Autonomous Vehicle Testing Services Market Size (2024 – 2030)

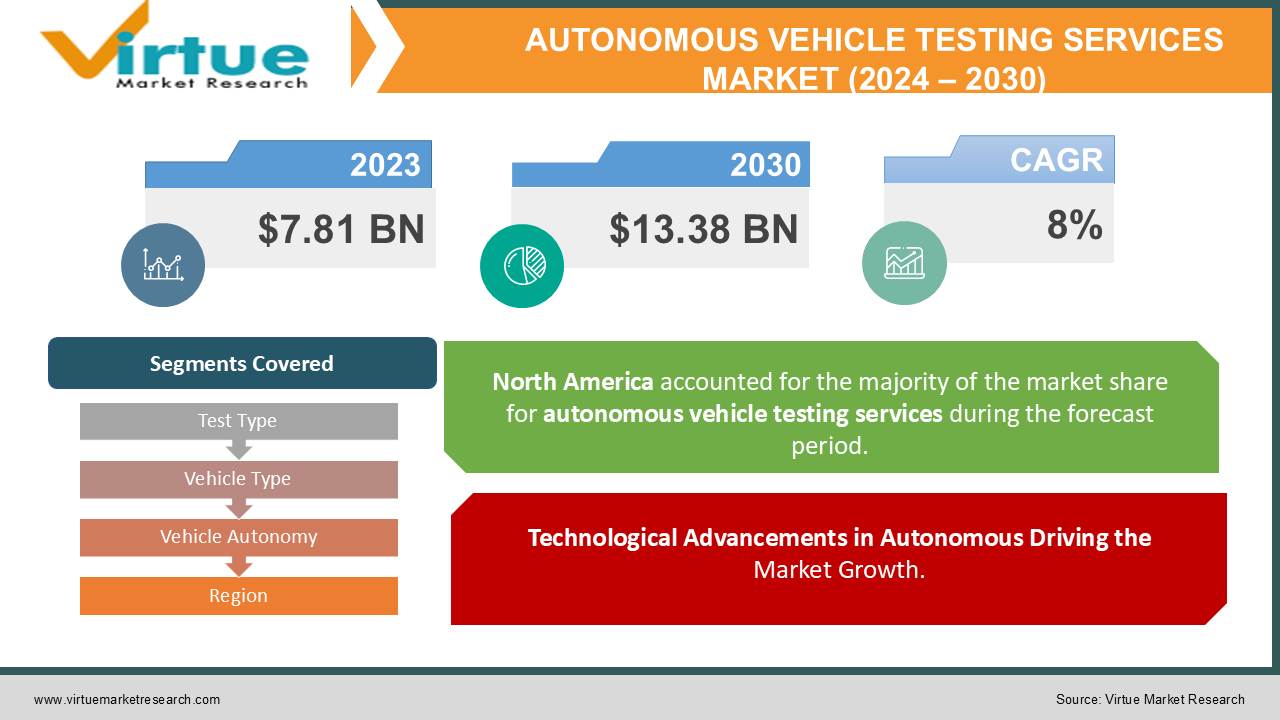

The Global Autonomous Vehicle Testing Services Market was valued at USD 7.81 billion in 2023 and is projected to reach a market size of USD 13.38 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 8% between 2024 and 2030.

The Global Autonomous Vehicle Testing Services Market is a rapidly evolving sector, driven by the increasing development and deployment of self-driving technologies. Autonomous vehicles (AVs) promise to revolutionize transportation by enhancing safety, reducing traffic congestion, and improving fuel efficiency. However, the path to widespread adoption of AVs requires rigorous testing to ensure their reliability and safety under diverse driving conditions. This has spurred a growing demand for comprehensive testing services that encompass simulation, on-road testing, and advanced data analytics.

Key Market Insights:

- Simulation and virtual testing currently account for approximately 40% of the total testing services market.

- The adoption of 5G technology in autonomous vehicle testing is expected to increase by 25% annually, enhancing real-time communication and data processing capabilities.

- The automotive sector constitutes about 60% of the demand for autonomous vehicle testing services, with significant contributions from electric vehicle manufacturers.

- Collaboration between automotive OEMs and tech companies has risen by 30% in the past two years, promoting innovation and resource sharing.

- The integration of AI and machine learning in testing processes has seen a 35% increase, improving the accuracy and efficiency of simulations.

- Safety and regulatory compliance testing services have grown by 20%, reflecting the stringent safety standards and regulatory requirements imposed globally.

Global Autonomous Vehicle Testing Services Market Drivers:

Technological Advancements in Autonomous Driving the Market Growth.

Technological advancements in autonomous driving are a primary driver for the Global Autonomous Vehicle Testing Services Market. Innovations in artificial intelligence (AI), machine learning (ML), and sensor technologies, such as LIDAR, radar, and advanced camera systems, have significantly enhanced the capabilities of autonomous vehicles (AVs). These technologies enable AVs to process vast amounts of data in real time, improving their ability to navigate complex environments safely and efficiently. The continuous evolution of these technologies necessitates extensive testing to ensure their reliability and effectiveness. Testing services must validate the performance of these sophisticated systems under various conditions, from urban settings to adverse weather scenarios. As technology progresses, the need for comprehensive, state-of-the-art testing environments grows, driving demand for specialized testing services that can keep pace with the rapid developments in autonomous driving technologies.

Regulatory Requirements and Safety Standards Fueling the Market Growth Globally.

Stringent regulatory requirements and safety standards are another crucial driver for the Global Autonomous Vehicle Testing Services Market. Governments and regulatory bodies worldwide are establishing rigorous frameworks to ensure the safety and reliability of autonomous vehicles before they can be deployed on public roads. These regulations mandate thorough testing and validation processes, encompassing simulation testing, on-road trials, and compliance with specific safety criteria.

The high stakes associated with the deployment of AVs, including public safety and liability concerns, compel manufacturers to invest heavily in comprehensive testing services. Additionally, regulatory bodies often require detailed documentation and evidence of testing, further increasing the demand for professional testing services. As autonomous driving technology advances, regulatory requirements are expected to become even more stringent, reinforcing the critical role of robust testing services in the market.

Global Autonomous Vehicle Testing Services Market Restraints and Challenges:

The Global Autonomous Vehicle Testing Services Market faces several significant restraints and challenges that could impact its growth. One of the primary challenges is the high cost associated with comprehensive testing processes. Developing and maintaining advanced testing facilities, equipped with cutting-edge technologies such as LIDAR, radar, and high-fidelity simulation systems, require substantial financial investment.

Additionally, the complexity of testing autonomous vehicles (AVs) across various scenarios and conditions adds to these costs. Another challenge is the technological and operational complexity involved in testing AVs. Ensuring that AVs can handle diverse and unpredictable real-world environments necessitates sophisticated testing protocols and extensive data collection and analysis, which can be time-consuming and resource-intensive. Furthermore, regulatory uncertainties and evolving safety standards present hurdles for the market.

Global Autonomous Vehicle Testing Services Market Opportunities:

The Global Autonomous Vehicle Testing Services Market is ripe with opportunities driven by the rapid advancement and adoption of autonomous driving technologies. One significant opportunity lies in the burgeoning electric vehicle (EV) market, which often overlaps with autonomous vehicle development. As more automakers invest in EVs equipped with self-driving capabilities, the need for specialized testing services that can validate both electric and autonomous functionalities is growing.

Another opportunity is the increasing collaboration between automotive manufacturers, tech companies, and testing service providers. These partnerships foster innovation and allow for the pooling of resources to develop advanced testing solutions that can address the complex challenges of autonomous driving. Additionally, the rise of smart cities offers a unique testing environment where AVs can be integrated with intelligent infrastructure, necessitating sophisticated testing to ensure seamless interaction.

The global push towards reducing road accidents and improving traffic efficiency through automation further amplifies the demand for rigorous testing services. Moreover, the expansion of 5G technology provides a robust communication framework that enhances real-time data processing and vehicle-to-everything (V2X) interactions, presenting new avenues for testing service providers. By capitalizing on these trends, the autonomous vehicle testing services market can significantly expand its scope and scale, driving innovation and growth.

GLOBAL AUTONOMOUS VEHICLE TESTING SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By Test Type, Vehicle Type, Vehicle Autonomy, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tesla Inc., NVIDIA Corporation, Uber Technologies Inc., Baidu Inc., General Motors Co. (Cruise), Robert Bosch GmbH, Continental AG, Denso Corporation, ZF Friedrichshafen AG, Horiba MIRA Ltd. |

SEGMENTATION ANALYSIS

Global Autonomous Vehicle Testing Services Market Segmentation: By Test Type

-

Software Testing

-

Simulation Testing

-

Driving Testing

By Test Type, Software Testing market holds the highest market share in 2023 and is poised to maintain its dominance throughout the forecast period. Complex software systems are at the heart of autonomous vehicles, playing a crucial role in perception, decision-making, and control, which makes software testing an indispensable part of their development. Ensuring safety and reliability through rigorous software testing is paramount for public acceptance, as autonomous vehicles must consistently perform under various conditions without failure.

The ongoing evolution of autonomous vehicle technology means that software testing is not a one-time task but a continuous process to identify and rectify potential issues. Compliance with stringent regulatory safety and performance standards necessitates comprehensive software testing, ensuring that autonomous vehicles meet all legal and safety requirements. The future outlook for software testing in the autonomous vehicle market is strong, driven by the increasing complexity of software and the growing emphasis on safety.

Advancements in testing methodologies, including the use of artificial intelligence and machine learning, are expected to further enhance the effectiveness of software testing services, making them even more critical to the development process. However, it's important to recognize that other testing types, such as hardware-in-the-loop (HIL) testing and real-world testing, are also essential. These methodologies complement software testing, contributing to the overall validation of the vehicle's capabilities and ensuring a holistic approach to autonomous vehicle development.

Global Autonomous Vehicle Testing Services Market Segmentation: By Vehicle Type

-

Passenger Car

-

Commercial Vehicle

Passenger Car market share is poised to maintain its dominance throughout the forecast period. Passenger cars represent a vast market potential for autonomous technology due to their large consumer base and the significant public and industry interest in developing autonomous vehicles for personal transportation. These cars serve as technological showcases, demonstrating the capabilities of autonomous systems to a wide audience and fostering greater acceptance and interest.

Governments worldwide are prioritizing regulations for autonomous passenger cars, driving investment, and extensive testing in this area. The focus on regulatory compliance ensures these vehicles meet safety standards, further encouraging development and market readiness.

While passenger cars currently dominate the autonomous vehicle testing landscape, it's important to recognize the potential for expansion into other vehicle types, such as commercial vehicles and delivery robots. These segments are gaining traction, presenting unique challenges and opportunities that could influence the overall market dynamics. Commercial vehicles, for instance, promise efficiency gains in logistics, while delivery robots offer last-mile solutions, highlighting the diverse applications of autonomous technology. As these segments grow, they will complement the development of autonomous passenger cars, contributing to a broader and more robust market.

Global Autonomous Vehicle Testing Services Market Segmentation: By Vehicle Autonomy

-

Level 1

-

Level 2

-

Level 3

-

Level 4/5

Level 3 held the highest market share last year, 2023, and is poised to maintain its dominance throughout 2024-2030. Level 3 autonomy in autonomous vehicles presents several complexities and challenges that impact its development and testing. One major challenge is the seamless handover of control between the human driver and the vehicle, which requires sophisticated engineering to ensure safety and reliability. This complexity has resulted in slower development compared to lower levels of automation.

Additionally, regulatory hurdles contribute to the slow progress, as many countries are still formulating regulations for Level 3 systems, creating uncertainties for both automakers and testing service providers. Consumer acceptance also poses a challenge, as there may be reluctance among drivers to fully trust the vehicle in all driving conditions, given that Level 3 requires the driver to remain prepared to take control if necessary.

On the other hand, the industry is making rapid strides towards higher levels of autonomy, such as Level 4 and Level 5, which promise greater benefits by reducing or eliminating the need for human intervention. These advancements drive significant opportunities for testing services, as the focus shifts toward achieving fully autonomous capabilities.

Global Autonomous Vehicle Testing Services Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America currently holds the majority of the market share and is poised to maintain its dominance throughout the forecast period. North America has established itself as a leader in autonomous vehicle development and testing due to early adoption, substantial investment from major tech companies and automakers, and a favorable regulatory environment in countries like the US, which has encouraged innovation. The region’s advanced infrastructure, including sophisticated road networks and robust digital connectivity, further supports extensive testing of autonomous vehicles. However, several challenges threaten its sustained dominance.

Global competition is intensifying, with regions such as Asia, particularly China and Europe making significant strides in autonomous vehicle technology and infrastructure, presenting strong competition. Additionally, shifting regulatory landscapes both in North America and globally could affect market dynamics, introducing uncertainties for testing services. Cost factors also play a role, as the high expense of testing and development might drive companies to seek lower-cost regions for certain activities.

Looking ahead, while North America is expected to remain a key hub for autonomous vehicle testing, its dominance will likely be challenged by other regions. The global automotive industry’s expanding reach and the rapid pace of technological advancements will contribute to a more competitive and balanced distribution of testing activities across the globe.

COVID-19 Impact Analysis on the Global Autonomous Vehicle Testing Services Market.

The COVID-19 pandemic had a profound impact on the Global Autonomous Vehicle Testing Services Market, creating both challenges and opportunities. The initial outbreak led to widespread disruptions as lockdowns and social distancing measures halted many on-road testing activities and slowed down the development timelines of autonomous vehicle (AV) projects.

Supply chain disruptions also caused delays in the availability of essential components and technologies necessary for testing. However, the pandemic underscored the importance of automation and contactless technologies, indirectly boosting interest in AVs. This shift accelerated investments in digital and virtual testing platforms, as companies sought to continue development remotely.

Simulation and AI-driven testing methods gained traction, offering safe and efficient alternatives to physical testing. Additionally, the increased focus on public health and safety highlighted the potential of autonomous vehicles in reducing human interactions in logistics and transportation, creating new avenues for AV deployment and testing.

As the world recovers and adapts to the new normal, the AV testing services market is expected to rebound with a stronger emphasis on innovative and resilient testing solutions that can withstand future disruptions. The pandemic, while initially a setback, ultimately accelerated technological advancements and strategic investments in the autonomous vehicle sector.

Latest trends / Developments:

The Global Autonomous Vehicle Testing Services Market is witnessing several latest trends and developments that are shaping its future. One significant trend is the increased use of simulation and virtual testing environments, driven by advancements in artificial intelligence (AI) and machine learning (ML). These technologies allow for extensive testing of autonomous vehicles (AVs) in diverse scenarios without the need for physical prototypes, reducing costs and accelerating development timelines.

Another key development is the integration of 5G technology, which enhances real-time communication and data processing capabilities, essential for advanced AV testing. This connectivity supports vehicle-to-everything (V2X) interactions, enabling more comprehensive and realistic testing conditions.

Additionally, there is a growing focus on safety and regulatory compliance, with testing service providers developing sophisticated tools to ensure AVs meet stringent safety standards. Collaborations between automotive manufacturers, tech companies, and testing firms are becoming more common, fostering innovation and resource sharing. The expansion of smart city initiatives also presents new testing opportunities, as AVs must interact seamlessly with intelligent infrastructure.

Furthermore, the increasing emphasis on sustainability is driving the adoption of electric and hybrid testing platforms, reflecting the broader industry shift towards eco-friendly solutions. These trends collectively indicate a dynamic and evolving market, poised for significant growth and technological advancement.

Key Players:

-

Uber Technologies Inc.

-

Baidu Inc.

-

General Motors Co. (Cruise)

-

Robert Bosch GmbH

-

Continental AG

-

Denso Corporation

-

ZF Friedrichshafen AG

-

Horiba MIRA Ltd.

Chapter 1. Autonomous Vehicle Testing Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Autonomous Vehicle Testing Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Autonomous Vehicle Testing Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Autonomous Vehicle Testing Services Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Autonomous Vehicle Testing Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Autonomous Vehicle Testing Services Market – By Test Type

6.1 Introduction/Key Findings

6.2 Software Testing

6.3 Simulation Testing

6.4 Driving Testing

6.5 Y-O-Y Growth trend Analysis By Test Type

6.6 Absolute $ Opportunity Analysis By Test Type, 2024-2030

Chapter 7. Autonomous Vehicle Testing Services Market – By Vehicle Type

7.1 Introduction/Key Findings

7.2 Passenger Car

7.3 Commercial Vehicle

7.4 Y-O-Y Growth trend Analysis By Vehicle Type

7.5 Absolute $ Opportunity Analysis By Vehicle Type, 2024-2030

Chapter 8. Autonomous Vehicle Testing Services Market – By Vehicle Autonomy

8.1 Introduction/Key Findings

8.2 Level 1

8.3 Level 2

8.4 Level 3

8.5 Level 4/5

8.6 Y-O-Y Growth trend Analysis By Vehicle Autonomy

8.7 Absolute $ Opportunity Analysis By Vehicle Autonomy, 2024-2030

Chapter 9. Autonomous Vehicle Testing Services Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Test Type

9.1.3 By Vehicle Type

9.1.4 By Vehicle Autonomy

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Test Type

9.2.3 By Vehicle Type

9.2.4 By Vehicle Autonomy

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Test Type

9.3.3 By Vehicle Type

9.3.4 By Vehicle Autonomy

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Test Type

9.4.3 By Vehicle Type

9.4.4 By Vehicle Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Test Type

9.5.3 By Vehicle Type

9.5.4 By Vehicle Autonomy

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Autonomous Vehicle Testing Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Tesla Inc.

10.2 NVIDIA Corporation

10.3 Uber Technologies Inc.

10.4 Baidu Inc.

10.5 General Motors Co. (Cruise)

10.6 Robert Bosch GmbH

10.7 Continental AG

10.8 Denso Corporation

10.9 ZF Friedrichshafen AG

10.10 Horiba MIRA Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

By 2023, the Global Autonomous Vehicle Testing Services market is expected to be valued at USD 7.81 billion.

Through 2030, the Global Autonomous Vehicle Testing Services market is expected to grow at a CAGR of 8%.

By 2030, the Global Autonomous Vehicle Testing Services Market is expected to grow to a value of USD 13.38 billion.

North America is predicted to lead the Global Autonomous Vehicle Testing Services market.

The Global Autonomous Vehicle Testing Services Market has segments By Test Type, Vehicle Type, Vehicle Autonomy, and Region.