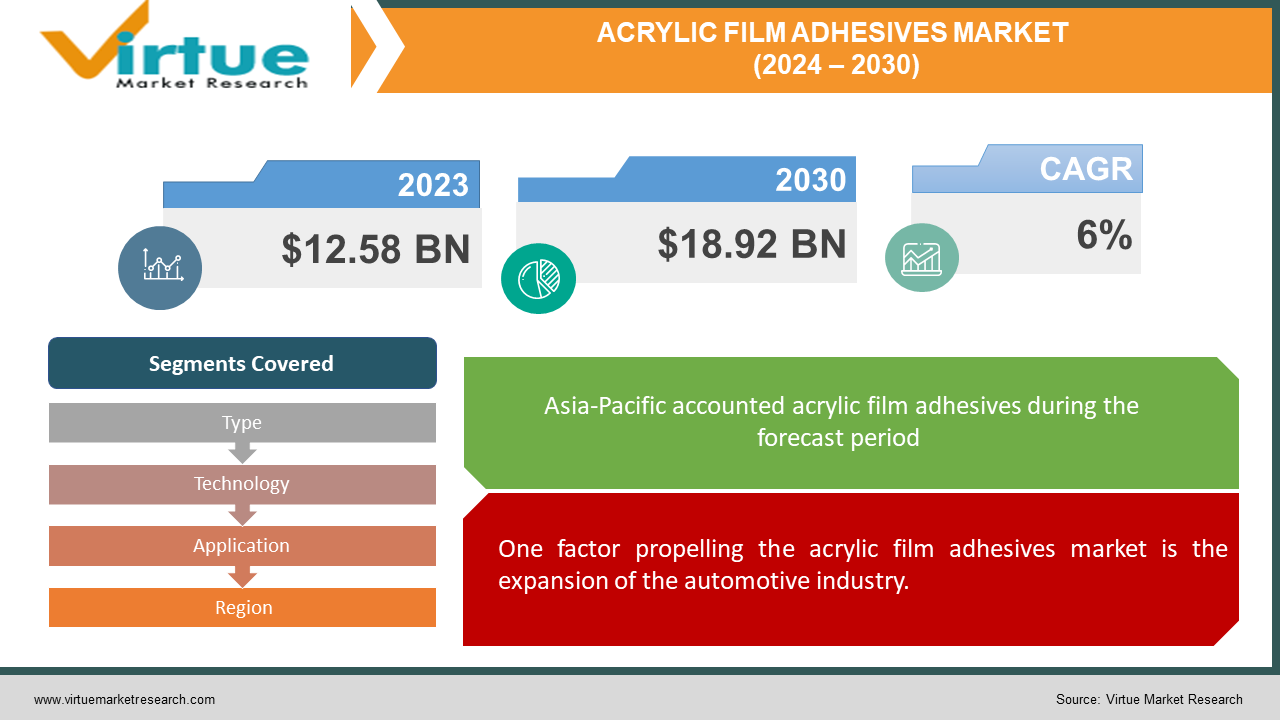

The Global Acrylic Film Adhesives Market was valued at USD 12.58 billion and is projected to reach a market size of USD 18.92 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6%.

Acrylic film adhesives are surface-applied thin films that form durable, strong bonds. Due to their resistance to heat, chemicals, and moisture, they are widely used in a variety of industries, including electronics, packaging, automotive, aerospace, construction, and medicine. These adhesives are created by the polymerization of acrylic monomers, which results in the formation of large molecules, or polymers. Reactive acrylic film adhesives react to heat, UV light, or moisture to cure and become strong. Pressing non-reactive types against a surface causes them to become sticky. These adhesives can be tailored to meet specific needs in terms of thickness, width, length, color, and design. They are available in rolls, sheets, tapes, and labels. It is also possible to add fillers or additives to enhance properties like resistance, adhesion, or flexibility.

Key Market Insights:

In 2023, acrylic film adhesives, particularly tapes, will command a substantial market share of 70.8%, mainly from applications involving assembly and carton sealing.

The demand for acrylic film adhesives is expected to increase significantly at a consistent rate of 20% per year over the next five years. There is a strong upward trend in the market, with a forecasted growth rate of 30% by the year 2026.

20.5% of the market volume is made up of labels, which are used in the food, packaging, and industrial sectors. The remaining 8.7% is made up of graphic films, which are used for branding, signage, and advertising purposes.

Due to the expansion of e-commerce, the development of infrastructure, and industrial growth, the Asia-Pacific region has the largest market share and presents significant opportunities for market expansion.

Global Acrylic Film Adhesives Market Drivers:

One factor propelling the acrylic film adhesives market is the expansion of the automotive industry.

Acrylic film adhesives are used in the automotive industry for several applications, including structural bonding, panel attachment, and sealing. Vehicle parts like roofs, doors, and trunks are joined together by structural bonding. Panel bonding is the process of joining panels, like fenders and hoods, to the car's body. Sealing aids in preventing water, dust, and noise from entering the vehicle. Because acrylic film adhesives are strong, lightweight, adhere well, withstand adverse conditions, and cure quickly, they are advantageous in automotive applications. Their reduced weight is particularly significant for cars looking to lose weight. They increase the overall strength of vehicles by forming stronger bonds than conventional adhesives. Adhesives for acrylic films can adhere to a wide range of automotive materials, including composites, metal, and plastic. They also cure more quickly than conventional adhesives, which facilitates accelerated car production. These adhesives are resistant to UV light, solvents, and extremely high and low temperatures. Methyl methacrylate or acrylic film adhesives are used in the automotive industry to affix door panels and other external car parts. The rising demand for cars, urbanization, and improvements in fuel-efficient vehicle technologies are all contributing to the automobile industry's rapid growth.

The building sector is the one driving the rising demand for acrylic film adhesives.

Because acrylic film adhesives perform better and last longer than conventional adhesives, they are frequently used in the building industry for a variety of applications. They provide advantages like faster curing times, improved resistance to chemicals and UV rays, and enhanced weather resistance. Acrylic film adhesives are used in roofing applications to firmly and completely seal substrates against roofing membranes. To establish strong bonds between substrates and flooring materials, they are also utilized in flooring. Acrylic film adhesives are also used in insulation applications to seal airtight gaps and hold insulating materials in place. They are appropriate for commercial and industrial applications due to their resistance to acids and bases. Compared to traditional adhesives, acrylic film adhesives cure more quickly, expediting the construction process. They offer robust, long-lasting bonds that resist environmental variables and the rigors of construction. Construction projects use thick mastic or putty-like acrylic film adhesives to attach panels, insulating boards, and ceiling tiles. The building and construction sector is expanding as a result of rising investment, urbanization, advances in architecture, and the development of residential real estate.

Acrylic Film Adhesives Market Challenges and Restraints:

The market for acrylic film adhesives is struggling because of the unstable prices of the raw materials—acrylic and methacrylic acids, acrylate, and other materials—used in their manufacturing, as well as the restricted supply of finished goods. Strict government regulations are another thing impeding the growth of the acrylic film adhesives market. Studies demonstrating the possible harm and respiratory hazards linked to solvent-based acrylic film adhesives have also hindered the adhesives' commercial expansion. The market for acrylic film adhesives faces considerable challenges due to a combination of factors, such as unstable raw material prices and strict regulations.

Acrylic Film Adhesives Market Opportunities:

Numerous applications in various industries, including electronics, packaging, construction, and automotive, define the acrylic film adhesives market. The weather resistance, chemical resistance, and quick cure times of acrylic film adhesives make them perfect for a variety of applications, including flooring, electronics assembly, roofing, and carton sealing. New products have entered the market to address specific needs of the industry, such as structural acrylic film adhesives and low-VOC adhesives. The market is still expanding, especially in the Asia-Pacific region, despite obstacles like fluctuating raw material prices and regulatory restrictions. This growth is being driven by factors like rising industrialization and the need for sophisticated infrastructure. Possibilities include creating environmentally friendly adhesive solutions, breaking into new markets, improving technology, broadening one's market base, and establishing alliances to promote innovation and growth. Stakeholders can spur innovation and growth in the acrylic film adhesives market by seizing these opportunities and meeting changing industry and consumer demands.

ACRYLIC FILM ADHESIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Type, Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M, Henkel AG & Co. KGa, Sika AG, H.B. Fuller, Bostik SA, Dow, Ashland Inc., Lord Corporation, Avery Dennison Corporation, Huntsman Corporation |

Global Acrylic Film Adhesives Market Segmentation: By Type

-

Graphic Films

-

Tapes

-

Labels

With 70.8% of the market share in 2023, tapes remained the most popular product on the market. This is mostly because of how frequently they are used to seal cartons for packaging. Because they are lightweight, simple to use, and environmentally friendly in comparison to other fastening techniques, tapes are also frequently used in assembly for industries like electronics and the automotive sector. Because labels are used in so many different applications—food labels, packing lists, envelopes, permanent labels, fabric labels, tire labels, detachable labels, specialty labels, and durable labels—the market for labels is growing. The labeling industry prefers self-adhesive labels made from acrylic emulsions because of their superior properties, which enable larger web sizes, faster processing speeds, and overall higher conversion efficiency. Road signs, branding, advertising displays, weather-resistant graphics, home décor, point-of-sale promotions, outdoor advertising, and vehicle graphics are just a few of the many applications for graphic films that use pressure-sensitive adhesives. Because branding and advertising visuals are so important in shaping consumer demand, big businesses are concentrating more on them.

Global Acrylic Film Adhesives Market Segmentation: By Technology

-

Water-Based

-

Solvent-Based

-

Reactive

Water-based acrylic adhesives are the market leaders and are widely used in construction, paper and packaging, furniture manufacturing, healthcare, and other industries. The demand for acrylic adhesives is being driven in the Asia-Pacific (APAC) region by various factors, including the expansion of the pharmaceutical sector, the growth of e-commerce, the presence of major automotive manufacturers, and the increasing development of infrastructure backed by government initiatives. The government's support of eco-friendly packaging regulations and affordable housing is anticipated to increase demand for acrylic adhesives. Because of their excellent bond, ability to withstand high temperatures, and flexibility in cold weather, water-based acrylic adhesives are recommended for use in a variety of industries, including construction, packaging, transportation, and tape. Reactive acrylic film adhesives provide better durability, chemical resistance, and bond strength. They cure chemically, usually with heat or UV light. Because of their superior performance, reactive adhesives are becoming more and more in demand, particularly in the automotive, electronics, and construction industries where high-performance adhesives are required. Reactive adhesives are becoming more and more popular due to their exceptional performance qualities and rising demand from a variety of industries.

Global Acrylic Film Adhesives Market Segmentation: By Application

-

Packaging

-

Transportation

-

Electronics

-

Construction

-

Woodworking

-

Consumer

-

Medical

Acrylic film adhesives hold nearly 20% of the market share in the construction industry, making them important. Compared to conventional adhesives, they provide superior weather resistance, chemical resistance, and UV protection for use in roofing, flooring, and insulation applications. Because of its superior thermal stability and resistance to chemicals and UV rays, acrylic film adhesives find extensive application in the electronics industry, an industry that is experiencing rapid growth. In the upcoming years, the global market for acrylic film adhesives is anticipated to be driven by this increased demand across numerous industries. Another common use for acrylic film adhesives is packaging, which includes labels, signs, tubes, bags, cigarette filters, carton side seams, closures, and specialty packaging. Demand for product packaging and related materials has surged in the packaging industry, particularly as a result of the pandemic's growth in e-commerce. The packaging industry will probably continue to see growth in the need for acrylic film adhesives as consumer preferences continue to shift in favor of packaged goods.

Global Acrylic Film Adhesives Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Throughout the forecast period, the acrylic film adhesives market is anticipated to be dominated by the Asia-Pacific region due to factors like the availability of accessible land and skilled labor at a low cost. This region's market is expected to expand as industries move toward developing nations like China and India. The Asia-Pacific region's rapidly expanding packaging, automotive, and electronics industries are among the industries driving the demand for acrylic film adhesives. Due to their high load-bearing capacity and resilience to impact and shock, these adhesives are especially well-liked in the automotive industry, which will increase demand for them. The demand for acrylic film adhesives in transportation applications is expected to rise as middle-class incomes rise in nations like China and India and car sales rise. Europe is the second-largest market for acrylic film adhesives, with significant contributions from nations like the UK, Germany, and France. These nations profit from strong demand in several industries, such as fast-moving consumer goods (FMCG), electronics, furniture, building, packaging, and automobiles. The market is expanding as a result of rising disposable incomes, increased spending on corrugated packaging, and e-commerce in these areas.

COVID-19 Impact on the Global Acrylic Film Adhesives Market:

The global market for acrylic film adhesives has been significantly impacted by the COVID-19 pandemic. Due to the disruption of global supply chains, there are now labor and resource shortages, which present logistical challenges. The production of sanitizers and other necessary goods has diverted alcohol, a crucial ingredient in acrylic film adhesives, further impacting supply. The distribution and transportation of raw materials and acrylic film adhesives have also been hampered by lockdowns and travel restrictions. Government-imposed health and safety laws have resulted in lower consumption in many industries, including aerospace, automotive, construction, electronics, medical, and packaging, which has affected the demand for acrylic film adhesives. This has caused activities in several industries to slow down or stop completely, which has affected the demand for acrylic film adhesives as a whole.

Latest Trend/Development:

The landscape of the acrylic film adhesives market is being shaped by several trends and developments. To address environmental concerns, manufacturers are concentrating on developing formulations with low volatile organic compound (VOC) content and reduced odor, especially for applications in cramped areas like car interiors. New generations of acrylic film adhesives with enhanced features, such as low-odor structural adhesives and pressure-sensitive adhesives (PSAs) designed for particular applications like automotive assembly, are introduced by creative product launches by businesses like 3M and Toyochem Co., Ltd. To satisfy various industry demands, there is also a noticeable focus on improving performance attributes like UV protection, chemical resistance, weather durability, and quicker curing times. Beyond their traditional applications, acrylic film adhesives are being used more and more in a variety of industries, such as electronics assembly, labeling, graphic films for branding and advertising, and specialized packaging. Together, these developments show how the industry has responded to changing consumer demands by offering acrylic film adhesive applications that are more versatile, safe, and perform better.

Key Players:

-

3M

-

Henkel AG & Co. KGaA

-

Sika AG

-

H.B. Fuller

-

Bostik SA

-

Dow

-

Ashland Inc.

-

Lord Corporation

-

Avery Dennison Corporation

-

Huntsman Corporation

Market News:

-

New acrylic pressure-sensitive adhesives (PSA) with low volatile organic compound (VOC) and little odor were released by Toyochem Co., Ltd. in April 2022. The product, known as Oribain EXK 21-046, is intended for usage in cramped spaces, like the inside of cars and buildings.

Chapter 1. ACRYLIC FILM ADHESIVES MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. ACRYLIC FILM ADHESIVES MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. ACRYLIC FILM ADHESIVES MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. ACRYLIC FILM ADHESIVES MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. ACRYLIC FILM ADHESIVES MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. ACRYLIC FILM ADHESIVES MARKET – By Type

6.1 Introduction/Key Findings

6.2 Graphic Films

6.3 Tapes

6.4 Labels

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. ACRYLIC FILM ADHESIVES MARKET – By Technology

7.1 Introduction/Key Findings

7.2 Water-Based

7.3 Solvent-Based

7.4 Reactive

7.5 Y-O-Y Growth trend Analysis By Technology

7.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. ACRYLIC FILM ADHESIVES MARKET – By Application

8.1 Introduction/Key Findings

8.2 Packaging

8.3 Transportation

8.4 Electronics

8.5 Construction

8.6 Woodworking

8.7 Consumer

8.8 Medical

8.9 Y-O-Y Growth trend Analysis By Application

8.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. ACRYLIC FILM ADHESIVES MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Technology

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Technology

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Technology

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Technology

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Technology

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. ACRYLIC FILM ADHESIVES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 3M

10.2 Henkel AG & Co. KGaA

10.3 Sika AG

10.4 H.B. Fuller

10.5 Bostik SA

10.6 Dow

10.7 Ashland Inc.

10.8 Lord Corporation

10.9 Avery Dennison Corporation

10.10 Huntsman Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Acrylic film adhesives are a particular class of acrylic film adhesives that are applied to substrates as thin films.

The Global Acrylic Film Adhesives Market was estimated to be worth USD 12.58 billion in 2023 and is projected to reach a value of USD 18.92 billion by 2030, growing at a CAGR of 6% during the forecast period 2024-2030.

The automotive industry and construction industry are the driving factors of the Global Acrylic Film Adhesives Market.

Fluctuating raw materials and stringent government regulations are hindering the market expansion for acrylic film adhesives.

Label type is the fastest growing in the Global Acrylic Film Adhesives Market.