Cultivated Meat Market Size (2024 – 2030)

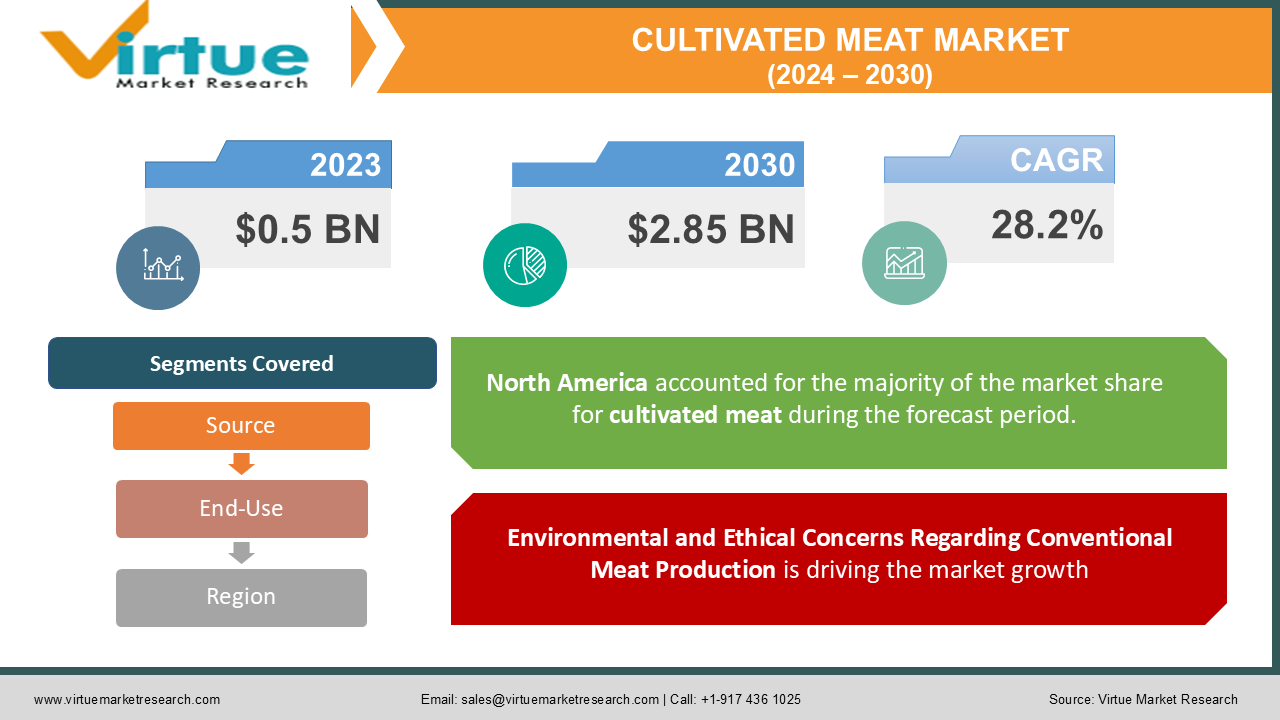

The Global Cultivated Meat Market was valued at USD 0.5 billion in 2023 and is projected to grow at an impressive CAGR of 28.2% from 2024 to 2030, reaching a market value of USD 2.85 billion by 2030.

Cultivated meat, also known as lab-grown or cultured meat, is produced by culturing animal cells in a controlled environment, creating a sustainable and ethical alternative to conventional meat. With growing concerns over the environmental impact of traditional livestock farming, animal welfare, and the rising demand for protein-rich foods, cultivated meat is emerging as a viable solution for the future of food. The market is set to witness substantial growth driven by technological advancements, increasing investment, and growing consumer awareness of the environmental and ethical benefits of cultivated meat.

Key Market Insights:

Poultry dominates the cultivated meat market, accounting for more than 40% of the market share in 2023, due to high consumer demand and lower production costs compared to other meat sources.

North America is the largest market for cultivated meat, holding over 45% of the global market share in 2023, driven by increasing R&D activities, supportive regulatory frameworks, and consumer acceptance.

The food service segment accounts for the largest share of the end-use market, as restaurants and fast-food chains explore cultivated meat options to meet growing consumer demand for sustainable and ethical food choices.

Europe is expected to see significant growth due to strong governmental support for alternative protein sources, environmental sustainability policies, and rising awareness of climate change.

Global Cultivated Meat Market Drivers:

Environmental and Ethical Concerns Regarding Conventional Meat Production is driving the market growth

One of the primary drivers of the global cultivated meat market is the growing concern over the environmental impact of traditional livestock farming. Livestock production is a major contributor to greenhouse gas emissions, deforestation, water usage, and land degradation. It is estimated that animal agriculture accounts for 14.5% of global greenhouse gas emissions, making it one of the leading causes of climate change. Additionally, livestock farming is a significant driver of deforestation, with large areas of forest being cleared for grazing and feed production. Cultivated meat offers a more sustainable alternative by significantly reducing the environmental footprint of meat production. Studies have shown that cultivated meat can reduce land use by up to 95%, water use by 80%, and greenhouse gas emissions by up to 90% compared to conventional meat. As concerns over climate change and environmental sustainability continue to grow, consumers and governments are increasingly looking for alternative protein sources that are less harmful to the planet.

Technological Advancements and Declining Production Costs is driving the market growth

Technological advancements in cell culture, bioreactor design, and tissue engineering are playing a crucial role in driving the growth of the cultivated meat market. Over the past decade, significant progress has been made in improving the efficiency of cell culture processes, optimizing nutrient media, and scaling up production. These advancements have helped reduce the cost of producing cultivated meat, making it more commercially viable.In the early stages of cultivated meat development, the cost of producing a single lab-grown burger was prohibitively high, with estimates ranging from $250,000 to $325,000 per burger in 2013. However, thanks to technological innovations, the cost has dropped dramatically, with some companies now producing cultivated meat at around $50 per pound. As production costs continue to decline, cultivated meat is expected to become more affordable and accessible to a wider range of consumers. The development of more efficient bioreactors has also contributed to the scalability of cultivated meat production. Bioreactors are used to grow animal cells in a controlled environment, and advancements in bioreactor design have improved the yield and quality of cultivated meat. Companies are now focusing on scaling up production to meet growing consumer demand while maintaining product consistency and quality.

Increasing Investment and Government Support is driving the market growth

The cultivated meat market has attracted significant investment from venture capital firms, food companies, and governments, further driving its growth. In recent years, there has been a surge in funding for cultivated meat startups, with companies like Memphis Meats, Mosa Meat, and Aleph Farms securing multi-million-dollar investments to accelerate research and development, scale production, and bring cultivated meat products to market. In 2021 alone, the cultivated meat industry raised over $500 million in investment, more than doubling the total amount raised in previous years. This influx of capital has enabled companies to invest in cutting-edge technologies, hire top talent, and build large-scale production facilities, bringing cultivated meat closer to commercial viability. Governments around the world are also recognizing the potential of cultivated meat to address food security, environmental sustainability, and public health concerns. Several governments, particularly in Europe and Asia, are providing funding for research into alternative proteins, including cultivated meat, as part of their broader sustainability and climate change initiatives. For example, the European Union has allocated millions of euros in funding for alternative protein research under its Horizon 2020 program.

Global Cultivated Meat Market Challenges and Restraints:

Regulatory Uncertainty and Approval Delays is restricting the market growth

One of the major challenges facing the global cultivated meat market is regulatory uncertainty. As a relatively new industry, cultivated meat does not yet have established regulatory frameworks in many countries. Regulatory approval is critical for bringing cultivated meat products to market, and the lack of clear guidelines has led to delays in commercialization. In most countries, cultivated meat is classified as a novel food, which requires extensive safety testing and approval from regulatory bodies before it can be sold to consumers. This approval process can be lengthy and costly, creating barriers for startups and smaller companies that may not have the resources to navigate complex regulatory requirements. Additionally, there is still limited data on the long-term health effects of consuming cultivated meat, which may slow down regulatory approval in some regions. Singapore made headlines in 2020 by becoming the first country to approve the sale of cultivated meat, setting an important precedent for other countries. However, regulatory pathways in major markets such as the U.S., Europe, and China are still in the development stages. The U.S. Food and Drug Administration (FDA) and the U.S. Department of Agriculture (USDA) have taken initial steps toward regulating cultivated meat, but full approval has not yet been granted. In Europe, the European Food Safety Authority (EFSA) is in the process of reviewing cultivated meat products, but approvals are expected to take several years.

Consumer Acceptance and Perception is restricting the market growth

While the environmental and ethical benefits of cultivated meat are widely recognized, consumer acceptance remains a significant challenge for the market. Cultivated meat is a novel product that is unfamiliar to most consumers, and there are concerns about the "unnatural" nature of lab-grown meat. Some consumers are hesitant to try cultivated meat due to perceptions that it is highly processed, synthetic, or lacking in flavor compared to conventional meat. Surveys have shown that consumer attitudes toward cultivated meat vary widely depending on factors such as age, geography, and cultural preferences. Younger consumers, particularly those in urban areas, tend to be more open to trying cultivated meat, especially if it is marketed as a sustainable and ethical alternative to traditional meat. However, older consumers and those in rural areas may be more resistant to the idea of lab-grown meat, viewing it as unnatural or unnecessary.

Market Opportunities:

The global cultivated meat market presents numerous growth opportunities driven by technological innovation, evolving consumer preferences, and the urgent need to address environmental sustainability. As the world faces increasing challenges related to climate change, food security, and public health, cultivated meat offers a compelling solution that aligns with global sustainability goals. One of the most promising opportunities for the cultivated meat market lies in its potential to disrupt the traditional meat industry. With the global population expected to reach 9.7 billion by 2050, the demand for protein is projected to increase significantly. Conventional meat production, which relies heavily on land, water, and feed, is unlikely to meet this growing demand sustainably. Cultivated meat, on the other hand, can be produced using a fraction of the resources required for traditional livestock farming, making it a scalable solution for feeding the world’s population while minimizing environmental impact. Another key opportunity for the cultivated meat market is the growing interest in alternative proteins among consumers, particularly younger generations. Millennials and Gen Z are increasingly conscious of the environmental and ethical implications of their food choices, and many are actively seeking out plant-based and cultured meat alternatives. This demographic is also more willing to experiment with new food technologies and adopt novel products, making them a key target market for cultivated meat companies.

CULTIVATED MEAT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

28.2% |

|

Segments Covered |

By Source, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Memphis Meats, Mosa Meat, Aleph Farms, JUST Inc., Future Meat Technologies, Finless Foods, Shiok Meats, BioTech Foods, BlueNalu, Wild Type |

Cultivated Meat Market Segmentation: By Source

-

Poultry

-

Beef

-

Pork

-

Seafood

The poultry segment is the most dominant in the cultivated meat market, accounting for over 40% of the market share in 2023. Poultry is one of the most consumed meat types globally, and its production process in the cultivated form is relatively simpler and more cost-effective compared to other meats. Cultivated poultry products such as chicken nuggets and chicken breasts are already being developed by several companies, making it easier for consumers to adopt these products. The high demand for chicken in both developed and developing countries, coupled with the lower production costs of cultivated poultry, makes this segment the leading source in the market.

Cultivated Meat Market Segmentation: By End-Use

-

Food Service

-

Retail

The food service segment is the largest end-use market, accounting for more than 60% of the global cultivated meat market in 2023. The food service industry, including restaurants, fast-food chains, and catering services, is increasingly adopting sustainable and ethical food options to meet consumer demand. Cultivated meat offers a premium and environmentally friendly alternative to traditional meat, making it an attractive option for the food service industry. With major food chains exploring partnerships with cultivated meat producers, this segment is expected to remain dominant over the forecast period.

Cultivated Meat Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America is the largest market for cultivated meat, holding over 45% of the global market share in 2023. The U.S. is a key player in the market, with several leading cultivated meat companies, such as Memphis Meats and JUST, based in the country. North America’s dominance is driven by strong investment in R&D, favorable regulatory frameworks, and growing consumer acceptance of alternative proteins. The region’s focus on sustainability and reducing the environmental impact of food production has further accelerated the adoption of cultivated meat. Additionally, the U.S. government’s support for innovative food technologies and the presence of major venture capital firms investing in the industry contribute to North America’s leadership position in the market.

COVID-19 Impact Analysis on the Global Cultivated Meat Market:

The COVID-19 pandemic had a significant impact on the global food industry, highlighting vulnerabilities in the traditional meat supply chain and accelerating interest in alternative proteins, including cultivated meat. During the pandemic, meat processing plants faced widespread shutdowns and supply chain disruptions, leading to shortages and price increases for conventional meat products. These challenges underscored the need for more resilient and sustainable food production methods, driving increased attention toward cultivated meat.

The pandemic also heightened consumer awareness of food safety and hygiene, as concerns over zoonotic diseases and the risk of contamination in meat processing plants grew. Cultivated meat, produced in a controlled and sterile environment, offers a safer and more hygienic alternative to conventional meat, addressing these concerns. As a result, consumer interest in cultivated meat increased during the pandemic, particularly among those seeking safer and more sustainable food options. In response to the pandemic, governments and investors also placed greater emphasis on food security and innovation, with many seeing cultivated meat as a solution to future disruptions in the food supply chain. The pandemic accelerated investment in the cultivated meat industry, with several companies securing significant funding to scale up production and bring products to market. Post-pandemic, the cultivated meat market is expected to continue growing as consumers and governments prioritize sustainability, food security, and public health. The lessons learned from the COVID-19 pandemic are likely to drive further innovation and investment in the cultivated meat space, positioning it as a key player in the future of food production.

Latest Trends/Developments:

The cultivated meat market is witnessing several key trends and developments that are shaping its future. One of the most notable trends is the increasing focus on scalability and cost reduction. As companies move from the research and development phase to commercialization, there is a growing emphasis on scaling up production to meet consumer demand. This includes the development of larger bioreactors, more efficient cell culture methods, and the optimization of nutrient media to reduce production costs. The goal is to produce cultivated meat at a price point that is competitive with traditional meat, making it accessible to a broader range of consumers. Another key trend is the expansion of product offerings. While the initial focus of cultivated meat companies was on ground meat products such as burgers and chicken nuggets, there is now a push to develop more complex products, including steaks, pork chops, and seafood. Advances in tissue engineering and 3D bioprinting are enabling companies to create structured meat products that closely mimic the texture and appearance of conventional meat. This expansion of product offerings is expected to drive further consumer interest and adoption of cultivated meat. The regulatory landscape for cultivated meat is also evolving, with more countries working to establish clear guidelines for the approval and sale of these products. In addition to Singapore, which approved the sale of cultivated meat in 2020, other countries such as the U.S. and the European Union are making progress in developing regulatory frameworks. As more countries approve the sale of cultivated meat, the market is expected to expand rapidly, with new players entering the space and existing companies scaling up production.

Key Players:

-

Memphis Meats

-

Mosa Meat

-

Aleph Farms

-

JUST Inc.

-

Future Meat Technologies

-

Finless Foods

-

Shiok Meats

-

BioTech Foods

-

BlueNalu

-

Wild Type

Chapter 1. Cultivated Meat Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cultivated Meat Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cultivated Meat Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cultivated Meat Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cultivated Meat Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cultivated Meat Market – By Source

6.1 Introduction/Key Findings

6.2 Poultry

6.3 Beef

6.4 Pork

6.5 Seafood

6.6 Y-O-Y Growth trend Analysis By Source

6.7 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Cultivated Meat Market – By End-Use

7.1 Introduction/Key Findings

7.2 Food Service

7.3 Retail

7.4 Y-O-Y Growth trend Analysis By End-Use

7.5 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 8. Cultivated Meat Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Source

8.1.3 By End-Use

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Source

8.2.3 By End-Use

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Source

8.3.3 By End-Use

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Source

8.4.3 By End-Use

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Source

8.5.3 By End-Use

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Cultivated Meat Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Memphis Meats

9.2 Mosa Meat

9.3 Aleph Farms

9.4 JUST Inc.

9.5 Future Meat Technologies

9.6 Finless Foods

9.7 Shiok Meats

9.8 BioTech Foods

9.9 BlueNalu

9.10 Wild Type

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cultivated Meat Market was valued at USD 0.5 billion in 2023 and is expected to grow to USD 2.85 billion by 2030, with a CAGR of 28.8% from 2024 to 2030.

Key drivers include environmental and ethical concerns regarding conventional meat production, technological advancements reducing production costs, and increasing investment and government support for sustainable food solutions.

The market is segmented by source (Poultry, Beef, Pork, Seafood) and end-use (Food Service, Retail).

North America is the dominant region, holding over 45% of the global market share in 2023, driven by strong investment, favorable regulations, and growing consumer acceptance

Leading players include Memphis Meats, Mosa Meat, Aleph Farms, JUST Inc., Future Meat Technologies, and Finless Foods, among others.