Automotive Software Market Size (2024 – 2030)

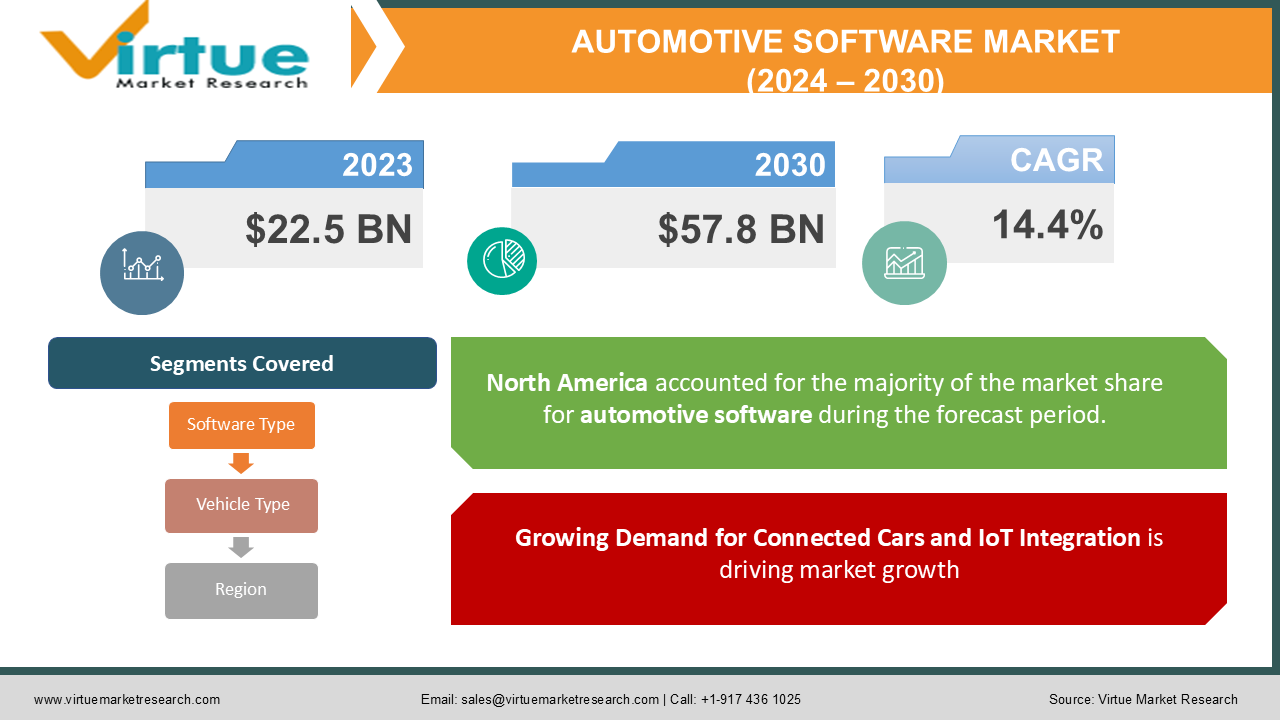

The Global Automotive Software Market was valued at USD 22.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 14.4% from 2024 to 2030. By 2030, the market is projected to reach USD 57.8 billion.

Automotive software plays a crucial role in modern vehicles, enabling various functionalities, including advanced driver assistance systems (ADAS), in-vehicle infotainment, and autonomous driving. The market’s growth is being driven by the increasing demand for connected cars, the rising adoption of electric vehicles (EVs), and the growing importance of software for vehicle safety, comfort, and efficiency. As automakers shift focus toward software-defined vehicles, the automotive software market is poised for substantial growth in the coming years.

Key Market Insights:

In 2023, ADAS accounted for a significant portion of the market due to the growing integration of safety and automation features in vehicles. By 2030, ADAS software is expected to hold more than 30% of the total market share.

The connected car market is one of the primary drivers of automotive software demand. By 2025, it is projected that over 80% of new vehicles sold globally will be equipped with some form of connectivity, whether for entertainment, navigation, or diagnostics.

The electric vehicle (EV) sector is experiencing rapid growth, with EV sales rising by more than 40% year-over-year in 2023. This trend is fueling demand for software that manages battery life, charging infrastructure, and overall vehicle performance.

Automotive cybersecurity is becoming an increasingly critical component of the automotive software market, with manufacturers investing heavily in solutions that protect vehicles from data breaches and hacking attempts. The cybersecurity segment is projected to grow at a CAGR of 17% through 2030.

In 2023, Europe held the largest market share in the automotive software market, driven by stringent emissions regulations, high adoption rates of electric vehicles, and the presence of key automotive manufacturers.

Autonomous driving is expected to be one of the fastest-growing segments of the automotive software market, with Level 3 and Level 4 autonomous vehicles becoming more common on roads by 2027. Software for autonomous driving is anticipated to grow at a CAGR of over 20% during the forecast period.

Global Automotive Software Market Drivers:

Growing Demand for Connected Cars and IoT Integration is driving market growth: One of the most significant drivers of the automotive software market is the rising demand for connected cars. With the proliferation of the Internet of Things (IoT), vehicles are becoming smarter, more interactive, and capable of connecting with external devices and infrastructure. The growing consumer demand for seamless connectivity, infotainment systems, and smart navigation features is pushing automotive manufacturers to integrate advanced software solutions in their vehicles. These systems allow for real-time data exchange, enabling features such as live traffic updates, remote diagnostics, and vehicle-to-everything (V2X) communication. As IoT technology continues to evolve, connected vehicles are set to become the norm, further propelling the demand for automotive software. Moreover, the integration of 5G technology will significantly enhance the capabilities of connected cars, allowing for faster data transmission and improved vehicle communication systems, driving the market growth.

Rising Adoption of Electric Vehicles (EVs) is driving market growth: The increasing shift towards electric vehicles (EVs) is a major driver of the automotive software market. Governments around the world are implementing strict regulations to reduce carbon emissions, encouraging automakers to produce more EVs. With the global electric vehicle market growing at a rapid pace, the demand for automotive software that can optimize battery performance, enhance charging efficiency, and improve energy management systems is surging. EVs rely heavily on software to manage their battery systems, regulate power distribution, and control various driving functions, making software an integral part of their operation. Furthermore, the software helps monitor vehicle diagnostics and charging infrastructure, contributing to the overall performance and efficiency of EVs. As more automakers transition towards producing electric vehicles, the automotive software market is expected to experience robust growth, especially in regions like Europe, where stringent emissions regulations are driving EV adoption.

Autonomous Driving and Advanced Driver Assistance Systems (ADAS) is driving market growth: The automotive industry's shift towards autonomous driving is another key driver for the automotive software market. With the development of autonomous vehicles (AVs), software is essential for enabling features like self-driving capabilities, lane departure warnings, and collision avoidance systems. Advanced Driver Assistance Systems (ADAS) have already become a standard in modern vehicles, offering features like adaptive cruise control, automated braking, and blind-spot detection, all of which rely on sophisticated software. As technology evolves, the demand for software that powers these systems will continue to grow. Autonomous driving software must process vast amounts of data from sensors, cameras, and radar systems to ensure the vehicle can navigate safely and efficiently. Companies like Tesla, Google (Waymo), and Uber are investing heavily in autonomous vehicle development, which is expected to drive significant growth in the automotive software market. The push towards full autonomy, with Level 3 and Level 4 autonomous vehicles expected to hit the roads by the late 2020s, will further expand the market's potential.

Global Automotive Software Market Challenges and Restraints:

The complexity of Software Integration and High Development Costs is restricting market growth: One of the significant challenges facing the automotive software market is the complexity of software integration into modern vehicles. Automotive software systems require extensive testing and validation to ensure they meet the industry's stringent safety and performance standards. The development of sophisticated software, particularly for advanced features like ADAS and autonomous driving, involves complex algorithms, machine learning models, and real-time data processing capabilities. This increases the time and costs associated with software development. Additionally, automotive manufacturers face the challenge of integrating third-party software into vehicles' existing electronic control units (ECUs), often leading to compatibility issues and system malfunctions. The development of software-defined vehicles, where software drives most of the vehicle's functions, further complicates this integration process. High costs associated with R&D and the need for specialized engineering talent make it challenging for smaller players to compete in the market. This limits the entry of new companies and could slow down innovation in the industry, restraining overall market growth.

Cybersecurity Threats and Data Privacy Concerns is restricting market growth: As vehicles become more connected and autonomous, they become prime targets for cyberattacks. Automotive cybersecurity has become a critical concern as connected vehicles exchange vast amounts of data, including personal information, through cloud networks. Hackers can potentially exploit vulnerabilities in automotive software to gain unauthorized access to a vehicle’s system, leading to serious safety risks such as loss of control over the vehicle. This threat has made consumers wary of adopting connected cars, especially when considering the potential risks to their safety and privacy. Automakers are under increasing pressure to develop secure software that can withstand cyberattacks while complying with data privacy regulations like the General Data Protection Regulation (GDPR) in Europe. However, implementing robust cybersecurity measures adds additional costs and complexity to software development. Failure to address cybersecurity and data privacy concerns effectively could undermine consumer trust in connected and autonomous vehicles, potentially limiting the widespread adoption of automotive software solutions.

Market Opportunities:

The global automotive software market presents several opportunities for growth, driven by emerging trends in electrification, digitalization, and automation. One of the most significant opportunities lies in the development of software for electric vehicles (EVs), which require complex systems for managing battery life, energy consumption, and charging infrastructure. As EV adoption accelerates worldwide, particularly in Europe and North America, automotive software developers have the chance to create innovative solutions that improve vehicle efficiency and extend battery longevity. Moreover, the increasing government incentives and stricter emission regulations in various countries will further boost the demand for electric vehicles, consequently driving the need for advanced EV software systems. Another promising opportunity is in the autonomous driving sector. As the automotive industry moves towards full autonomy, the demand for autonomous driving software is expected to rise exponentially. Companies working on artificial intelligence (AI) and machine learning (ML) algorithms to enable autonomous navigation, real-time decision-making, and obstacle detection will have a competitive advantage. Autonomous vehicles rely heavily on software for sensor fusion, object detection, and route planning, which presents a lucrative opportunity for software developers to play a pivotal role in shaping the future of transportation. Additionally, advancements in sensor technology, such as LiDAR, radar, and cameras, will further enhance the capabilities of autonomous driving software.

AUTOMOTIVE SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

40% |

|

Segments Covered |

By Software Type, Vehicle Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bosch Software Innovations GmbH, NXP Semiconductors, Aptiv PLC, Elektrobit, Blackberry QNX, Renesas Electronics Corporation, Continental AG, Nvidia Corporation, Tesla Inc., Wind River Systems, Inc. |

Automotive Software Market Segmentation: By Software Type

-

Vehicle Management Software

-

Safety and Security Software

-

Infotainment and Telematics Software

-

Autonomous Driving Software

-

Others (Maintenance, Vehicle Analytics)

The Infotainment and Telematics Software segment is the most dominant in terms of market share. With consumers demanding enhanced in-car experiences, this software offers advanced features like navigation, entertainment, communication, and real-time diagnostics, becoming essential for connected vehicles.

Automotive Software Market Segmentation: By Vehicle Type

-

Passenger Vehicles

-

Commercial Vehicles

-

Electric Vehicles (EVs)

-

Autonomous Vehicles (AVs)

The Electric Vehicle (EV) segment is anticipated to dominate the market. With the rapid rise of EV adoption, software solutions are critical for managing battery performance, vehicle diagnostics, and improving the overall driving experience for electric vehicles.

Automotive Software Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America is the dominant region in the automotive software market, driven by the presence of major automakers, high consumer demand for connected vehicles, and substantial investments in autonomous vehicle technology. The region’s advanced infrastructure, coupled with regulatory support for electric vehicles and autonomous driving, positions it as a leader in the automotive software space.

COVID-19 Impact Analysis on the Automotive Software Market:

The COVID-19 pandemic had a mixed impact on the automotive software market. Initially, automotive production came to a halt due to factory shutdowns, supply chain disruptions, and a decrease in consumer spending, resulting in a slowdown in software demand. However, the pandemic accelerated the digital transformation of the automotive industry, with a growing focus on connected vehicles and software-defined features. As remote work and social distancing measures became the norm, consumers and businesses sought more advanced digital solutions, leading to an increased demand for connected car technologies, real-time diagnostics, and infotainment systems. Additionally, the push for electrification continued to grow as governments introduced post-pandemic recovery plans that emphasized sustainability and reduced emissions, further boosting the demand for EV software. In the long term, the pandemic has reinforced the automotive industry’s transition towards software-driven innovation, with the industry’s recovery now largely dependent on software advancements and digital technologies.

Latest Trends/Developments:

The automotive software market is witnessing several trends and developments that are shaping its future growth. One key trend is the increasing focus on software-defined vehicles, where software controls most of the vehicle’s functions, from safety and performance to entertainment and autonomous driving. Major automakers are transitioning from hardware-driven models to software-centric architectures, allowing for over-the-air (OTA) updates, improved vehicle performance, and enhanced personalization. This shift is enabling vehicles to evolve post-purchase, creating new revenue streams for manufacturers through subscription-based services and software upgrades. Another trend is the growing use of artificial intelligence (AI) and machine learning (ML) in automotive software. AI-driven algorithms are being employed in areas like autonomous driving, predictive maintenance, and in-car voice assistants, providing a more intuitive and seamless driving experience. AI is also being used in vehicle cybersecurity to detect and mitigate potential threats in real-time. Moreover, the integration of 5G technology is revolutionizing the automotive software landscape. With faster data transmission speeds and lower latency, 5G enables real-time vehicle-to-everything (V2X) communication, enhancing the capabilities of connected and autonomous vehicles. This development is expected to further accelerate the adoption of smart vehicles and autonomous driving software in the coming years.

Key Players:

-

Bosch Software Innovations GmbH

-

NXP Semiconductors

-

Aptiv PLC

-

Elektrobit

-

Blackberry QNX

-

Renesas Electronics Corporation

-

Continental AG

-

Nvidia Corporation

-

Tesla Inc.

-

Wind River Systems, Inc.

Chapter 1. Automotive Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Software Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Software Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Software Market – By Software Type

6.1 Introduction/Key Findings

6.2 Vehicle Management Software

6.3 Safety and Security Software

6.4 Infotainment and Telematics Software

6.5 Autonomous Driving Software

6.6 Others (Maintenance, Vehicle Analytics)

6.7 Y-O-Y Growth trend Analysis By Software Type

6.8 Absolute $ Opportunity Analysis By Software Type, 2024-2030

Chapter 7. Automotive Software Market – By Vehicle Type

7.1 Introduction/Key Findings

7.2 Passenger Vehicles

7.3 Commercial Vehicles

7.4 Electric Vehicles (EVs)

7.5 Autonomous Vehicles (AVs)

7.6 Y-O-Y Growth trend Analysis By Vehicle Type

7.7 Absolute $ Opportunity Analysis By Vehicle Type, 2024-2030

Chapter 8. Automotive Software Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Software Type

8.1.3 By Vehicle Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Software Type

8.2.3 By Vehicle Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Software Type

8.3.3 By Vehicle Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Software Type

8.4.3 By Vehicle Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Software Type

8.5.3 By Vehicle Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Automotive Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Bosch Software Innovations GmbH

9.2 NXP Semiconductors

9.3 Aptiv PLC

9.4 Elektrobit

9.5 Blackberry QNX

9.6 Renesas Electronics Corporation

9.7 Continental AG

9.8 Nvidia Corporation

9.9 Tesla Inc.

9.10 Wind River Systems, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Automotive Software Market was valued at USD 22 billion in 2023 and is projected to reach USD 57.8 billion by 2030, growing at a CAGR of 14.4% from 2024 to 2030.

Key drivers include the growing demand for connected cars, the rising adoption of electric vehicles (EVs), and the increasing integration of advanced driver assistance systems (ADAS) and autonomous driving technologies.

The market is segmented by software type (vehicle management, infotainment and telematics, ADAS, and others) and vehicle type (passenger vehicles, commercial vehicles, electric vehicles, and autonomous vehicles).

North America is the dominant region, driven by the presence of major automakers, a strong focus on autonomous driving, and substantial investments in connected vehicle technology.

Leading players include Bosch Software Innovations GmbH, Aptiv PLC, Elektrobit, Blackberry QNX, Nvidia Corporation, and Tesla Inc.