Commercial Vehicle Market Size (2024 – 2030)

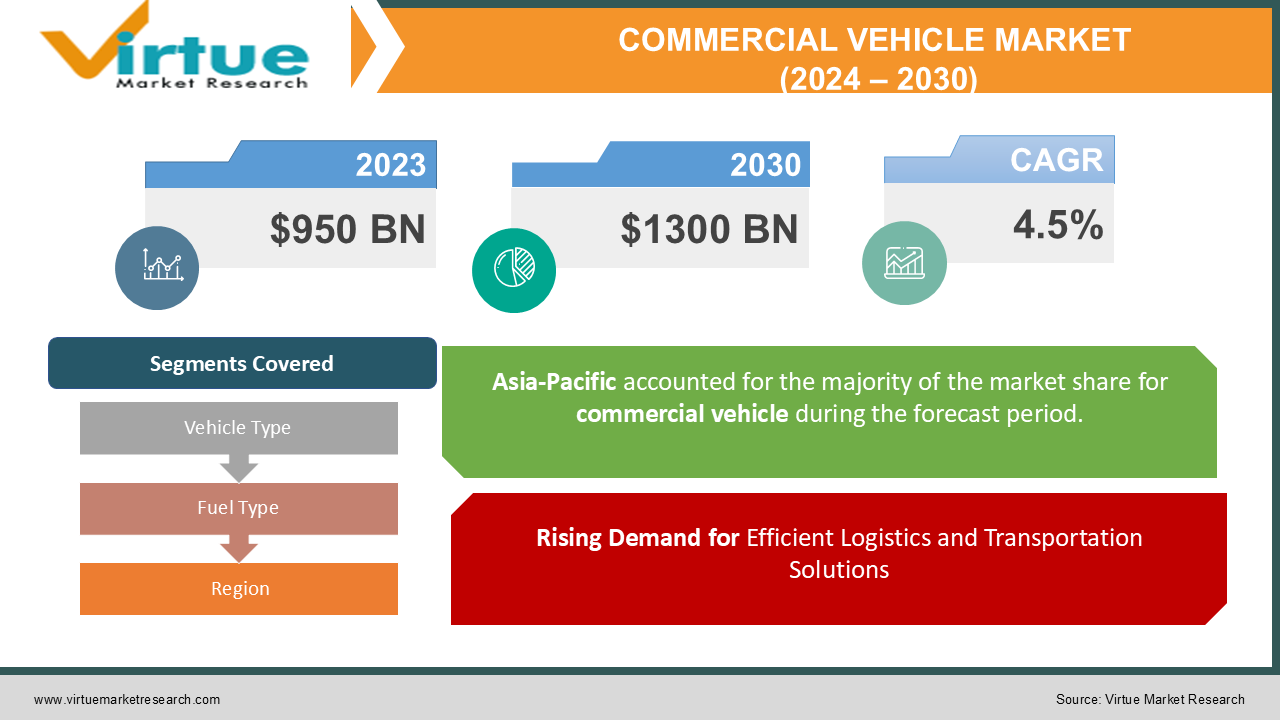

The Global Commercial Vehicle Market was valued at USD 950 billion in 2023 and is expected to reach USD 1,300 billion by 2030, growing at a CAGR of 4.5% from 2024 to 2030.

This market encompasses vehicles primarily used for the transportation of goods and passengers, which includes light commercial vehicles, heavy trucks, and buses. Key factors driving this market include rapid urbanization, increased demand for logistics and transportation, and the shift towards electric commercial vehicles in response to environmental concerns and government regulations.

A commercial vehicle is any motor vehicle designed and used for transporting goods or passengers for commercial purposes. This broad category encompasses a wide range of vehicles, from small vans and pickup trucks to large trucks and buses. Commercial vehicles are vital to the global economy, playing a crucial role in the transportation of goods, materials, and people. They are essential for industries such as logistics, construction, agriculture, and tourism. As the global economy continues to grow, the demand for efficient and reliable commercial vehicles is expected to increase, driving innovation and technological advancements in the automotive industry.

Key Market Insights:

The growing e-commerce sector has significantly increased demand for light commercial vehicles (LCVs), accounting for nearly 50% of the market in 2023.

Emerging markets in the Asia-Pacific region are witnessing a surge in commercial vehicle demand, contributing to more than 40% of global market growth.

Technological advancements, such as autonomous driving and fleet management systems, are being increasingly adopted in the commercial vehicle sector to enhance operational efficiency.

Electric commercial vehicles are projected to grow at the fastest rate, with a CAGR exceeding 20%, driven by environmental regulations and carbon emission targets.

North America and Europe dominate the heavy truck segment due to well-developed transport infrastructure and a high reliance on road freight.

The Asia-Pacific region leads the market for buses, particularly in countries like China and India, where buses are a primary mode of public transportation.

Diesel remains the dominant fuel type, accounting for over 70% of the commercial vehicle market share, although electric and hybrid alternatives are gaining traction.

Government policies favoring eco-friendly transportation and incentives for electric vehicle adoption are reshaping the commercial vehicle landscape.

Global Commercial Vehicle Market Drivers:

Rising Demand for Efficient Logistics and Transportation Solutions

The expanding e-commerce sector, coupled with globalization, has led to a significant increase in demand for efficient logistics and transportation solutions. Light commercial vehicles, in particular, have seen increased usage for last-mile delivery services in urban areas. With the boom in online retail and consumer preferences for faster delivery, companies are relying heavily on commercial vehicles to streamline operations and meet customer expectations. This trend is particularly noticeable in regions like North America and Europe, where e-commerce giants are continuously upgrading their logistics fleets to improve delivery timelines and service quality.

Government Initiatives and Environmental Regulations Supporting Electric Vehicles

Governments worldwide are introducing stringent regulations to limit greenhouse gas emissions and are promoting the adoption of electric commercial vehicles. This shift is evident in regions such as the European Union, where legislation mandates strict emission standards for commercial vehicles, encouraging manufacturers to develop low-emission alternatives. Additionally, several countries are providing tax incentives, subsidies, and charging infrastructure to promote electric commercial vehicles, further accelerating their adoption. This government support has spurred investment in electric and hybrid vehicle technology, which is anticipated to drive significant growth in the commercial vehicle market over the next decade.

Advancements in Autonomous and Connected Vehicle Technology

The commercial vehicle market is seeing rapid advancements in autonomous driving and connected technology. Fleet operators are increasingly adopting telematics and fleet management solutions that offer real-time vehicle tracking, fuel efficiency optimization, and predictive maintenance. Autonomous vehicle technology is also gaining traction, with companies testing self-driving trucks for long-haul transportation to reduce operational costs and improve efficiency. These advancements in vehicle technology are transforming fleet management and enhancing productivity, which is a substantial driver for the growth of the commercial vehicle market globally.

Global Commercial Vehicle Market Challenges and Restraints:

High Cost and Limited Infrastructure for Electric Commercial Vehicles

While there is a growing demand for electric commercial vehicles, the high cost of electric vehicles (EVs) and limited charging infrastructure pose significant challenges. The upfront cost of electric commercial vehicles is higher compared to their diesel counterparts, which can be a deterrent, especially for small and medium-sized fleet operators. Additionally, the lack of widespread charging stations, particularly in rural or remote areas, limits the adoption of electric commercial vehicles, as operators are concerned about range anxiety and operational efficiency.

Stringent Emission Norms and Regulatory Compliance Issues is restricting the market growth

The commercial vehicle industry faces stringent emissions regulations that require manufacturers to invest in costly research and development to comply with regulatory standards. Meeting these emission norms, especially for heavy trucks and buses, often requires advanced exhaust treatment systems and emission reduction technologies. These added costs can be a burden on manufacturers and fleet operators, leading to increased vehicle prices. Additionally, compliance with evolving environmental regulations requires frequent vehicle upgrades, which can increase operating costs and pose a challenge to fleet owners and commercial vehicle manufacturers.

Market Opportunities:

The increasing focus on sustainable and efficient urban transport presents substantial growth opportunities for the Global Commercial Vehicle Market. The trend towards electrification is opening up significant opportunities for manufacturers to develop zero-emission vehicles suitable for urban logistics, public transport, and last-mile delivery services. Furthermore, with advancements in autonomous technology, there is a potential shift toward fully autonomous commercial fleets, especially in controlled environments such as warehouses and logistics centers. The demand for connected commercial vehicles with advanced telematics, predictive maintenance, and fleet management solutions is also rising, creating an opportunity for tech companies and automotive manufacturers to innovate and cater to fleet operators’ needs. Moreover, the growing infrastructure investments in Asia-Pacific countries for public transport and logistics further offer lucrative prospects for market players to expand their footprint and tap into these high-growth regions.

COMMERCIAL VEHICLE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Vehicle Type, Fuel Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Daimler AG, Volvo Group, Ford Motor Company, PACCAR Inc., Toyota Motor Corporation, Isuzu Motors Ltd., Tata Motors Limited, Hyundai Motor Company, MAN SE, Scania AB |

Commercial Vehicle Market Segmentation: By Vehicle Type

-

Light Commercial Vehicles (LCVs)

-

Heavy Trucks

-

Buses

Light Commercial Vehicles hold the largest share of the market, driven by the rising demand for e-commerce and last-mile delivery solutions. With the growth of online retail, LCVs are increasingly being used for urban logistics, offering flexibility and cost-effectiveness for short-distance transport.

Commercial Vehicle Market Segmentation: By Fuel Type

-

Diesel

-

Electric

-

Hybrid

Diesel remains the dominant fuel type in the commercial vehicle market, primarily due to its efficiency and high energy density, which makes it suitable for long-haul transportation. However, as electric infrastructure expands, the electric segment is projected to grow at a faster rate, especially for urban applications.

Commercial Vehicle Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific is the largest and fastest-growing market for commercial vehicles, accounting for over 40% of the global market share. This dominance is attributed to the region's rapid economic growth, urbanization, and demand for public transportation and logistics solutions. Countries such as China, India, and Japan are significant contributors to the market, with China being a leading manufacturer of commercial vehicles.

COVID-19 Impact Analysis on the Commercial Vehicle Market:

The COVID-19 pandemic had a mixed impact on the Global Commercial Vehicle Market. While initial lockdowns and supply chain disruptions in 2020 caused a decline in production and sales, the market saw a gradual recovery as economies reopened. The pandemic highlighted the importance of logistics and transportation, especially for essential goods. Consequently, e-commerce boomed, increasing the demand for LCVs to support last-mile delivery operations. Additionally, governments in various regions offered incentives and relief packages to support the automotive industry, which facilitated market recovery. However, the pandemic also accelerated the shift towards electric and sustainable transportation as governments and companies focused on green recovery efforts, thus promoting long-term growth for electric commercial vehicles.

Latest Trends/Developments:

One of the latest trends in the commercial vehicle market is the integration of electric and hybrid vehicles, driven by rising environmental awareness and regulatory pressure. Major commercial vehicle manufacturers are investing in electric LCVs and buses, targeting urban areas where emissions regulations are stricter. Another significant trend is the adoption of autonomous and connected vehicle technologies in the logistics and transportation sector. Companies are exploring autonomous trucks and advanced telematics to enhance operational efficiency and reduce human error. The rise of digitalization and data analytics is also transforming fleet management, allowing companies to monitor vehicle health, optimize routes, and predict maintenance needs. Additionally, hydrogen fuel cell technology is emerging as a viable solution for heavy-duty commercial vehicles, with several pilot projects underway in North America and Europe. Key trends shaping this market include the electrification of commercial vehicles, the adoption of advanced driver assistance systems (ADAS), and the integration of telematics and connected vehicle technologies. Electric commercial vehicles, powered by batteries or fuel cells, are gaining traction due to their zero-emission benefits and potential cost savings. ADAS features, such as automatic emergency braking, lane departure warning, and adaptive cruise control, are being incorporated into commercial vehicles to enhance safety and driver comfort. Telematics solutions are providing valuable insights into vehicle performance, fuel efficiency, and driver behavior, enabling fleet operators to optimize their operations and reduce costs. Additionally, connected vehicle technologies are facilitating communication between vehicles, infrastructure, and other road users, leading to improved traffic flow and reduced congestion. As the commercial vehicle market continues to evolve, these trends are poised to reshape the industry and drive the adoption of sustainable and intelligent transportation solutions.

Key Players:

-

Daimler AG

-

Volvo Group

-

Ford Motor Company

-

PACCAR Inc.

-

Toyota Motor Corporation

-

Isuzu Motors Ltd.

-

Tata Motors Limited

-

Hyundai Motor Company

-

MAN SE

-

Scania AB

Chapter 1. Commercial Vehicle Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Commercial Vehicle Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Commercial Vehicle Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Commercial Vehicle Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Commercial Vehicle Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Commercial Vehicle Market – By Vehicle Type

6.1 Introduction/Key Findings

6.2 Light Commercial Vehicles (LCVs)

6.3 Heavy Trucks

6.4 Buses

6.5 Y-O-Y Growth trend Analysis By Vehicle Type

6.6 Absolute $ Opportunity Analysis By Vehicle Type, 2024-2030

Chapter 7. Commercial Vehicle Market – By Fuel Type

7.1 Introduction/Key Findings

7.2 Diesel

7.3 Electric

7.4 Hybrid

7.5 Y-O-Y Growth trend Analysis By Fuel Type

7.6 Absolute $ Opportunity Analysis By Fuel Type, 2024-2030

Chapter 8. Commercial Vehicle Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Vehicle Type

8.1.3 By Fuel Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Vehicle Type

8.2.3 By Fuel Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Vehicle Type

8.3.3 By Fuel Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Vehicle Type

8.4.3 By Vehicle Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Vehicle Type

8.5.3 By Fuel Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Commercial Vehicle Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Daimler AG

9.2 Volvo Group

9.3 Ford Motor Company

9.4 PACCAR Inc.

9.5 Toyota Motor Corporation

9.6 Isuzu Motors Ltd.

9.7 Tata Motors Limited

9.8 Hyundai Motor Company

9.9 MAN SE

9.10 Scania AB

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 950 billion in 2023 and is projected to reach USD 1,300 billion by 2030, growing at a CAGR of 4.5%.

Key drivers include the demand for efficient logistics, government support for electric vehicles, and advancements in autonomous technology.

The market is segmented by Vehicle Type (LCVs, Heavy Trucks, Buses) and Fuel Type (Diesel, Electric, Hybrid).

Asia-Pacific dominates, holding over 40% of the global market share, due to rapid urbanization and growth in logistics.

Leading players include Daimler AG, Volvo Group, Ford Motor Company, PACCAR Inc., and Toyota Motor Corporation