Cocoa Products Market Size (2024 - 2030)

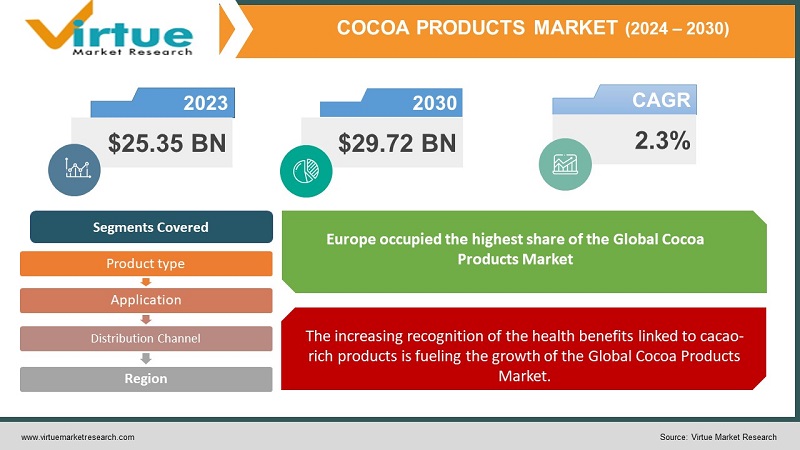

The Global Cocoa Products Market was valued at USD 25.35 Billion and is projected to reach a market size of USD 29.72 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 2.3%.

Cocoa products are utilized to enrich the savor and texture of diverse food products. This offer not just taste but also essential nutritional and functional benefits to dishes that incorporate this ingredient. Making chocolates, for instance, necessitates the incorporation of cocoa butter, cocoa liquor, and cocoa powder. The advantageous properties of cocoa butter like its specific melting and contraction points evoke a delightful melting sensation in the mouth and make it easier to extract chocolates from molds. Furthermore, chocolate effectively conceals the unpalatable taste of pills and other pharmaceuticals, which leads to a growing utilization of chocolate for medicinal purposes. The cocoa products industry is mature, with key players like Barry Callebaut, Cargill, Nestlé, and Hershey. Dark chocolate stands as the primary type within the industry, but milk chocolate also holds a significant presence. Due to the delightful flavors, downstream industries are projected to demand more cocoa and chocolate products, indicating substantial market potential. Manufacturers are working on creating diverse flavored cocoa and chocolate varieties by using technology and additional ingredients. The key raw materials utilized for cocoa and chocolate production entail cocoa beans, sugar, and milk.

Global Cocoa Products Market Drivers:

The increasing recognition of the health benefits linked to cacao-rich products is fueling the growth of the Global Cocoa Products Market.

Cacao seeds are highly praised for offering an array of health advantages. A few of these advantages encompass lower blood pressure levels, improve heart health, alleviate chronic fatigue syndrome, provision of unparalleled protection against sunburn, etc. Cacao seeds' ample polyphenol content offers unmatched advantages in safeguarding the body against oxidative stress, cancer, inflammation, and other related afflictions. Furthermore, cacao seeds comprise vital minerals like magnesium and iron that encourage healthy digestion and maintain optimal energy levels. Therefore, this factor propels the demand for cocoa products.

The growing popularity of chocolate confectionery is another factor contributing to the growth of the Global Cocoa Products Market.

The demand for chocolate confections is augmenting owing to the mounting chocolate popularity among consumers in emerging economies. Developed markets are also witnessing an upsurge in the demand for molded and countline chocolates, which is projected to positively impact the Global Cocoa Products Market. Key manufacturers are introducing new chocolate types like dark chocolate and ruby chocolate to their product portfolios, which propels industry growth. The custom of gifting chocolates amidst festive seasons is also estimated to have a profound impact on the market's growth.

Global Cocoa Products Market Challenges:

The Global Cocoa Products market is encountering challenges, primarily in terms of the easy availability and inexpensiveness of alternatives. The market for cocoa butter is detrimentally affected by the augmenting demand for equivalents like palm oil, soybean oil, shea, and rapeseed oil owing to their ready availability and budget-friendliness. These alternatives experience growth owing to their ability to enhance the fat stability and composition of chocolate products. Thus, these obstacles inhibit the growth of the Global Cocoa Products Market.

Global Cocoa Products Market Opportunities:

Theobromine, present in cocoa powder, aids in relieving inflammation and safeguarding against ailments like heart disease, cancer, and diabetes. As cocoa is rich in phytonutrients while being low in fat and sugar content, the calories attained from cocoa powder are packed with beneficial compounds. Because raw products are made from agitated, dry, unroasted cacao beans, they are frequently less processed and healthier. Nevertheless, regular dark chocolate with a minimum of 70% cacao is an excellent source of antioxidants and minerals, which creates a tremendous market opportunity.

COVID-19 Impact on the Global Cocoa Products Market:

The Global Cocoa Products Market has been considerably influenced by the COVID-19 outbreak. As a result of rigorous lockdowns, travel restrictions, and social distancing measures, the demand for cocoa products waned. Disruptions in the supply chains highly affected the expedited production and distribution of cocoa products. Furthermore, the demand for cocoa products dwindled due to the financial uncertainty for many consumers created by the pandemic, which reduced discretionary spending. These factors negatively impacted the market's growth. Despite these challenges, the market is projected to rebound alongside the global recovery from the pandemic.

Global Cocoa Products Market Recent Developments:

-

In May 2023, Ferrero North America unveiled new products and seasonal treats, such as Kinder Chocolate, at the Annual Sweets & Snacks Expo in Chicago.

-

In February 2023, Mars Wrigley India introduced GALAXY FUSIONS Dark chocolate with 70% cocoa in India, and it will now be locally produced in the country.

-

In July 2022, Lil’Goodness, a health-focused food, and snacking brand, launched India's first zero-added sugar prebiotic cocoa powder. This unique cocoa powder is made from natural prebiotic fibers and 100 percent real cocoa rich in antioxidants.

COCOA PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2.3% |

|

Segments Covered |

By Product type, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Hershey Company (United States), Barry Callebaut AG (Switzerland), Touton S.A. (France), Cargill, Incorporated (United States), Nestlé S.A. (Switzerland), Olam International Limited (Singapore), Niche Cocoa Industry Ltd. (Ghana), Blommer Chocolate Company (United States), United Cocoa Processors Inc. (United States), Dutch Cocoa B.V. (Netherlands) |

Global Cocoa Products Market Segmentation: By Product Type

-

Cocoa Beans

-

Cocoa Butter

-

Cocoa Paste and Liquor

-

Cocoa Powder and Cake

-

Chocolate

-

Others

Based on the Product Type, the Cocoa Beans segment occupied the highest market share in the year 2022. The growth can be ascribed to cocoa beans being commonly consumed as candy, used to make beverages, and employed to add flavor or coating to diverse confections and bakery items. Chocolate, a highly popular sweet, occupies the prime spot when it comes to utilizing cocoa beans the most. Cocoa beans are utilized in various chocolate items, encompassing milk chocolate, dark chocolate, and other delightful cocoa-infused delicacies. Furthermore, cocoa beans are a valuable source of quick energy owing to their high carbohydrate content. They also comprise stimulating alkaloids such as theobromine and caffeine in minuscule quantities.

Global Cocoa Products Market Segmentation: By Application

-

Food and Beverages

-

Cosmetics

-

Pharmaceuticals

-

Others

Based on the Application, the Food and Beverages segment occupied the highest market share in the year 2022. The growth can be ascribed to the flourishing food and beverage industry, which presents ample prospects for cocoa-derived products. Chocolate continues to be a popular flavor in new launches across beverages, bakery, and confectionery segments. It remains an extensively utilized ingredient in the sweets and beverages sector. This ongoing trend is anticipated to propel the future demand for cocoa butter and cocoa powder. The worldwide food service industry plays a pivotal role in the rising acclaim of top-quality and specialized cocoa-based offerings. Foodservice conglomerates seek greater personalization, value-added products, and multifunctional solutions, which will aid the Cocoa Products Market to expand even more.

Global Cocoa Products Market Segmentation: By Distribution Channel

-

Convenience Stores

-

Specialty Stores

-

Supermarkets/Hypermarkets

-

E-commerce

-

Others

Based on the Distribution Channel, the Supermarkets/Hypermarkets segment occupied the highest market share in the year 2022. The growth can be ascribed to the amplified reach and accessibility of supermarkets/hypermarkets, which allow for a larger consumer base. These locations are evolving into the go-to, one-stop store for daily necessities because of the abundance of goods offered at substantial savings. Given the availability of an array of goods and discounts on them, the need for supermarkets/hypermarkets has gone up, delivering consumers with a one-of-a-kind shopping experience. Consumers often prefer to purchase cocoa products like chocolate bars, cocoa spread, cocoa nibs, etc., in bulk, which is easier to do at supermarkets/hypermarkets.

Global Cocoa Products Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

Based on the Region, Europe occupied the highest share of the Global Cocoa Products Market in the year 2022. The region is also anticipated to expand at the quickest rate over the forecast period 2023-2030. The growth can be ascribed to the extensive utilization of cocoa products across diverse applications, Europe's status as a major center for industrial chocolate production, home to renowned chocolate producers in nations like Belgium, Netherlands, Germany, and Switzerland, and the increasing consumer awareness regarding sustainable cocoa production and ethical sourcing of cocoa beans.

Global Cocoa Products Market Key Players:

-

The Hershey Company (United States)

-

Barry Callebaut AG (Switzerland)

-

Touton S.A. (France)

-

Cargill, Incorporated (United States)

-

Nestlé S.A. (Switzerland)

-

Olam International Limited (Singapore)

-

Niche Cocoa Industry Ltd. (Ghana)

-

Blommer Chocolate Company (United States)

-

United Cocoa Processors Inc. (United States)

-

Dutch Cocoa B.V. (Netherlands)

Chapter 1. Cocoa Products Market - Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cocoa Products Market - Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2024 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Cocoa Products Market - Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Cocoa Products Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Cocoa Products Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cocoa Products Market - By Product Type

6.1 Cocoa Beans

6.2 Cocoa Butter

6.3 Cocoa Paste and Liquor

6.4 Cocoa Powder and Cake

6.5 Chocolate

6.6 Others

Chapter 7. Cocoa Products Market - By Application

7.1 Food and Beverages

7.2 Cosmetics

7.3 Pharmaceuticals

7.4 Others

Chapter 8. Cocoa Products Market - By Distribution Channel

8.1 Convenience Stores

8.2 Specialty Stores

8.3 Supermarkets/Hypermarkets

8.4 E-commerce

8.5 Others

Chapter 9. Cocoa Products Market – By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Latin America

9.5 The Middle East

9.6 Africa

Chapter 10. Cocoa Products Market – Key players

10.1 The Hershey Company (United States)

10.2 Barry Callebaut AG (Switzerland)

10.3 Touton S.A. (France)

10.4 Cargill, Incorporated (United States)

10.5 Nestlé S.A. (Switzerland)

10.6 Olam International Limited (Singapore)

10.7 Niche Cocoa Industry Ltd. (Ghana)

10.8 Blommer Chocolate Company (United States)

10.9 United Cocoa Processors Inc. (United States)

10.10 Dutch Cocoa B.V. (Netherlands)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cocoa Products Market was valued at USD 25.35 Billion and is projected to reach a market size of USD 29.72 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 2.3%.

The Global Cocoa Products Market Drivers are the Increasing Recognition of the Health Benefits Linked to Cocoa-Rich Products and the Growing Popularity of Chocolate Confectionery.

Based on the Product Type, the Global Cocoa Products Market is segmented into Cocoa Beans, Cocoa Butter, Cocoa Paste and Liquor, Cocoa Powder and Cake, Chocolate, and Others.

Germany, Belgium, and Switzerland are the most dominating countries in the region of Europe for the Global Cocoa Products Market.

The Hershey Company, Barry Callebaut AG, and Touton S.A. are the leading players in the Global Cocoa Products Market.