Cat Food Market Size (2024 – 2030)

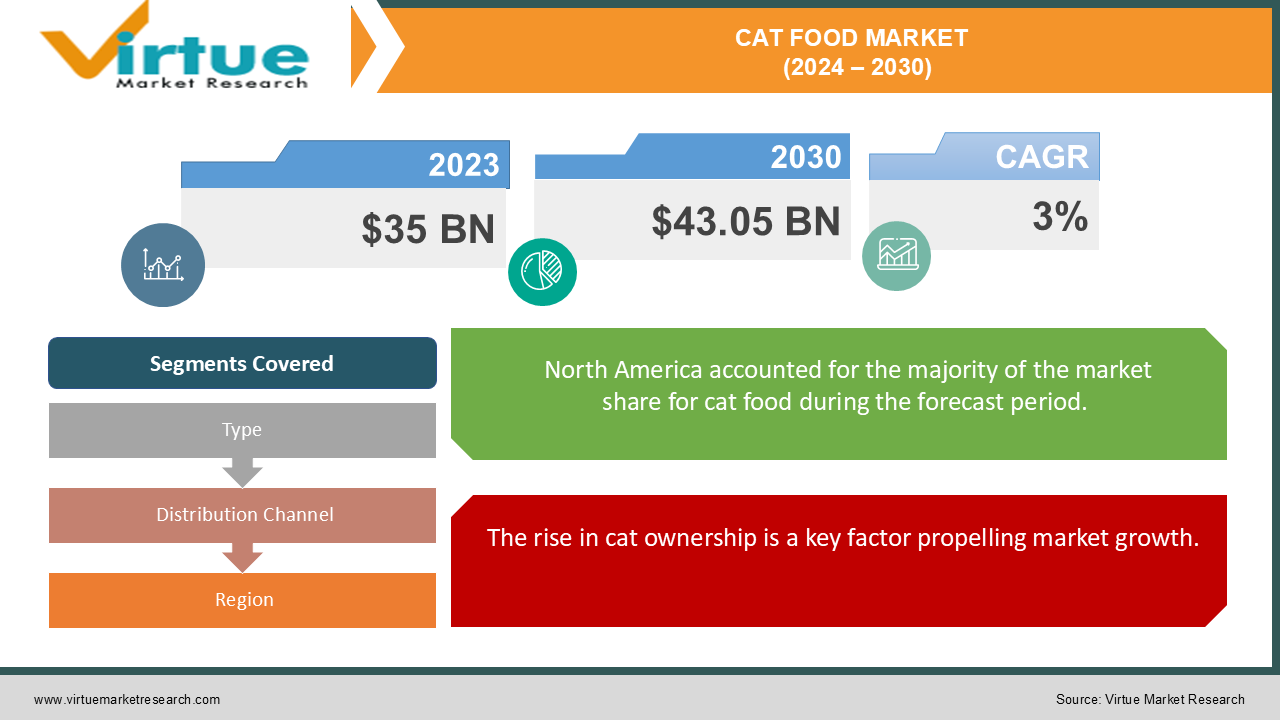

The Cat Food Market was valued at USD 35 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 43.05 billion by 2030, growing at a CAGR of 3%.

Feline food is a specialized category of pet nutrition tailored to meet the dietary requirements of cats. As obligate carnivores, cats necessitate a diet rich in protein and fats derived from animal sources. Consequently, cat food often incorporates meat-based proteins, including chicken, turkey, fish, and beef. In addition to protein, it provides vital nutrients such as vitamins, minerals, and fats, which are crucial for overall well-being and fulfilling the nutritional needs of cats. These nutrients play a significant role in the growth and development of kittens, as well as in the health maintenance of adult cats.

Key Market Insights:

-

The expansion of the cat food market can be linked to the increasing number of cat owners, the trend of humanizing pets, and a heightened awareness of the significance of pet nutrition on a global scale.

-

Furthermore, the growth of e-commerce and the accessibility of cat food online have simplified the process for pet owners to discover and acquire products that meet their cats' individual dietary requirements.

Cat Food Market Drivers:

The rise in cat ownership is a key factor propelling market growth.

The global cat food market is notably influenced by the rising trend of cat humanization, where cats are increasingly viewed as integral members of the family. This cultural shift has contributed to a significant rise in pet ownership worldwide. In 2022, cats accounted for 32.3% of the global pet food market, marking a 55.8% increase from 2017, driven by an 18.8% growth in the cat population. Furthermore, in various countries, cats are often seen as symbols of luck and prosperity, particularly in Europe, which enhances the positive outlook for the market. Cats also require less living space than dogs and can be left alone for extended periods without human supervision. For example, between 2017 and 2022, over 70% of pet owners, including cat owners in Russia and the United States, regarded their cats as family members, friends, or children. This rising ownership and growing awareness of cats' health and well-being are significantly boosting the demand for cat food.

Increasing awareness among individuals is a key driver of market growth.

The growing health-conscious mindset among cat owners is a significant factor shaping the cat food market. Cat owners are increasingly dedicating a substantial portion of their pet-related expenses to cat food, driven by concerns for their pets' well-being and a desire for products that address specific health issues such as obesity, diabetes, and food allergies. For example, pet food

represented 42.4% of total pet expenditures in the United States in 2022. Additionally, around 40% of pet owners in the U.S. opted for premium pet food during the same year, while in Hong Kong, the premium segment accounted for 75% of cat food sales. Manufacturers are responding by investing in the development of a diverse range of specialized products, including those that promote functional benefits such as improved immunity, digestive health, and coat condition, which is expected to further enhance the cat food market's growth. For instance, in October 2023, Nestlé announced the launch of two new production units at its Purina pet food factory in Hungary, resulting in a 66% increase in output and raising the facility's annual production capacity from approximately 150,000 metric tons to 250,000 metric tons.

Cat Food Market Restraints and Challenges:

A lack of knowledge among consumers acts as a constraint on market growth.

The cat food market encounters several challenges, predominantly linked to consumer education and awareness. A significant hurdle is informing pet owners about the necessity of providing nutritionally balanced diets for their cats, as many continue to depend on traditional and often insufficient food sources. Market participants also face difficulties in developing pricing strategies that make quality cat food accessible to a broader audience while still preserving profit margins. Additionally, there is a need for enhanced regulatory compliance and quality control standards to ensure the safety of pet food products. Supply chain disruptions, particularly during the pandemic, have further affected the availability of ingredients for cat food manufacturers.

Cat Food Market Opportunities:

The expansion of product offerings presents significant opportunities within the market.

Key market players are increasingly investing in research and development to provide a wider range of flavors, textures, and enhanced nutritional profiles in cat food. For instance, in March 2024, UK-based vegan pet food company Omni launched a nutritionally complete cat food featuring cultivated chicken meat, thereby broadening its product range. Additionally, the incorporation of modern technology in manufacturing processes is facilitating the production of a greater variety of pet foods with improved nutritional value and extended shelf life.

CAT FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mars Petcare, Hill's Pet Nutrition, Nestle Purina PetCare Company Diamond Pet Foods, J.M Smucker, Evanger’s Dog and Cat Food Company Inc. Affinity Petcare SA, Nutro Products Inc., Fromm Family Foods LLC |

Cat Food Market Segmentation: By Type

-

Wet Food

-

Dry Food

-

Treats

The wet food segment has emerged as the dominant force in the cat food market. This predominance is largely due to its high moisture content and the essential nutrition it provides. As natural carnivores, cats derive much of their hydration from their food, making a wet diet an effective way for pet owners to ensure their cats receive adequate hydration, which is crucial for overall health. Additionally, the moisture content helps reduce the risk of urinary tract infections.

Wet food is often viewed as more palatable than dry alternatives, thanks to its appealing aroma, texture, and flavor. As a result, cats generally enjoy wet food more. The market offers a wide variety of flavors and textures, including options such as organic, grain-free, and limited ingredient formulations, allowing pet owners to select the ideal products to meet their cats' nutritional needs and preferences.

On the other hand, dry food, commonly referred to as kibble, is expected to experience growth in the coming years. One of its primary advantages is convenience, as it can be left out for cats to graze on throughout the day. This is particularly beneficial for busy pet owners who may not have time to feed their pets multiple times daily. Moreover, dry food is usually more cost-effective than wet options, making it an appealing choice for budget-conscious pet owners.

Cat Food Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online Stores

-

Specialist Stores

-

Others

The supermarkets and hypermarkets segment has emerged as the leading force in the cat food market, primarily due to the availability of specialized and unique products. One of the key advantages of purchasing cat food from these retailers is convenience. Typically located in easily accessible areas, supermarkets and hypermarkets offer pet owners a quick and efficient option for obtaining the necessary cat food items. Furthermore, these establishments allow customers to compare various brands and prices, enabling informed decisions based on their budget and quality preferences.

Specialty stores, which include small, locally-owned pet shops as well as larger chains like Petco and Petsmart, focus specifically on pet supplies. Many of these stores emphasize providing a premium shopping experience for both customers and their pets, featuring a wide selection of high-quality foods and other pet products.

The online channels segment is projected to experience significant growth during the forecast period. Online shopping for cat food has gained popularity in recent years, offering pet owners a convenient, straightforward, and efficient way to access high-quality products. Online retailers provide a variety of options for cat owners, including premium and specialty food brands that may not be available in traditional retail outlets.

Cat Food Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America has established itself as the largest market for cat food and is projected to maintain this position throughout the forecast period. Key factors driving the North American cat food market include easy accessibility, product innovations, and effective marketing strategies. Additionally, a strong culture of pet ownership and a high level of pet humanization are further fueling growth in the region. In 2022, North America accounted for the largest share of the global pet food market, valued at approximately $77.43 billion. The United States and Mexico stand out as major contributors to this market, attributed to their high rates of pet ownership. Consumers in the region prioritize the health and well-being of their cats, resulting in an increasing demand for premium and natural cat food products.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic significantly affected the global cat food market, presenting both positive and negative challenges, primarily due to supply chain disruptions. On the positive side, the pandemic led to an increase in pet adoption and ownership, with pet food expenditures rising by 11% in the U.S. in 2020. However, as lockdowns have been lifted, the market is anticipated to experience further expansion in the coming years.

Latest Trends/ Developments:

April 2024: Go! Solutions unveiled its latest functional cat food recipe, Go! Solutions Hairball Control + Urinary Care. Developed in collaboration with Board-Certified Veterinary Nutritionists, this formulation aims to manage hairballs and prevent urinary struvite crystals in cats.

March 2024: Meatly, a UK-based cultivated meat company, launched the world’s first cans of cat food featuring cultivated chicken as the primary protein source.

March 2024: Tropikal Pet, a Turkish producer known for brands like Goody and Champion, secured $9 million in funding from Eminova Holdings International. This investment is expected to enhance the company’s capacity, double its existing export sales, introduce new products, mitigate rising working capital costs, operate at full capacity, and facilitate entry into the U.S. market.

March 2024: Vafo's Brit brand released its super-premium Brit Care Cat RAW Treats, which prioritize quality and nutrition. This new product line promises cats a "distinctive dining experience" by combining irresistible flavors with essential nutrients to support overall health.

Key Players:

These are top players in the Cat Food Market :

-

Mars Petcare

-

Hill's Pet Nutrition

-

Nestle Purina PetCare Company Diamond Pet Foods

-

J.M Smucker

-

Evanger’s Dog and Cat Food Company Inc. Affinity Petcare SA

-

Nutro Products Inc.

-

Fromm Family Foods LLC

Chapter 1. Cat Food Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cat Food Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cat Food Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cat Food Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cat Food Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cat Food Market – By Type

6.1 Introduction/Key Findings

6.2 Wet Food

6.3 Dry Food

6.4 Treats

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Cat Food Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Convenience Stores

7.4 Online Stores

7.5 Specialist Stores

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Cat Food Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Cat Food Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Mars Petcare

9.2 Hill's Pet Nutrition

9.3 Nestle Purina PetCare Company Diamond Pet Foods

9.4 J.M Smucker

9.5 Evanger’s Dog and Cat Food Company Inc. Affinity Petcare SA

9.6 Nutro Products Inc.

9.7 Fromm Family Foods LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The expansion of the cat food market can be linked to the increasing number of cat owners, the trend of humanizing pets, and a heightened awareness of the significance of pet nutrition on a global scale.

The top players operating in the Cat Food Market are - Mars Petcare, Hill's Pet Nutrition, Nestle Purina PetCare Company, Diamond Pet Foods, J.M Smucker, Evanger’s Dog and Cat Food Company Inc., Affinity Petcare SA, Nutro Products Inc. and Fromm Family Foods LLC.

The COVID-19 pandemic significantly affected the global cat food market, presenting both positive and negative challenges, primarily due to supply chain disruptions.

April 2024: Go! Solutions unveiled its latest functional cat food recipe, Go! Solutions Hairball Control + Urinary Care. Developed in collaboration with Board-Certified Veterinary Nutritionists, this formulation aims to manage hairballs and prevent urinary struvite crystals in cats.

North America has established itself as the largest market for cat food and is projected to maintain this position throughout the forecast period.