Corn Seed Market Size (2024 – 2030)

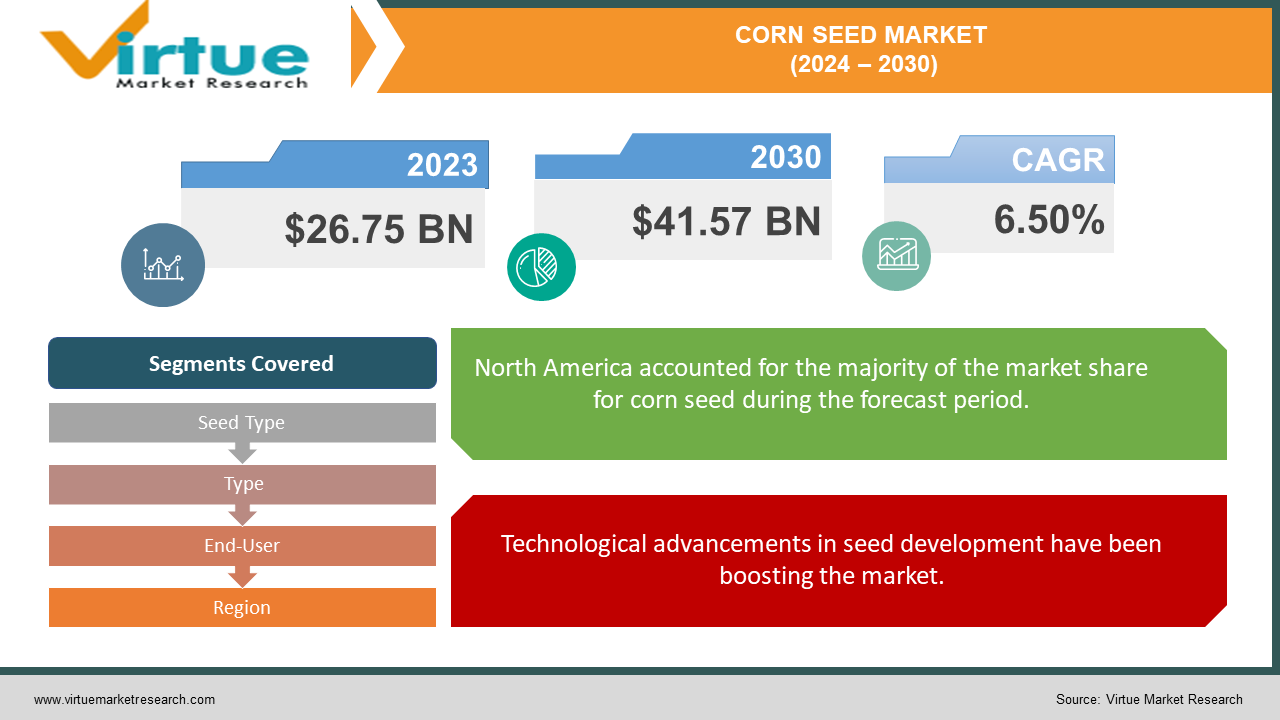

The Global Corn Seed Market was valued at USD 26.75 billion and is projected to reach a market size of USD 41.57 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6.50%.

Maize is a grain that is farmed for its enormous, starchy seeds. Corn, or corn seeds, are the fruits of this grain. The white, pithy material that forms the ear is surrounded by rows of corn seeds, which are roughly the size of peas. There are many different hues of corn seeds, including black, purple, green, red, white, and yellow. The seeds, also referred to as corn, are processed into a variety of helpful compounds and are utilized as a source of biofuel as well as food for people and animals. In the past, this market has had a notable presence, especially in North American countries. This was used as a staple food for many years. Presently, the market has seen considerable growth owing to market expansion and technological advancements. In the future, with a focus on GM crops and innovations, immense development is anticipated.

Key Market Insights:

With a production output of almost 1.2 billion metric tons, corn is the most significant grain in the world, according to Statista.

The United States harvested maize on over 80 million acres of land in 2022.

More than 277 million metric tons of maize were produced in China in 2022.

33.5 million metric tons of grain were produced in India in 2023–2024.

Corn Seed Market Drivers:

Population growth and dietary shifts have been contributing to the success.

The emerging economies of Asia, Latin America, and the Middle East have seen a surge in the population rate. Urbanization in these regions has changed the standard of living. The rising middle class and increasing disposable income have been outcomes. People have started to go out more often. As a result, the number of restaurants and eateries has also seen an increase. These culinary units have been diversifying their menus to accommodate the tastes of the public. People have been keen on experimenting with different cuisines due to their awareness and interest. Mexico, Jamaica, Vietnam, Latin America, the Philippines, France, and Puerto Rico are some of the major areas that utilize corn regularly as a part of their diet. These menus have spread to many countries, making them an appealing option. They add a distinctive sweet taste. Furthermore, the popularity of veganism has been advantageous. This is a part of the vegan and vegetarian diet used in many salads, pizza, sauces, soups, and other side dishes. Apart from this, the growing animal industry is fueling the growth. Cattle, pigs, and fowl all eat corn, which is a major source of protein and energy for them. Steepwater, a nutrient-rich liquid that may be added to cattle's diet as a protein supplement or utilized as a binder in feed pellets, is similarly made from corn. Another significant source of protein and energy in animal feed is the pulverized germ of maize kernels, sometimes known as germ meal.

Technological advancements in seed development have been boosting the market.

Corn yield is being enhanced by the new seed technology in several ways. Corn seeds are sown earlier in the growing season and with greater density by farmers. Producers have also increased the amount of corn land they planted since insect resistance has made it possible to farm maize profitably in formerly difficult areas. Drought circumstances are more suited for corn types that have undergone genetic modification (GM). Additionally, certain seed options, like corn rootworm resistance, are improved with biotech characteristics that may increase drought tolerance. Besides, GM varieties can mature earlier. Furthermore, yield, tolerance to environmental stress, and nutritional profile are being improved. Apart from this, the oil composition of crops has increased by using photo seed technology. The performance of corn seeds is improved by these technical developments, which also help corn production systems remain resilient and sustainable. Farmers are being encouraged to adopt these new techniques for better production.

Corn Seed Market Restraints and Challenges:

Health and resistance concerns are the main issues that the market is currently facing.

Mycotoxins, which are produced by fungi, can infect corn. Consuming large amounts of corn contaminated with these chemicals can raise the chance of developing certain cancers and liver, lung, and immune system dysfunction. Secondly, bloating, gas, diarrhea, indigestion, and stomach pains are among the digestive problems that can result from eating too much maize. Thirdly, consuming excessive amounts of maize can cause a blood sugar increase, which can lead to weight gain. Due to its high GI and low fiber content, corn flour may cause a delay in the bloodstream's absorption of sugar. Besides, those who have celiac disease, an autoimmune condition that results in a response to gluten, may experience problems with corn. Moreover, corn has the potential to aggravate symptoms in those suffering from irritable bowel syndrome (IBS). Furthermore, phytic acid, a compound found in corn, might reduce the absorption of minerals. Additionally, protein content like zein found in this product is not absorbed by the human body. Apart from this, over time, certain varieties can develop resistance to pests and chemicals. To overcome resistance, this calls for constant research and development to create novel qualities and management techniques. To overcome resistance, constant research and development are vital to creating novel qualities and management techniques.

Corn Seed Market Opportunities:

Precision farming methods may maximize crop management, boost overall farm output, and place seeds more precisely. Examples of these methods include GPS-guided planting, soil mapping, and data analytics. Seed firms may create products especially made for precision agricultural systems, giving farmers specialized options. Secondly, digital agricultural platforms are beneficial. They provide farmers with valuable information regarding improving yield, pest resistance, seed recommendations, and other agronomic advice. This can help in broadening knowledge and producing crops with superior characteristics. Thirdly, sustainable practices are being emphasized. Businesses can promote crops that require less soil, fertilizer, land, and water. Carbon footprints can be reduced by prioritizing local produce.

CORN SEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.50% |

|

Segments Covered |

By Seed Type, Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Monsanto Company (Bayer CropScience), DuPont Pioneer (Corteva Agriscience), Syngenta AG (ChemChina), Dow AgroSciences LLC (Corteva Agriscience), KWS SAAT SE, Groupe Limagrain, Bayer CropScience, BASF SE, Land O'Lakes, Inc., Sakata Seed Corporation |

Corn Seed Market Segmentation: By Seed Type

-

Hybrid-certified seeds

-

Farm-saved seeds

-

Open-pollinated certified seeds

With more than 86% of the global corn seed market share in 2023, hybrid seeds are the largest and fastest-growing category in the industry. The benefits of hybrid corn seeds include better yields, enhanced genetics, and distinctive features that help plants withstand pests and unfavorable growth environments. In addition, compared to inbred lines, hybrid corn plants are more uniform, tougher, and more effective against weeds.

Corn Seed Market Segmentation: By Type

-

Field corn

-

Sweet corn

-

Popcorn

-

Baby corn

Popcorn is the largest and fastest-growing type, with a share of around 60%. This corn is flint and has a mushy inside that pops when roasted, with a hard shell. It has a nutritious whole grain in the center of the little kernel that is naturally low in fat and calories, gluten-free, and non-GMO, making it a perfect choice for health-conscious consumers. This is widely available and pops easily when compared to other grains. Additionally, it is also inexpensive to prepare and is easily prepared at home.

Corn Seed Market Segmentation: By End-User

-

Animal feed

-

Food

-

Industrial applications

-

Biofuels

Animal feed is the largest growing end-user. Because corn is a high-energy feed that promotes rapid weight gain in animals and is easier to store and transport than fresh grass or hay, it is utilized in animal feed. Corn is the primary ingredient in animal feed, accounting for 50–70% of pig and poultry diets. It is also the most widely used energy supplement in cow feed. Corn is a significant feed component in chicken diets, accounting for up to 65% of metabolizable energy and 20% of crude protein. Corn increases fat deposition in cattle, which enhances growth efficiency and carcass quality grades. Additionally, corn increases dairy cow productivity and lowers the amount of acreage required to meet the needs of the cows for feed. Biofuel is the fastest-growing category. Corn is a common feedstock for biofuels due to its high starch content, which facilitates easy conversion into ethanol. Studies indicate that the common gasoline additive corn ethanol can cut greenhouse gas emissions by 46% when compared to conventional gasoline. Moreover, biodegradable and having clean ignition, biofuels derived from corn have the potential to increase energy security. Furthermore, maize can be grown, harvested, and stored in large amounts in many areas.

Corn Seed Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest growing market. The United States is one of the largest producers of maize globally. This area has an enormous cultivation of GM and hybrid varieties. This is used in American cuisine as a part of their diet. Animal feed is another major segment leading to the upsurge. Besides, the import and export trade for this crop helps increase profit. Asia-Pacific is the fastest-growing market. Countries like China and India are at the forefront. This is because of the growing population. Corn is being consumed in many Asian households as a meal replacement. Biofuels are an important application enabling the progress of this region. Many startups are coming up with innovative ideas to utilize corn seed for biofuel production. Apart from this, advancements in breeding technologies have augmented the production rate.

COVID-19 Impact Analysis on the Global Corn Seed Market:

The viral epidemic hurt the market in many ways. Lockdowns, restricted travel, and social isolation were all part of the new normal. Logistics, transportation, and supply chain management were impacted by this. This had an effect on trade operations as well as imports and exports. Agricultural activities suffered losses with yields. The rules that were implemented forced the closure of most hotels, diners, and restaurants.

Furthermore, a shortage of funds caused a delay in the introduction of new partnerships and products. Research and medical applications, including hospital beds, vaccines, PPE kits, oxygen tanks, masks, etc., received the most funding. A great deal of uncertainty prevailed, and many people experienced job losses. Many individuals purchased only the necessities. Apart from this, corn is high in sugar content. People who were infected with coronavirus and had a history of diabetes had an increased risk of complications. As a result, sales of this crop declined. Post-pandemic, the market has begun to pick up. The loosening of rules and regulations has helped in normal functioning. E-commerce is helping to augment sales.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this. There is a growing preference for organic and non-GMO crops. This is because of their positive impact on health in the long run. Farmers can capitalize on this trend. Crops can be grown without the aid of chemicals, fertilizers, and other compounds. Certifications from esteemed institutions can be obtained to verify their validity. This helps in gathering a broader consumer base, increasing revenue generation. However, care should be taken to not attract pests to these crops by implementing techniques like crop rotation and companion planting. Additionally, neem oil and other botanical extracts can be used to keep away insects.

Key Players:

-

Monsanto Company (Bayer CropScience)

-

DuPont Pioneer (Corteva Agriscience)

-

Syngenta AG (ChemChina)

-

Dow AgroSciences LLC (Corteva Agriscience)

-

KWS SAAT SE

-

Groupe Limagrain

-

Bayer CropScience

-

BASF SE

-

Land O'Lakes, Inc.

-

Sakata Seed Corporation

-

In March 2024, Origin Agritech, a Beijing-based provider of agricultural technology, revealed a breakthrough in corn production technology. After two years of field testing, the business created a high-yield corn inbred line using gene-editing techniques that is more productive than conventional corn, with a yield gain of over 50% compared to the original line. By 2024, the business hopes to incorporate this characteristic into commercial maize lines, which may lower seed production costs and improve food security.

-

In July 2023, in Banggo Village, Indonesia, Bayer Crop Science introduced the herbicide-tolerant biotech maize variety Dekalb DK95R. According to the firm, farmers who use DK95R can see a 30% boost in yields over those who use conventional methods. Lower input costs and greater yields are the causes of this income growth.

-

In March 2023, the commercial introduction of Corteva Agriscience's VorceedTM EnlistTM corn products in Canada was announced. Vorceed Enlist corn products integrate RNAi technology with three modes of action: three for above-ground pest control and three for below-ground insect protection. In addition, they are resistant to glyphosate, glufosinate, 2,4-D-choline, and FOP herbicides. The products are designed to assist farmers in defending their crops against pressure from corn roots.

Chapter 1. Corn Seed Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Corn Seed Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Corn Seed Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Corn Seed MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Corn Seed Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Corn Seed Market– By Seed Type

6.1 Introduction/Key Findings

6.2 Hybrid-certified seeds

6.3 Farm-saved seeds

6.4 Open-pollinated certified seeds

6.5 Y-O-Y Growth trend Analysis By Seed Type

6.6 Absolute $ Opportunity Analysis By Seed Type, 2024-2030

Chapter 7. Corn Seed Market– By Type

7.1 Introduction/Key Findings

7.2 Field corn

7.3 Sweet corn

7.4 Popcorn

7.5 Baby corn

7.6 Y-O-Y Growth trend Analysis By Type

7.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Corn Seed Market– By End-User

8.1 Introduction/Key Findings

8.2 Animal feed

8.3 Food

8.4 Industrial applications

8.5 Biofuels

8.6 Y-O-Y Growth trend Analysis By End-User

8.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Corn Seed Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Seed Type

9.1.3 By Type

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Seed Type

9.2.3 By Type

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Seed Type

9.3.3 By Type

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Seed Type

9.4.3 By Type

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Seed Type

9.5.3 By Type

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Corn Seed Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Monsanto Company (Bayer CropScience)

10.2 DuPont Pioneer (Corteva Agriscience)

10.3 Syngenta AG (ChemChina)

10.4 Dow AgroSciences LLC (Corteva Agriscience)

10.5 KWS SAAT SE

10.6 Groupe Limagrain

10.7 Bayer CropScience

10.8 BASF SE

10.9 Land O'Lakes, Inc.

10.10 Sakata Seed Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global corn seed market was valued at USD 26.75 billion and is projected to reach a market size of USD 41.57 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6.50%.

Population growth, dietary shifts, and technological advancements in seed development are the main factors propelling the global corn seed market.

Based on seed type, the global corn seed market is segmented into hybrid-certified seeds, farm-saved seeds, and open-pollinated certified seeds.

North America is the most dominant region for the global corn seed market.

Monsanto Company, DuPont Pioneer, and Syngenta AG are the key players operating in the global corn seed market.