Green Data Center Market Size (2025 – 2030)

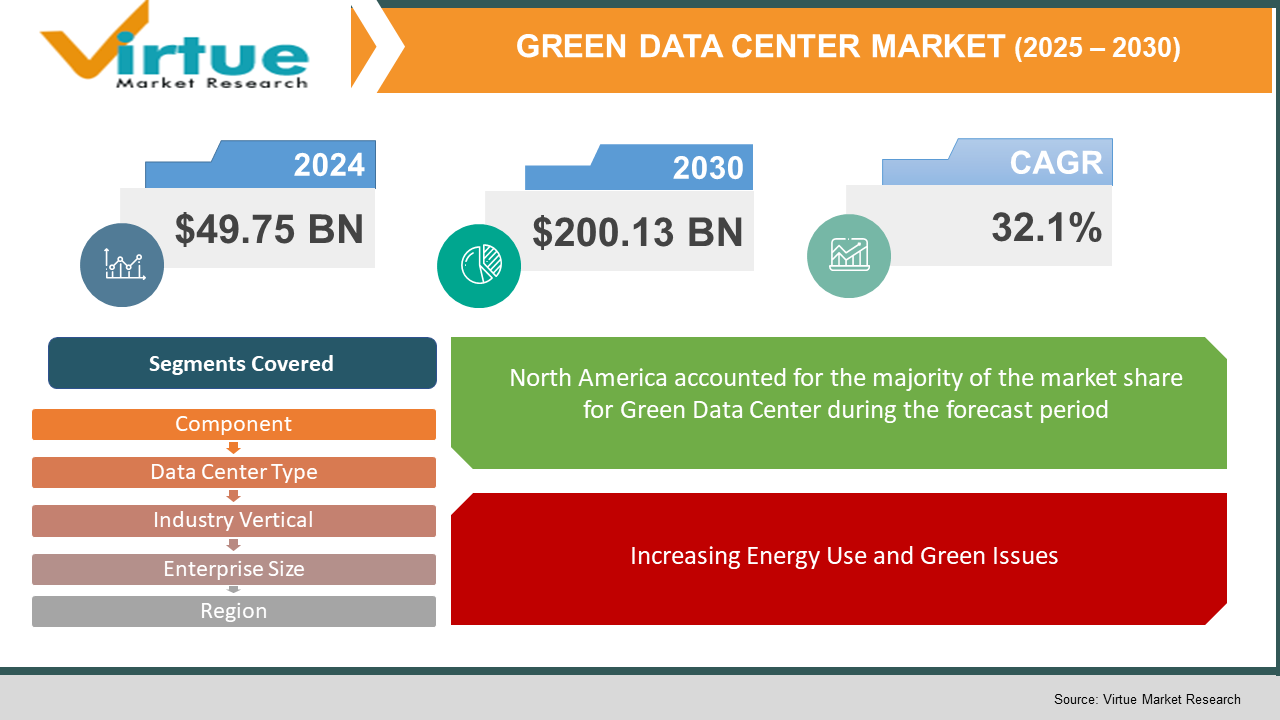

The Green Data Center Market was valued at $49.75 billion and is projected to reach a market size of $200.13 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 32.1%.

The term Green Data Center Market is used to denote the market for the design and implementation of data centers that employ power-saving technology to reduce environmental footprints. Data centers are created to store, process, and disseminate data with lower power consumption and diminished carbon footprints. Green data centers employ innovative technology like advanced UPS systems, power-efficient servers, and green cooling solutions to maximize energy efficiency. As opposed to the conventional arrangements, they eschew old systems and focus on resource-compliant infrastructure. Organizations in different parts of the world are turning more toward green data center solutions within their sustainability programs in an attempt to lower operational expenses and comply with regulatory requirements. As the demand for storage continues to grow, deployment of brighter power and cooling systems has been a significant trend. Certain data centers are even looking into alternative sources of energy such as hydrogen to meet new global sustainability standards. In general, the market is picking up pace with increasing environmental awareness, improved green technologies, and favorable government policies. The application of proven research methodologies has enabled the identification of key drivers, opportunities, and regional dominance, and thus the green data center market is a strategic option for a greener digital future.

Key Market Insights:

- The green data center market is highly competitive, with a combination of domestic and international competitors. Although the market is moderately concentrated, the key players are highly focused on product innovation and strategic mergers and acquisitions to protect and increase market share.

- In November 2022, SB Energy Global collaborated with Google to supply 942 MW of renewable power to fuel Google's data centers in Texas. Under the deal, four massive solar projects (1.2 GW total) with 75% of energy will come online by mid-2024, supporting Google's clean energy aspirations in the region.

- Volkswagen AG pledged to achieve net carbon neutrality in its data center operations by 2027. Volkswagen collaborated with Green Mountain, a Norwegian CO₂-neutral data center operator, using 100% hydropower-based renewable electricity and natural fjord cooling to minimize emissions and sustainably grow computing capacity.

- In January 2020, At the World Economic Forum Annual Meeting, a coalition of industry and academic representatives launched the Swiss Data Center Efficiency Label with the first objective to decarbonize data centers in Switzerland and drastically lower their total energy consumption. Launched by industry organizations Digital Switzerland and HPE, the partnership has established the Swiss Datacenter Efficiency Association (SDEA) as an owner of the evaluation and award procedure for the label. The project is promoted by the Swiss Federal Office of Energy in the context of the Swiss Energy program.

Green Data Center Market Key Drivers:

From Power-Hungry to Power-Smart: The Green Data Center Evolution

Increasing Energy Use and Green Issues.

The high growth of digital technologies such as cloud computing, artificial intelligence (AI), and big data has caused a huge upsurge in data center power consumption. Conventional data centers have high energy consumption and carbon output, which is a source of environmental degradation. This has brought about the need to seek sustainable practices, leading organizations to embrace green data centers that consume power-efficient technologies and green energy to reduce their carbon footprint.

Strict Government Regulations and Sustainability Efforts.

Governments across the globe are enforcing strict environmental regulations to address climate change and ensure sustainability. Initiatives like the European Green Deal focus on achieving climate neutrality by 2050, which urges industries to go green. As a result, companies are investing in green data centers to meet these regulations and adhere to global sustainability efforts, thus improving their corporate social responsibility image.

Integration of Next-Generation Technologies for Increased Efficiency.

Integration of innovative technologies such as AI and ML in the data center function is transforming power management and operating efficiency. Systems that use AI can improve cooling and power consumption, forecast maintenance, and lower energy usage overall. Not only is this technology working toward environmental ends but it also economically attractive savings, giving green data centers an economically affordable answer for enterprises.

Green Data Center Market Restraints and Challenges:

Overcoming the Challenges in the Green Data Center Market.

The shift to green data centers is crucial for environmentally friendly digital infrastructure, yet there are various challenges to sustainable implementation. One of the key challenges is the high upfront investment needed for incorporating energy-saving technologies and green energy sources. Constructing or refurbishing buildings with sophisticated cooling equipment, energy-efficient servers, and integrated renewable power requires substantial funds, which might be out of reach, particularly for small- to medium-sized businesses. Second, the integration of green technology is complex and raises issues related to compatibility. The process of making new green systems compatible with legacy infrastructure necessitates careful planning and technical skills, which are not always present in all companies. In addition, the swift expansion of data centers due to the advancements in artificial intelligence and cloud computing has resulted in a higher energy demand. In countries such as Ireland, data centers have contributed to 21% of the country's electricity consumption in 2023, which is causing concerns over energy sustainability and grid capacity. Such spikes in energy needs can put pressure on current power grids and even require dependency on non-greens and may offset some of the advantages of green data centers to the environment. Strategically investing in, supporting policy-wise, and technologically addressing these issues could make green data centers more prevalent and efficient.

Green Data Center Market Opportunities:

Unlocking Growth and Emerging Opportunities in the Green Data Center Market.

The green data center market is on the verge of significant growth, fueled by several compelling opportunities that complement global sustainability initiatives and technological innovations. The growing availability and cost-effectiveness of renewable energy sources, including solar, wind, and hydroelectric power, represent a major opportunity for data centers to lower operating expenses and carbon emissions by adopting these clean energy solutions. In addition, the fast pace of innovation in energy-efficient technologies such as AI-powered cooling solutions and smart energy management allows data centers to maximize performance while reducing environmental footprint. Governments and regulatory bodies across the globe are also promoting green data centers with financial incentives and support in terms of policies for organizations that build green infrastructure. In addition, increasing corporate social responsibility and green movement demands are making companies move toward green data centers, building a better brand image, and satisfying their stakeholders. These combined drivers represent fertile ground for the growth and development of the green data center market that has environmental payoffs and financial benefits for forward-looking organizations.

GREEN DATA CENTRE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

32.1% |

|

Segments Covered |

By DATA CENTRE TYPE, component, industry vertical, enterprise size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Schneider Electric SE, Vertiv Holdings Co., Hewlett Packard Enterprise (HPE), Cisco Systems, Inc., Dell Technologies Inc, IBM Corporation, Fujitsu Ltd., Huawei Technologies Co., Ltd., Eaton Corporation plc, Digital Realty Trust, Inc. |

Green Data Center Market Segmentation:

Green Data Center Market Segmentation: By Component

- Solutions

- Services

With the changing picture of green data centers, services are growing at the fastest pace. With companies ever-increasingly focusing on sustainability, specialized services like system integration, maintenance, and consulting are in great demand. Such services are essential to properly implement and maintain energy-saving technologies for data centers. It takes a professional hand to adopt green solutions smoothly and at their best performance. Therefore, the services segment is expected to record a high compound annual growth rate (CAGR) over the next few years, mirroring its critical role in enabling the shift towards eco-friendly data center operations.

On the other hand, the solutions segment continues to be the leading segment in the green data center market. This area includes critical technologies, such as energy-efficient power systems, enhanced cooling systems, and monitoring and management systems to cut down energy usage and cost of operations. The urgent demand for sustainable infrastructure has prompted organizations to invest in these solutions, which help to increase efficiency and reduce environmental footprints. Consequently, the solutions segment remains to hold the greatest market share, highlighting its central position in the establishment of green data center programs.

Green Data Center Market Segmentation: By Data Center Type

- Colocation Data Centers

- Hyperscale Data Centers

- Enterprise Data Centers

Colocation data centers are seeing fast growth in the green data center market. This is spurred by companies that want to outsource their IT infrastructure to communal facilities that have sustainability as their focus. Colocation providers provide energy-efficient offerings, such as sophisticated cooling technology and renewable energy integration, that enable companies to save on operations and reduce their environmental footprint without incurring substantial capital investment. This model is not only scalable but also sustainable as it can match corporate sustainability targets, hence is a suitable option for companies seeking to promote green credentials.

Corporate data centers at present occupy the highest market share in the green data center space. Corporate customers are making higher investments in environmentally friendly data center solutions to address corporate social responsibility and comply with strong environmental legislation. By adopting energy-efficient technologies and practices, businesses can lessen their carbon footprint and operations costs. The focus on sustainability not only boosts brand image but also guarantees adherence to changing environmental regulations, reinforcing enterprise data centers' position at the top of the market.

Green Data Center Market Segmentation: By Industry Vertical

- IT & Telecom

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- Government & Defense

- Manufacturing

The IT & Telecom industry is witnessing the fastest growth in the green data center market. This growth is fueled by the increasing need for computing, networking, and storage capacity, especially with the increasing use of cloud computing and data-intensive applications. With environmental sustainability gaining importance, IT and telecom organizations are increasingly investing in energy-efficient data centers to lower operational expenses and minimize their carbon footprint. This is also supplemented by the industry's focus on corporate social responsibility and the requirement to adhere to strict environmental laws. The BFSI industry is currently the largest market holder in the green data center market.

Financial institutions deal with enormous amounts of sensitive information, requiring secure, dependable, and efficient data storage systems. The take-up of green data centers in this industry is driven by regulatory pressures, risk management concerns, and a quest for operational efficiency. Through the adoption of energy-efficient and resilient technology, BFSI organizations hope to minimize risks related to power supply outages, security intrusions, and compliance failures, as well as express concern for the environment.

Green Data Center Market Segmentation: By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Large companies are dominating the green data center market presently, commanding a large revenue share. Theirs is the leverage of having great financial capabilities for investing in power-efficient technologies and green infrastructure. Large organizations usually have large IT operations and storage requirements for their data, rendering the implementation of green data centers a strategic investment to maximize operating efficiency and also fulfill corporate sustainability goals.

SMEs are becoming the fastest-growing part of the green data center segment. The rising awareness of the advantages of energy-efficient data solutions, such as cost savings and lower environmental footprints, by SMEs is driving the growth. Additionally, the green data center solution being scalable enables the SMEs to grow their business sustainably, congruent with the business growth and environmental requirements.

Green Data Center Market Segmentation: By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

The global green data center market displays the differential levels of adoption and growth in different regions, with differences in the level of technological upgrades, regulatory regimes, and green campaigns. North America heads the market with about 39% of the global market share due to effective environmental regulations and heavy investment in renewable energy by large technology companies. Europe comes next with a 30% market share, led by strict environmental laws and high levels of carbon-cutting ambitions. The Asia-Pacific ranks approximately 25% of the market share, with high growth rates driven by the escalation of digitalization and encouraging government policies on green tech. Latin America and Middle East & Africa contribute relatively minor shares of 4% and 2%, respectively, but are slowly gaining traction as people become more aware of sustainable practices.

COVID-19 Impact Analysis on the Green Data Center Market:

The COVID-19 pandemic had a major impact on the green data center market, both in terms of challenges and opportunities. In the first place, lockdowns and travel bans across the world caused supply chain disruptions, resulting in delays in equipment delivery and halting the commissioning of new data center projects. The lack of workforce also hindered construction and maintenance operations, affecting the timely rollout of green data centers. Yet, the pandemic also hastened digital transformation across industries, driving more dependence on remote work and digital services. The spike in digital activity highlighted the importance of energy-efficient and resilient data infrastructure, driving demand for green data center solutions. Companies became more concerned with the environmental footprint of their IT activities, leading to a move toward sustainable practices to lower carbon footprints and operating expenses. Though economic uncertainties caused some firms to rethink or postpone investment in green technology, the broad trend underscored the imperative importance of sustainable data centers in ensuring long-term operational stability and environmental stewardship.

Trends/Developments:

Nxtra (the data center arm of Bharti Airtel) partnered with Bloom Energy in September 2022 to deploy a low-emission fuel cell in its Karnataka data center. The action aligns with Nxtra's plans to reduce its carbon footprint and rely on a hydrogen-ready clean fuel supply.

In May 2023, Huawei launched its Fan Wall Chilled Water-Cooling Solution and PowerPOD 3.0 at the Green Data Center Summit. These power and cooling solutions based on AI are designed to improve energy efficiency and drive sustainable operations in Asia Pacific data centers.

Key Players:

- Schneider Electric SE

- Vertiv Holdings Co.

- Hewlett Packard Enterprise (HPE)

- Cisco Systems, Inc.

- Dell Technologies Inc.

- IBM Corporation

- Fujitsu Ltd.

- Huawei Technologies Co., Ltd.

- Eaton Corporation plc

- Digital Realty Trust, Inc.

Chapter 1. GREEN DATA CENTER MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. GREEN DATA CENTER MARKET– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GREEN DATA CENTER MARKET– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GREEN DATA CENTER MARKET- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GREEN DATA CENTER MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GREEN DATA CENTER MARKET– By Component

6.1 Introduction/Key Findings

6.2 Solutions

6.3 Services

6.4 Y-O-Y Growth trend Analysis By Component

6.5 Absolute $ Opportunity Analysis By Component , 2025-2030

Chapter 7. GREEN DATA CENTER MARKET– By Data Center Type

7.1 Introduction/Key Findings

7.2 Colocation Data Centers

7.3 Hyperscale Data Centers

7.4 Enterprise Data Centers

7.5 Y-O-Y Growth trend Analysis By Data Center Type

7.6 Absolute $ Opportunity Analysis By Data Center Type , 2025-2030

Chapter 8. GREEN DATA CENTER MARKET– By Industry Vertical

8.1 Introduction/Key Findings

8.2 IT & Telecom

8.3 BFSI (Banking, Financial Services, and Insurance)

8.4 Healthcare

8.5 Government & Defense

8.6 Manufacturing

8.7 Y-O-Y Growth trend Analysis Industry Vertical

8.8 Absolute $ Opportunity Analysis Industry Vertical , 2025-2030

Chapter 9. GREEN DATA CENTER Market– By Enterprise Size

9.1 Introduction/Key Findings

9.2 Large Enterprises

9.3 Small & Medium Enterprises (SMEs)

9.4 Y-O-Y Growth trend Analysis Enterprise Size

9.5 Absolute $ Opportunity Analysis Enterprise Size , 2025-2030

Chapter 10. GREEN DATA CENTER MARKET, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Component

10.1.3. By Industry Vertical

10.1.4. By Data Center Type

10.1.5. Enterprise Size

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Component

10.2.3. By Industry Vertical

10.2.4. By Data Center Type

10.2.5. Enterprise Size

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Component

10.3.3. By Enterprise Size

10.3.4. By Data Center Type

10.3.5. Industry Vertical

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Enterprise Size

10.4.3. By Data Center Type

10.4.4. By Product Component

10.4.5. Industry Vertical

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Industry Vertical

10.5.3. By Enterprise Size

10.5.4. By Data Center Type

10.5.5. Component

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. GREEN DATA CENTER MARKET– Company Profiles – (Overview, Service Enterprise Size Product Component Portfolio, Financials, Strategies & Developments)

11.1 Schneider Electric SE

11.2 Vertiv Holdings Co.

11.3 Hewlett Packard Enterprise (HPE)

11.4 Cisco Systems, Inc.

11.5 Dell Technologies Inc.

11.6 IBM Corporation

11.7 Fujitsu Ltd.

11.8 Huawei Technologies Co., Ltd.

11.9 Eaton Corporation plc

11.10 Digital Realty Trust, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The market is expanding due to increasing environmental regulations, rising energy costs, and a growing emphasis on corporate sustainability. Organizations are adopting energy-efficient technologies and renewable energy sources to reduce operational expenses and carbon footprints.

Key industries include Information Technology (IT) & Telecom, Banking, Financial Services, and Insurance (BFSI), healthcare, government, and manufacturing. These sectors prioritize energy efficiency and sustainability to meet regulatory requirements and enhance operational efficiency

AI enhances energy management and cooling efficiency in data centers. Machine learning algorithms optimize power usage and predict thermal conditions, leading to reduced energy consumption and improved sustainability

North America leads the market, driven by a significant number of data centers and stringent environmental regulations. The U.S., in particular, emphasizes green practices to reduce operating costs and environmental impact

Emerging trends include the adoption of liquid cooling technologies, AI-powered energy management systems, and increased use of renewable energy sources. These innovations aim to enhance energy efficiency and reduce the environmental impact of data centers