Cocoa Powder Market Size (2025 – 2030)

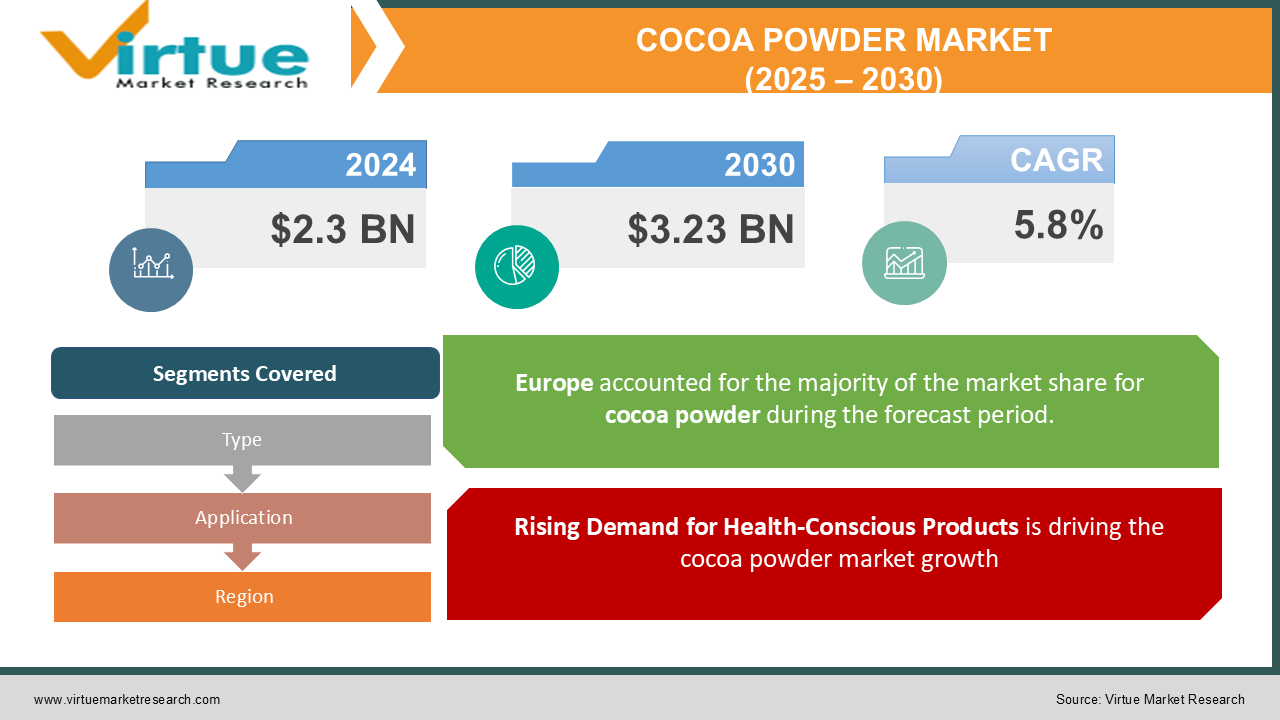

The Global Cocoa Powder Market was valued at USD 2.3 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030, reaching USD 3.23 billion by 2030.

Cocoa powder, a key derivative of cocoa beans, is widely used in industries such as confectionery, bakery, dairy, beverages, and dietary supplements. With its rich flavor, color-enhancing properties, and functional benefits, cocoa powder is integral to numerous consumer and industrial applications. Increasing consumer demand for healthier and natural food products, alongside growing interest in functional foods, has contributed significantly to market growth. Moreover, advancements in processing technologies are enhancing product quality and expanding its application scope.

Key Market Insights

-

Cocoa powder accounted for over 40% of the global cocoa derivatives market share in 2024, emphasizing its broad application across sectors.

-

The global production of cocoa beans, the primary raw material, reached approximately 5 million metric tons in 2024, with West Africa contributing over 70% of the supply.

-

The increasing adoption of cocoa powder in plant-based and vegan products is expanding its relevance in the dietary supplement and health-focused food segments.

-

The Asia-Pacific region exhibited the highest growth rate, driven by rising disposable incomes and Western food trends in countries like China and India.

-

Sustainability certifications such as Fair Trade and Rainforest Alliance are gaining prominence, ensuring ethically sourced cocoa powder appeals to conscientious consumers. Innovations in packaging and smaller pack sizes have enhanced accessibility for retail consumers, boosting household consumption of cocoa powder. The inclusion of cocoa powder in premium, artisanal, and single-origin chocolate products has further fueled market demand.

Global Cocoa Powder Market Drivers

Rising Demand for Health-Conscious Products is driving the cocoa powder market growth:

The increasing focus on health and wellness is driving the demand for cocoa powder, which is rich in antioxidants and offers potential health benefits such as improved heart health and reduced inflammation. Cocoa powder is a popular ingredient in the formulation of functional foods and beverages, catering to health-conscious consumers. Additionally, its compatibility with low-sugar and low-fat products has expanded its use in guilt-free indulgences. Manufacturers are leveraging these attributes to promote cocoa-based products as not just tasty but also nutritious options, meeting the growing demand for clean-label products.

Expanding Applications in Diverse Industries is driving the cocoa powder market growth:

The versatility of cocoa powder makes it a crucial ingredient in industries beyond confectionery. It is widely used in bakery products, beverages (hot chocolate, coffee mixes), and dairy products (flavored milk, ice creams). Its inclusion in dietary supplements and protein shakes is increasing, particularly among health and fitness enthusiasts. The cosmetic industry has also embraced cocoa powder for its antioxidant properties, using it in skincare products and masks. This broad application scope ensures consistent demand across various markets and reduces dependency on a single sector.

Technological Advancements in Cocoa Processing is driving the cocoa powder market growth:

Continuous advancements in cocoa processing technologies have significantly improved the quality and functionality of cocoa powder. Innovations in alkalization processes have enhanced the solubility, color, and flavor of cocoa powder, making it suitable for high-end applications. These advancements are enabling manufacturers to create tailored products for specific needs, such as beverages, bakery, and health foods. Additionally, improved processing efficiencies are lowering production costs, allowing manufacturers to offer competitively priced products while maintaining quality.

Global Cocoa Powder Market Challenges and Restraints

Volatile Cocoa Bean Prices is restricting the cocoa powder market growth:

The price volatility of cocoa beans, driven by factors such as unpredictable weather patterns, pest infestations, and political instability in cocoa-producing regions, poses a significant challenge for the cocoa powder market. These fluctuations impact the cost of production and disrupt supply chains, making it difficult for manufacturers to maintain consistent pricing. Furthermore, the reliance on a few key producing countries like Côte d’Ivoire and Ghana amplifies the risks associated with supply disruptions. To mitigate this, manufacturers are investing in sustainable sourcing practices and fostering long-term partnerships with farmers.

Stringent Quality and Safety Regulations is restricting the cocoa powder market growth:

Cocoa powder manufacturers face stringent regulatory requirements related to food safety, quality standards, and labeling. For instance, regions like North America and Europe enforce strict guidelines regarding permissible levels of contaminants, such as cadmium and pesticide residues. Additionally, obtaining certifications like organic or Fair Trade requires adherence to rigorous protocols, which can increase production costs. To overcome these challenges, companies are investing in advanced testing and traceability systems to ensure compliance and maintain consumer trust.

Market Opportunities

The Cocoa Powder Market offers substantial growth opportunities, particularly in the realms of sustainability, innovation, and emerging markets. The rising consumer preference for organic and ethically sourced products is driving demand for certified cocoa powder, creating opportunities for manufacturers to differentiate themselves. Additionally, the growing popularity of plant-based diets has expanded the application of cocoa powder in vegan and dairy-free products. Emerging economies in Asia-Pacific, Latin America, and the Middle East are witnessing rapid urbanization and increasing consumer spending on premium and imported products, presenting untapped potential for cocoa powder manufacturers. Collaborations with food and beverage companies to develop unique, cocoa-based offerings tailored to regional preferences can further enhance market penetration.

COCOA POWDER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Barry Callebaut, Cargill, Incorporated, Olam International, Nestlé S.A., The Hershey Company, Mondelez International, Blommer Chocolate Company, Puratos Group, ECOM Agro industrial Corporation, Ghirardelli Chocolate Company |

Cocoa Powder Market Segmentation - By Type

-

Natural Cocoa Powder

-

Alkalized (Dutch-Processed) Cocoa Powder

Alkalized cocoa powder leads this category, owing to its enhanced solubility, mild flavor, and deep color, making it highly suitable for premium beverages and desserts.

Cocoa Powder Market Segmentation - By Application

-

Confectionery

-

Bakery

-

Beverages

-

Dairy Products

-

Dietary Supplements

-

Others (Cosmetics, Pharmaceuticals)

The bakery segment dominates the application market, accounting for majority of the demand in 2024, driven by the widespread use of cocoa powder in cakes, cookies, brownies, and pastries.

Cocoa Powder Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe is the largest market for cocoa powder, with a revenue share exceeding 35% in 2024. The region’s established bakery and confectionery industries, combined with strong consumer demand for premium and artisanal products, drive this dominance. Additionally, European manufacturers are leading in sustainable cocoa sourcing practices, appealing to eco-conscious consumers. Innovations in food processing and a robust retail infrastructure further reinforce Europe’s position as a key market.

COVID-19 Impact Analysis on the Cocoa Powder Market

The COVID-19 pandemic had a profound effect on the cocoa powder market, causing significant disruptions in supply chains and influencing consumer habits. At the onset of the pandemic, cocoa-producing regions faced severe logistical challenges, including transportation delays and labor shortages, which hindered production and distribution. Despite these setbacks, the market began to recover as lockdowns led to an increased demand for comfort foods. With many people staying home, cocoa-based products like chocolates, baked goods, and hot beverages saw a surge in popularity. Additionally, the trend of home baking gained momentum, further driving the demand for cocoa powder in households. As in-person shopping became limited, e-commerce platforms quickly became a key distribution channel for manufacturers, enabling them to directly connect with consumers and adapt to the changing retail environment. This shift to online shopping ensured that cocoa products remained accessible to a wide audience. Furthermore, the pandemic prompted consumers to focus more on health and wellness, which led to an increased interest in the potential health benefits of cocoa. Rich in antioxidants, cocoa powder gained recognition for its inclusion in functional foods and beverages, which are perceived as beneficial for overall well-being. In summary, while the pandemic initially posed challenges to the cocoa powder market, it also created new opportunities for growth. The demand for indulgent and comfort-oriented foods, the rise of home baking, and the shift toward e-commerce helped the market recover, while heightened health awareness opened new avenues for cocoa powder in the functional food sector.

Latest Trends/Developments

The cocoa powder market is experiencing significant changes driven by shifting consumer preferences and technological innovations. Sustainability has become a top priority, with major manufacturers focusing on traceable supply chains and acquiring certifications like Rainforest Alliance and Fair Trade. These efforts ensure ethical sourcing and address growing consumer demand for transparency and environmental responsibility. At the same time, product innovation is expanding, with options such as single-origin and flavored cocoa powders catering to diverse and evolving tastes. In response to environmental concerns, many companies are adopting eco-friendly and biodegradable packaging, aligning their practices with global sustainability initiatives. This shift reflects a broader commitment to reducing the environmental footprint of cocoa production and packaging. Additionally, cocoa powder's versatility has contributed to its growing presence in plant-based and vegan food formulations, further expanding its appeal across various dietary preferences. The increasing popularity of online retail platforms has also transformed the cocoa powder market by enabling direct-to-consumer sales. Manufacturers can now personalize their offerings, creating unique products that cater to individual preferences and enhancing customer engagement. This shift toward e-commerce has not only provided a more convenient shopping experience but has also allowed brands to build closer relationships with consumers. Overall, the cocoa powder market is adapting to changing consumer demands, with a strong focus on sustainability, innovation, and personalization. These transformations are helping shape the future of the industry, making cocoa products more accessible, ethical, and appealing to a broader range of consumers.

Key Players

-

Barry Callebaut

-

Cargill, Incorporated

-

Olam International

-

Nestlé S.A.

-

The Hershey Company

-

Mondelez International

-

Blommer Chocolate Company

-

Puratos Group

-

ECOM Agroindustrial Corporation

-

Ghirardelli Chocolate Company

Chapter 1. Cocoa Powder Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cocoa Powder Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cocoa Powder Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cocoa Powder Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cocoa Powder Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cocoa Powder Market – By Type

6.1 Introduction/Key Findings

6.2 Natural Cocoa Powder

6.3 Alkalized (Dutch-Processed) Cocoa Powder

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Cocoa Powder Market – By Application

7.1 Introduction/Key Findings

7.2 Confectionery

7.3 Bakery

7.4 Beverages

7.5 Dairy Products

7.6 Dietary Supplements

7.7 Others (Cosmetics, Pharmaceuticals)

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Cocoa Powder Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Cocoa Powder Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Barry Callebaut

9.2 Cargill, Incorporated

9.3 Olam International

9.4 Nestlé S.A.

9.5 The Hershey Company

9.6 Mondelez International

9.7 Blommer Chocolate Company

9.8 Puratos Group

9.9 ECOM Agroindustrial Corporation

9.10 Ghirardelli Chocolate Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cocoa Powder Market was valued at USD 2.3 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030, reaching USD 3.23 billion by 2030.

Key drivers include rising demand for health-conscious products, expanding applications in diverse industries, and advancements in cocoa processing technologies.

The market is segmented by type (natural cocoa powder, alkalized cocoa powder) and by application (confectionery, bakery, beverages, dairy products, dietary supplements, and others).

Europe dominates the market with over 35% of the global revenue share in 2024, driven by a strong bakery and confectionery industry and consumer demand for premium products.

Leading players include Barry Callebaut, Cargill, Incorporated, Olam International, Nestlé S.A., and The Hershey Company.