Cocoa Ingredients Market Size (2025 – 2030)

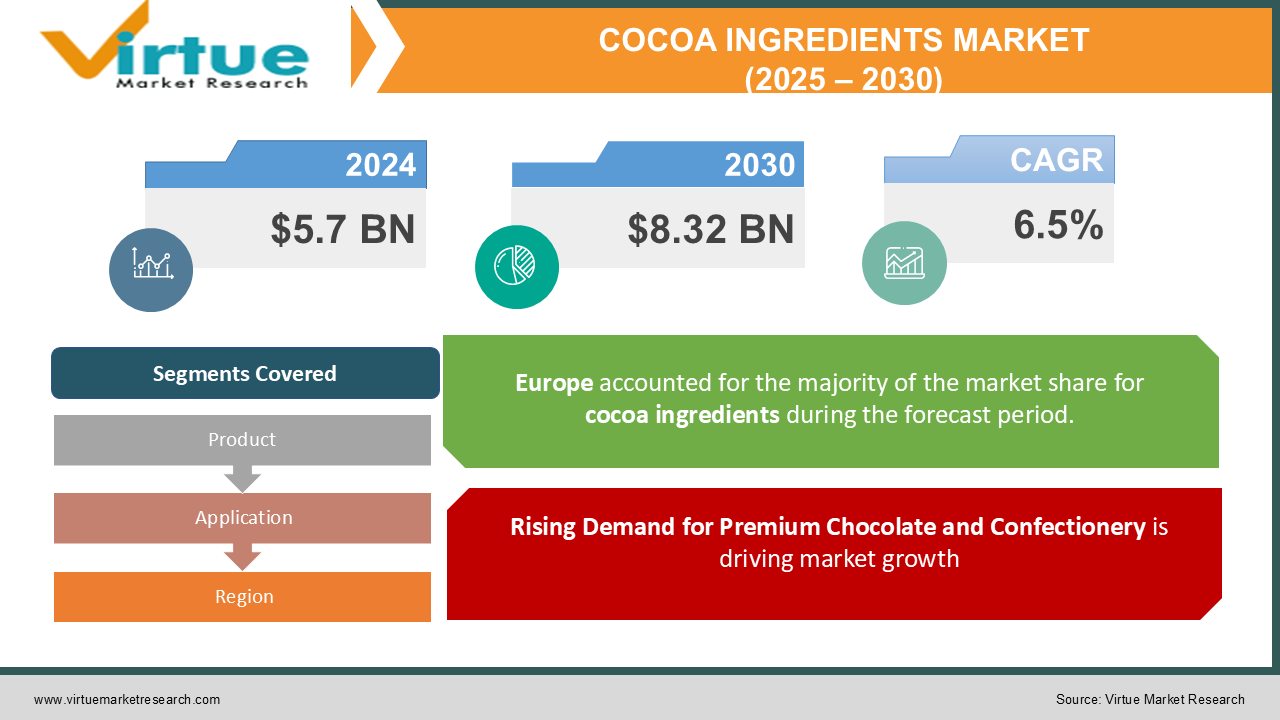

The Global Cocoa Ingredients Market was valued at USD 5.7 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. By 2030, the market is expected to reach USD 8.32 billion.

The Cocoa Ingredients Market focuses on products derived from cocoa beans, such as cocoa powder, cocoa butter, and cocoa liquor, used across diverse industries including confectionery, bakery, beverages, and cosmetics. With increasing consumer preferences for premium and functional foods, the demand for cocoa ingredients is escalating. Additionally, the rising interest in dark chocolate and its associated health benefits is a significant growth driver.

Key Market Insights

-

The global production of cocoa beans reached approximately 5 million metric tons in 2024, with West Africa contributing over 70% of the total supply.

-

Cocoa butter held the largest revenue share in 2024, driven by its wide application in confectionery and cosmetics due to its smooth texture and moisturizing properties.

-

Dark chocolate, known for its high cocoa content and health benefits like improved heart health and antioxidants, accounted for 35% of cocoa ingredient demand in 2024.

-

The Asia-Pacific region exhibited the fastest growth, driven by expanding middle-class populations and increasing disposable incomes, particularly in India and China.

-

Sustainable cocoa sourcing has emerged as a critical focus, with major players committing to certifications such as Fair Trade and Rainforest Alliance.

-

Increasing adoption of cocoa ingredients in plant-based and vegan products has expanded the application scope of cocoa powder and cocoa butter.

-

Innovations in cocoa extraction technologies have improved efficiency, reduced waste, and enhanced flavor profiles, catering to diverse industry needs.

-

The global push for sugar reduction has bolstered demand for natural cocoa-based products in the health-conscious consumer segment.

Global Cocoa Ingredients Market Drivers

Rising Demand for Premium Chocolate and Confectionery is driving market growth:

The shift in consumer preferences toward high-quality and artisanal chocolates is a major growth driver for the cocoa ingredients market. Premium chocolates, characterized by high cocoa content, minimal processing, and unique flavors, are gaining traction globally. Increasing disposable incomes, particularly in developing economies, are enabling consumers to invest in premium chocolate products. Moreover, manufacturers are incorporating innovative ingredients like single-origin cocoa and functional additives, further elevating consumer interest. This trend has prompted significant investments in cocoa sourcing and processing technologies, ensuring consistent quality and supply for premium products. The focus on ethical sourcing has also boosted consumer trust and loyalty.

Expanding Application in Non-Confectionery Sectors is driving market growth:

Cocoa ingredients are increasingly utilized in industries beyond confectionery, including beverages, dairy, and personal care. Cocoa powder is a key ingredient in ready-to-drink beverages and health supplements due to its rich flavor and antioxidant properties. In the cosmetic industry, cocoa butter is prized for its emollient properties, making it a staple in skincare and haircare formulations. The rise of functional foods and beverages incorporating cocoa ingredients to deliver health benefits has further widened their application scope. This diversification reduces dependency on the confectionery segment and ensures steady demand across multiple sectors.

Growing Awareness of Health Benefits is driving market growth:

The health benefits associated with cocoa consumption are another significant driver of market growth. Studies highlighting the role of flavonoids in improving cardiovascular health, reducing inflammation, and enhancing cognitive function have spurred consumer interest in dark chocolate and cocoa-based products. Additionally, the demand for low-sugar, high-cocoa products aligns with global health and wellness trends. Food manufacturers are leveraging these attributes to position cocoa-based products as nutritious indulgences, catering to health-conscious consumers without compromising taste.

Global Cocoa Ingredients Market Challenges and Restraints

Volatility in Cocoa Prices is restricting market growth:

The cocoa industry is highly sensitive to price fluctuations, influenced by factors such as weather conditions, pest infestations, and political instability in key cocoa-producing regions like West Africa. These fluctuations directly impact production costs for manufacturers and create uncertainties in supply chains. Furthermore, sustainability initiatives, while beneficial for the long-term health of the industry, often involve additional costs, which can strain profit margins. Addressing these challenges requires a concerted effort by stakeholders to stabilize supply chains, invest in resilient agricultural practices, and adopt risk mitigation strategies.

Stringent Regulatory and Quality Standards is restricting market growth:

Compliance with regulatory standards for food safety, labeling, and quality poses a challenge for cocoa ingredient manufacturers. Stringent requirements in regions like North America and Europe necessitate thorough testing and certification, particularly for products marketed as organic or Fair Trade. Additionally, the presence of contaminants such as heavy metals or pesticide residues can lead to product recalls and reputational damage. Manufacturers must invest in robust quality assurance measures, traceability systems, and sustainable sourcing practices to navigate these challenges effectively.

Market Opportunities

The Global Cocoa Ingredients Market presents significant opportunities for growth, driven by shifting consumer preferences and technological advancements. The rising popularity of plant-based and vegan diets has expanded the market for dairy-free chocolate and cocoa-based alternatives. Manufacturers are innovating with new product formats such as cocoa-based protein bars, snacks, and beverages to cater to this demand. Additionally, the increasing penetration of e-commerce platforms has opened new avenues for marketing and distributing premium cocoa products, particularly in emerging markets. Collaborative efforts among stakeholders to promote sustainable cocoa farming and ensure fair wages for farmers are also creating long-term opportunities. With innovations in flavor profiling, manufacturers can tap into the growing demand for customized and region-specific products, further enhancing market potential.

COCOA INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Barry Callebaut, Cargill, Incorporated, Olam International, Nestlé S.A., Mars, Incorporated, The Hershey Company, Blommer Chocolate Company, ECOM Agroindustrial Corporation, Puratos Group, Mondelez International |

Cocoa Ingredients Market Segmentation - By Product

-

Cocoa Powder

-

Cocoa Butter

-

Cocoa Liquor

Cocoa powder is the most dominant product type, accounting for over 40% of the market share in 2024. Its versatility in confectionery, bakery, and beverage applications makes it a preferred choice across industries.

Cocoa Ingredients Market Segmentation - By Application

-

Confectionery

-

Bakery

-

Beverages

-

Dairy Products

-

Cosmetics

-

Pharmaceuticals

The confectionery segment leads in terms of application, driven by the consistent demand for chocolates and related products globally. This segment accounted for 55% of the application share in 2024.

Cocoa Ingredients Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe remains the largest market for cocoa ingredients, accounting for over 35% of the global revenue share in 2024. The region’s long-standing chocolate tradition, coupled with strong consumer interest in premium and organic products, drives this dominance. Additionally, European manufacturers are at the forefront of sustainable sourcing initiatives, which align with consumer preferences for ethically sourced products. The region’s robust confectionery sector and innovation in dairy and bakery applications further enhance its market position.

COVID-19 Impact Analysis on the Cocoa Ingredients Market

The COVID-19 pandemic had a profound effect on the cocoa ingredients market, disrupting both supply chains and consumer behavior. In key cocoa-producing regions like Côte d'Ivoire and Ghana, lockdown measures resulted in labor shortages, causing delays in the harvesting and processing of cocoa beans. This disruption impacted the availability of cocoa and its derivatives on the global market. On the demand side, the closure of restaurants, cafes, and bakeries during the early phases of the pandemic led to a significant decline in sales of cocoa-based products typically consumed outside the home. However, the market began to recover as lockdowns persisted, with many consumers turning to comfort foods such as chocolate and cocoa-infused beverages to cope with the stress and isolation. This shift in consumer preferences helped stabilize demand for cocoa ingredients. The rise of e-commerce played a crucial role in the market's rebound. With many consumers staying at home, online retail became a vital distribution channel, allowing manufacturers to reach customers directly. The shift toward online shopping was particularly important for the sales of cocoa-based products, which found a strong presence on digital platforms. Additionally, as the pandemic heightened awareness of health and immunity, interest in dark chocolate and cocoa products with potential health benefits surged. Products that emphasized functional qualities, such as antioxidant-rich dark chocolate, resonated with consumers looking for healthier indulgence options. This trend helped to mitigate some of the pandemic's negative effects on the cocoa ingredients market, supporting both demand and market recovery.

Latest Trends/Developments

The cocoa ingredients market is undergoing significant transformation, driven by several key trends. Sustainability continues to be a major focus, with leading companies adopting traceable sourcing practices to promote fair trade and minimize environmental impact. These initiatives not only ensure ethical sourcing but also contribute to reducing the industry's carbon footprint. Technological advancements in cocoa processing are playing a vital role in improving flavor retention and increasing yield efficiency. These innovations help manufacturers meet growing consumer demand for high-quality cocoa products while optimizing production processes. The rise of plant-based diets has also spurred innovation in the cocoa market. Dairy-free chocolate and cocoa-based alternatives are increasingly popular, catering to the expanding vegan consumer base. This shift in dietary preferences has prompted manufacturers to create new formulations that align with plant-based lifestyles, making cocoa products more accessible to a diverse audience. In addition, digital marketing and e-commerce have become crucial tools for manufacturers to connect with the modern, tech-savvy consumer. Online platforms allow for personalized product offerings, subscription services, and direct engagement, enhancing the customer experience and driving sales. These strategies are helping brands build stronger connections with their audience, particularly in the digital age. Another emerging trend is the exploration of unique flavor profiles, such as single-origin and fermented cocoa products. These innovations cater to the growing demand for premium chocolate experiences, offering distinct and complex flavors that appeal to sophisticated palates. As a result, the cocoa ingredients market is becoming increasingly dynamic, with a focus on quality, sustainability, and consumer-centric innovations.

Key Players

-

Barry Callebaut

-

Cargill, Incorporated

-

Olam International

-

Nestlé S.A.

-

Mars, Incorporated

-

The Hershey Company

-

Blommer Chocolate Company

-

ECOM Agroindustrial Corporation

-

Puratos Group

-

Mondelez International

Chapter 1. Cocoa Ingredients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cocoa Ingredients Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cocoa Ingredients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cocoa Ingredients Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cocoa Ingredients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cocoa Ingredients Market – By Product

6.1 Introduction/Key Findings

6.2 Cocoa Powder

6.3 Cocoa Butter

6.4 Cocoa Liquor

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Cocoa Ingredients Market – By Application

7.1 Introduction/Key Findings

7.2 Confectionery

7.3 Bakery

7.4 Beverages

7.5 Dairy Products

7.6 Cosmetics

7.7 Pharmaceuticals

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Cocoa Ingredients Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Cocoa Ingredients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Barry Callebaut

9.2 Cargill, Incorporated

9.3 Olam International

9.4 Nestlé S.A.

9.5 Mars, Incorporated

9.6 The Hershey Company

9.7 Blommer Chocolate Company

9.8 ECOM Agroindustrial Corporation

9.9 Puratos Group

9.10 Mondelez International

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cocoa Ingredients Market was valued at USD 5.7 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. By 2030, the market is expected to reach USD 8.32 billion.

Key drivers include rising demand for premium chocolate, expanding application in non-confectionery sectors, and growing awareness of cocoa’s health benefits.

The market is segmented by product (cocoa powder, cocoa butter, cocoa liquor) and by application (confectionery, bakery, beverages, dairy, cosmetics, pharmaceuticals).

Europe is the dominant region, accounting for over 35% of the global revenue share in 2024, driven by strong consumer demand for premium and sustainable cocoa products.

Leading players include Barry Callebaut, Cargill, Incorporated, Olam International, Nestlé S.A., and Mars, Incorporated.