Data Center Market Size (2025-2030)

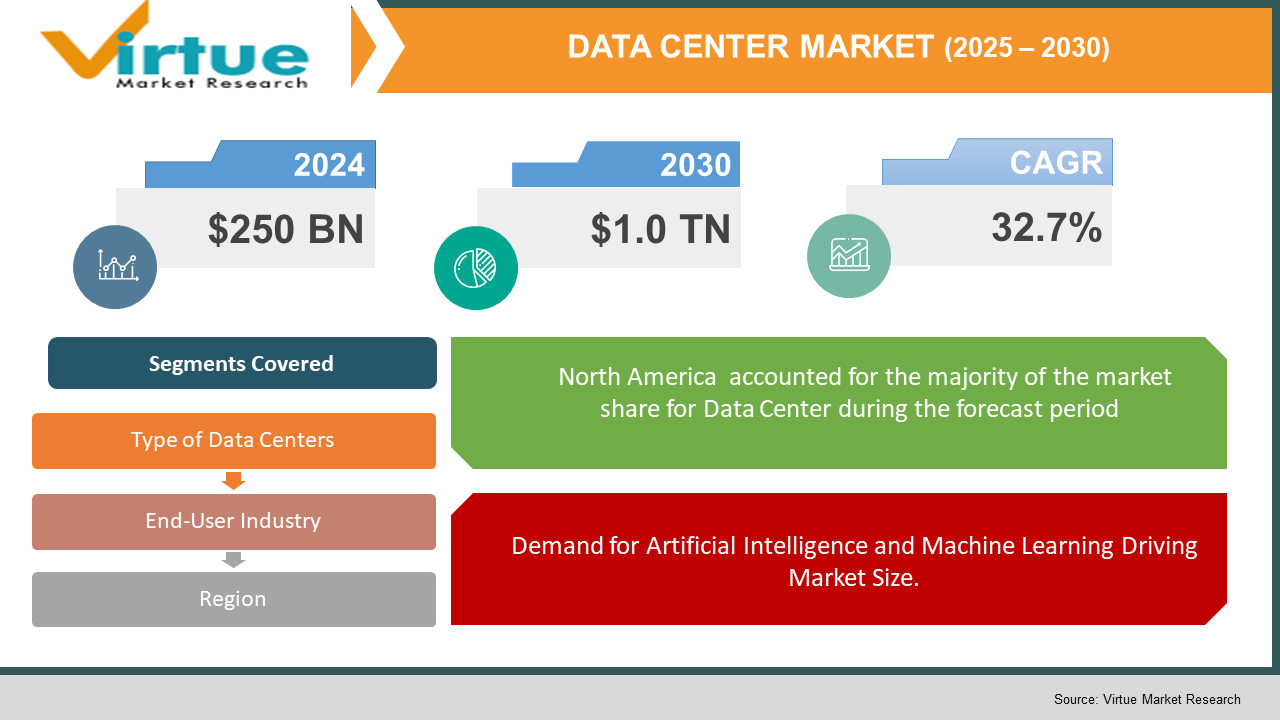

The Data Center Market was valued at USD 250 billion and is projected to reach a market size of USD 1.0 trillion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 32.7%.

The worldwide data centre market is experiencing fast growth, fueled by the rising consumption of cloud computing, artificial intelligence (AI), and the escalating requirement for data processing and storage. An increased GTM strategies has been witnessed in this market. As organisations and consumers increasingly depend on digital services, the demand for scalable and efficient data centres has never been more essential. Hyperscale data centres, especially those run by cloud titans such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, are at the forefront of addressing this demand. Moreover, the move towards edge computing and the emergence of AI workloads are having a profound impact on data centre architecture and capacity planning. The market is expected to be around USD 700 billion in 2030, with a significant boom in investments to come in the following years. North America continues to be the largest market, though growth is rapidly taking place in Asia-Pacific and Europe due to digital transformation and growing internet penetration. In Europe alone, electricity consumption in data centres is projected to triple by 2030, underscoring the importance of these facilities in powering energy-hungry technologies. The growing demand for AI and cloud services, coupled with evolving technologies, puts the data centre market at the forefront of the world's digital economy.

Key Market Insights:

- The emergence of AI and machine learning is heavily impacting the data centre industry. AI workloads will comprise almost 70% of overall data centre capacity by 2030, and AI applications are boosting the demand for high-performance computing and dedicated infrastructure. This growth is forcing data centres to invest in AI-capable hardware, such as GPUs and data storage solutions that are optimized for it.

- With the rise of environmental issues, data centres are heavily concentrating on sustainability. In a 2023 report, it is mentioned that close to 50% of data centres worldwide are making green commitments toward renewable sources of energy and are implementing liquid cooling technologies to cut down on energy usage. Energy efficiency is emerging as a differentiator, with organizations setting net-zero emission targets by 2030.

- Edge computing is growing fast, particularly to cater to the demand for quicker data processing closer to end-users. As of 2025, more than 75% of data will be created and processed beyond conventional data centres, and edge sites will be instrumental in this. The migration towards the edge is accelerating due to the increasing demand for low-latency applications in industries like self-driving cars, smart cities, and IoT devices.

- Supply chain shortages, especially the unavailability of key components such as semiconductors and specialized cooling systems, have hindered data centre builds in 2023 and 2024. This has resulted in increased lead times for new data centre construction, prompting the industry to look for substitute materials and construction methods in order to deploy more quickly.

- The rollout of 5G networks is driving the demand for localized data centres, as telecoms need infrastructure that can offer low latency and high-speed connectivity. More telecom operators as of late 2023 are integrating data centers with 5G infrastructure to support real-time applications such as virtual reality and augmented reality services. This will continue, and telecom-driven data centres will be more common.

Data Center Market Drivers:

Digital Transformation and Cloud Adoption Driving Market Growth.

The ongoing expansion of cloud services remains a major driver of the data centre market. In 2023, worldwide spending on public cloud reached $536 billion, and growth will continue as firms move faster with their digital transformation initiatives. Organizations are progressively moving applications to the cloud for versatility, elasticity, and expense savings, creating a tremendous need for data centre infrastructure to enable these services.

Demand for Artificial Intelligence and Machine Learning Driving Market Size.

The growth of AI and machine learning is propelling data centre expansion, especially with the enhanced adoption of AI-driven applications and models. According to 2024 estimates, AI workloads will represent 70% of all data centre capacity by 2030, leading to investment in dedicated hardware such as GPUs and high-end processors. Data centres are evolving their infrastructure to meet these compute- and memory-intensive applications with optimized storage and processing capabilities.

Edge Computing and IoT Expansion Driving Market Size.

The accelerated growth in the Internet of Things (IoT) and the growing requirement for low-latency services are driving the demand for edge computing. By 2025, 75% of data is expected to be processed outside of conventional data centres, with edge data centres offering localized infrastructure to enable real-time processing. Autonomous vehicles, healthcare, and manufacturing are particularly fueling the demand for edge data centres to enable the increasing number of connected devices.

Data Center Market Restraints and Challenges:

Supply Chain Disruptions in Electronics Limiting Market Growth.

The international data centre market has been confronted with considerable supply chain disruptions over the last few years, affecting the availability of key components such as semiconductors and cooling solutions. In 2023 and 2024, hardware delivery delays and rising costs have hampered the development of new facilities. These disruptions are compelling organizations to implement alternative sourcing strategies and redesign infrastructure in order to deploy on time.

Sustainability Issues and Energy Consumption Limiting Market Growth.

Data centres utilize enormous amounts of energy, causing governments and green groups to pile pressure on carbon footprint reductions. In 2023, the electricity consumption in data centres across Europe was forecasted to come close to triple by 2030, escalating the pressure to adopt more efficient solutions and environmentally friendly practices. Achieving net-zero emissions continues to be one of the largest challenges facing the industry in order to meet its sustainability targets.

Regulatory and Data Privacy Compliance Limiting Market Growth.

With increasing data privacy issues around the world, data centres are under pressure to adhere to strict regulations such as the EU's GDPR and equivalent legislation in other parts of the world. Adherence to these regulations is complicated and involves heavy investments in security, data storage, and operational procedures. Non-compliance risks such as fines and reputational loss, pose challenges to data centres, especially those with operations in multiple jurisdictions.

Data Center Market Opportunities:

The future of the data centre market presents a number of significant opportunities, led by the expansion of cloud computing, AI, and edge computing. As more companies shift to cloud environments, the need for scalable, flexible, and secure data centre services will continue to grow. The sudden growth of AI usage offers a big opportunity for data centres to make investments in purpose-built infrastructure, including GPUs and high-end processing, to accommodate AI workloads. Edge computing also offers an increasing opportunity, with sectors like IoT, autonomous vehicles, and healthcare demanding local data centres for low-latency processing. Also, as sustainability gains attention, there is an increasing demand for energy-efficient and green data centre solutions, such as renewable energy integration and new cooling technologies.

DATA CENTER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

32.7% |

|

Segments Covered |

By Type of Data Centers , End-User Industry , and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amazon Web Services (AWS), Microsoft Azure, Google Cloud, Equinix, Digital Realty, Alibaba Cloud, IBM Cloud, Oracle Cloud, CoreSite Realty Corporation, CyrusOne, etc. |

Data Center Market Segmentation:

Data Center Market Segmentation: by Type of Data Centers

- Enterprise Data Centers

- Colocation Data Centers

- Hyperscale Data Centers

The global data centre market is divided into three primary types: Enterprise Data Centers, Colocation Data Centers, and Hyperscale Data Centers. Enterprise data centres, which make up approximately 30% of the market, are owned and operated by individual companies for internal IT operations and are increasingly being replaced by outsourced solutions due to cost and scalability challenges.

Colocation data centres account for about 15-20% of the market and allow businesses to rent space, power, and cooling, providing them with flexibility without the overhead of owning and maintaining their own infrastructure. Hyperscale data centres, the largest segment with around 50% of the market share, are utilized by cloud service providers like Amazon Web Services, Microsoft Azure, and Google Cloud to support their massive data processing needs, offering unparalleled scalability and efficiency.

The hyperscale segment is the fastest-growing, driven by the rise in cloud computing, AI, and data analytics. Colocation data centres continue to grow as enterprises seek to offload infrastructure management while maintaining control over their IT operations. Despite the rise of cloud solutions, enterprise data centres remain critical for industries requiring high security and compliance, such as financial services.

Data Center Market Segmentation: by End-User Industry

- Cloud Service Providers

- Telecommunications

- IT & Technology

The data centre market is also segmented by end-user industry, with Cloud Service Providers, Telecommunications, and IT & Technology sectors as the key contributors. Cloud service providers account for approximately 40% to 45% of the market, driven by the increasing reliance on cloud platforms for storage, computing, and network services, with major players such as AWS and Microsoft Azure dominating this segment.

Telecommunications companies, which represent about 10% to 15% of the market, are expanding their data center infrastructure in line with the growing demand for 5G and edge computing, offering localized data processing to improve network performance.

The IT & Technology sector, contributing roughly 25% to 30% of the market, includes industries like finance, healthcare, and e-commerce, all of which rely heavily on data centres to store and process large volumes of sensitive data. As businesses in this sector continue their digital transformation, the demand for more advanced, secure, and scalable data centre solutions will increase. Cloud service providers lead the way in scaling data centre operations to meet the demands of global users and applications. Telecommunications and IT & technology companies are increasingly focusing on hybrid and multi-cloud solutions to optimize their data and network management capabilities.

Data Center Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

The worldwide data centre market is heavily influenced by regional forces, with North America dominating the market at around 40% to 45%, led by the presence of key cloud service providers such as Amazon, Microsoft, and Google, and strong demand for cloud services and AI technologies.

Asia-Pacific is next with about 30% to 35% of the market, driven by fast-paced digital growth, growth of cloud infrastructure, and growing internet penetration across China, India, and Japan.

Europe takes about 20% to 25% of the market where data centres are expanding due to growing demand for cloud services, tough data protection laws such as GDPR, and a move towards sustainability in energy consumption.

South America commands a smaller percentage, at 5% to 7%, but is experiencing more investment in data centres as sectors like e-commerce, banking, and telecommunications are experiencing digital growth.

Middle East and Africa account for approximately 5% to 6% of the market, with the region growing due to the establishment of smart cities, government-sponsored efforts, and growing dependency on cloud solutions across the UAE and Saudi Arabia.

North America is at the forefront of technology innovation and data centre growth, but Asia-Pacific's high growth rate makes it a prime region for future growth. With cloud services and digital infrastructures expanding worldwide, Europe will be likely to emphasize green and energy-efficient data centre solutions to address demand and regulatory imperatives. Meanwhile, South America, the Middle East, and Africa will continue to exhibit slow growth through regional tech developments and increasing foreign investment.

Article: Transformers Aren’t “Just Equipment” Anymore: They’re a Strategic Chokepoint

COVID-19 Impact Analysis on the Global Data Center Market:

The pandemic of COVID-19 pandemic deeply influenced the data centre sector with both challenges and opportunities. Following the worldwide migration towards remote working, online services, and online commerce, demand for cloud computing, data storage, and information technology infrastructure picked up pace, prompting data centres to scale their capacity to manage rising traffic and workload. Yet, the pandemic also caused supply chain disruptions, which resulted in delays in building new data centres and the shipment of essential hardware, including servers and cooling systems. In spite of these issues, the sector experienced rapid digital transformation across industries, with companies quickly embracing cloud and edge computing technologies to enable remote work. The greater dependence on cloud services and data-driven technologies also further emphasized the demand for resilient, scalable infrastructure, leading to an investment surge in data centres. Additionally, COVID-19 emphasized the significance of resilient, agile data centre operations, with operators improving disaster recovery strategies and investing in automation to ensure uptime and reduce human intervention.

Latest Trends/ Developments:

The market for data centres is experiencing a number of major trends through 2023 and 2024. One major trend is the increased adoption of edge computing, fueled by intensifying demand for low-latency services, particularly in verticals such as autonomous vehicles and IoT. Sustainability is also an important concern, with numerous data centres pledging 100% renewable power and big players such as Google and Microsoft pushing towards net-zero emissions by 2030. The emergence of artificial intelligence (AI) is driving the upgrade in infrastructure in data centres, especially with the need for high-performance GPUs and specialty processors to support AI workloads. Moreover, the continued rollout of 5G networks is forcing telecom providers to construct more localized edge data centres, enhancing real-time processing and decreasing latency. Lastly, data privacy legislation, including the GDPR and emerging U.S. state-level data legislation, is causing data centres to enhance their compliance functions, adding cost and complexity to operations but also opportunities for those that can fulfil the regulatory requirements.

Key Players:

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud

- Equinix

- Digital Realty

- Alibaba Cloud

- IBM Cloud

- Oracle Cloud

- CoreSite Realty Corporation

- CyrusOne

Chapter 1. DATA CENTER MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. DATA CENTER MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. DATA CENTER MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. DATA CENTER MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. DATA CENTER MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. DATA CENTER MARKET – By Type of Data Centers

6.1 Introduction/Key Findings

6.2 Enterprise Data Centers

6.3 Colocation Data Centers

6.4 Hyperscale Data Centers

6.5 Y-O-Y Growth trend Analysis By Type of Data Centers

6.6 Absolute $ Opportunity Analysis By Type of Data Centers , 2025-2030

Chapter 7. DATA CENTER MARKET – By End-User Industry

7.1 Introduction/Key Findings

7.2 Cloud Service Providers

7.3 Telecommunications

7.4 IT & Technology

7.5 Y-O-Y Growth trend Analysis By End-User Industry

7.6 Absolute $ Opportunity Analysis By End-User Industry , 2025-2030

Chapter 8. DATA CENTER MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End-User Industry

8.1.3. By Type of Data Centers

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type of Data Centers

8.2.3. By End-User Industry

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type of Data Centers

8.3.3. By End-User Industry

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type of Data Centers

8.4.3. By End-User Industry

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type of Data Centers

8.5.3. By End-User Industry

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. DATA CENTER MARKET– Company Profiles – (Overview, Packaging Type Portfolio, Financials, Strategies & Developments)

9.1 Amazon Web Services (AWS)

9.2 Microsoft Azure

9.3 Google Cloud

9.4 Equinix

9.5 Digital Realty

9.6 Alibaba Cloud

9.7 IBM Cloud

9.8 Oracle Cloud

9.9 CoreSite Realty Corporation

9.10 CyrusOne

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Data Center Market was valued at USD 250 billion and is projected to reach a market size of USD 1.0 trillion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 32.7%.

Digital Transformation and Cloud Adoption, Demand for Artificial Intelligence and Machine Learning, and Edge Computing and IoT Expansion are some of the key market drivers in the Data Center Market.

Enterprise Data Centers, Colocation Data Centers, and Hyperscale Data Centers by Data Centre Type in the Data Center Market.

North America is the most dominant region for the Global Data Center Market.

Amazon Web Services (AWS), Microsoft Azure, Google Cloud, Equinix, Digital Realty, Alibaba Cloud, IBM Cloud, Oracle Cloud, CoreSite Realty Corporation, CyrusOne, etc.