Middle East and Africa Edible Mushroom Market Size (2024-2030)

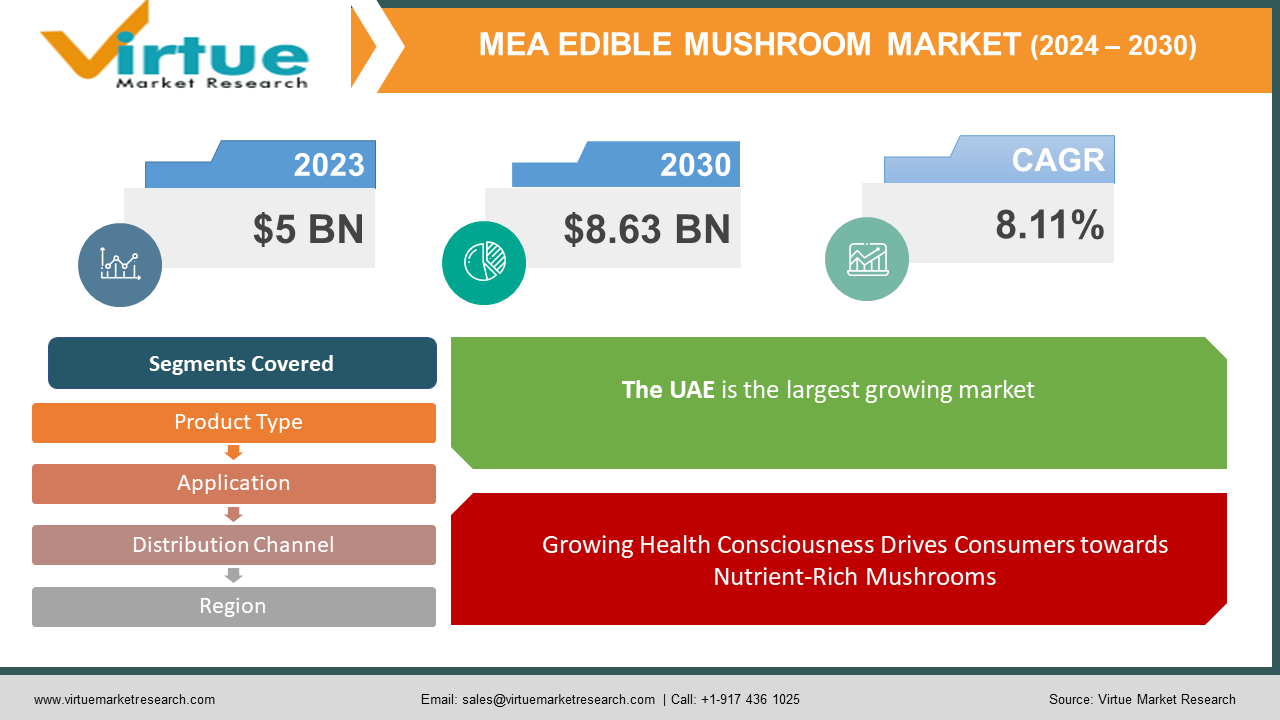

The Middle East and Africa Edible Mushroom Market was valued at USD 5 billion in 2023 and is projected to reach a market size of USD 8.63 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 8.11%.

The Middle East and Africa edible mushroom market is experiencing a surge in popularity, driven by factors like increasing urbanization, growing health consciousness, and a rising demand for diverse culinary experiences. Button mushrooms remain the most popular variety, but other options like shiitake and oyster mushrooms are gaining traction. Fresh mushrooms dominate the market, while processed options like dried and canned are becoming increasingly popular. Supermarkets, convenience stores, and specialty stores are the primary distribution channels, with online retail witnessing significant growth. Leading players in the market include Costa Group, Okechamp S.A., and Monterey Mushrooms. While challenges like the short shelf life of fresh mushrooms exist, the future of the market appears promising, offering opportunities for both domestic and international players to capitalize on the growing demand for edible mushrooms in the region.

Key Market Insights:

- The edible mushroom market in the Middle East and Africa is experiencing a delicious surge, driven by several key factors. Increasing urbanization and disposable income are putting more money in people's pockets, leading them to explore healthier and more convenient food options like mushrooms. Additionally, growing health consciousness is putting a spotlight on the nutritional benefits of mushrooms, which are low in calories, fat-free, and packed with essential vitamins, minerals, and antioxidants. Finally, the popularity of diverse culinary trends, particularly those from East Asia, is boosting demand for unique mushroom varieties like shiitake and oyster mushrooms.

- This flourishing market is segmented into various categories. Button mushrooms still hold the lion's share, but other options like shiitake and oyster are gaining traction. Fresh mushrooms currently dominate the market, though processed options like dried, frozen, and canned are becoming increasingly popular. Supermarkets and hypermarkets remain the primary distribution channels, followed by convenience stores and specialty stores. However, online retail is rapidly emerging as a significant player, offering increased convenience to consumers.

- Looking ahead, the future of the Middle East and Africa's edible mushroom market appears bright. The aforementioned factors are expected to continue driving growth, presenting exciting opportunities for both domestic and international players. However, challenges like the limited shelf life of fresh mushrooms and underdeveloped cold chain infrastructure in certain regions need to be addressed for sustained growth.

The Middle East and Africa Edible Mushroom Market Drivers:

Urbanization and Rising Disposable Income Fuel Demand for Convenient and Healthy Food Options:

As populations in the region shift towards urban areas, their disposable income often increases. This leads to increased spending on convenient and healthy food options, including edible mushrooms.

Growing Health Consciousness Drives Consumers towards Nutrient-Rich Mushrooms:

Consumers are becoming increasingly aware of the health benefits associated with mushrooms. They are low in calories, fat-free, and rich in essential nutrients like vitamins, minerals, and antioxidants, making them a popular choice for health-conscious individuals.

Expanding Culinary Trends Diversify Palates and Increase Demand for New Varieties:

The growing popularity of diverse cuisines, particularly those from East Asia, is driving demand for a wider variety of mushroom types. This includes options like shiitake and oyster mushrooms, which are traditionally used in these culinary styles.

Improved Retail and Cold Chain Infrastructure Enable Wider Availability and Distribution:

The development of modern supermarkets and hypermarkets, along with improvements in cold chain infrastructure, facilitates better storage and distribution of fresh mushrooms, leading to increased availability and wider consumer reach.

Rising Demand for Functional Foods Positions Mushrooms as Health-Promoting Option:

Consumers are increasingly interested in foods that offer additional health benefits beyond basic nutrition. Mushrooms are gaining recognition for their potential health-promoting properties, such as boosting immunity and reducing inflammation, further driving market growth.

The Middle East and Africa Edible Mushroom Market Restraints and Challenges:

One major challenge lies in the short shelf life of fresh mushrooms. This poses logistical difficulties for transportation and storage, leading to spoilage and waste. Additionally, underdeveloped cold chain infrastructure in certain regions further restricts wider distribution and market penetration. Furthermore, limited consumer awareness and cultural perceptions towards mushrooms can act as a barrier. In some regions, the consumption of certain mushroom varieties might be unfamiliar or even discouraged due to cultural beliefs.

The market also faces competition from cheaper alternatives like traditional vegetables and legumes. Additionally, the relatively high cost of production compared to some conventional crops can limit affordability for certain consumer segments.

Finally, limited research and development in the region regarding advanced cultivation techniques and new mushroom varieties can hinder innovation and competitiveness in the global market. Addressing these challenges through improved storage and transportation facilities, raising consumer awareness through educational campaigns, and promoting the versatility and health benefits of mushrooms are crucial for sustained growth in the Middle East and Africa's edible mushroom market.

The Middle East and Africa Edible Mushroom Market Opportunities:

One key opportunity lies in capitalizing on the growing demand for diverse mushroom varieties. As consumer palates evolve and culinary trends diversify, catering to the increasing interest in shiitake, oyster, and other specialty mushrooms can be highly profitable. Furthermore, investing in innovative cultivation techniques that extend shelf life and improve yield can significantly address the challenge of short shelf life and optimize resource utilization. Additionally, developing efficient cold chain infrastructure in under-served regions can unlock new markets and facilitate wider distribution.

The rising demand for organic and sustainable food options presents another opportunity. By focusing on organic mushroom production and highlighting the environmental benefits of mushroom cultivation, businesses can tap into a growing segment of eco-conscious consumers.

Investing in consumer education and awareness campaigns can play a crucial role in overcoming cultural barriers and promoting the versatility and health benefits of mushrooms. This can involve collaborating with chefs, influencers, and educators to showcase the culinary applications and nutritional value of these delicious and nutritious fungi. Finally, exploring partnerships and collaborations with established players in the global market can provide valuable knowledge, technology transfer, and access to international distribution channels, propelling regional businesses towards sustainable growth and global competitiveness.

MIDDLE EAST AND AFRICA EDIBLE MUSHROOM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.11% |

|

Segments Covered |

By Product Type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Iran, UAE, Qatar, Oman, Iraq, Bahrain, Kuwait, Rest of Middle East |

|

Key Companies Profiled |

Costa Group, Okechamp S.A., Monterey Mushrooms Inc., Monaghan Mushrooms, Drinkwater's Mushroom Ltd., The Mushroom Company, Shanghai Finc Bio-Tech Inc., CMP Mushrooms |

The Middle East and Africa Edible Mushroom Market Segmentation:

Middle East and Africa Edible Mushroom Market Segmentation: By Product Type:

- Button mushrooms.

- Other varieties

Button mushrooms currently reign supreme in the Middle East and Africa's edible mushroom market, capturing around 80% of the share due to their familiarity and versatility. However, other varieties like shiitake and oyster mushrooms are experiencing the fastest growth, driven by the increasing popularity of diverse culinary trends and expanding palates.

Middle East and Africa Edible Mushroom Market Segmentation: By Application:

- Fresh consumption

- Food processing industry

- Nutraceutical and pharmaceutical applications

The dominant segment in the Middle East and Africa edible mushroom market by application is fresh consumption, accounting for around 70% of the market share. This is driven by the popularity of mushrooms in various culinary dishes. However, the nutraceutical and pharmaceutical applications segment is witnessing the fastest growth.

Middle East and Africa Edible Mushroom Market Segmentation: By Distribution Channel:

- Supermarkets and hypermarkets

- Convenience stores

- Specialty stores

- Online retail

Among distribution channels, supermarkets, and hypermarkets currently dominate the Middle East and Africa edible mushroom market due to their extensive reach and established infrastructure. However, online retail is experiencing the fastest growth.

Middle East and Africa Edible Mushroom Market Segmentation: Regional Analysis:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

United Arab Emirates (UAE): The UAE reigns supreme in the region, boasting the largest market share due to its affluent population, health-conscious consumers, and well-established retail infrastructure. Here, premium and diverse mushroom varieties like shiitake and oyster are increasingly popular, reflecting a growing appreciation for culinary exploration.

Saudi Arabia: Saudi Arabia holds immense potential with its large and growing market fuelled by rising disposable income and urbanization. However, the focus here primarily lies on fresh mushrooms, aligning with established consumer preferences and traditional culinary practices.

Qatar: An emerging market with exciting potential, Qatar's edible mushroom market is fuelled by its growing population and increasing awareness of the health benefits of mushrooms.

Israel: Israel stands out with its well-developed mushroom production and consumption culture, catering to both domestic and export markets. They are known for adopting innovative and sustainable cultivation techniques, setting a benchmark for the region.

South Africa: Leading the pack in Sub-Saharan Africa, South Africa enjoys a relatively mature market driven by its developed retail sector and growing consumer interest in healthy food options. While button mushrooms dominate, demand for other varieties is gradually rising.

COVID-19 Impact Analysis on the Middle East and Africa Edible Mushroom Market:

The COVID-19 pandemic painted a complex picture for the Middle East and Africa's edible mushroom market. While initial disruptions in supply chains, restaurant closures, and shifting consumer behavior posed challenges, the market also witnessed some positive developments.

On the negative side, lockdowns and movement restrictions hampered transportation and logistics, leading to supply shortages and price fluctuations. Additionally, the closure of restaurants and hotels significantly reduced demand from the hospitality sector. Furthermore, shifting consumer behavior, with initial panic buying followed by cautious spending, impacted overall market demand.

However, the pandemic also triggered some positive impacts. With people spending more time at home, there was a rise in demand for fresh ingredients like mushrooms for home cooking, benefiting certain market segments. Additionally, the heightened awareness of health and immunity during the pandemic potentially drove interest in the perceived health benefits of mushrooms. Finally, the surge in e-commerce grocery shopping offered a convenient alternative for consumers and facilitated market access for some players.

Latest Trends/ Developments:

The Middle East and Africa's edible mushroom market is brimming with exciting trends and developments. Consumers are increasingly seeking diverse and flavorful options beyond button mushrooms, driven by culinary exploration and growing awareness of unique health benefits offered by different varieties. Sustainability is gaining traction, with consumers favoring organically grown mushrooms and businesses adopting eco-friendly cultivation practices. Convenience remains key, leading to a rise in ready-to-eat and value-added products like pre-sliced and seasoned options. Innovation in packaging and shelf life extension techniques are being explored to address the challenge of short shelf life. Additionally, the surge of e-commerce platforms provides convenient access for consumers and wider market reach for producers. Finally, increasing investments and collaborations between local and international players foster knowledge sharing, technology transfer, and market expansion opportunities. These trends highlight the dynamic and promising future of the edible mushroom market in the Middle East and Africa.

Key Players:

- Costa Group

- Okechamp S.A.

- Monterey Mushrooms Inc.

- Monaghan Mushrooms

- Drinkwater's Mushroom Ltd.

- The Mushroom Company

- Shanghai Finc Bio-Tech Inc.

- CMP Mushrooms

Chapter 1. Middle East and Africa Edible Mushroom Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Edible Mushroom Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Edible Mushroom Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Edible Mushroom Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Edible Mushroom Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Edible Mushroom Market– By Product Type

6.1. Introduction/Key Findings

6.2. Button mushrooms.

6.3. Other varieties

6.4. Y-O-Y Growth trend Analysis By Product Type

6.5. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Middle East and Africa Edible Mushroom Market– By Application

7.1. Introduction/Key Findings

7.2. Fresh consumption

7.3. Food processing industry

7.4. Nutraceutical and pharmaceutical applications

7.5. Y-O-Y Growth trend Analysis By Application

7.6. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Middle East and Africa Edible Mushroom Market– By Distribution Channels

8.1. Introduction/Key Findings

8.2. Supermarkets & Hypermarkets

8.3. Convenience Stores

8.4. Online Retailers

8.5. Specialty Stores

8.6. Y-O-Y Growth trend Analysis By Distribution Channels

8.7. Absolute $ Opportunity Analysis By Distribution Channels , 2024-2030

Chapter 9 . Middle East and Africa Edible Mushroom Market, By Geography – Market Size, Forecast, Trends & Insights

9 .1. Middle East and Africa

9 .1.1. By Country

9 .1.1.1. Saudi Arabia

9 .1.1.2. Qatar

9 .1.1.3. UAE

9 .1.1.4. Israel

9 .1.1.5. South Africa

9 .1.1.6. Nigeria

9 .1.1.7. Kenya

9 .1.1.9 . Egypt

9 .1.1.9 . Rest of the Middle East

9.1.2. By Product Type

9.1.3. By application

9.1.4. Distribution Channels

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Middle East and Africa Edible Mushroom Market– Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

10.1. Costa Group

10.2. Okechamp S.A.

10.3. Monterey Mushrooms Inc.

10.4. Monaghan Mushrooms

10.5. Drinkwater's Mushroom Ltd.

10.6. The Mushroom Company

10.7. Shanghai Finc Bio-Tech Inc.

10.8. CMP Mushrooms

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Middle East and Africa Edible Mushroom Market was valued at USD 5 billion in 2023 and is projected to reach a market size of USD 8.63 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 8.11%.

Urbanization and Rising Disposable Income Fuel Demand for Convenient and Healthy Food Options, Growing Health Consciousness Drives Consumers Towards Nutrient-Rich Mushrooms, Expanding Culinary Trends Diversify Palates and Increase Demand for New Varieties, Improved Retail and Cold Chain Infrastructure Enable Wider Availability and Distribution, Rising Demand for Functional Foods Positions Mushrooms as Health-Promoting Option.

Supermarkets and hypermarkets, Convenience stores, Specialty stores, Online retail

The United Arab Emirates (UAE) currently holds the dominant position in the Middle East and Africa edible mushroom market due to its high disposable income, growing health consciousness, and established retail infrastructure

Costa Group, Okechamp S.A., Monterey Mushrooms Inc., Monaghan Mushrooms, Drinkwater's Mushroom Ltd., The Mushroom Company, Shanghai Finc Bio-Tech Inc., CMP Mushrooms