Canned Dog Food Market Size (2024–2030)

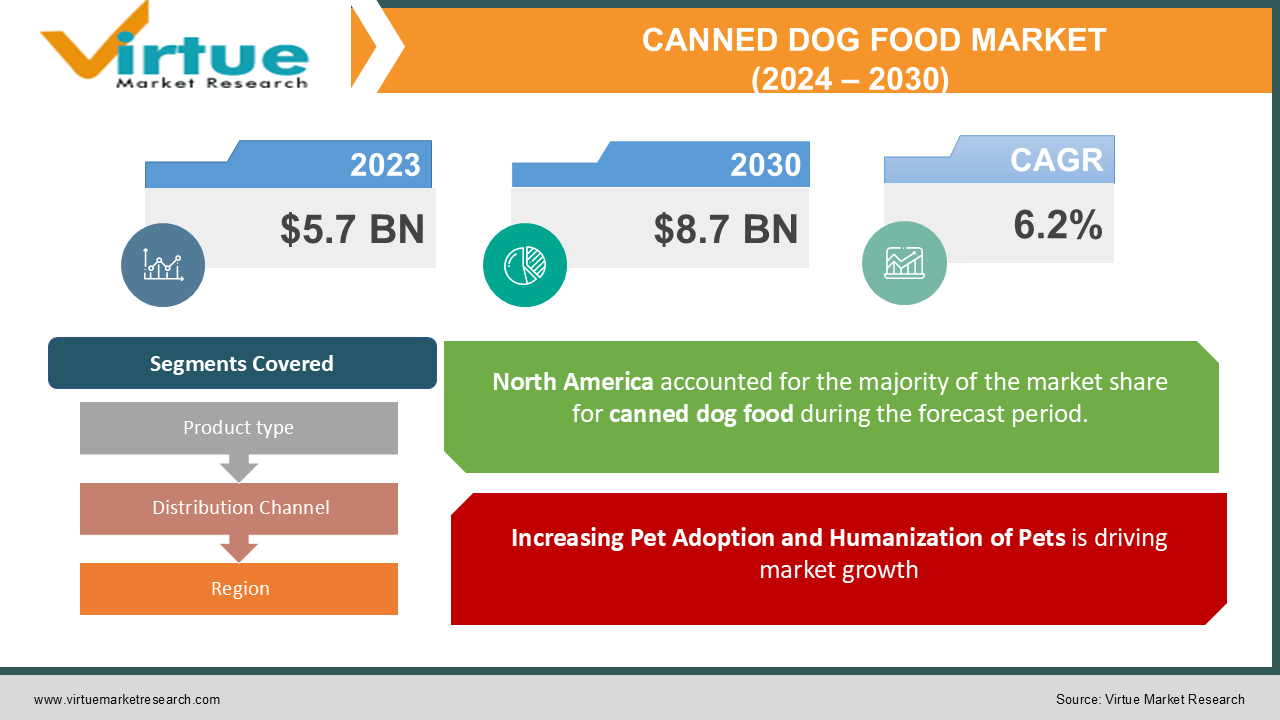

The Global Canned Dog Food Market was valued at USD 5.7 billion in 2023 and is expected to grow at a CAGR of 6.2% from 2024 to 2030, reaching USD 8.7 billion by 2030.

Canned dog food has become an essential segment in the pet food market due to its long shelf life, high nutritional content, and ease of digestion. It is widely preferred by pet owners looking for convenient, high-quality food options for their dogs. The growth of this market is fueled by increased pet adoption rates, rising disposable income, and the growing awareness of pet nutrition.

Canned dog food is known for its high moisture content and is particularly suitable for dogs with specific dietary needs, including hydration issues or dental problems. As consumers shift toward premium and natural pet food products, manufacturers are developing canned food that incorporates organic ingredients, functional benefits, and gourmet flavors, driving demand in the market.

Key Market Insights:

-

The grain-free canned dog food segment is projected to grow at a CAGR of 7.0%, driven by increasing consumer demand for gluten-free and allergen-friendly options.

-

Supermarkets and hypermarkets dominate the distribution channel, accounting for 45% of the total market share in 2023, as pet owners prefer buying in bulk from physical stores.

-

North America holds the largest share of the canned dog food market, with 38% of global sales in 2023, supported by high pet ownership rates and consumer preferences for premium pet food.

-

Asia-Pacific is expected to see the fastest growth with a CAGR of 8.4% due to rising pet ownership rates, expanding urbanization, and increasing awareness of pet care in countries like China and India.

-

The premiumization trend in pet food is boosting demand for organic and natural canned dog food, with products containing no artificial preservatives or additives gaining popularity.

Global Canned Dog Food Market Drivers:

Increasing Pet Adoption and Humanization of Pets is driving market growth: One of the major drivers of the global canned dog food market is the rising rate of pet adoption and the growing trend of pet humanization. In many households, dogs are viewed as family members, and this shift in perception has led to increased spending on high-quality, premium dog food, including canned options. The rise in single-person households and an aging population in developed countries have contributed to higher pet adoption rates, as pets offer companionship and emotional support. This humanization trend has transformed the way pet owners approach pet care, with a growing focus on providing nutritious, well-balanced meals for their pets. Canned dog food is perceived as a superior option due to its higher moisture content, rich texture, and the ability to offer a variety of flavors and formulations. Pet owners are increasingly choosing canned dog food that mirrors the quality and nutrition of human food, often opting for products that contain real meat, organic vegetables, and functional ingredients that support their dog's health and well-being.

Shift Toward Premium and Natural Pet Foods is driving market growth: The growing trend toward premiumization in the pet food industry is significantly boosting the demand for canned dog food. Pet owners, particularly in developed markets, are increasingly opting for premium and natural products that offer superior nutrition and health benefits. This shift is fueled by rising consumer awareness of the ingredients used in pet food and a desire to provide pets with the best possible nutrition to ensure their long-term health and well-being. Premium canned dog food is often made with high-quality ingredients such as real meat, fish, and vegetables, and is free from artificial additives, preservatives, and fillers. Many premium brands emphasize the use of organic, grain-free, and non-GMO ingredients, which are perceived as healthier and more in line with human-grade food standards. These products are often positioned as functional foods, offering additional benefits such as improved digestion, enhanced skin and coat health, and support for joint and bone development.

Growing Urbanization and Increase in Disposable Income is driving the market growth: Rapid urbanization and rising disposable incomes, particularly in emerging markets, are key drivers of the global canned dog food market. As more people move to urban areas, the number of pet-owning households is increasing, particularly in densely populated cities where pets provide companionship and emotional support. The growing trend of nuclear families and the increase in single-person households in urban areas have further contributed to the rise in pet ownership, leading to higher demand for pet food products, including canned dog food. Urbanization has also led to changes in lifestyles, with many pet owners leading busier lives and seeking convenient pet food options that are easy to store and serve. Canned dog food meets this need, as it offers a long shelf life, requires minimal preparation, and provides complete nutrition in a convenient format. This convenience factor is particularly important for urban pet owners who may have limited time or space for preparing fresh food for their pets.

Global Canned Dog Food Market Challenges and Restraints:

Concerns Over the Environmental Impact of Packaging is restricting the market growth: One of the key challenges facing the global canned dog food market is the environmental impact of packaging, particularly the use of metal cans and plastic liners. As consumer awareness of environmental issues grows, there is increasing scrutiny on the use of single-use packaging and its contribution to pollution and waste. Canned dog food, which is typically packaged in metal cans, faces criticism for its reliance on non-biodegradable materials that contribute to landfill waste. While metal cans are recyclable, the recycling rates for these materials vary by region, and the overall environmental impact of producing and disposing of metal packaging remains a concern for environmentally conscious consumers. Additionally, the production of metal cans involves significant energy consumption and resource extraction, further contributing to environmental degradation.

Health Concerns and Regulatory Scrutiny is restricting the market growth: Health concerns related to the ingredients used in canned dog food and the regulatory scrutiny surrounding pet food safety are significant challenges for the global market. Pet owners are becoming increasingly aware of the potential health risks associated with certain ingredients, such as artificial preservatives, fillers, and by-products, which are commonly found in lower-quality canned dog food. As a result, there is growing demand for transparency in ingredient sourcing and production practices, as well as stricter regulations governing the pet food industry. In recent years, there have been several high-profile recalls of canned pet food products due to contamination with harmful substances, such as bacteria or toxins, which can pose serious health risks to pets. These incidents have raised concerns among pet owners about the safety and quality of the canned dog food they purchase, leading to increased scrutiny of the manufacturing processes and sourcing practices of pet food companies.

Market Opportunities:

The global canned dog food market presents numerous growth opportunities, driven by evolving consumer preferences and increasing demand for premium, natural, and functional pet food products. One of the most significant opportunities lies in the expansion of the premium and natural pet food segments, as consumers continue to seek high-quality, organic, and health-conscious options for their pets. Pet owners are willing to pay a premium for canned dog food that is made from real, whole ingredients, free from artificial additives, and tailored to their pets' specific dietary needs. Another key opportunity is the growth of the online retail channel, which has seen a significant surge in demand due to the convenience and variety it offers to pet owners. E-commerce platforms provide an ideal space for pet food manufacturers to showcase their products, reach a wider audience, and offer personalized recommendations based on the preferences and needs of pet owners. The increasing adoption of subscription-based models, where pet food is delivered regularly to consumers, further enhances the growth potential of online retail in the canned dog food market. There is also a growing opportunity for functional and specialized canned dog food, which targets specific health concerns or life stages. Products that cater to weight management, digestive health, joint support, and allergy management are gaining traction as pet owners become more aware of the health benefits of tailored nutrition. This trend is expected to drive further innovation in the market, with manufacturers developing products that offer targeted nutritional support for various dog breeds and age groups.

CANNED DOG FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Product type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestlé Purina PetCare, Mars Petcare, Hill's Pet Nutrition, Blue Buffalo (General Mills), The J.M. Smucker Company, WellPet LLC, Merrick Pet Care, Nature's Logic, Canidae Pet Foods, Royal Canin |

Canned Dog Food Market Segmentation: By Product Type

-

Grain-Free Canned Dog Food

-

With Grains Canned Dog Food

The grain-free canned dog food segment is projected to dominate the market, accounting for 60% of total revenue in 2023. Grain-free products are popular among pet owners who believe in feeding their dogs a diet closer to their ancestral diet, which is high in protein and free from grains that may cause allergies or digestive issues in some dogs.

Canned Dog Food Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Pet Specialty Stores

-

Online Retail

The supermarkets/hypermarkets distribution channel holds the largest share of the market, contributing 45% of total revenue in 2023. These stores offer the convenience of bulk purchasing and wide availability, making them a popular choice among pet owners who prefer to buy pet food along with their regular groceries.

Canned Dog Food Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America leads the global canned dog food market, capturing 38% of total revenue in 2023. The region's dominance is attributed to high pet ownership rates, increased consumer spending on premium pet food products, and a strong preference for convenient, ready-to-serve pet food options like canned dog food.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a mixed impact on the global canned dog food market. Initially, the market faced supply chain disruptions due to lockdowns, factory shutdowns, and transportation restrictions. However, the pandemic also led to an increase in pet adoption, as more people sought companionship during the lockdown periods. This surge in pet ownership contributed to a rise in demand for pet food, including canned dog food. As pet owners spent more time at home, there was a greater focus on pet care and nutrition, leading to increased demand for premium and natural canned dog food products. Additionally, the shift toward e-commerce during the pandemic boosted online sales of canned dog food, as consumers preferred contactless shopping and home delivery options. While the initial challenges of the pandemic negatively impacted the supply side of the market, the overall demand for canned dog food grew, particularly in the premium and natural segments. Moving forward, the pandemic has accelerated the trend toward online shopping for pet food, and the long-term impact of this shift is expected to drive growth in the e-commerce channel for canned dog food.

Latest Trends/Developments:

Several trends are shaping the future of the global canned dog food market. One of the most prominent trends is the increasing demand for clean-label pet food products. Pet owners are seeking transparency in the ingredients used in their pets' food, and brands that offer clean-label canned dog food, free from artificial preservatives, colors, and flavors, are gaining popularity. This trend aligns with the broader human food industry, where consumers are also seeking more natural, minimally processed options. Another trend is the rise of functional and breed-specific pet food. As pet owners become more aware of their dogs' specific dietary needs, there is a growing demand for canned dog food that addresses specific health concerns, such as joint health, digestive health, or skin and coat conditions. Brands are responding to this demand by developing products with targeted health benefits, often using ingredients such as probiotics, omega-3 fatty acids, and glucosamine. The increasing adoption of sustainable packaging solutions is also driving innovation in the canned dog food market. With growing concerns about the environmental impact of packaging waste, manufacturers are exploring eco-friendly materials, such as recyclable metal cans and biodegradable packaging, to meet consumer demand for more sustainable products.

Key Players:

-

Nestlé Purina PetCare

-

Mars Petcare

-

Hill's Pet Nutrition

-

Blue Buffalo (General Mills)

-

The J.M. Smucker Company

-

WellPet LLC

-

Merrick Pet Care

-

Nature's Logic

-

Canidae Pet Foods

-

Royal Canin

Chapter 1. Canned Dog Food Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Canned Dog Food Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Canned Dog Food Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Canned Dog Food Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Canned Dog Food Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Canned Dog Food Market– By Product Type

6.1 Introduction/Key Findings

6.2 Grain-Free Canned Dog Food

6.3 With Grains Canned Dog Food

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Canned Dog Food Market– By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Pet Specialty Stores

7.4 Online Retail

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Canned Dog Food Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Canned Dog Food Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Nestlé Purina PetCare

9.2 Mars Petcare

9.3 Hill's Pet Nutrition

9.4 Blue Buffalo (General Mills)

9.5 The J.M. Smucker Company

9.6 WellPet LLC

9.7 Merrick Pet Care

9.8 Nature's Logic

9.9 Canidae Pet Foods

9.10 Royal Canin

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The global canned dog food market was valued at USD 5.7 billion in 2023 and is expected to reach USD 8.7 billion by 2030, growing at a CAGR of 6.2% during the forecast period.

The major drivers include the increasing pet adoption rate, the humanization of pets, the shift toward premium and natural pet foods, and rising disposable income, particularly in urban areas.

The market is segmented by product type (grain-free, with grains) and distribution channel (supermarkets/hypermarkets, pet specialty stores, online retail).

North America is the dominant region, accounting for 38% of total market revenue in 2023, driven by high pet ownership rates and a preference for premium pet food products.

Key players include Nestlé Purina PetCare, Mars Petcare, Hill's Pet Nutrition, Blue Buffalo, and The J.M. Smucker Company, among others.