Europe Edible Mushroom Market Size (2024-2030)

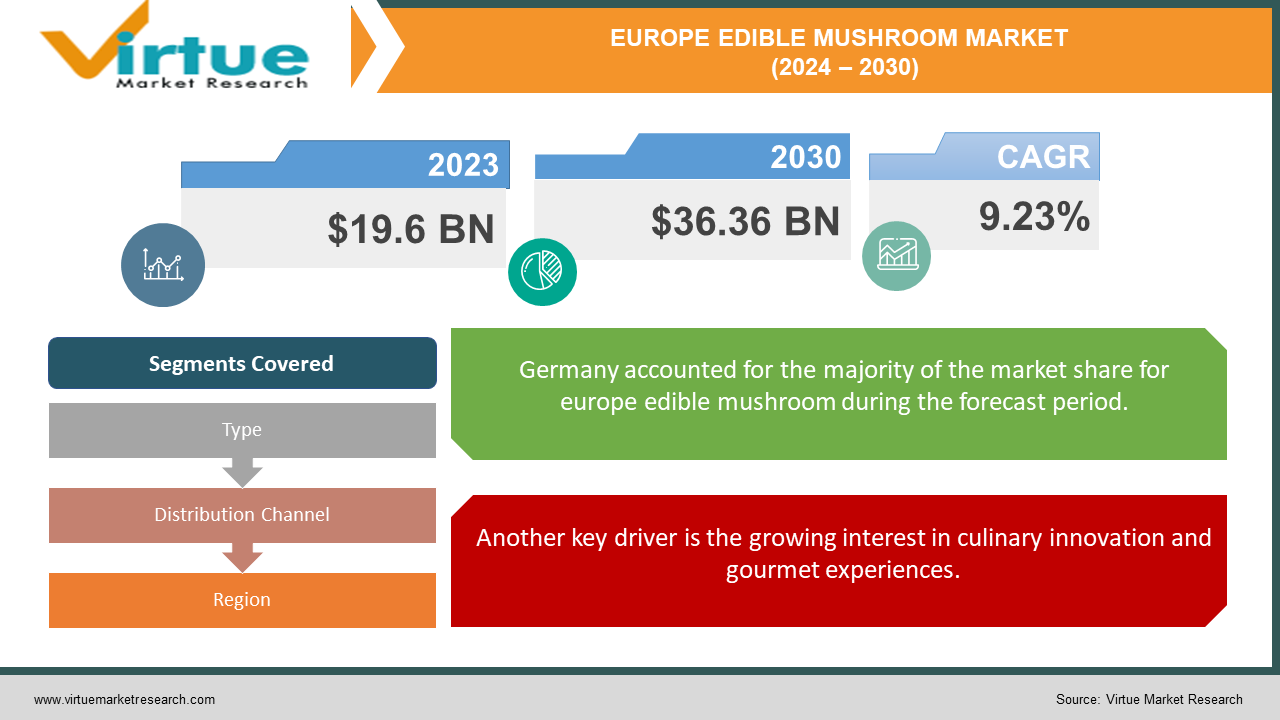

The Europe Edible Mushroom Market was valued at USD 19.6 Billion in 2023 and is projected to reach a market size of USD 36.36 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.23%.

Due to growing consumer interest in sustainable, unusual, and healthful food alternatives, the edible mushroom business in Europe is expanding and changing significantly. A common ingredient in many European cuisines, edible mushrooms are prized for their distinctive tastes and high nutritional content. Button mushrooms, shiitake, oyster mushrooms, and other species are all part of this sector, which serves a range of gastronomic tastes and health-conscious customers. The market is growing as a result of several causes. Urbanization, changes in lifestyle, and heightened knowledge of the health advantages of mushrooms are critical. Due to their abundance of proteins, vitamins, minerals, and antioxidants, mushrooms are a favored option for people trying to improve their eating habits.

Key Market Insights:

Button mushrooms account for 55% of the total market share. Shiitake mushrooms hold a 20% share of the market. Oyster mushrooms represent 15% of the market share.

France produces over 150,000 tons of mushrooms annually. The Netherlands exports around 40% of its mushroom production. Poland's mushroom production exceeds 200,000 tons per year.

The average price of button mushrooms in Europe is €3 per kg. Shiitake mushrooms are priced at around €10 per kg. Oyster mushrooms cost approximately €8 per kg.

Mushroom imports in Europe reached 100,000 tons in 2023. The European Union's mushroom export value was €700 million in 2023.

The food service sector consumes 35% of the total mushroom production. Household consumption of mushrooms is 65% of the market.

The demand for functional mushrooms (medicinal) is growing at 7% annually.

The European mushroom market contributes 0.5% to the agricultural GDP.

Europe Edible Mushroom Market Drivers:

One of the primary drivers of the edible mushroom market in Europe is the increasing consumer focus on health and wellness.

While they are rich in dietary fiber, vitamins B and D, minerals (selenium, copper, potassium), and antioxidants, mushrooms are low in calories, fat, and cholesterol. These qualities make them a desirable choice for customers who are concerned about their health. Mushrooms' reputation as a superfood is further enhanced by their immune-stimulating abilities and possible anti-cancer effects. Growing rates of lifestyle disorders like diabetes, obesity, and heart problems have made people look for natural and functional meals that improve their general health. Given their abundance of nutrients, mushrooms are a great fit for this trend. Another important aspect is the rising acceptance of plant-based diets due to worries about environmental sustainability and animal welfare.

Another key driver is the growing interest in culinary innovation and gourmet experiences.

Mushrooms are an essential component of many traditional dishes in Europe's rich and varied culinary culture. Chefs and amateur cooks are being encouraged to experiment with many sorts of mushrooms, including exotic ones like shiitake, maitake, enoki, and chanterelles, by the current trend of experimenting with flavors and textures. Social media, culinary blogs, and cooking programs have all gained popularity, which has increased the prominence of mushrooms in modern cuisine. Mushrooms are becoming more and more acceptable to a wider range of people thanks to creative recipes and cooking methods. The demand for mushrooms is also being driven by the growing number of gourmet restaurants and culinary festivals that celebrate them.

Europe Edible Mushroom Market Restraints and Challenges:

The perishability of the product is one of the major issues the edible mushroom market is experiencing. Mushrooms are quite prone to spoiling because of their short shelf life, which usually lasts just a few days to a week. Because of this perishability, it might be difficult for growers and merchants to guarantee that customers will always have access to fresh mushrooms. Another issue influencing the edible mushroom business is price volatility. Many variables, including weather, insect infestations, and shifts in input prices (e.g., substrates, labor, energy), can affect the cost of producing mushrooms. These swings can affect the mushroom industry's profitability and make it difficult for growers to keep their pricing steady. Furthermore, the market is also impacted by the rivalry between imported and local mushrooms. Although mushrooms grown locally are certain to be fresher, imported mushrooms can have lower manufacturing costs since they are grown in other places. For the competitors in the market, keeping competitive prices while balancing supply and demand is a constant problem.

Europe Edible Mushroom Market Opportunities:

Technological advancements in mushroom cultivation offer significant opportunities for industry expansion. Innovations including hydroponics, vertical growing, and controlled environment agriculture (CEA) are revolutionizing the mushroom industry. These technologies enable year-round production, higher yields, and better control over growing conditions, ensuring a consistent supply and high-quality output. The technique of creating the perfect growing environment for mushrooms via the use of advanced climate control devices is known as CEA. By using this technology, the impacts of the outside weather are mitigated as well as the likelihood of diseases and pests spreading. "Vertical farming," or growing mushrooms in layers stacked vertically, maximizes space use and increases yield. Hydroponics, a method of growing plants without soil, allows for precise control over fertilizer and watering. There are a lot of prospects for the edible mushroom industry to expand as a result of the expansion into new markets in Europe and throughout the world. Demand in emerging economies is being driven by growing consumer knowledge of the culinary variety and health advantages of mushrooms. Growing interest in mushrooms is being seen in Eastern European countries as well as in parts of Asia and North America, which presents profitable potential for European growers.

EUROPE EDIBLE MUSHROOM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.23% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Monaghan Mushrooms (Ireland), Champignon de Paris (France), The Mushroom Group (UK), Banken Champignons (Netherlands), Bonduelle (France), Growers Mushrooms (UK), AGA (Poland), Yee Fung (Hong Kong), Eco Mushrooms (Spain), Mycelia (Netherlands), Tesco (UK), Carrefour (France), Aldi (Germany), Lidl (Germany), Edeka (Germany), Ahold, Delhaize (Netherlands), Casino Group (France), Schwartzkopf (Germany). |

Europe Edible Mushroom Market Segmentation:

Europe Edible Mushroom Market Segmentation: By Types:

- Button mushrooms

- Shiitake mushrooms

- Oyster mushrooms

- Other Exotic Varieties

In Europe, button mushrooms are the most widely eaten kind and command the largest share of the market. These mushrooms, which are commonly referred to as white mushrooms, make up around 55% of the market. They are popular because of their moderate flavor, ease of preparation, and accessibility. In European cooking, button mushrooms are a common ingredient in soups, salads, pizzas, and pasta dishes.

With about 20% of the market share at the moment, shiitake mushrooms are the variety that grows the quickest in the European market. Gourmet chefs and health-conscious customers are becoming more and more drawn to shiitake mushrooms, which are prized for their deep, umami taste and many health advantages. They are abundant in vitamins, minerals, and bioactive substances that have been connected to a number of health advantages, such as bolstering the immune system and having anti-inflammatory qualities.

Europe Edible Mushroom Market Segmentation: By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

Supermarkets and hypermarkets make up over 60% of mushroom sales, making them the primary distribution channels. These major retail chains make sure that customers can easily obtain fresh mushrooms by providing a huge variety of mushroom species. They make sure that customers can get all they need at one location by providing a wide variety of mushroom species, from basic button mushrooms to exotic ones.

With an approximate 10% yearly growth rate, online shopping is the edible mushroom distribution route that is expanding the quickest. The quick growth of this sector is being fueled by the ease of internet purchasing and the growing digitization of the food industry. From the convenience of their homes, customers may buy mushrooms, with same-day or scheduled delivery choices available.

Europe Edible Mushroom Market Segmentation: Regional Analysis:

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany is the clear market leader in Europe for edible mushrooms, holding a strong 22% of the market. Numerous elements that are strongly embedded in German culture, consumer behavior, and agricultural methods may be traced to this domination. For a considerable amount of time, German cuisine has embraced mushrooms as a versatile ingredient. Traditional recipes like Pilzpfanne (a mushroom pan) and Jägerschnitzel (a hunter's schnitzel with a mushroom sauce) include mushrooms prominently. Because mushrooms are associated with culture, there is a consistent market for them, which sustains a booming economy. Beyond their conventional use, mushrooms are becoming more and more popular among German consumers as a high-protein, low-calorie, and healthful food choice.

Despite having a 10% market share in the European edible mushroom market, Spain is now the nation with the quickest rate of growth in this industry. With remarkable yearly growth rates, the Spanish edible mushroom market has been surpassing its European peers and establishing itself as a prominent participant in the sector. Spain's edible mushroom industry is expanding rapidly due to a number of causes. First of all, there has been a notable change in Spanish eating patterns toward a diet that is healthier and more plant-based. Because of their excellent nutritional content and low-calorie count, mushrooms are becoming more and more popular as a flexible element in Spanish cooking and as an alternative to meat. The industry is expanding mostly due to consumers' rising knowledge of the health advantages of mushrooms.

COVID-19 Impact Analysis on the Europe Edible Mushroom Market:

The initial months of the pandemic were marked by a significant disruption to the European mushroom industry's labor force. Restrictions on movement and social distancing measures hampered the ability of migrant workers, who often play a crucial role in mushroom cultivation, to travel and work in European farms. This labor shortage resulted in a temporary decline in production and a potential disruption in the supply chain. However, amidst the initial challenges, an unforeseen silver lining emerged. Lockdowns and restrictions on movement led to a surge in home cooking across Europe. Consumers, confined to their homes, rediscovered the joys of preparing meals from scratch. This trend presented a golden opportunity for the fresh mushroom market. The pandemic also triggered a heightened focus on health and immunity-boosting foods. Consumers became more mindful of their dietary choices, seeking out foods perceived to have health benefits. This trend played perfectly into the hands of the mushroom industry. With a significant portion of the population confined to their homes, online grocery shopping witnessed an exponential surge. This trend also impacted the European edible mushroom market. Consumers increasingly opted for the convenience of ordering fresh mushrooms online, alongside other groceries, for home delivery.

Latest Trends/ Developments:

With about 90% of the market, fresh mushrooms continue to be the most popular category in Europe. Fresh produce is preferred because consumers are becoming more and more interested in high-quality, healthful foods. This excitement hasn't been tempered by busy lifestyles; pre-washed and handy packing choices are making fresh mushrooms a sensible option for time-pressed customers. Edible mushrooms are in a good position to benefit from the growing interest in functional foods in the European market. Some types of mushrooms are thought to have several health advantages, including strengthening the immune system, supporting gastrointestinal health, and even having anti-cancer qualities. Techniques for vertical farming are being investigated for the production of mushrooms. These techniques provide a more regulated setting, which may minimize the environmental impact and water use. More openness from consumers about the sources and methods of food production is being demanded. European mushroom farmers may be able to gain a competitive advantage by showcasing sustainable practices through certifications and labels.

Key Players:

-

- Monaghan Mushrooms (Ireland)

- Champignon de Paris (France)

- The Mushroom Group (UK)

- Banken Champignons (Netherlands)

- Bonduelle (France)

- Growers Mushrooms (UK)

- AGA (Poland)

- Yee Fung (Hong Kong)

- Eco Mushrooms (Spain)

- Mycelia (Netherlands)

- Tesco (UK)

- Carrefour (France)

- Aldi (Germany)

- Lidl (Germany)

- Edeka (Germany)

- Ahold Delhaize (Netherlands)

- Casino Group (France)

- Schwartzkopf (Germany)

Chapter 1. Europe Edible Mushroom Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Edible Mushroom Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Edible Mushroom Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Edible Mushroom Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Edible Mushroom Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Edible Mushroom Market– By Type

6.1. Introduction/Key Findings

6.2. Button mushrooms

6.3. Shiitake mushrooms

6.4. Oyster mushrooms

6.5. Other Exotic Varieties

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Edible Mushroom Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets, hypermarkets and Retail stores

7.3. Convenience Stores

7.4. Specialty Stores

7.5. Online Retail

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Europe Edible Mushroom Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Edible Mushroom Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Monaghan Mushrooms (Ireland)

9.2. Champignon de Paris (France)

9.3. The Mushroom Group (UK)

9.4. Banken Champignons (Netherlands)

9.5. Bonduelle (France)

9.6. Growers Mushrooms (UK)

9.7. AGA (Poland)

9.8. Yee Fung (Hong Kong)

9.9. Eco Mushrooms (Spain)

9.10. Mycelia (Netherlands)

9.11. Tesco (UK)

9.12. Carrefour (France)

9.13. Aldi (Germany)

9.14. Lidl (Germany)

9.15. Edeka (Germany)

9.16. Ahold Delhaize (Netherlands)

9.17. Casino Group (France)

9.18. Schwartzkopf (Germany)

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Europeans are increasingly prioritizing health and wellness in their food choices. Edible mushrooms, perceived as low-calorie, fat-free, and rich in nutrients like fiber and vitamins, perfectly align with this trend

Mushrooms have a relatively short shelf life, and ensuring consistent quality throughout the supply chain can be challenging. Maintaining proper storage and transportation temperatures is crucial to minimize spoilage

Monaghan Mushrooms (Ireland), Champignon de Paris (France), The Mushroom Group (UK), Banken Champignons (Netherlands), Bonduelle (France), Growers Mushrooms (UK), AGA (Poland), Yee Fung (Hong Kong), Eco Mushrooms (Spain), Mycelia (Netherlands), Tesco (UK), Carrefour (France), Aldi (Germany), Lidl (Germany), Edeka (Germany), Ahold, Delhaize (Netherlands), Casino Group (France), Schwartzkopf (Germany).

The market is dominated by Germany, which commands a market share of around 22%.

With a market share of about 10%, Spain is expanding the quickest.