Asia Pacific Corn Seeds Market Size (2024-2030)

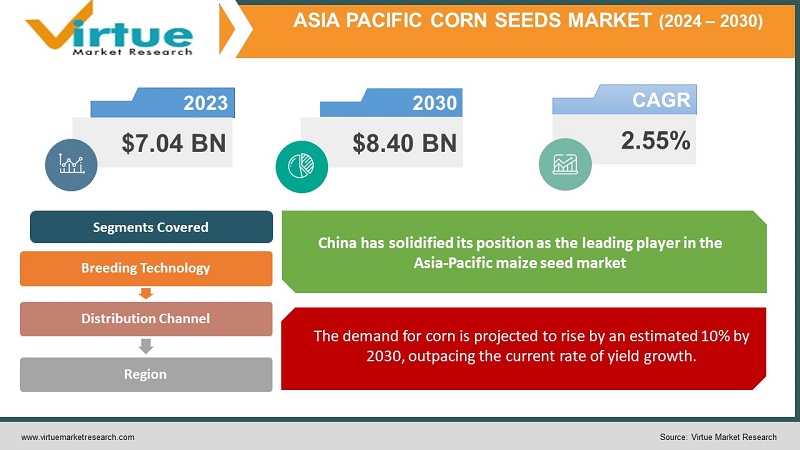

The Asia Pacific Corn Seeds Market was valued at USD 7.04 Billion in 2023 and is projected to reach a market size of USD 8.40 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 2.55%.

Like other parts of the world, the Asia Pacific region depends heavily on maize. The demand for high-yielding, disease-resistant maize varieties is rising in this area, which is a significant producer and consumer of the crop. Maize has several uses; it can be fed to animals, employed in industry, or consumed by people. Greater demand for maize-based products is anticipated as a result of the region's growing population and rising disposable income, necessitating more corn output. The region's maize producers are always looking for ways to maximize resource use and increase yields. Improved stress tolerance and disease resistance in premium maize seeds present a promising approach that will likely increase farmer acceptance.

Key Market Insights:

Consumption of corn for food, animal feed, and industrial applications is anticipated to increase by 10% in the Asia Pacific region by 2030, fueling demand for high-yielding corn seeds.

Public investments in agricultural development are expected to reach USD 20 billion annually across the region by 2027, potentially including subsidies for improved corn seed varieties.

Average corn yields in the region are projected to increase by 5% by 2030 due to the adoption of high-quality corn seeds with improved disease resistance and stress tolerance.

Erratic weather patterns are driving a 20% rise in demand for corn seeds with drought and flood tolerance by 2027.

Research into corn varieties with enhanced protein content and essential micronutrients is gaining traction, with potential market growth of 10% for these bio-fortified seeds by 2030.

The use of GMO corn seeds with enhanced disease resistance and herbicide tolerance is a growing trend, with a potential market growth of 12% by 2030 (regulations permitting).

The use of data analytics and digital tools for targeted seed selection based on soil conditions and climate data is projected to reach 25% of corn farms in the region by 2024.

Asia Pacific Corn Seeds Market Drivers:

The demand for corn is projected to rise by an estimated 10% by 2030, outpacing the current rate of yield growth.

The Asia Pacific region is home to a burgeoning population, with estimates suggesting an additional 1.5 billion people by 2030. This translates to a heightened demand for basic food sources, including corn. Rapid urbanization across the region leads to a shift in dietary patterns. Consumers are increasingly opting for processed foods and meat products, which often rely heavily on corn as a primary ingredient in animal feed. Hybrid corn seeds, dominating the market with a 70.2% share (2023), offer significant yield advantages over traditional open-pollinated varieties (OPVs). Their carefully selected genetics translate to increased corn production per hectare. Research into genetically modified organisms (GMOs) is paving the way for corn seeds with enhanced traits like herbicide tolerance and improved pest resistance. This allows farmers to optimize resource utilization and potentially increase yields.

Precision agriculture, a rapidly growing trend, is transforming the way corn is cultivated.

By analyzing soil characteristics, climate patterns, and historical yield data, farmers can select the most suitable corn seed varieties for their specific fields. This ensures optimal growth conditions and maximizes potential yields. Precision agriculture empowers farmers to apply fertilizers, water, and pesticides more precisely. This minimizes waste and ensures resources are directed where they are most needed, leading to cost savings and environmental benefits. The state of the environment and crop health may be monitored in real time thanks to sophisticated sensors and data-gathering instruments. As a result, farmers can minimize crop losses by promptly intervening, when possible, and problems such as pest infestations or nutrient deficits are detected early on.

Asia Pacific Corn Seeds Market Restraints and Challenges:

Many smallholder farmers lack access to adequate information and training on the benefits and proper use of high-quality corn seeds. Traditional farming practices and limited access to extension services can create a knowledge gap that hinders their willingness to experiment with new seed varieties. Smallholder farmers often operate with limited resources and face tight profit margins. The perceived risk associated with trying new, unfamiliar seed varieties can deter them from adopting improved corn seeds, even if they offer potential benefits. Lengthy and stringent approval processes for new corn seed varieties can hinder innovation and limit the availability of improved seeds to farmers. Streamlining these processes while maintaining high-quality standards is crucial. Erratic weather patterns can disrupt corn growth cycles, leading to reduced yields and crop losses. Traditional seed varieties may not be adequately equipped to handle these changing climatic conditions.

Asia Pacific Corn Seeds Market Opportunities:

Research and development efforts focused on creating corn seed varieties with enhanced drought tolerance are crucial. These seeds would require less water, allowing farmers to cultivate corn even in arid regions or during periods of limited rainfall. Flooding is another major concern for corn farmers. Developing corn seed varieties that can withstand temporary submergence or thrive in waterlogged conditions would be a game-changer, particularly in flood-prone areas. Rising temperatures can negatively impact corn growth and yields. Investing in research to create corn seeds with improved heat tolerance will be essential for ensuring stable corn production in the face of a warming climate. Collaboration between seed companies, research institutions, and government agencies can accelerate the development and deployment of climate-smart corn seeds. Public funding can support research initiatives, while private companies can leverage their expertise in breeding and seed production. Engaging farmers in the research and development process is crucial. Field trials and on-farm demonstrations allow farmers to test new seed varieties under real-world conditions and provide valuable feedback to researchers. The demand for organic corn, cultivated without synthetic fertilizers or pesticides, is rising. Seed companies can capitalize on this trend by developing and marketing high-quality organic corn seeds that cater to this growing market segment.

ASIA-PACIFIC CORN SEEDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2.55% |

|

Segments Covered |

By Breeding technology, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China , Japan , South Korea, India , Australia & New Zealand, Rest of Asia-Pacific |

|

Key Companies Profiled |

Corteva Agriscience , Syngenta Group , Bayer CropScience , BASF Agricultural Solutions , Shenfeng Seeds , JK Agri Genetics Ltd. , East-West Seed Company |

Asia Pacific Corn Seeds Market Segmentation:

Asia Pacific Corn Seeds Market Segmentation: By Breeding Technology:

- Hybrid Seeds

- Open-pollinated varieties (OPVs)

- Hybrid Derivatives

Dominating the market with an estimated 70.2% share (2023), hybrid corn seeds are the preferred choice for many farmers due to their superior yield potential. These seeds are carefully bred by crossing two genetically distinct parent lines, resulting in offspring with enhanced characteristics like increased disease resistance and higher grain production. Between 2024 and 2030, a 3.2% growth rate is projected for it. The ongoing need for greater maize yields and the growing uptake of contemporary farming techniques are the main drivers of this expansion.

Open-pollinated varieties (OPVs) Account for approximately 29.8% of the market share (2023), OPVs are pollinated naturally by wind or insects. They are known for their affordability, adaptability to local conditions, and ability to regenerate seeds from harvested crops. However, OPVs generally offer lower yields compared to hybrid seeds. Projected to witness a growth of 3.8% during the same period. While affordability remains a key advantage, the potential for yield improvement may lead some farmers to shift toward hybrid seeds.

Asia Pacific Corn Seeds Market Segmentation: By Distribution Channel:

- Seed Companies (Direct Sales)

- Local Seed Distributors

- Government Seed Programs

- E-commerce Platforms

Local seed distributors, often referred to as agro-dealers or seed retailers, form the backbone of the corn seeds market in the Asia Pacific region. These distributors are deeply entrenched in their communities, possessing a strong understanding of local farming practices, preferred seed varieties, and the specific needs of farmers in their region. Local distributors have a widespread presence, particularly in rural areas where large seed companies might have limited reach. Farmers can easily access seeds, obtain technical advice, and receive credit facilities from these local partners. Over time, local distributors develop strong relationships with farmers, fostering trust and brand loyalty. Farmers often rely on their expertise for guidance on seed selection, crop management practices, and potential issues.

E-commerce platforms are emerging as a disruptive force in the Asia Pacific corn seeds market, offering a new avenue for seed distribution. Online platforms enable farmers, particularly those in remote locations, to access a wider variety of seeds from different companies and potentially benefit from competitive pricing. E-commerce platforms offer detailed product descriptions, technical specifications, and user reviews, empowering farmers to make informed decisions about seed selection. Online platforms can facilitate efficient and convenient delivery of seeds directly to farms, eliminating the need for travel and potentially reducing transportation costs.

Asia Pacific Corn Seeds Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

With an astonishing 35% market share, China has solidified its position as the leading player in the Asia-Pacific maize seed market. The nation's extensive agricultural landscape, its quickly expanding population, and the government's deliberate focus on boosting food security and self-sufficiency are all contributing causes to this dominance. China's large amount of fertile land combined with its pleasant climate makes it the perfect place to grow maize. The varied topography of the nation, which stretches from the northeastern rich plains to the southern subtropical zones, makes it possible to grow a wide variety of maize varieties for use in food, feed, and industrial applications.

Due to its rapidly expanding population, shifting dietary habits, and government emphasis on food security and agricultural modernization, India has become the nation with the fastest rate of growth. The need for corn-based products has increased in India due to the country's fast-growing middle class and population, both for direct human consumption and as a vital component of animal feed. The demand for processed meals, breakfast cereals, and snacks made of maize has increased as incomes and dietary tastes have changed. This has led to a need for more maize to be produced and better seed varieties.

COVID-19 Impact Analysis on the Asia Pacific Corn Seeds Market:

Restrictions on movement hampered the availability of workers in seed production facilities and farms, potentially affecting seed processing, packaging, and planting schedules. Border closures and logistical challenges caused delays in the movement of seeds across international and even domestic borders. This could have impacted the availability of specific seed varieties for farmers, particularly those reliant on imported seeds. Uncertainty surrounding the pandemic and potential disruptions to food supply chains might have caused some farmers to delay planting or reduce their corn acreage, impacting seed demand in the short term. Seed companies and distributors increasingly embraced online platforms for seed sales and farmer education. This helped maintain some level of business continuity and minimize disruptions caused by physical restrictions. The pandemic highlighted the importance of robust domestic seed production capabilities. Countries with strong local seed industries were less vulnerable to disruptions in international seed supply chains. Governments in several Asia Pacific countries implemented measures to support the seed sector. This included financial assistance to seed companies, facilitating transportation of seeds, and ensuring the availability of agricultural inputs for farmers.

Latest Trends/ Developments:

Research and development efforts are focused on creating corn seed varieties with enhanced drought tolerance. This allows farmers to cultivate corn in arid regions or during periods of limited rainfall, ensuring greater resilience in the face of climate change. Flooding is another major concern for corn farmers. Developing corn seed varieties that can withstand temporary submergence or thrive in waterlogged conditions would be a game-changer, particularly in flood-prone areas. Rising temperatures can negatively impact corn growth and yields. Investing in research to create corn seeds with improved heat tolerance is crucial for ensuring stable corn production in a warming climate. Collaboration between seed companies, research institutions, and government agencies can accelerate the development and deployment of climate-smart corn seeds. Public funding can support research initiatives, while private companies can leverage their expertise in breeding and seed production. Consumers are increasingly seeking organic corn, cultivated without synthetic fertilizers or pesticides. Seed companies can capitalize on this trend by developing and marketing high-quality organic corn seeds that cater to this growing market segment. Seed companies can collaborate with government and non-governmental organizations to promote nutrition programs. This can involve supplying biofortified corn seeds to targeted communities and educating farmers on their benefits.

Key Players:

- Corteva Agriscience

- Syngenta Group

- Bayer CropScience

- BASF Agricultural Solutions

- Shenfeng Seeds

- JK Agri Genetics Ltd.

- East-West Seed Company

Chapter 1. Asia Pacific Corn Seeds Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Corn Seeds Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Corn Seeds Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Corn Seeds Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Corn Seeds Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Corn Seeds Market– By Breeding Technology

6.1. Introduction/Key Findings

6.2. Hybrid Seeds

6.3. Open-pollinated varieties (OPVs)

6.4. Hybrid Derivatives

6.5. Y-O-Y Growth trend Analysis By Breeding Technology

6.6. Absolute $ Opportunity Analysis By Breeding Technology, 2024-2030

Chapter 7. Asia Pacific Corn Seeds Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Seed Companies (Direct Sales)

7.3. Local Seed Distributors

7.4. Government Seed Programs

7.5. E-commerce Platforms

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Asia Pacific Corn Seeds Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Breeding Technology

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia Pacific Corn Seeds Market– Company Profiles – (Overview, Breeding Technology Portfolio, Financials, Strategies & Developments)

9.1 Corteva Agriscience

9.2. Syngenta Group

9.3. Bayer CropScience

9.4. BASF Agricultural Solutions

9.5. Shenfeng Seeds

9.6. JK Agri Genetics Ltd.

9.7. East-West Seed Company

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Asia Pacific region is experiencing rapid population growth and urbanization. This translates to an increased demand for corn, both for human consumption (cornmeal, corn oil) and industrial uses (biofuels, livestock feed).

The seed market in some countries is fragmented, with numerous small and medium-sized seed companies competing with a few large players. This can limit access to high-quality seeds, particularly in remote areas

Corteva Agriscience, Syngenta Group, Bayer CropScience, BASF Agricultural

Solutions, Shenfeng Seeds, JK Agri Genetics Ltd., East-West Seed Company.

China has firmly established itself as the most dominant player in the Asia-Pacific corn seeds market, commanding an impressive 35% market share

India has emerged as the fastest-growing country, driven by a burgeoning population, changing dietary preferences, and the government's focus on agricultural modernization and food security initiatives