Meat Substitutes Market Size (2025 –2030)

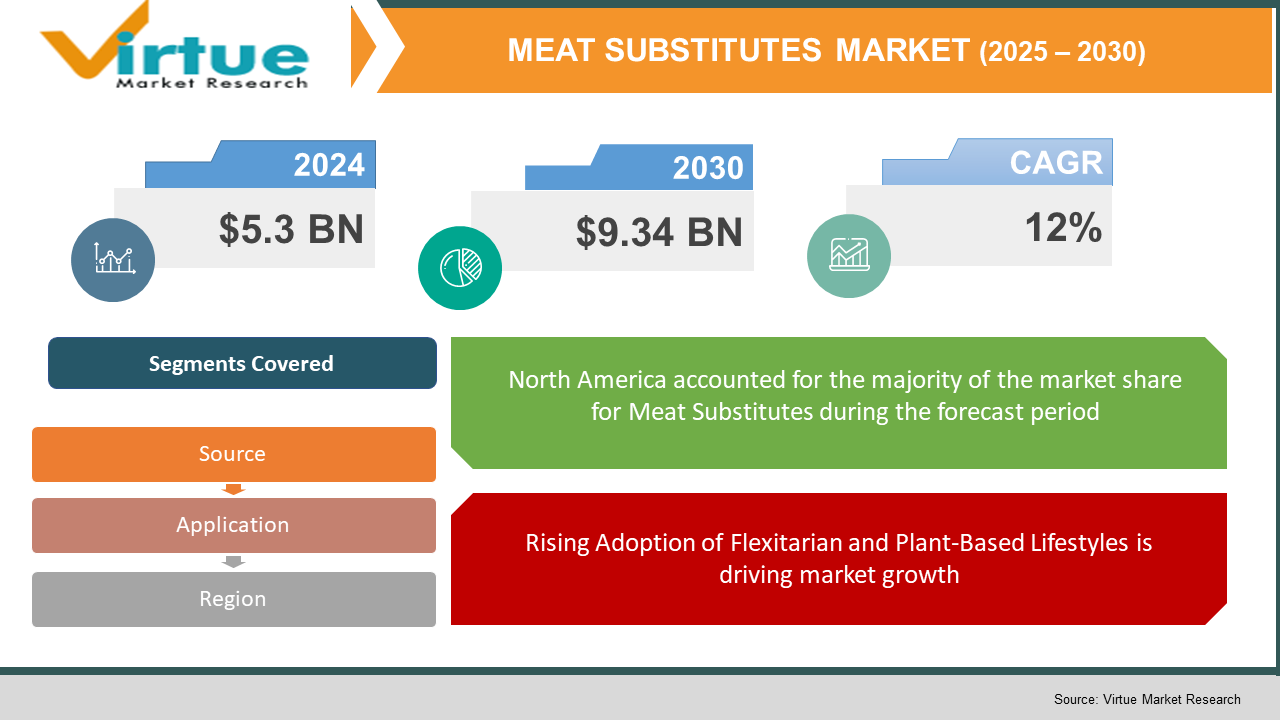

The Global Meat Substitutes Market was valued at USD 5.3 billion in 2023 and is projected to grow at a CAGR of 12% from 2024 to 2030. The market is expected to reach USD 9.34 billion by 2030.

The Meat Substitutes Market includes a variety of plant-based products, mycoprotein, and cultured alternatives designed to mimic the taste and texture of conventional meat. Rising consumer concerns around health, animal welfare, and environmental sustainability are major factors propelling market growth. The industry is being driven by a growing shift toward vegetarian, vegan, and flexitarian diets, creating demand for meat alternatives with high protein content, improved taste, and sustainable sourcing.

Key Market Insights:

Soy-based meat alternatives dominate the market, with nearly 40% of the market share, followed by pea protein and wheat-based products.

Supermarkets and hypermarkets represent the largest distribution channel, accounting for 45% of sales, though online channels are growing rapidly post-pandemic.

Asia-Pacific, led by China and India, is emerging as a lucrative market due to shifting dietary preferences and government policies promoting plant-based diets.

Global Meat Substitutes Market Drivers:

Growing Consumer Health Awareness and Demand for Sustainable Diets is driving market growth: Consumers are increasingly aware of the health risks associated with excessive meat consumption, including obesity, heart disease, and cancer. This trend is fueling the demand for healthier alternatives, such as meat substitutes that offer high protein and lower fat content. Additionally, concerns about the environmental impact of animal farming, including greenhouse gas emissions, land degradation, and water use, are encouraging consumers to seek sustainable food sources. This shift toward sustainability has also influenced food companies and restaurants to integrate more plant-based alternatives into their offerings.

Rising Adoption of Flexitarian and Plant-Based Lifestyles is driving market growth: Flexitarian diets, which emphasize plant-based foods while allowing occasional meat consumption, are gaining momentum, particularly in Europe and North America. Younger consumers, particularly millennials and Gen Z, are driving this change by prioritizing health and ethical considerations. The influence of social media campaigns promoting veganism and cruelty-free products further supports this trend. Many food chains and restaurants now offer plant-based options, such as vegan burgers and sausages, to cater to this expanding customer base, further boosting market growth.

Product Innovation and Technological Advancements in Food Science is driving market growth: Innovations in food science and technology have resulted in meat substitutes that closely replicate the texture, taste, and mouthfeel of animal-based products. Companies are investing heavily in research to enhance the sensory attributes of meat alternatives and explore new sources of protein, such as mycoprotein, insect protein, and cultured meat. Advances in extrusion technologies are also improving the scalability and affordability of these products, expanding their reach to mainstream consumers.

Global Meat Substitutes Market Challenges and Restraints:

High Production Costs and Premium Pricing is restricting market growth: Although the demand for meat substitutes is increasing, the relatively high cost of production compared to traditional meat products remains a key challenge. The use of innovative ingredients, like pea protein or mycoprotein, and the need for specialized manufacturing processes contribute to higher product prices. Consumers in emerging markets, where price sensitivity is high, often opt for cheaper meat options, limiting the market penetration of meat substitutes. Companies are actively working to reduce costs through technological innovations, but affordability remains a hurdle.

Taste and Consumer Perception Challenges is restricting market growth: While significant improvements have been made, some consumers still perceive meat substitutes as lacking in taste or texture compared to traditional meat. The acceptance of these products relies heavily on achieving taste parity with animal-based meat, a challenging feat. Additionally, the adoption of meat alternatives is hindered by cultural and dietary habits in certain regions, where traditional meat consumption is deeply ingrained. Convincing these consumers to switch requires not only product improvement but also targeted marketing efforts to change perception.

Market Opportunities:

The Meat Substitutes Market presents vast opportunities for growth, particularly with the increasing focus on sustainability and ethical consumption. Companies that can innovate beyond plant-based substitutes and introduce cultured meat or insect-based proteins are likely to tap into new customer segments. Collaboration with foodservice providers, including fast-food chains and restaurants, offers a promising channel for market penetration. Additionally, the growing awareness around food allergies, such as lactose or gluten intolerance, encourages manufacturers to develop allergen-free alternatives, further expanding the consumer base. Governments in several regions are also promoting plant-based diets through subsidies and incentives, providing further momentum. As consumer demand grows for ready-to-eat and convenient plant-based products, there is ample opportunity for manufacturers to diversify their product range with snacks, beverages, and frozen foods incorporating meat substitutes.

MEAT SUBSTITUTES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

12% |

|

Segments Covered |

By source, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

|

Meat Substitutes Market Segmentation:

Meat Substitutes Market Segmentation By Source:

- Soy-based Meat Alternatives

- Pea Protein-based Meat Alternatives

- Mycoprotein

- Wheat-based Meat Alternatives

- Others

Soy-based meat alternatives dominate the market, accounting for the largest share due to their high protein content, versatility, and established presence in multiple product forms such as burgers, sausages, and nuggets.

Meat Substitutes Market Segmentation By Application:

- Retail (Supermarkets/Hypermarkets, Convenience Stores)

- Foodservice (Restaurants, Fast Food Chains)

- Online Channels

Retail distribution, particularly through supermarkets and hypermarkets, holds the largest share of the market. These outlets provide a variety of plant-based products in a convenient setting, catering to a wide audience, including health-conscious consumers and those exploring plant-based diets.

Meat Substitutes Market Regional Segmentation:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is the leading region in the Meat Substitutes Market, driven by strong consumer demand for plant-based products, the presence of key industry players, and increasing environmental awareness. The region’s robust retail infrastructure further facilitates the availability of meat substitutes across diverse product categories.

COVID-19 Impact Analysis on the Meat Substitutes Market:

The COVID-19 pandemic had a nuanced impact on the meat substitutes market, catalyzing both challenges and opportunities. On one hand, the crisis disrupted traditional meat supply chains, leading to shortages and heightened consumer awareness of health and wellness. As people became increasingly concerned about their diets and immune health, interest in plant-based products surged. Many consumers turned to meat substitutes as healthier, more sustainable alternatives, which was further facilitated by the growth of online retail channels. This shift marked a significant turning point, with plant-based options gaining traction among a broader audience. However, the pandemic also led to temporary closures of restaurants and foodservice establishments, which negatively affected demand in that segment. With dining options limited, many consumers shifted their focus to home cooking, where they sought versatile ingredients like meat substitutes. This trend created an opportunity for brands to expand their reach through grocery stores and e-commerce platforms, effectively catering to the growing demand for plant-based products. As the world gradually recovered from the pandemic, the foodservice industry experienced a robust rebound. Many restaurant chains recognized the shifting consumer preferences and began to expand their plant-based offerings to meet rising expectations for healthier, sustainable menu options. This post-pandemic resurgence in foodservice not only revitalized the industry but also reinforced the momentum toward plant-based eating. In summary, while the pandemic introduced challenges, it also accelerated the adoption of meat substitutes, highlighting a growing commitment to sustainable and health-conscious eating habits. The combined effects of supply chain disruptions and increased health awareness contributed to a lasting change in consumer behavior, positioning the meat substitutes market for continued growth in the years to come.

Latest Trends/Developments:

The Meat Substitutes Market is experiencing rapid innovation as companies explore diverse protein sources, including algae, fungi, and insects, to enhance their product offerings. This experimentation aims to cater to a growing consumer demand for variety and sustainability in plant-based options. Cultured meat, still in its nascent stage, is garnering significant investment and interest, with the potential to transform the meat substitutes landscape by providing a viable alternative that mimics traditional meat more closely. Simultaneously, there is a rising emphasis on clean-label products, with manufacturers increasingly prioritizing transparency by offering options free from artificial additives and genetically modified ingredients. This trend aligns with consumer preferences for healthier, more natural foods, further driving the demand for plant-based alternatives. Additionally, the development of regional flavors tailored to local tastes is expanding consumer appeal. By customizing products to reflect cultural preferences, companies can attract a broader audience and encourage more people to incorporate meat substitutes into their diets. Partnerships between meat substitute producers and foodservice providers are becoming increasingly common, facilitating greater accessibility to plant-based options in fast food and casual dining settings. These collaborations not only enhance the visibility of meat substitutes but also help normalize their inclusion in everyday meals, encouraging more consumers to try them. Overall, the Meat Substitutes Market is poised for continued growth, driven by innovation, consumer preferences for healthier and more sustainable food choices, and strategic collaborations that enhance product availability. This evolving landscape promises to reshape dietary habits and contribute to a more sustainable food system in the future.

Key Players:

- Beyond Meat

- Impossible Foods

- Quorn Foods

- Gardein

- Tofurky

- MorningStar Farms

- Amy's Kitchen

- Oatly

- Lightlife Foods

Chapter 1. MEAT SUBSTITUTES MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. MEAT SUBSTITUTES MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. MEAT SUBSTITUTES MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. MEAT SUBSTITUTES MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. MEAT SUBSTITUTES MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MEAT SUBSTITUTES MARKET – By Source

6.1 Introduction/Key Findings

6.2 Soy-based Meat Alternatives

6.3 Pea Protein-based Meat Alternatives

6.4 Mycoprotein

6.5 Wheat-based Meat Alternatives

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Source

6.8 Absolute $ Opportunity Analysis By Source , 2025-2030

Chapter 7. MEAT SUBSTITUTES MARKET – By Application

7.1 Introduction/Key Findings

7.2 Retail (Supermarkets/Hypermarkets, Convenience Stores)

7.3 Foodservice (Restaurants, Fast Food Chains)

7.4 Online Channels

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. MEAT SUBSTITUTES MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Source

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Source

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Source

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Source

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Source

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. MEAT SUBSTITUTES MARKET – Company Profiles – (Overview, Type , Portfolio, Financials, Strategies & Developments)

9.1 Beyond Meat

9.2 Impossible Foods

9.3 Quorn Foods

9.4 Gardein

9.5 Tofurky

9.6 MorningStar Farms

9.7 Amy's Kitchen

9.8 Oatly

9.9 Lightlife Foods

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Meat Substitutes Market was valued at USD 5.3 billion in 2023 and is projected to grow at a CAGR of 12% from 2024 to 2030. The market is expected to reach USD 9.34 billion by 2030.

Key drivers include rising health awareness, adoption of plant-based lifestyles, and advancements in food science, resulting in improved taste and affordability of meat substitutes.

The market is segmented by source (e.g., soy-based, pea protein) and application (e.g., retail, foodservice, online).

North America leads the market due to high consumer demand, environmental awareness, and a well-established retail infrastructure

Leading players include Beyond Meat, Impossible Foods, Quorn Foods, Gardein, and MorningStar Farms.