DevOps as a Service Market Size, Share, Growth Analysis (2023 – 2030)

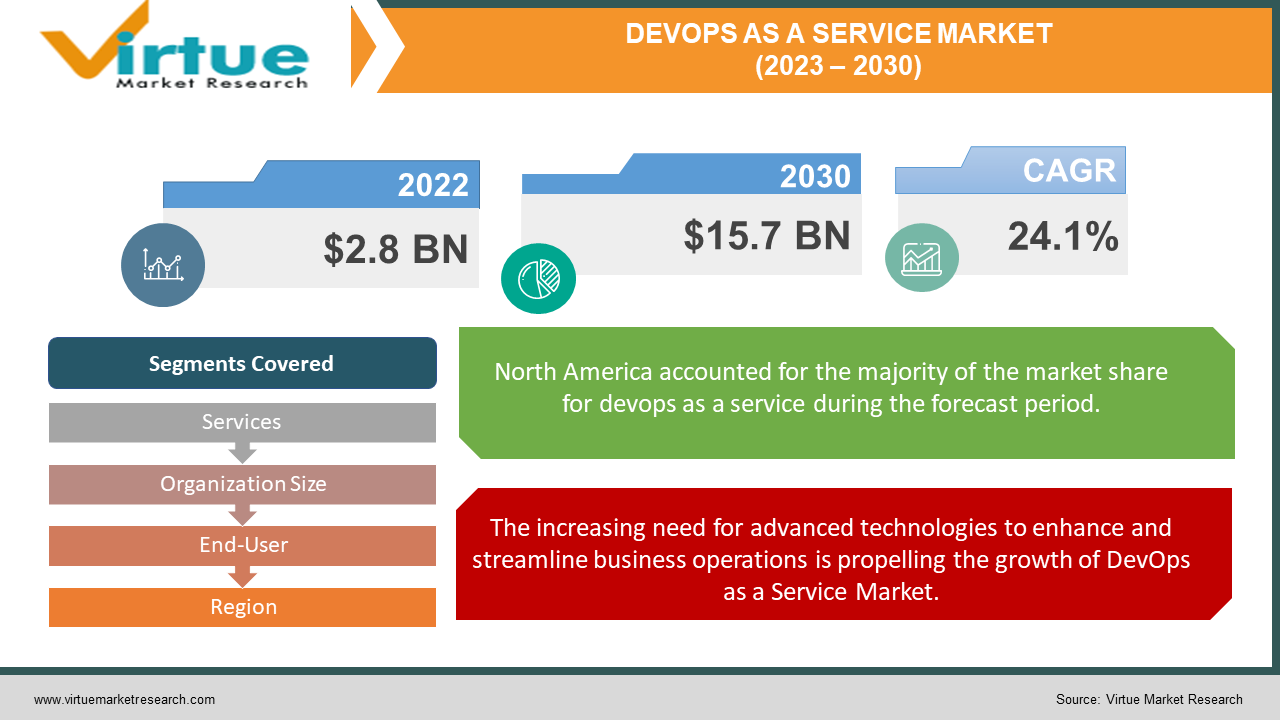

The Global DevOps as a Service Market was valued at USD 2.8 billion and is projected to reach a market size of USD 15.7 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 24.1%.

DOWNLOAD SAMPLE COPY OF THIS REPORT

DevOps as a Service (DaaS) is a cloud-based service model that provides organizations with a comprehensive set of tools, infrastructure, and expertise to support their DevOps practices and processes. DaaS is designed to streamline and simplify the implementation of DevOps principles, making it easier for companies to adopt and scale DevOps practices without the need to build and maintain their own DevOps toolchain and infrastructure.

This service model seamlessly integrates various tools, creating a unified approach that addresses different facets of the overall process. Instead of relying on individual specialized tools, the DevOps team leverages a consolidated toolset provided by the service.

The primary objective of DevOps as a Service is to meticulously monitor and track every step in the software delivery pipeline. This service model also ensures that organizations adhere to strategies like continuous delivery (CD) and continuous integration (CI), thereby enabling them to successfully achieve their desired business outcomes.

Additionally, when issues arise in the production environment, DevOps as a Service facilitates timely feedback to the development team, enabling swift resolution and fostering a culture of continuous improvement.

The DevOps market is poised for growth due to several factors, including the swift adoption of automated business processes across diverse industry sectors like government, healthcare, manufacturing, banking, and insurance. Additionally, the demand for continuous and rapid application delivery is on the rise, driven by the dynamic nature of today's IT environment and the applications operating within it. These factors are expected to play a significant role in driving the expansion of the DevOps market.

Key Market Insights:

The DevOps as a service market is poised for substantial growth, primarily driven by several key factors. The rapid adoption of automated business processes spans multiple industry verticals, including government, healthcare, manufacturing, banking, insurance, and more. Simultaneously, there is a growing demand for continuous and swift application delivery, a necessity in today's dynamic IT landscape with diverse applications. These factors are expected to play a pivotal role in accelerating the expansion of the DevOps as a service market.

Moreover, the increasing emphasis on improved productivity, streamlined workflows, the delivery of high-quality software, and cost-effective operations is expected to further fuel the growth of the DevOps market. Nevertheless, there is a challenge posed by the continued reliance on legacy processes, which may hinder the market's growth.

On the positive side, the emergence of advanced automated software development practices and the adoption of zero-touch technologies present lucrative opportunities for the DevOps as a Service market. These innovations promise to reshape the landscape by enhancing efficiency and reducing manual intervention, thus driving the adoption of DevOps services.

Global DevOps as a Service Market drivers:

The increasing need for advanced technologies to enhance and streamline business operations is propelling the growth of DevOps as a Service Market.

DevOps service technologies serve as vital platforms for businesses seeking to become agile, efficient, and responsive to the ever-changing demands of the market. These technologies hold a pivotal role in enhancing communication and collaboration among stakeholders, customers, IT operations, design, and business teams by removing barriers. Consequently, the increasing adoption of DevOps platforms by enterprises for automating software processes is expected to drive market growth in the foreseeable future.

Furthermore, there is a growing demand for rapid and continuous application delivery systems, which is anticipated to further boost market expansion in the forecast period. This anticipated growth can be attributed to the capabilities of DevOps service technologies to identify bottlenecks across applications, detect issues, optimize processes, and enable swift updates and faster deliveries. These factors are projected to propel the growth of the DevOps as a Service market in the coming years.

The adoption of Automated Software by the developing nations is fueling the market of DevOps as a Service.

The demand for automated software is on the rise, driven by the economic growth and industrialization occurring in developing nations. Countries like India, Brazil, Canada, Mexico, Russia, China, and others are anticipated to experience significant growth in the adoption of automated software.

As an illustration, in January 2019, Fidelity International Inc. employed a test automation framework to embrace a DevOps approach and implement an automated software release framework. This framework enabled them to adhere to the rollout schedule for their trading application. These innovations are expected to open up new opportunities for automated software, thereby increasing the demand for the DevOps market.

The continuous advancements in DevOps technologies present significant investment opportunities that contribute to the expansion of the DevOps market.

The continuous integration of cutting-edge technologies such as machine learning (ML) and artificial intelligence (AI) to create highly scalable and dependable DevOps platforms and solutions is expected to present significant growth opportunities for the global market in the foreseeable future.

For example, major technology players like Microsoft, IBM, and Google are actively exploring ways to innovate DevOps systems using ML, blockchain analysis, 5G, AI, quantum computing, and edge technologies for various purposes, including continuous deployment solutions, application performance testing, software testing and development forecasting, among others. These developments are poised to drive market growth in the coming years.

Global DevOps as a Service Market Opportunities:

The DevOps as a Service (DaaS) market is brimming with opportunities as organizations across various industries recognize the transformative potential of DevOps methodologies. One significant opportunity arises from the growing adoption of cloud-native technologies. DaaS providers are well-positioned to offer scalable and efficient solutions tailored for cloud-based DevOps workflows.

Additionally, the widespread adoption of microservices architectures and the increasing need for seamless orchestration only serve to bolster the demand for DaaS. Moreover, DaaS providers have the potential to enhance their services by integrating advanced security measures and compliance checks. This proactive approach aids organizations in reinforcing the security of their software development pipelines, aligning with the industry's growing emphasis on DevSecOps practices.

Furthermore, the ever-evolving landscape of IoT (Internet of Things) and edge computing presents yet another promising arena for DevOps as a Service to flourish. As the demand for swift deployment and management of edge devices and applications continues to rise, DaaS can play a pivotal role in streamlining the development and delivery of software to the edge.

DevOps as a Service market is brimming with opportunities driven by technological advancements, security concerns, emerging computing paradigms, and the overarching need for organizations to stay agile and competitive in the modern business landscape. All-in-all DevOps as a Service promises lucrative business endeavors during the coming years.

Global DevOps as a Service Market Restraints and Challenges:

As IT grapples with various cloud strategies, such as developing cloud-native applications, migrating legacy systems to the cloud, and embracing hybrid solutions, the demand for DevOps capabilities continues to surge. One pressing need is to bolster security measures associated with DevOps as a Service.

However, many organizations have encountered hurdles in implementing DevOps as a Service. These challenges encompass a shortage of skilled personnel, outdated infrastructure, and the evolving nature of corporate cultures. In essence, DevOps is a multifaceted endeavor that requires adaptable solutions to navigate the diverse cloud landscape while addressing security concerns. It also necessitates overcoming obstacles related to talent shortages, legacy systems, and evolving organizational dynamics.

DEVOPS AS A SERVICE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

24.1% |

|

Segments Covered |

By Services, Organization Size, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amazon Web Services, IBM Corporation, Google, Dell Technologies, GitLab, Atlassian Corporation, Oracle Corporation, CircleCI, Hewlett Packard Enterprise, VersionOne Inc. |

CUSTOMIZE THIS FULL REPORT AS PER YOUR NEEDS

SEGMENTATION ANALYSIS

Global DevOps as a Service Market Segmentation: By Services

-

Container Services

-

API Services

-

Professional Services

The container services segment is expected to hold the largest share in the market, making it the dominant segment. Containers play a crucial role in enabling the rapid development pace observed in the industry. Larger application deployments often rely on multiple containers organized as container clusters. Containers are gaining popularity among application development teams due to their flexibility and cost-efficiency.

Among the various segments, the managed service segment is forecasted to experience the highest growth rate and is positioned to capture a significant portion of market revenue throughout the forecast period.

Global DevOps as a Service Market Segmentation: By Organization Size

-

Large Enterprises

-

Small and Medium Enterprises

The market share in the DevOps sector is dominated by large enterprises, and this segment is also projected to exhibit a robust CAGR of 21.9% during the forecast period. Large enterprises were among the early adopters of DevOps practices, recognizing the potential to enhance quality and productivity, streamline processes, expedite time to market, and reduce IT operational costs. These organizations are expected to continue investing substantially in solutions that oversee the entire software development lifecycle, from development to operations, further driving market growth.

The small and medium enterprises (SMEs) segment is poised to experience the most rapid growth throughout the forecast period. SMEs have embraced DevOps platforms in significant numbers as they seek to compete effectively within their respective industries by strengthening their business operations. This widespread adoption by SMEs is anticipated to significantly contribute to market expansion in the coming years.

Global DevOps as a Service Market Segmentation: By End-User

-

Banking, Financial Services and Insurance

-

Telecommunication and IT Enabled Services

-

Retail

-

Healthcare

-

Manufacturing

-

Others

In 2022, the telecommunications and IT Enabled Services sector emerged as the dominant player in the market, capturing the largest share of market revenue at 26.3%. Several factors contribute to the growth of this segment, notably the emergence of advanced technologies such as virtual firewalls, traffic routing, and broadband remote server addresses, which have led to an increased demand for Continuous Integration/Continuous Delivery (CI/CD) solutions.

DevOps services are strategically employed to enhance overall company efficiency while remaining adaptable to evolving business demands. These services have proven effective in addressing the challenges encountered by the IT industry. Specifically, the IT sector has embraced DevOps services to automate various aspects of application development, testing, and operations processes, resulting in improved software quality, reduced delivery timelines, and an enhanced user experience.

Furthermore, the BFSI (Banking, Financial Services, and Insurance) market is emerging as the fastest-growing segment, projected to command a significant share of market revenue in the years ahead. This growth is attributed to the sector's handling of sensitive information, necessitating a focus on improving operational efficiency and security measures.

What's Next for Your Market? Get a Snapshot with FREE Sample Report

Global DevOps as a Service Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America has asserted its dominance in the DevOps as a Service market, commanding the highest market share in terms of revenue, which stood at approximately 47.5%. This trend is anticipated to continue its upward trajectory, further solidifying North America's position as a key player in the global market throughout the analysis period. The region's leadership in the industry can be primarily attributed to the presence of technologically advanced economies, notably the United States and Canada.

The United States, in particular, serves as a prominent innovation hub for emerging technologies, fostering an environment that encourages numerous enterprises to embrace DevOps services. Furthermore, intense competition within this region and the United States' concentration on application and software development are driving the adoption of DevOps platforms, expected to fuel market growth in the forthcoming years.

On the other hand, the Asia-Pacific DevOps as a Service market is poised for the highest CAGR during the forecast period. This growth is fueled by a surge in demand for automated software in countries like India, Japan, Singapore, and China.

COVID-19 Impact on the Global DevOps as a Service Market:

The outbreak of the COVID-19 pandemic brought about significant disruptions and posed unprecedented challenges across various industries and nations. However, it also had notable implications for the DevOps as a Service industry. During this period, there was a notable surge in demand for DevOps tools, driven by consumer preferences for digital platforms. Many software companies directed their focus toward in-demand technologies and explored innovative approaches to enhance their services for clients.

Additionally, the industry witnessed a growing number of collaborations and partnerships, involving both new entrants and established vendors, aiming to enhance work speed and flexibility in the evolving work environment. These developments had a positive impact on the market and are expected to contribute to its growth in the forecast period.

Latest Trends/ Developments:

The DevOps market is poised for substantial growth, primarily driven by several key factors. These include the rapid adoption of automated business processes across diverse industry verticals such as government, healthcare, manufacturing, banking, insurance, and others.

Additionally, there is a rising demand for continuous and swift application delivery. The market is further propelled by the increasing need for heightened productivity, streamlined workflows, the delivery of high-quality software, and cost-efficient operations.

The emergence of transformative technologies like Artificial Intelligence and Deep Learning are contributing to the expansion of the market as they harness the power to analyze vast datasets. They also play a significant role in automating repetitive tasks, enabling IT professionals to shift their focus towards more specialized roles.

Additionally, AI and DL aid in identifying patterns, predicting issues, and offering solutions. Furthermore, the growing popularity of the Internet of Things (IoT) has fostered increased interest in DevOps practices. This is due to the fact that the infrastructure and integrated applications associated with IoT are inherently interdependent, making DevOps an attractive approach for managing and optimizing IoT-related processes and systems.

Key Market Players:

-

Amazon Web Services

-

IBM Corporation

-

Google

-

Dell Technologies

-

GitLab

-

Atlassian Corporation

-

Oracle Corporation

-

CircleCI

-

Hewlett Packard Enterprise

-

VersionOne Inc.

- In September 2023, iTechGenic has partnered with Microsoft Azure and G7 CR Technologies, a subsidiary of Noventiq Company, as a participant in their STAB program for Independent Software Vendors (ISVs). This collaboration marks the launch of a pioneering platform designed to revolutionize the management of distributed teams and intricate development operations for engineering leaders and managers.

- In February 2023, GitLab Inc., a leading vendor in the DevOps platform space, has introduced a new feature called Cloud Seed in partnership with Google Cloud. This innovative feature is designed to streamline the process of purchasing and utilizing cloud services for developers. By collaborating with Google Cloud, GitLab aims to provide a seamless transition to the cloud for their customers. With Cloud Seed, organizations that use GitLab and Google Cloud can smoothly migrate to cloud infrastructure, simplifying their technology stack and expediting their cloud adoption journey.

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Chapter 1. DEVOPS AS A SERVICE MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. DEVOPS AS A SERVICE MARKET – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. DEVOPS AS A SERVICE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. DEVOPS AS A SERVICE MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. DEVOPS AS A SERVICE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. DEVOPS AS A SERVICE MARKET – By Services

6.1 Introduction/Key Findings

6.2 Container Services

6.3 API Services

6.4 Managed Services

6.5 Professional Services

6.6 Y-O-Y Growth trend Analysis By Services

6.7 Absolute $ Opportunity Analysis By Services, 2023-2030

Chapter 7. DEVOPS AS A SERVICE MARKET – By Organization Size

7.1 Introduction/Key Findings

7.2 Large Enterprises

7.3 Small and Medium Enterprises

7.4 Y-O-Y Growth trend Analysis By Organization Size

7.5 Absolute $ Opportunity Analysis By Organization Size, 2023-2030

Chapter 8. DEVOPS AS A SERVICE MARKET – By End-User

8.1 Introduction/Key Findings

8.2 Banking, Financial Services and Insurance

8.3 Telecommunication and IT Enabled Services

8.4 Retail

8.5 Healthcare

8.6 Manufacturing

8.7 Others

8.8 Y-O-Y Growth trend Analysis By End-User

8.9 Absolute $ Opportunity Analysis By End-User, 2023-2030

Chapter 9. DEVOPS AS A SERVICE MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Services

9.1.3 By Organization Size

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Services

9.2.3 By Organization Size

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Services

9.3.3 By Organization Size

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Services

9.4.3 By Organization Size

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Services

9.5.3 By Organization Size

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. DEVOPS AS A SERVICE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Amazon Web Services

10.2 IBM Corporation

10.3 Google

10.4 Dell Technologies

10.5 GitLab

10.6 Atlassian Corporation

10.7 Oracle Corporation

10.8 CircleCI

10.9 Hewlett Packard Enterprise

10.10 VersionOne Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global DevOps as a Service Market was valued at USD 2.8 billion and is projected to reach a market size of USD 15.7 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 24.1%.

The increasing need for advanced technologies to enhance and streamline business operations and investment opportunities are the market drivers.

Based on Organization size, the Global DevOps as a Service is segmented into Large Enterprises and Small and Medium Enterprises.

The United States of America is the most dominant country in the region of North America for the Global DevOps as a Service.

Amazon Web Service, IBM Corporation, Google, Dell Technologies, GitLab, Atlassian Corporation, Oracle Corporation, CircleCI, Hewlett Packard Enterprise, VersionOne Inc.