Advanced Driver Assistance Systems (ADAS) Market Size (2024 – 2030)

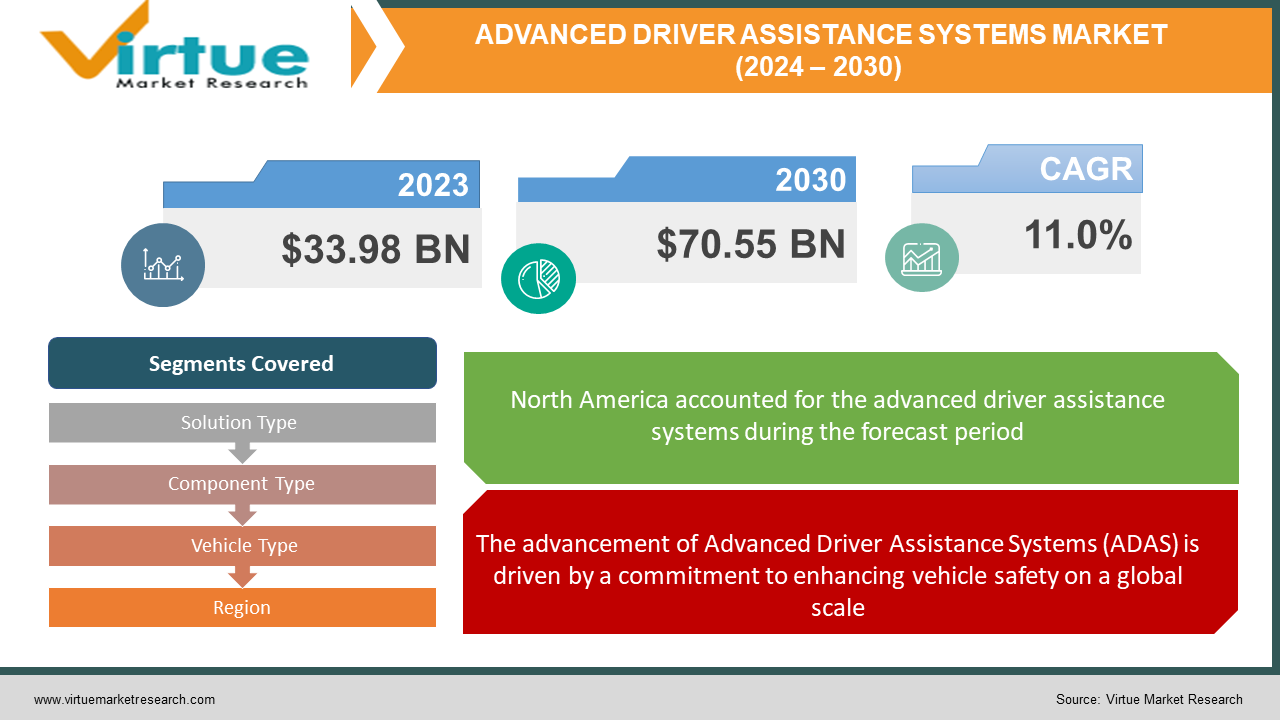

The Global Advanced Driver Assistance Systems (ADAS) Market is expected to grow from USD 33.98 billion in 2023 to reach a valuation of USD 70.55 billion by 2030 at a compound annual growth rate (CAGR) of 11.0% during 2024-2030.

The category of electronic components known as advanced driver assistance systems (ADAS) offers drivers an intelligent driving experience. These systems incorporate various sensors, including laser, infrared, radar, image, ultrasonic, LiDAR, and image sensors. The automotive industry is currently witnessing a significant trend in deploying ADAS in vehicles to enhance both comfort and safety on the road. The growing demand for a safer driving environment has led to an increased interest in assistive driving systems among consumers, thereby driving the growth of the ADAS market. The advanced driver assistance system provides several advantages, such as reducing property and life losses, lowering the accident rate, and more. It includes safety functions designed to enhance pedestrian and passenger safety by minimizing both the frequency and severity of motor vehicle accidents.

Key Market Insights:

A key driver for the growth of the market is the increasing demand for advanced driver assistance systems (ADAS) in compact passenger cars. Government regulations mandating the implementation of ADAS in vehicles are expected to further boost demand. The sales of luxury vehicles are on the rise globally due to increasing disposable income, economic stability, and a preference for materialistic lifestyles.

While developed countries like the U.S., Canada, Japan, Spain, South Korea, and Germany have a significant share of luxury car owners, developing countries such as India and China are experiencing substantial growth in luxury car sales. Germany stands out as the most lucrative luxury car market, attributed to the presence of major players like BMW, Mercedes-Benz, Audi AG, and Volkswagen. Germany is also the largest exporter of luxury cars worldwide, with the U.S. being a major consumer market.

The market is expected to see growth in the demand for advanced systems such as road sign recognition, night vision, and drowsiness monitoring. Additionally, traditional ADAS systems, including autonomous emergency braking and adaptive cruise control, are expected to experience exponential growth due to increased government regulations aimed at improving road safety and reducing accidents. For instance, the European Union mandated the implementation of adaptive cruise control systems in all heavy commercial vehicles by 2020, providing lucrative growth opportunities for the advanced driver assistance systems market in the forecast period.

Global Advanced Driver Assistance Systems (ADAS) Market Drivers:

The advancement of Advanced Driver Assistance Systems (ADAS) is driven by a commitment to enhancing vehicle safety on a global scale.

Recognizing the pivotal role safety features play for automotive users, governments worldwide have mandated the integration of elements like lane departure warning (LDW) and automatic emergency braking (AEB). Consequently, a range of safety features has been developed to aid drivers and diminish the occurrence of accidents. For instance, the driver monitoring system diligently observes the driver, issuing alerts or warnings in cases of drowsiness or distraction.

The market experiences growth spurred by a continuous elevation in standards and regulations associated with Advanced Driver Assistance Systems, given their widespread integration across various vehicle types.

ADAS serves the purpose of mitigating human errors that contribute to auto accidents. Operating both passively, through warning signals of potential collisions, and actively, by halting or guiding the vehicle, ADAS aims to prevent accidents and save lives. Fully autonomous vehicles further mitigate risks associated with impaired drivers, reducing instances of driving-related fatalities, currently accounting for 17% of total road traffic injury deaths. Such vehicles employ systems that optimize routes, leading to improved fuel efficiency, reduced emissions, and lower costs.

Global Advanced Driver Assistance Systems (ADAS) Market Restraints and Challenges:

The development of infrastructure for Advanced Driver Assistance Systems remains a challenge in various countries.

The effective functioning of ADAS relies on basic infrastructure such as well-maintained roads, clear lane markings, and GPS connectivity. V2V and V2X communications, essential for ADAS, demand robust connectivity infrastructure. Information vital for semi-autonomous and autonomous trucks, including lane changes, object detection, and traffic conditions, requires reliable connectivity on highways. In developing countries like Mexico, Brazil, and India, the IT infrastructure on highways is gradually evolving, with limited 3G and 4G-LTE networks primarily available in urban and semi-urban areas. Connectivity issues persist in semi-urban and rural regions, necessitating government support for the adoption of ADAS features. The lack of government regulations and information technology communication infrastructure acts as significant barriers to the growth of ADAS in developing regions.

Environmental constraints and security threats pose hindrances to market growth.

The safety features integral to ADAS, comprising sensors and actuators such as radar, LiDAR, ultrasonic sensors, cameras, and infrared devices, rely on accurate methods to ensure vehicle, driver, passenger, and pedestrian safety. System functionality is contingent on traffic and weather conditions, necessitating a delicate balance between automation and manual control. Additionally, ensuring the security of ADAS from malicious hackers is paramount. Potential infiltrations through Bluetooth, Wi-Fi, or GPS can compromise vehicle control, posing a substantial challenge for system manufacturers and OEMs.

Global Advanced Driver Assistance Systems (ADAS) Market Opportunities:

An opportunity of significant importance lies in the escalating demand for autonomous vehicles.

The advent of autonomous vehicles is poised to revolutionize the landscape of transportation. The incorporation of Advanced Driver Assistance Systems (ADAS) technologies has streamlined the intricacies of driving, introducing features such as lane monitoring, emergency braking, stability controls, and more. Autonomous vehicles heavily depend on advanced technologies and systems, including LiDAR, radar, ultrasonic sensors, and high-definition cameras, for comprehensive data collection. An onboard intelligent autonomous driving system analyzes this data to navigate the vehicle safely. The algorithms employed in autonomous vehicles enhance driving precision through continuous learning over time. The insights and advancements gained by one vehicle are disseminated to all other vehicles in the network.

A recent breakthrough in the realm of autonomous vehicles is the emergence of Vehicular Ad hoc Network (VANET), a distinct subclass of Mobile Ad hoc Network (MANET). VANET is specifically tailored for roads, treating the vehicle as a mobile node. Essential applications of VANET, such as active safety and intelligent transport, necessitate cutting-edge vehicle-to-vehicle communication technologies, notably routing technology. This encompasses functions like accident notifications, preemptive alerts regarding accidents, information on construction sites, speed limit violations, traffic light status, fog advisories, darkness alerts, and location-specific services. Pioneered by industry leaders such as Google, Tesla, and Audi, these advancements are pivotal in the development of self-driving car technology.

ADVANCED DRIVER ASSISTANCE SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.0% |

|

Segments Covered |

By Solution Type, Component Type, Vehicle Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Altera Corporation (Intel Corporation), Autoliv Inc., DENSO CORPORATION., Continental AG, Garmin Ltd., Infineon Technologies AG, Magna International Inc., Mobileye, Robert Bosch GmbH, Valeo SA, Wabco Holdings Inc |

Global Advanced Driver Assistance Systems (ADAS) Market Segmentation: By Solution Type

-

Adaptive Cruise Control (ACC)

-

Blind Spot Detection System (BSD)

-

Park Assistance

-

Lane Departure Warning (LDWS) System

-

Tire Pressure Monitoring System (TPMS)

-

Autonomous Emergency Braking (AEB)

-

Adaptive Front Lights (AFL)

-

Others

In 2023, the adaptive cruise control (ACC) segment led the market with a dominant market share of 19.7%. The growth is attributed to heightened demand for safety features, advancements in sensor and radar technology, and governmental regulations mandating ACC system inclusion in specific vehicles, especially commercial ones.

The blind spot detection system (BSD) segment is projected to achieve the fastest Compound Annual Growth Rate (CAGR) of 13.4% during the forecast period. Utilizing sensors to detect vehicles in blind spots, BSD systems alert drivers with visual or audible warnings, effectively preventing accidents caused by lane changes without checking blind spots. The segment's growth is fueled by an increasing demand for safety features and the enhanced affordability and reliability of BSD systems.

Global Advanced Driver Assistance Systems (ADAS) Market Segmentation: By Component Type

-

Processor

-

Sensors

-

Radar

-

LiDAR

-

Ultrasonic

-

Others

-

Software

-

Others

In 2023, the sensor segment claimed the largest revenue share at 31.9%. It is anticipated to register a swift CAGR of 12.3% over the forecast period, underlining the critical role of sensors in vehicle automation. LIDAR, RADAR, ultrasonic, camera, and other sensors collaboratively ensure functional accuracy, facilitating the desired assistance and safety functions in ADAS.

The processor segment is poised for significant CAGR growth, driven by the escalating demand for more powerful and sophisticated ADAS features. As ADAS systems necessitate robust processors to execute complex algorithms for object detection, movement tracking, and decision-making, enhanced processing power enables systems to perform intricate tasks like lane-keeping assistance and adaptive cruise control.

Global Advanced Driver Assistance Systems (ADAS) Market Segmentation: By Vehicle Type

-

Passenger Car

-

Commercial Vehicle

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

The passenger car segment, accounting for 73.4% of the revenue share in 2023, is expected to register a rapid CAGR of 11.2% throughout the forecast period. The growth is fueled by heightened demand for safety systems in developing markets, driven by increased consumer awareness, supportive legislation, and improving road safety standards. Regulations in regions like the European Union, with initiatives like Vision Zero, mandate the integration of key safety features in new passenger vehicles by 2022.

The commercial vehicle segment, with a notable focus on light commercial vehicles in 2022, is projected to experience significant CAGR growth. However, regulations in the European Union mandate the implementation of basic ADAS functions in all heavy commercial vehicles, influencing the anticipated rise in demand for ADAS in heavy commercial vehicles.

Global Advanced Driver Assistance Systems (ADAS) Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America dominated the market in 2023 with a market share of 32.9%, driven by technological advancements, the presence of major industry players, a higher adoption rate of new technology, and improved economic conditions. The region's growth is further fueled by rising fatality rates and increased sales of high-end vehicles, particularly in Canada and the U.S.

The Asia-Pacific region is poised for the fastest CAGR of 12.3% over the forecast period, attributed to increased adoption of advanced electronics and high automobile production in countries like Japan, China, and South Korea. Government initiatives, such as the implementation of emergency brake systems and adaptive cruise control systems, encourage Original Equipment Manufacturers (OEMs) to enter the market. The shift of production plants by European and American manufacturers, including Mercedes Benz, Volkswagen, and General Motors, to these countries further contributes to the region's growth.

COVID-19 Impact Analysis on the Global Advanced Driver Assistance Systems (ADAS) Market:

The advancement of the global Advanced Driver Assistance Systems (ADAS) market within the automotive industry was adversely affected by the COVID-19 pandemic. The adoption of ADAS faced hindrances due to various factors, including disruptions in the supply chain, a shortage of chips, slow growth in automotive manufacturing, and limited acceptance of Electric Vehicles (EVs) in developing nations. Suppliers providing raw materials for ADAS encountered operational challenges as a result of government-imposed lockdowns and restrictions. According to the National Association of Manufacturers in the U.S., which represents industries of all sizes across all 50 states, approximately 51% of manufacturers had to alter their operations in response to the economic repercussions of the COVID-19 pandemic.

Recent Trends and Developments in the Global Advanced Driver Assistance Systems (ADAS) Market:

In June 2023, Continental AG disclosed its initiative to develop cost-effective Advanced Driver Assistance Systems (ADAS) for both cars and two-wheelers in the Indian market. The company's objective is to enhance the safety and affordability of vehicles in the Indian automotive sector.

Also in June 2023, Continental unveiled a new High-Performance Computer (HPC) designed for automobiles. This innovative system seamlessly integrates the cluster, infotainment, and Advanced Driver Assistance Systems (ADAS) into a unified unit.

In January 2023, NXP Semiconductors, a U.S.-based automotive radar manufacturer, launched a new radar Integrated Circuit (IC) series named SAF85xx. Specifically designed for next-generation ADAS and automated driving systems, this series amalgamates NXP's advanced radar detector and processing technologies into a singular device. This provides tier-one suppliers and Original Equipment Manufacturers (OEMs) with enhanced flexibility, catering to short to long-range radar applications while meeting stringent safety requirements set by NCAP.

In November 2022, Continental AG inaugurated its largest Research and Development (R&D) facility for ADAS, Anti-lock Braking System (ABS), and components in Bengaluru. This center has played a pivotal role in software development for radar-based driver assistance systems and single-channel ABS systems, commonly utilized in motorcycles with smaller engine capacities.

Key Players:

-

Altera Corporation (Intel Corporation)

-

Autoliv Inc.

-

DENSO CORPORATION.

-

Continental AG

-

Garmin Ltd.

-

Infineon Technologies AG

-

Magna International Inc.

-

Mobileye

-

Robert Bosch GmbH

-

Valeo SA

-

Wabco Holdings Inc

Chapter 1. Advanced Driver Assistance Systems (ADAS) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Advanced Driver Assistance Systems (ADAS) Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Advanced Driver Assistance Systems (ADAS) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Advanced Driver Assistance Systems (ADAS) Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Advanced Driver Assistance Systems (ADAS) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Advanced Driver Assistance Systems (ADAS) Market – By Solution Type

6.1 Introduction/Key Findings

6.2 Adaptive Cruise Control (ACC)

6.3 Blind Spot Detection System (BSD)

6.4 Park Assistance

6.5 Lane Departure Warning (LDWS) System

6.6 Tire Pressure Monitoring System (TPMS)

6.7 Autonomous Emergency Braking (AEB)

6.8 Adaptive Front Lights (AFL)

6.9 Others

6.10 Y-O-Y Growth trend Analysis By Solution Type:

6.11 Absolute $ Opportunity Analysis By Solution Type:, 2024-2030

Chapter 7. Advanced Driver Assistance Systems (ADAS) Market – By Component Type

7.1 Introduction/Key Findings

7.2 Processor

7.3 Sensors

7.4 Radar

7.5 LiDAR

7.6 Ultrasonic

7.7 Others

7.8 Software

7.9 Others

7.10 Y-O-Y Growth trend Analysis By Component Type:

7.11 Absolute $ Opportunity Analysis By Component Type:, 2024-2030

Chapter 8. Advanced Driver Assistance Systems (ADAS) Market – By Vehicle Type

8.1 Introduction/Key Findings

8.2 Passenger Car

8.3 Commercial Vehicle

8.4 Light Commercial Vehicle

8.5 Heavy Commercial Vehicle

8.6 Y-O-Y Growth trend Analysis By Vehicle Type

8.7 Absolute $ Opportunity Analysis By Vehicle Type, 2024-2030

Chapter 9. Advanced Driver Assistance Systems (ADAS) Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Solution Type

9.1.3 By Component Type

9.1.4 By Vehicle Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Solution Type

9.2.3 By Component Type

9.2.4 By Vehicle Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Solution Type

9.3.3 By Component Type

9.3.4 By Vehicle Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Solution Type

9.4.3 By Component Type

9.4.4 By Vehicle Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Solution Type

9.5.3 By Component Type

9.5.4 By Vehicle Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Advanced Driver Assistance Systems (ADAS) Market – Company Profiles – (Overview, By Solution Type: Portfolio, Financials, Strategies & Developments)

10.1 Altera Corporation (Intel Corporation)

10.2 Autoliv Inc.

10.3 DENSO CORPORATION.

10.4 Continental AG

10.5 Garmin Ltd.

10.6 Infineon Technologies AG

10.7 Magna International Inc.

10.8 Mobileye

10.9 Robert Bosch GmbH

10.10 Valeo SA

10.11 Wabco Holdings Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Advanced Driver Assistance Systems (ADAS) Market size is valued at USD 33.98 billion in 2023.

The worldwide Global Advanced Driver Assistance Systems (ADAS) Market growth is estimated to be 11.0% from 2024 to 2030.

The Global Advanced Driver Assistance Systems (ADAS) Market is segmented By Solution Type (Adaptive Cruise Control (ACC), Blind Spot Detection System (BSD), Park Assistance, Lane Departure Warning (LDWS) System, Tire Pressure Monitoring System (TPMS), Autonomous Emergency Braking (AEB), Adaptive Front Lights (AFL), Others); By Component Type (Processor, Sensors, Software, Others); By Vehicle Type (Passenger Car, Commercial Vehicle).

Trends such as autonomous driving, AI integration, and connectivity are creating a transformative opportunity for the global advanced driver assistance systems (ADAS) market. Opportunities include increased use of electric vehicles, improved safety features, and regulatory backing, which together create a dynamic and cutting-edge environment for business.

The COVID-19 pandemic had a major effect on the global advanced driver assistance systems (ADAS) market, leading to delays in production, lower consumer spending, and disruptions in the supply chain. But as the automotive industry recovered, the crisis drove digitization and increased attention to ADAS innovation and safety solutions.