LiDAR (Light Detection and Ranging) Market Size (2025 – 2030)

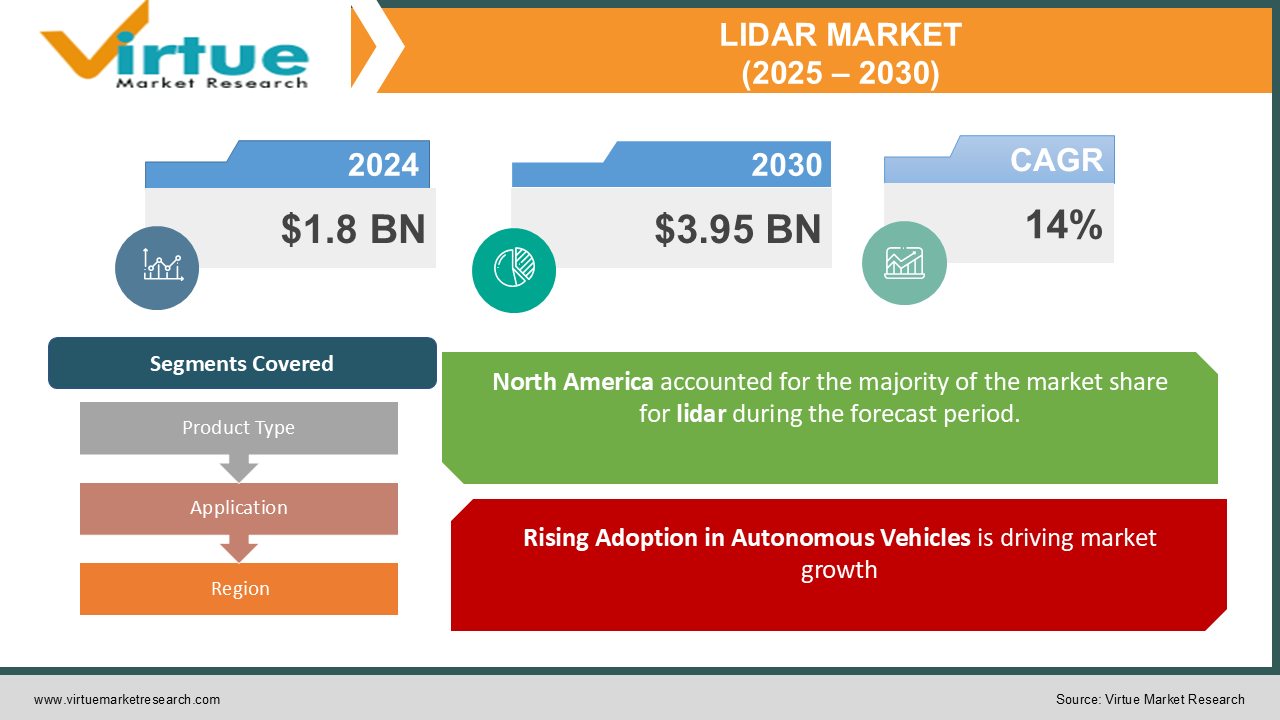

The Global LiDAR (Light Detection and Ranging) Market was valued at USD 1.8 billion in 2024 and is projected to grow at a CAGR of 14% from 2025 to 2030. The market is expected to reach USD 3.95 billion by 2030.

LiDAR is a remote sensing technology that uses laser light to measure distances, generate precise 3D maps, and provide high-resolution spatial data. It has applications across various industries, including automotive, construction, agriculture, defense, and environmental monitoring. The increasing adoption of LiDAR in autonomous vehicles, smart cities, and advanced mapping solutions is a major driver of market growth. Additionally, advancements in LiDAR technology, such as solid-state LiDAR, are enhancing its efficiency, reliability, and affordability.

Key Market Insights

-

The adoption of LiDAR in autonomous vehicles is expected to grow at a CAGR of over 20%, driven by its critical role in real-time navigation and obstacle detection.

-

Aerial LiDAR systems account for the largest share in terms of revenue, contributing over 40% to the market in 2024, due to their extensive use in topographical surveys and environmental monitoring.

-

North America leads the market, representing 45% of the global share in 2024, fueled by investments in automotive technologies, defense, and smart infrastructure projects.

-

Solid-state LiDAR is emerging as the fastest-growing technology segment, offering compact, cost-effective, and robust solutions suitable for mass-market applications.

-

Agriculture and forestry are witnessing increased adoption of LiDAR for precision farming and forest management, driving a CAGR of 12% in this segment.

-

The demand for LiDAR in flood mapping and coastal monitoring is growing due to the increasing frequency of natural disasters and the need for proactive environmental management.

-

Government initiatives for smart city development and infrastructure modernization are driving LiDAR adoption in urban planning and construction projects. The integration of LiDAR with AI and machine learning is enhancing data analysis capabilities, providing actionable insights across multiple applications.

Global LiDAR Market Drivers

Rising Adoption in Autonomous Vehicles is driving market growth:

The automotive industry is a significant driver for the LiDAR market, with self-driving technology being a focal point of innovation. LiDAR sensors are essential for enabling Level 3 and above autonomy, providing accurate real-time data for object detection, collision avoidance, and path planning. The growing interest from automotive giants like Tesla, Waymo, and Ford in incorporating LiDAR into their autonomous vehicle systems underscores its importance. As consumer demand for safer and more efficient transportation solutions increases, the integration of LiDAR into advanced driver-assistance systems (ADAS) and autonomous vehicles is expected to accelerate, boosting market growth.

Expansion of Smart Cities and Infrastructure Development is driving market growth:

Governments worldwide are investing heavily in smart city initiatives, which rely on advanced technologies for urban planning, traffic management, and infrastructure monitoring. LiDAR systems offer precise mapping and spatial analysis capabilities, making them indispensable for these projects. Applications include monitoring traffic flows, optimizing transportation networks, and ensuring structural integrity of buildings and bridges. For instance, the deployment of LiDAR in Europe’s Smart City Lighthouse Projects highlights its role in modernizing urban environments.

Advancements in LiDAR Technology is driving market growth:

Continuous innovation in LiDAR technology is propelling market growth. The emergence of solid-state LiDAR, which eliminates moving parts and reduces costs, has made LiDAR systems more accessible for mass-market applications. Additionally, advancements in laser technology, sensor miniaturization, and data processing algorithms have enhanced the accuracy and reliability of LiDAR systems. These improvements have widened their application scope, from automotive and defense to agriculture and consumer electronics. The trend toward miniaturized LiDAR systems also supports their integration into drones and mobile devices, further diversifying market opportunities.

Global LiDAR Market Challenges and Restraints

High Initial Costs and Integration Complexity is restricting market growth:

The cost of LiDAR systems, particularly for high-performance models, remains a significant barrier to widespread adoption. These costs include hardware, installation, and software for data analysis. While advancements like solid-state LiDAR aim to reduce expenses, the high initial investment still limits accessibility for small and medium-sized enterprises (SMEs). Additionally, integrating LiDAR into existing systems requires specialized expertise, which adds to operational complexity and costs. This challenge is particularly evident in industries with limited technological infrastructure, such as traditional agriculture and small-scale construction.

Regulatory and Safety Concerns is restricting market growth:

LiDAR technology faces regulatory hurdles, especially in the automotive and aerospace sectors. The deployment of autonomous vehicles equipped with LiDAR must meet stringent safety standards, which vary by region. These regulations can slow down the adoption process, as manufacturers must ensure compliance before commercialization. In the case of aerial LiDAR systems, regulations governing the use of drones and low-altitude flying devices add further constraints. Privacy concerns related to data collection in public spaces also present challenges, requiring clear guidelines and transparent practices to address stakeholder apprehensions.

Market Opportunities

The LiDAR market offers significant growth opportunities across various sectors. In the automotive industry, the push toward fully autonomous vehicles represents a substantial opportunity for LiDAR sensor manufacturers. Similarly, the integration of LiDAR in drones for applications such as land surveying, precision agriculture, and disaster management is gaining momentum. Smart cities and infrastructure projects provide an expansive market for LiDAR, with governments prioritizing investments in modernizing urban environments. Emerging applications, such as LiDAR in augmented reality (AR) and virtual reality (VR) devices, open doors for consumer electronics markets. Furthermore, advancements in AI and machine learning for LiDAR data analysis enhance its value in delivering actionable insights across industries, making it a crucial tool for future innovation.

LIDAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

14% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Velodyne LiDAR, Quanergy Systems, Luminar Technologies, Innoviz Technologies, Ouster, Faro Technologies, Teledyne Optech, Leica Geosystems, RIEGL Laser Measurement Systems, Trimble Inc. |

LiDAR Market Segmentation - By Product Type

-

Aerial LiDAR

-

Terrestrial LiDAR

-

Mobile LiDAR

-

Solid-state LiDAR

Aerial LiDAR dominates the market, contributing over 40% of global revenue in 2024. Its application in topographical surveys, forestry, and flood risk mapping makes it a critical tool for environmental monitoring and urban planning projects.

LiDAR Market Segmentation - By Application

-

Automotive

-

Construction

-

Agriculture and Forestry

-

Mining

-

Defense and Security

-

Others

The automotive segment leads the market, accounting for over 35% of total demand in 2024. The increasing focus on autonomous driving technologies and advanced driver-assistance systems (ADAS) drives this segment’s dominance.

LiDAR Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America holds the dominant position in the LiDAR market, with a 45% share in 2024. The region’s leadership is driven by robust investments in automotive innovation, smart city projects, and defense technologies. The presence of leading LiDAR companies and strong government support for technological advancements further strengthen North America’s position.

COVID-19 Impact Analysis on the LiDAR Market

The COVID-19 pandemic had a significant impact on the LiDAR market, disrupting supply chains and delaying project implementations across various industries. These initial setbacks affected production and distribution, particularly in sectors reliant on LiDAR for advanced mapping and surveying tasks. However, the pandemic also emphasized the critical role of LiDAR in sectors such as healthcare, logistics, and public safety, where automation and remote monitoring became essential. During the pandemic, drones equipped with LiDAR technology were increasingly used for tasks such as monitoring crowd densities and delivering medical supplies, showcasing the technology's versatility in real-time monitoring and crisis management. The pandemic-driven need for remote solutions further highlighted the importance of LiDAR in ensuring safety, efficiency, and innovation in critical sectors. In the post-pandemic era, the push for smart city initiatives aimed at improving urban resilience has opened up new opportunities for LiDAR adoption. With governments and urban planners focusing on building smarter, more sustainable cities, LiDAR’s ability to provide accurate, detailed 3D mapping is crucial for infrastructure development, environmental monitoring, and disaster response. Overall, while the pandemic presented challenges, it also underscored the adaptability and utility of LiDAR technology. Its ability to contribute to a wide range of applications, from healthcare to urban planning, has reinforced its value as an indispensable tool in addressing complex global challenges and driving innovation in multiple industries.

Latest Trends/Developments

The LiDAR market is undergoing significant transformation, driven by emerging trends that enhance its capabilities and broaden its applications. One of the key developments is the growing adoption of solid-state LiDAR technology. Known for its affordability and reliability, solid-state LiDAR is becoming the preferred choice for mass-market applications, including consumer electronics and automotive industries. Its ability to offer high performance at a lower cost is making it more accessible for a variety of use cases. Another major trend is the integration of LiDAR with artificial intelligence (AI) and machine learning (ML). This combination is enabling advanced analytics, such as real-time object detection, classification, and enhanced data processing. AI-powered LiDAR systems can analyze vast amounts of data quickly, making them ideal for applications in autonomous vehicles, security, and industrial automation. In the construction industry, LiDAR-equipped drones are revolutionizing site surveys and progress monitoring. These drones can quickly capture detailed, accurate data, reducing manual labor and improving project efficiency. By providing precise 3D models and real-time updates, LiDAR is helping construction teams better plan and execute their projects. Consumer applications are also expanding, particularly with the rise of LiDAR-enabled augmented reality (AR) and virtual reality (VR) devices. These devices benefit from LiDAR’s ability to accurately map and interact with real-world environments, enhancing the immersive experience for users. A significant advancement in the LiDAR market is the development of 4D LiDAR, which adds temporal data to traditional spatial measurements. This innovation is particularly valuable in dynamic environments, such as autonomous driving and robotics, where real-time movement and interaction are crucial. The addition of time as a dimension allows LiDAR systems to better navigate and adapt to changing conditions, further expanding their use in cutting-edge technologies.

Key Players

-

Velodyne LiDAR

-

Quanergy Systems

-

Luminar Technologies

-

Innoviz Technologies

-

Ouster

-

Faro Technologies

-

Teledyne Optech

-

Leica Geosystems

-

RIEGL Laser Measurement Systems

-

Trimble Inc.

Chapter 1. LiDAR Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. LiDAR Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. LiDAR Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. LiDAR Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. LiDAR Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. LiDAR Market – By Product Type

6.1 Introduction/Key Findings

6.2 Aerial LiDAR

6.3 Terrestrial LiDAR

6.4 Mobile LiDAR

6.5 Solid-state LiDAR

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. LiDAR Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Construction

7.4 Agriculture and Forestry

7.5 Mining

7.6 Defense and Security

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. LiDAR Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. LiDAR Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Velodyne LiDAR

9.2 Quanergy Systems

9.3 Luminar Technologies

9.4 Innoviz Technologies

9.5 Ouster

9.6 Faro Technologies

9.7 Teledyne Optech

9.8 Leica Geosystems

9.9 RIEGL Laser Measurement Systems

9.10 Trimble Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global LiDAR (Light Detection and Ranging) Market was valued at USD 1.8 billion in 2024 and is projected to grow at a CAGR of 14% from 2025 to 2030. The market is expected to reach USD 3.95 billion by 2030.

Key drivers include the rising adoption of LiDAR in autonomous vehicles, smart cities, and infrastructure projects, as well as advancements in solid-state LiDAR technology.

By product type: Aerial LiDAR, Terrestrial LiDAR, Mobile LiDAR, Solid-state LiDAR.

By application: Automotive, Construction, Agriculture and Forestry, Mining, Defense and Security, Others

North America is the dominant region, accounting for 45% of global revenue in 2024, driven by investments in automotive technologies and smart city projects.

Leading players include Velodyne LiDAR, Luminar Technologies, Innoviz Technologies, Ouster, and Leica Geosystems.