Europe Corn Seeds Market Size (2024-2030)

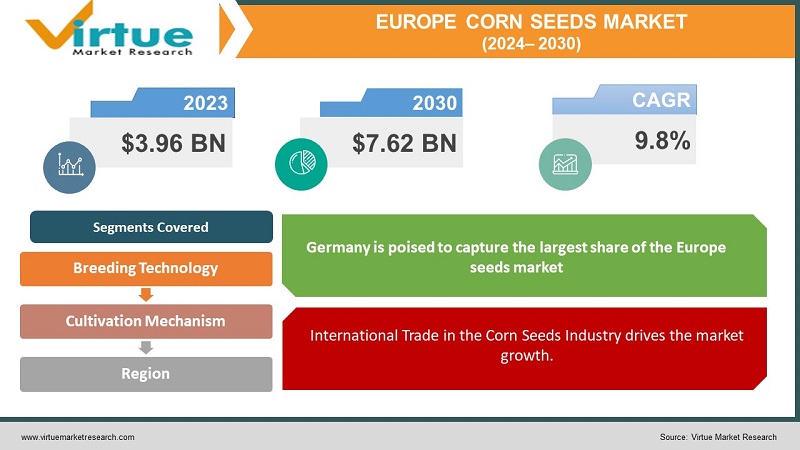

The Europe Corn Seeds Market was valued at USD 3.84 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 6.41 billion by 2030, growing at a CAGR of 7.6%.

A seed, fundamental in the reproduction of numerous plant species, comprises an embryo encased within a seed coat, essential for agricultural propagation. Seeds, utilized as inputs in agricultural and farming endeavors, come in both conventional and genetically modified forms.

Corn hailed as the premier among cereals due to its superior genetic yield capacity within the cereal family, is prized for its multifaceted economic value, encompassing every aspect of the plant, from grain to leaves, stalk, tassel, and cob. These elements serve as vital resources in the creation of a diverse array of food and non-food items. Cultivated across 166 nations worldwide, ranging from tropical to temperate climates and spanning altitudes from sea level to 3000 meters, corn boasts a cultivation area of approximately 205 million hectares. The worldwide production of corn totals 1210 million tonnes, with an average yield of 5878 kilograms per hectare. Its cultivation transcends various soil types, climates, biodiversity, and management practices.

Key Market Insights:

In the European market, row crops dominated the open-pollinated varieties segment in 2023, constituting a significant portion of its overall value at 95.4%. Row crops, characterized by their linear planting arrangement, necessitate a substantial volume of seeds for sowing, with seed rates notably higher compared to hybrid crops. Additionally, row crops typically offer a pricing advantage of 20-30% in comparison to hybrid varieties.

Europe plays a substantial role in the corn seed market, utilizing 12% of the total seed volume and dedicating over 7% of the cropping area to seed cultivation. Notably, the majority of seeds in Europe, accounting for 82% in 2022, are purchased pre-treated, marking a significant increase from the 70% reported in 2020.

Europe Corn Seeds Market Drivers:

International Trade in the Corn Seeds Industry drives the market growth.

While international trade contributes a modest 12% to corn production, its significance has steadily increased over the past two decades. The volume of corn trade has surged from 55 million tonnes to approximately 80 million tonnes, with recent years witnessing the most rapid growth in corn trade.

The structure of the corn seeds market is characterized by a high concentration of exports and a low concentration of imports. This pattern arises due to the limited number of countries with substantial corn surpluses available for exportation. Conversely, a larger number of nations rely on international markets to meet their domestic animal feeding needs, often importing corn as a primary feed ingredient.

Europe Corn Seeds Market Restraints and Challenges:

Market growth in the agricultural sector may face obstacles due to the elevated costs associated with agricultural equipment and pesticides. Additionally, a scarcity of skilled farmers and inadequate government initiatives are significant factors that could impede market expansion throughout the forecast period. Moreover, the proliferation of counterfeit hybrid seeds and fraudulent products, alongside the inflated costs of seeds attributed to substantial research and development expenses for seed quality enhancement, are poised to pose considerable challenges to the growth of the European seeds market.

Europe Corn Seeds Market Opportunities:

Rising Adoption of Advanced Technologies creates opportunities

Corn seed companies are progressively embracing advanced technologies such as biotechnology and genomics to engineer high-yielding and disease-resistant corn varieties. This strategic adoption of cutting-edge technologies is instrumental in enhancing both the quality and yield of corn, thereby fueling the expansion of the corn seeds market.

Increasing Population and Food Demand

The corn seeds market is significantly influenced by the escalating population growth and the corresponding surge in food demand. As the world's population continues to expand, there is a concurrent increase in the need for food staples, including corn. Renowned for its versatility, corn serves as a vital source of calories, nutrition, and energy for a considerable portion of the populace. Moreover, corn plays a pivotal role not only in direct human consumption but also as a primary component in animal feed. With the expansion of livestock production aimed at meeting the rising demand for animal-derived products, there is a consequent uptick in the requirement for corn as feed. This escalating demand underscores the necessity for high-quality corn seeds capable of yielding crops with desirable traits to meet the evolving needs of the market.

EUROPE CORN SEEDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.8% |

|

Segments Covered |

By Breeding technology, cultivation mechanism, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Syngenta, Dow AgroSciences, Bayer CropScience AG, Limagrain, Monsanto Company, DLF Trifolium, Nuziveedu Seeds, Corteva Agriscience, China National Seed, CP Seed |

Europe Corn Seeds Market Segmentation:

Europe Corn Seeds Market Segmentation By Breeding Technology:

- Hybrids

- Open Pollinated Varieties

- Hybrid Derivatives

The hybrid segment is anticipated to maintain the largest revenue share. This dominance can be attributed to the substantial contribution of hybrid seeds to enhanced crop yield. Hybrid seeds facilitate the transmission of desirable traits from both parent plants through cross-pollination, resulting in offspring that often exhibit superior characteristics. These traits encompass not only increased yields and enhanced disease resistance but also heightened adaptability to diverse environmental conditions. Furthermore, hybrid seeds may offer additional advantages such as elevated nutritional content or superior taste profiles. The progress in biotechnology has played a pivotal role in advancing the development of novel and improved hybrid seeds, further bolstering their significance in the market.

Europe Corn Seeds Market Segmentation By Cultivation Mechanism:

- Open Field

- Protected Cultivation

The Open Field segment asserts its dominance in the market. The European seeds market anticipates significant growth, fueled by factors such as escalating demand for biofuel extraction and the prevalence of both conventional and genetically modified seeds. The surge in urban farming and rooftop gardening augments the need for seeds suitable for limited-space cultivation, while the adoption of vertical farming techniques necessitates seeds tailored for controlled indoor environments. Moreover, heightened concerns regarding plant diseases drive the demand for disease-resistant seed varieties. The integration of smart agriculture technologies further propels market expansion, with sensors, drones, and data analytics optimizing agricultural processes.

Alfalfa and forage corn, prominent forage crops across Europe, are subject to extensive cultivation efforts aimed at enhancing yield and quality through advanced breeding techniques. With changing climates, the demand for alfalfa cultivars exhibiting high uniformity and adaptability to regional conditions has surged, meeting the evolving needs of open field cultivation mechanism.

Europe Corn Seeds Market Segmentation- by region

- France

- Germany

- Italy

- Spain

- United Kingdom

- Rest of Europe

Germany is poised to capture the largest share of the Europe seeds market throughout the forecast period. Renowned for its robust agricultural sector, Germany has emerged as a leading agricultural force, underpinned by its steadfast commitment to advanced farming methodologies. Farmers in the country have enthusiastically embraced cutting-edge technologies, including hybrid seeds and innovative seed technologies, which offer myriad benefits such as heightened yields and enhanced disease resistance. This proactive adoption of new technologies has propelled Germany to the forefront of the European seed market, solidifying its position as a trailblazer in agricultural innovation. Moreover, Germany's unwavering dedication to agricultural research and development has been instrumental in its success. The nation hosts numerous esteemed agricultural research institutions and universities that continuously strive to enhance seed varieties and refine farming practices.

Russia, boasting the largest expanse of agricultural land in the region, is experiencing the swiftest growth, fueled by its extensive utilization of commercial seeds.

Meanwhile, France has witnessed an uptick in the adoption of innovative hybrid seeds. The burgeoning demand for biofuels and processing industries has further contributed to the expansion of this pivotal segment.

COVID-19 Pandemic: Impact Analysis

The market for corn seeds is currently experiencing notable expansion due to several factors. Ongoing innovations are continually enhancing the performance and adaptability of conventional corn seed products, thereby boosting their efficiency. Growing consumer knowledge regarding the advantages of conventional corn seeds is propelling demand across different sectors. Moreover, government policies aimed at promoting sustainability and environmental care are encouraging the use of conventional corn seed solutions. Industries like construction, automotive, and electronics are showing substantial interest in these products. Continued investment in research and development is expected to improve the market further, leading to ongoing growth. As companies work to meet shifting consumer preferences and regulatory demands, the corn seed market is set for sustained progress in the near future.

Latest Trends/ Developments:

- In July 2023, Syngenta unveiled a novel hybrid winter barley boasting tolerance to barley yellowing virus (BYDV) alongside enhanced yield potential.

- Similarly, in July 2023, BASF augmented its Xitavo soybean seed portfolio by introducing 11 new high-yielding varieties tailored for the 2024 growing season. These additions incorporate the innovative Enlist E3 technology, engineered to combat resilient weeds effectively.

- In June 2023, Corteva Agriscience inaugurated its inaugural combined crop protection and seed research laboratory in the EMEA region. Situated in Eschbach, Germany, this state-of-the-art R&D facility represents a USD 6.61 million investment. Notably, the laboratory aligns with Corteva Agriscience's sustainability objectives, featuring energy-efficient infrastructure.

Key Players:

These are top 10 players in the Europe Corn Seeds Market: -

- Syngenta

- Dow AgroSciences

- Bayer CropScience AG

- Limagrain

- Monsanto Company

- DLF Trifolium

- Nuziveedu Seeds

- Corteva Agriscience

- China National Seed

- CP Seed

Chapter 1. Europe Corn Seeds Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Application

1.5. Secondary Application

Chapter 2. Europe Corn Seeds Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Corn Seeds Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Corn Seeds Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Europe Corn Seeds Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Corn Seeds Market– By Type

6.1. Introduction/Key Findings

6.2. Starch Blends

6.3. Polylactic Acid (PLA)

6.4. Polyhydroxyalkanoates (PHAs)

6.5. Polybutylene Adipate Terephthalate (PBAT)

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Corn Seeds Market– By Application

7.1. Introduction/Key Findings

7.2 Packaging

7.3. Agriculture & Horticulture

7.4. Consumer Goods

7.5. Textiles

7.6. Technical Applications

7.7. Y-O-Y Growth trend Analysis By Application

7.8. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe Corn Seeds Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K.

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Corn Seeds Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. BASF

9.2. Novamont

9.3. Total Corbion PLA

9.4. NatureWorks

9.5. Biotec

9.6. FKuR

9.7. Rodenburg Biopolymers

9.8. Synbra

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The structure of the corn seeds market is characterized by a high concentration of exports and a low concentration of imports. This pattern arises due to the limited number of countries with substantial corn surpluses available for exportation. Conversely, a larger number of nations rely on international markets to meet their domestic animal feeding needs, often importing corn as a primary feed ingredient

The top players operating in the Europe Corn Seeds Market are - Syngenta, Dow AgroSciences, Bayer CropScience AG, Limagrain, Monsanto Company, DLF Trifolium, Nuziveedu Seeds, Corteva Agriscience, China National Seed, CP Seed.

Corn seed companies are progressively embracing advanced technologies such as biotechnology and genomics to engineer high-yielding and disease-resistant corn varieties. This strategic adoption of cutting-edge technologies is instrumental in enhancing both the quality and yield of corn, thereby fueling the expansion of the corn seeds market.

France has witnessed an uptick in the adoption of innovative hybrid seeds. The burgeoning demand for biofuels and processing industries has further contributed to the expansion of this pivotal segment