Modular Data Center Market Size (2025 – 2030)

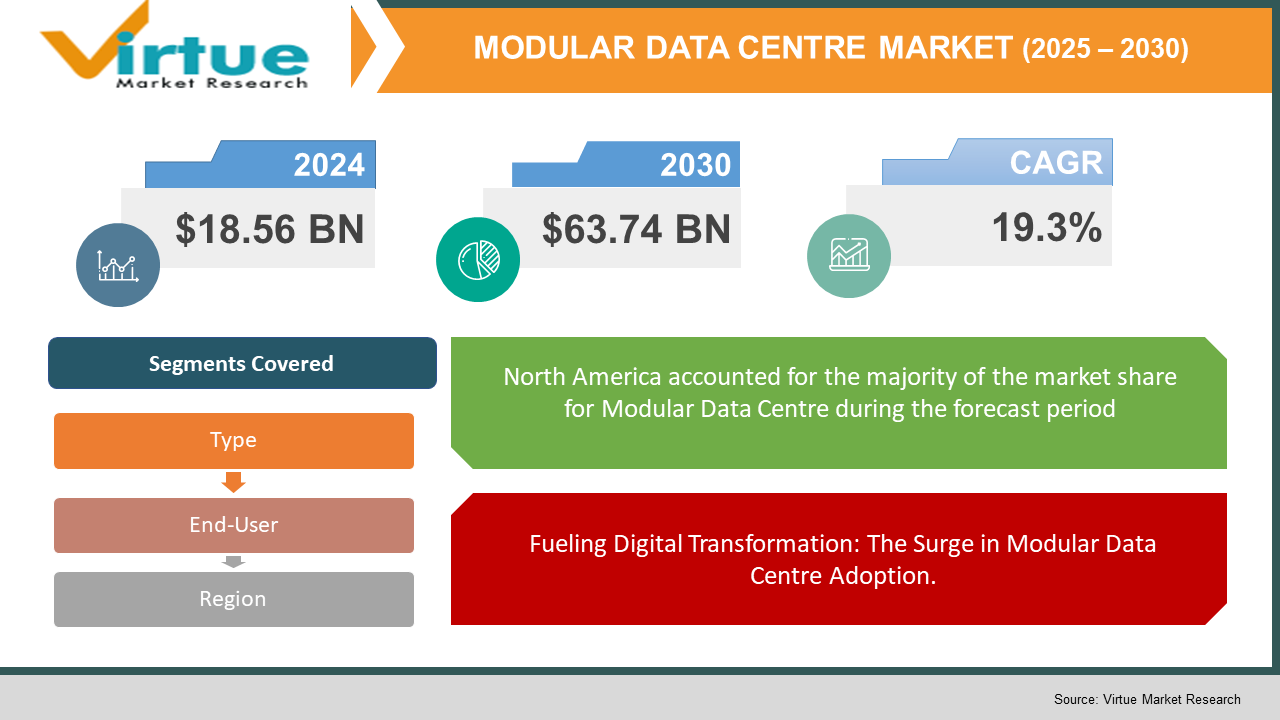

The Modular Data Centre Market was valued at USD 18.56 billion and is projected to reach a market size of USD 63.74 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 19.3%.

Modular Data Centres represent a revolutionary approach to data centre infrastructure, offering prefabricated, standardized components that can be rapidly deployed and scaled as needed. These solutions have emerged as a critical innovation in the digital infrastructure landscape of the 21st century, addressing traditional data centre limitations through portable, flexible designs. With the continuous evolution of this sector, demand for modular solutions that enable faster deployment, energy efficiency, and cost optimization is rising steadily across industries.

Key Market Insights:

- According to research conducted by the Data Centre Infrastructure Management Association in 2022, organizations implementing modular data centre solutions reported average deployment times of 3-6 months compared to 18-24 months for traditional builds, representing an 85% reduction in time-to-market for critical computing resources.

- A comprehensive industry survey among 500 IT decision-makers revealed that 76% of enterprises deploying modular data centres achieved between 25-40% cost savings compared to traditional construction methods, with prefabricated solutions eliminating many of the variables and delays associated with conventional building approaches.

- Energy efficiency metrics collected from 150 operational facilities indicate modular data centres consistently deliver 28% better power usage effectiveness (PUE) ratings compared to industry averages, with the most advanced implementations achieving PUE values as low as 1.08 versus the industry standard of 1.67 for conventional facilities.

- The flexibility of modular deployment has proven particularly valuable for capacity planning, with 82% of surveyed organizations reporting improved alignment between infrastructure investment and actual computing requirements, reducing overprovisioning by 34% and improving capital efficiency by approximately 27% according to financial performance indicators.

Modular Data Centre Market Drivers:

Fueling Digital Transformation: The Surge in Modular Data Centre Adoption.

Organizations across sectors are facing increasingly unpredictable digital transformation timelines, making traditional data centre construction cycles of 18-24 months increasingly untenable for competitive operations. Modular solutions address this challenge directly by reducing deployment times by up to 85%, with typical implementations completed in 3-6 months from initial order to operational status. This dramatic improvement in time-to-market provides substantial competitive advantages for organizations experiencing rapid growth or responding to emerging market opportunities. The economic benefits further enhance the appeal of modular approaches, with standardized manufacturing processes reducing overall capital expenditure by 25-40% compared to traditional construction. These savings result from factory-based quality control, optimized supply chains, and the elimination of many on-site construction variables that frequently cause budget overruns in conventional projects. The engineering standardization inherent in modular design also significantly reduces operational complexity, with 67% of organizations reporting improved maintenance efficiency and 43% lower staffing requirements for routine operations. Additionally, the scalability aspects of modular architecture allow organizations to implement a pay-as-you-grow strategy, enabling capacity expansion in precise increments that match actual computing demands rather than requiring speculative overprovisioning. This capability has proven particularly valuable in volatile markets, with organizations reporting 27% improvements in capital utilization efficiency.

The convergence of edge computing requirements and emerging technologies is creating powerful new drivers for modular data centre adoption.

As organizations implement distributed computing architectures to reduce latency and improve application performance, the standardized nature of modular solutions provides ideal building blocks for consistent edge deployments. Industry research indicates that 73% of organizations implementing edge strategies prefer modular infrastructure for its consistency and predictability across diverse geographical locations. The standardization inherent in modular designs ensures identical operational characteristics regardless of location, with 65% of organizations reporting significant reductions in management complexity for distributed infrastructure. Additionally, modern modular solutions increasingly incorporate specialized configurations optimized for artificial intelligence and machine learning workloads, with designs featuring liquid cooling capabilities that support processor densities up to 50kW per rack – a critical requirement for compute-intensive applications that exceed the capabilities of traditional air-cooled environments.

Modular Data Centre Market Restraints and Challenges:

Transport issues are a primary concern for the Modular data centre, along with regulations that allow limited flexibility.

Despite significant advantages, modular data centre adoption faces several notable obstacles. Transportation logistics present significant challenges, with module dimensions restricted by highway regulations and shipping constraints, limiting design flexibility. These restrictions can force architectural compromises, particularly for deployments requiring specialized configurations or in locations with challenging access conditions. Initial customization capabilities are frequently more limited compared to traditional construction, with 58% of organizations reporting some constraints in tailoring modular solutions to specific technical requirements. Permitting and regulatory frameworks designed for conventional construction often lack appropriate processes for modular facilities, with 43% of projects experiencing delays related to compliance approvals. The perception of modular solutions as temporary or inferior sometimes persists among conservative stakeholders, with 37% of IT leaders indicating resistance from organizational decision-makers despite compelling technical and financial advantages.

Modular Data Centre Market Opportunities:

The evolving landscape of digital infrastructure presents exceptional opportunities for modular data centre innovation and market expansion. The explosive growth of edge computing deployments creates natural alignment with modular solutions that ensure consistent implementation across diverse geographical locations. Advanced sustainability requirements are driving the development of next-generation modular systems with integrated renewable energy capabilities, including direct DC power systems that improve efficiency by 14% compared to traditional AC architectures. The increasing specialization of computing workloads has created demand for purpose-built modules optimized for specific applications, with AI-focused configurations commanding premium pricing 35% above standard modules. The shift toward hybrid infrastructure strategies is creating opportunities for modular solutions that facilitate seamless integration between on-premises and cloud environments. Developing markets present particularly significant expansion potential, with 67% of organizations in regions with limited existing infrastructure preferring modular approaches for rapid capability deployment.

MODULAR DATA CENTRE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

19.3% |

|

Segments Covered |

By Type, End user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hewlett Packard Enterprise, Dell Technologies, Cisco Systems, IBM Corporation, and Schneider Electric |

Modular Data Centre Market Segmentation:

Modular Data Center Market Segmentation: By Type

- Functional Module

- Performance-optimized Module

On decent data, based on type, the performance-optimized module segment dominated with approximately 63% market share and continues to lead the market. These sophisticated modules incorporate advanced cooling technologies, high-density power distribution, and optimized airflow management systems that deliver superior operational efficiency compared to standard modules. Leading vendors report demand for these specialized solutions has increased 47% year-over-year as organizations prioritize operational excellence over initial acquisition costs.

The functional module segment accounts for 36.5% of the market and serves organizations seeking standardized solutions that can be rapidly deployed with minimal customization requirements. This segment demonstrates particularly strong growth in edge computing applications, with 58% of deployments supporting distributed computing strategies rather than centralized facilities. The simplicity and reliability of these solutions make them ideal for organizations with limited specialized technical resources, particularly in emerging markets experiencing digital infrastructure expansion.

Modular Data Center Market Segmentation: By End-User

- BFSI

- IT & Telecom

- Government

- Healthcare

- Others

The IT & Telecom sector dominated the market with approximately 32.6% share, reflecting the sector's intensive infrastructure requirements and continuous expansion cycles. Telecommunications providers have been particularly aggressive in adopting modular solutions, with 78% implementing standardized edge deployments to support 5G infrastructure expansion. Cloud service providers leverage modular approaches for rapid capacity expansion, with an average deployment time of 4.2 months compared to 22 months for traditional construction methods.

The BFSI (Banking, Financial Services, and Insurance) sector represents 24.8% of the market and demonstrates strong growth driven by increasing regulatory requirements for data sovereignty and disaster recovery capabilities. Financial institutions report a 42% improvement in regulatory compliance verification for modular deployments compared to traditional facilities, largely due to the standardized documentation and certification processes enabled by factory construction. The sector's emphasis on business continuity and operational resilience aligns perfectly with the predictable performance characteristics and rapid deployment capabilities of modular solutions.

Modular Data Center Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

The North American region dominated the global modular data centre market with a revenue share of 36.2%. This leadership position reflects the region's advanced digital infrastructure requirements and early adoption of innovative deployment methodologies. The United States alone hosts 43% of global hyperscale capacity, with modular solutions increasingly utilized for both expansion of existing facilities and new deployments. Industry reports indicate 65% of new data centre capacity added in 2022 incorporated some form of modular construction, representing a 23% increase from 2020 levels.

The Asia-Pacific region is anticipated to grow at the fastest rate of approximately 24.1% during the forecast period. This exceptional growth is driven by rapid digital transformation initiatives across developing economies, with particular strength in India, where data centre capacity is projected to triple by 2028. China's digital infrastructure expansion continues at an unprecedented pace, with 37% of new facilities utilizing modular approaches to accelerate deployment. The region's challenging climate conditions are driving innovation in specialized cooling technologies, with 58% of modular deployments incorporating advanced thermal management systems optimized for high-temperature, high-humidity environments.

COVID-19 Impact Analysis on the Global Modular Data Centre Market:

The COVID-19 pandemic significantly accelerated the adoption of modular data centre solutions as organizations scrambled to expand digital infrastructure capacity in response to remote work requirements and accelerated digital transformation initiatives. The crisis exposed the limitations of traditional construction approaches, with 72% of conventional data centre projects experiencing substantial delays due to workforce restrictions, supply chain disruptions, and site access limitations. In contrast, modular solutions demonstrated remarkable resilience, with 84% of projects maintaining delivery schedules within three weeks of pre-pandemic projections due to the controlled factory environment and reduced on-site labour requirements. The pandemic permanently shifted organizational perspectives regarding infrastructure agility, with 78% of IT decision-makers reporting increased prioritization of deployment speed and operational flexibility in their infrastructure planning. This shift in priorities has established modular approaches as a strategic advantage rather than merely a tactical option, with 63% of organizations incorporating modular solutions into their formal technology roadmaps versus just 36% pre-pandemic.

Trends/Developments:

The modular data centre sector is experiencing rapid innovation in liquid cooling technologies, with immersion and direct-to-chip solutions increasingly integrated into standard modules to support the extreme power densities required by AI and high-performance computing applications.

Advanced prefabrication techniques are revolutionizing deployment capabilities, with vendors including Vertiv and ABB introducing ultra-rapid deployment modules that can be operational within 12 weeks of order placement.

Microsoft recently announced its "Circular Centres" initiative, incorporating modular data centre components designed for 90% material recovery and repurposing, while Schneider Electric launched EcoStruxure Modular Data Centre solutions featuring enhanced energy efficiency that reduces carbon footprint by 35% compared to previous generations.

Key Players:

- Hewlett Packard Enterprise

- Dell Technologies

- Cisco Systems

- IBM Corporation

- Huawei Technologies

- Schneider Electric

- Vertiv Group

- Rittal GmbH

- Eaton Corporation

- BladeRoom Group

- Cannon Technologies

- CommScope

Chapter 1. MODULAR DATA CENTRE MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. MODULAR DATA CENTRE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. MODULAR DATA CENTRE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. MODULAR DATA CENTRE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. MODULAR DATA CENTRE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MODULAR DATA CENTRE MARKET – By Type

6.1 Introduction/Key Findings

6.2 Functional Module

6.3 Performance-optimized Module

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. MODULAR DATA CENTRE MARKET – By End-User

7.1 Introduction/Key Findings

7.2 BFSI

7.3 IT & Telecom

7.4 Government

7.5 Healthcare

7.6 Others

7.7 Y-O-Y Growth trend Analysis By End-User

7.8 Absolute $ Opportunity Analysis By End-User , 2025-2030

Chapter 8. MODULAR DATA CENTRE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End-User

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By End-User

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By End-User

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By End-User

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By End-User

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. MODULAR DATA CENTRE MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 Hewlett Packard Enterprise

9.2 Dell Technologies

9.3 Cisco Systems

9.4 IBM Corporation

9.5 Huawei Technologies

9.6 Schneider Electric

9.7 Vertiv Group

9.8 Rittal GmbH

9.9 Eaton Corporation

9.10 BladeRoom Group

9.11 Cannon Technologies

9.12 CommScope

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Modular Data Centre Market was valued at USD 18.56 billion and is projected to reach a market size of USD 63.74 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 19.3%.

. The escalating demand for rapid deployment capabilities, enhanced flexibility in data infrastructure, and the convergence of edge computing requirements are propelling the global modular data centre industry.

Based on Component, the Global Modular Data Centre Market is segmented into Solution and Services

North America is the most dominant region for the Global Modular Data Centre Market.

Hewlett Packard Enterprise, Dell Technologies, Cisco Systems, IBM Corporation, and Schneider Electric are the key players operating in the Global Modular Data Centre Market