Automotive Graphic Processor Unit (GPU) Market Size (2023 - 2030)

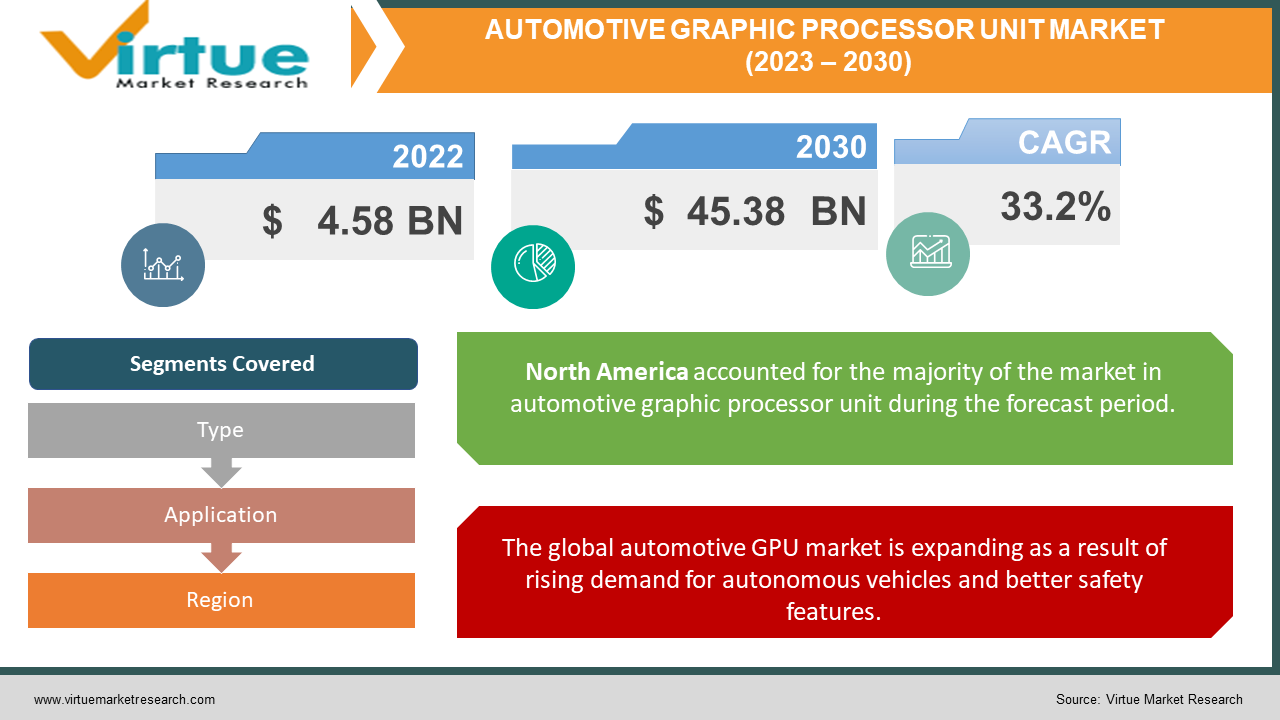

According to our research report, the global Automotive Graphic Processor Unit (GPU) Market size is at USD 4.58 billion in 2022 and is estimated to reach 45.38 billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 33.2%. The growing demand for autonomous vehicles, better safety features, and ongoing advancements in artificial intelligence (AI), the Internet of Things (IoT), deep learning, augmented reality (AR), and virtual reality are some factors driving the global automotive graphic processor unit (GPU) market (VR).

Industry Overview :

A computer chip called a graphics processing unit, often referred to as a visual processing unit, is used to create images by quickly performing mathematical calculations. In contrast to CPUs, it has hundreds of cores that can manage thousands of threads at once. While the GPUs found in standalone cards have their RAM, they share the main memory with the CPU in chipsets. Transistors are used in graphics processing units to conduct the mathematical operations necessary for 3D graphics. Dedicated GPUs are being replaced by integrated and hybrid GPUs in applications including supercomputers, virtual reality and augmented reality systems and artificial intelligence platforms. A GPU can be built into a video card or integrated into the motherboard of a personal computer. A range of industry sectors, including the automotive industry, are using CPUs to enable 3D content and graphics applications. For instance, CAD and simulation software allows graphic processing units to create lifelike images or animations, which support manufacturing & design applications. The demand for advancements in GPU technology is also driven by AI, ML, autonomous driving, and navigation (vehicles, robotics).

Modern vehicles need strong GPUs, especially if they are being used for autonomous driving. The automobile sector has experienced tremendous expansion during the past ten years. A powerful GPU (and CPU) is required to drive the artificial intelligence in a Tesla, BMW, Porsche, or any other automobile. The introduction of affordable, effective, and powerful electric cars marked a significant turning point for this industry. Modern vehicles all come with GPUs as standard equipment. The majority of modern cars on the road today have displays, and just like other displays, the rendering of the image requires a computer (a GPU). In some circumstances, code that typically runs on CPUs can be optimized to perform up to 20 times quicker when executed on the GPU as they are massively parallel processing devices. With the aid of an AI accelerator, like the neural network accelerator (NNA) from Imagination, that may be further increased, leading to considerable power savings, which is important as electric vehicles (EVs) is by far the most prevalent platform for autonomous solutions. GPUs are ideally suited for the job when it comes to autonomous vehicle requirements as they can handle parallel signal processing and picture analysis. ADAS platforms can use GPU parallel computing to analyze sensor data from lidar, radar, and infrared cameras in real-time as image processing is a natural fit for this kind of component. This is likely to eliminate human error from the process, resulting in a significant increase in the speed, efficiency, and safety of automotive transportation. To support Level 5 autonomous driving systems, powerful GPUs for all car types are required for gaming, video, and other forms of entertainment.

COVID-19 pandemic impact on Automotive Graphic Processor Unit (GPU) Market

The global automotive graphic processing unit (GPU) market has shown rapid expansion in recent years, but in 2020 the market experienced a sharp decline as a result of the COVID-19 pandemic. The COVID-19 epidemic compelled several governments to impose lockdown, which halted the operations of numerous organizations and had an impact on the global economy. Additionally, numerous businesses around the world have seen a deficiency in hardware components from suppliers. Additionally, production efforts for GPUs have been impacted by the operational disruptions in the electronics sector brought on by the Covid-19 outbreak. The supply chain and distribution channels were affected by the coronavirus pandemic, which in turn had an impact on the sectors that relied on GPU components. Nonetheless, the demand is anticipated to rise as a result of the widespread use of graphics processors in design and engineering applications. The strain on automotive design departments to produce new car innovations quickly, meet the fluctuating expectations of the market, and keep up with an expanding product line is mounting. Research institutions benefited from the expanded computing capabilities of GPU developers and their ecosystem partners during the COVID-19 epidemic.

MARKET DRIVERS:

The global automotive GPU market is expanding as a result of rising demand for autonomous vehicles and better safety features.

The ability of new autonomous systems to quantify uncertainty through real-time simulation, which necessitates quick processing, is crucial to their effectiveness. Examples of these systems include drones and self-driving cars. The fast-developing innovations of autonomous vehicles and improved driver-assistance technologies (ADAS) are becoming more vital. Autonomous vehicles can lessen collisions, save money on fuel, speed up travel, and even give those who are unable to drive access to transportation. By allowing functions like lane detection, lane departure warning, distracted driver warning, and road signs or pedestrian detection, embedded GPUs powered by AI can help autonomous vehicles become smarter. To increase the accuracy and performance of navigation, autonomous systems augment it with high-quality sensor data. This enables a better understanding of the environment. Compared to a standard CPU, the GPU offers greater processing, memory, and efficiency. This market's expansion is also being fueled by the increasing adoption of 3D content and advanced graphics-intensive applications in automobiles. For instance, CAD and simulation programs make use of GPUs to create lifelike animations or graphics to aid production and design applications in the automotive industry.

The industry is expanding as a result of factors such as ongoing developments in artificial intelligence (AI), IoT, deep learning augmented reality (AR), and virtual reality (VR).

A key enabler for completely autonomous vehicles may potentially turn out to be deep learning, a type of machine learning, and an element of artificial intelligence (AI). It is virtually hard to foresee every scenario that a self-driving vehicle might experience. For deep neural networks to learn, adapt, and enhance their problem-solving abilities in real-time, deep learning, which is supported by powerful GPUs, analyses enormous volumes of data. Geo-tagging of images and landmarks can assist deep learning algorithms in autonomous vehicles to dynamically choose travel routes, with sensor integration enabling safe and accurate on-road navigation. Toyota is investigating the use of GPU-powered simulation and deep learning 3 to enhance the intelligence of its self-driving vehicles. With significant advancements in graphics technology and related consumer electronics technologies, achieving full virtual or augmented reality and producing an engaging user experience are now achievable. Graphic processing units are anticipated to become more widely used when AR and VR are integrated into more applications. GPU applications in the Internet of Things (IoT) include dynamic 3D user interfaces and 3D visuals for user interface composite processing.

MARKET RESTRAINTS :

The GPUs used for autonomous driving is built using designs intended for the mainstream market; as a result, they may not have the fundamental characteristics required for safe operation in automobiles.

The computer performance requirements of autonomous driving (AD) systems can be met by GPUs. The GPUs used for autonomous driving, however, may lack essential characteristics required for proper functioning under vehicle safety rules as they are built on designs for the mass market. Under challenging operating circumstances, GPUs are more prone to sporadic hardware flaws (such as extremely high temperatures). Use of ISO 26262 standard solutions, such as diversity and redundancy, should be done with caution while employing GPUs.

The market's expansion may be hampered by difficulties with computational complexity.

Artificial intelligence methods, particularly deep learning, need specialized hardware due to the huge volume of data and the complexity of the computations. For quick parallel calculation, hardware can be highly optimized, such as graphic processing units (GPU) or tensor processing units (TPU). Speed comes at a higher cost and with more energy usage. There is no certainty that a specific algorithm will be able to find a solution under real-time restrictions, even when using specialized technology. Therefore, choosing algorithms carefully takes into account their complexity and CPU requirements in real-time systems. Some cars have a weaker GPU/CPU, which causes the infotainment system to run slowly or not at all. A weaker GPU also restricts the availability of potential new functionalities.

ROBOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

33.2% |

|

Segments Covered |

By Type, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nvidia Corporation, AMD, Intel Corporation, Qualcomm Technologies, Inc., Imagination Technologies |

This research report on the Automotive Graphic Processor Unit (GPU) market has been segmented based on type, application, and region.

Automotive Graphic Processor Unit (GPU) Market – By Type

- Integrated

- Discrete

Based on Type, the Automotive Graphic Processor Unit (GPU) Market is bifurcated into Integrated and Discrete. The integrated GPU is embedded with the CPU rather than being provided on a separate card. A discrete GPU is a separate chip that is installed on its circuit board and commonly connected to a PCI Express slot. Thinner and lighter systems, lower power consumption, and reduced system costs are all made possible by CPUs that include a fully integrated GPU on their motherboards. With integrated GPUs, many computing applications can function effectively.

A discrete GPU, often known as a dedicated graphics card, is more appropriate for applications that require a lot of resources and have high-performance requirements. These GPUs increase processing power at the expense of increased energy use and heat production. For discrete GPUs to perform at their best, separate cooling is typically required. With the introduction of cutting-edge technologies like machine learning (ML) and deep learning, the demand for discrete GPUs has rapidly expanded, leading to their use in advanced driving assistance systems (ADAS), the infotainment system, and computing-intensive servers in cars, and other applications.

Automotive Graphic Processor Unit (GPU) Market – By Application

- Advanced Driver Assistance Systems(ADAS)

- Automatic emergency braking

- Blind spot detection

- Night Vision

- Navigation System

- Automatic Parking

- Adaptive Cruise Control

- Adaptive Headlights

- Heads-up Display (HUD)

- Pedestrian detection/avoidance

- Traffic sign recognition

- Lane departure warning/correction

- Others

- Infotainment System

- Telematics

- Others

Based on Application, the Automotive Graphic Processor Unit (GPU) Market is bifurcated into Advanced Driver Assistance Systems (ADAS), Infotainment Systems, Telematics, and Others. With the aid of embedded vision, ADAS systems actively increase safety by lowering the likelihood of accidents and occupant injuries. A novel AI function that uses sensor fusion to recognize and process things is integrated into the vehicle's cameras. With the use of image recognition software, ultrasonic sensors, lidar, and radar, sensor fusion combines massive volumes of data like how the human brain processes information. Physically, this technology can react more quickly than a driver ever could. It can instantly evaluate streaming video, identify what it reveals, and decide how to respond. Among these discrete sensors are Light detection and ranging (LiDAR), which uses pulsed laser light to gauge a target's distance, Infrared (IR) cameras systems, which use thermal imaging to see in the dark, and radio detection and ranging (radar), which is similar to LiDAR but uses radio waves rather than a laser. By allowing functions like lane detection, lane departure warning, road signs or pedestrian detection, and distracted driver warning, embedded GPUs powered by AI can make autonomous vehicles smarter. Deep learning algorithms can be used in autonomous vehicles to dynamically determine travel routes with the help of geo-tagging of photos and landmarks. Sensor integration enables accurate and reliable on-road navigation.

Advanced driver-assistance systems (ADAS) based on GPU technology can also lessen human error, which is responsible for 94 % of auto accidents in the US alone and 1.2 million fatalities annually, according to data from the World Health Organization and the National Highway Traffic Safety Administration, respectively. Businesses in the sector have been integrating considerably more sophisticated sensors and cameras to find objects in the area. The bird's eye view parking help is the newest invention. The heads-up display, or HUD, is another recently introduced and practical feature. A HUD's primary function is to show the necessary information on the windshield, which spares the driver from having to look down at the instruments. Alternately, the information is projected directly onto a dedicated, clear display that is mounted in front of the windscreen. Usually used as a speedometer and GPS aid, a car HUD. Numerous optional infotainment system options for new car models are available and can help the driver. The embedded technologies known as telematics are utilized to control several vehicle functions. For instance, telematics systems connect the car to the cloud (V2X) and protect the passengers (eCall and Roadside Assistance.) Telematics is essential for providing over-the-air updates for passenger and vehicle security.

Automotive Graphic Processor Unit (GPU) Market - By Region:

- North America

- Europe

- Asia-Pacific

- Rest of the World

Based on regional analysis, the North America Automotive Graphic Processing Unit (GPU) Market is anticipated to account for a significant market share owing to the presence of key market players in the region and rising demand for GPUaaS from the CAD/CAM industry. Within Europe, the automotive graphic processor unit market in Germany is anticipated to grow at a high CAGR during the forecast period. Asia-Pacific holds a considerable share in the global automotive market owing to the huge demand for high graphic computing systems. The presence of numerous gaming sector giants in the region is forecasted to support the APAC market value during the forecast period.

Major Key Players in the Market

- Nvidia Corporation

- AMD

- Intel Corporation

- Qualcomm Technologies, Inc.

- Imagination Technologies are among the tech behemoths dominating the global automotive Graphic Processing Unit (GPU) Market. Nvidia produces the best discrete graphics cards, while Intel is unrivaled in terms of integrated graphics.

NVIDIA is one of the top innovators in the current market of operations focused on GPU Automotive integrations on a global scale of operability. Nvidia has more than 370 collaborations committed to autonomous driving. The goal of Nvidia is to make self-driving cars more effective and secure. Nvidia is therefore working with organizations like Tesla, Toyota, Volkswagen, and Audi. For completely autonomous systems, NVIDIA DRIVE Hyperion 8 is a computational framework and sensing toolkit.

To compete in the worldwide market, Imagination Technologies has been creating new functional automated driving systems. The virtualization technology capabilities of the PowerVR technology enable it to run several operating systems (OS) on a single GPU core with a little performance impact.

Notable happenings in the Automotive Graphic Processor Unit (GPU) Market in the recent past:

Product Launch- In May 2022, AMD introduced the AMD Radeon RX 6950 XT, the most potent graphics card in the Radeon RX 6000 Series family, the Radeon RX 6750 XT, and Radeon RX 6650 XT graphics cards as new additions to the AMD Radeon™ RX 6000 Series product range.

Product Launch- In January 2021, Qualcomm Technologies, Inc. unveiled its newest line of digital cockpit solutions with the 4th Generation Qualcomm® SnapdragonTM Automotive Cockpit Platforms. The vehicle digital cockpit is transitioning to a zonal electronic/electrical (E/E) compute architecture driven by the cost, complexity, and requirement for a central computing consolidation.

Product Launch- In June 2021, Tesla unveiled a cutting-edge AV training supercomputer. The incredible GPU cluster that supports Autopilot and full self-driving are powered by NVIDIA A100 GPUs. For the highest-performing data centers around the world, NVIDIA A100 GPUs provide acceleration at every scale. The A100 GPU, which is supported by NVIDIA's Ampere Architecture, offers up to 20 times the performance of the previous generation and can be divided into seven GPU instances to adapt to changing demands.

Acquisition- In October 2020, AMD and Xilinx announced signing a legally binding agreement under which AMD will pay $35 billion in all-stock for Xilinx. The acquisition will establish Xilinx as the industry's top high-performance computing business and greatly broaden AMD's client base and product portfolio across a variety of emerging areas. The deal is anticipated to produce market-leading growth and be immediately accretive to AMD margins, EPS, and free cash flow creation. AMD will provide the strongest portfolio of high-performance processor technologies in the market, integrating GPUs, CPUs, FPGAs, Adaptive SoCs, and deep software knowledge to allow industry-leading computing platforms for cloud, edge, and end devices. Together, the combined company will seize opportunities across some of the most significant growth categories in the industry, including data centers, the automobile, aerospace, industrial, PCs, gaming, communications, and defense.

Chapter 1. Automotive Graphic Processor Unit (GPU) Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Automotive Graphic Processor Unit (GPU) Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2027) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2027

2.3.2. Impact on Supply – Demand

Chapter 3. Automotive Graphic Processor Unit (GPU) Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Automotive Graphic Processor Unit (GPU) Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Automotive Graphic Processor Unit (GPU) Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Automotive Graphic Processor Unit (GPU) Market – By Type

6.1. Integrated

6.2. Discrete

Chapter 7. Automotive Graphic Processor Unit (GPU) Market – By Application

7.1. Advanced Driver Assistance Systems(ADAS)

7.1.1. Automatic emergency braking

7.1.2. Blind spot detection

7.1.3. Night Vision

7.1.4. Navigation System

7.1.5. Automatic Parking

7.1.6. Adaptive Cruise Control

7.1.7. Adaptive Headlights

7.1.8. Heads-up Display (HUD)

7.1.9. Pedestrian detection/avoidance

7.1.10 Traffic sign recognition

7.1.11. Lane departure warning/correction

7.1.12. Others

7.2. Infotainment System

7.3. Telematics

7.4. Others

Chapter 8. Automotive Graphic Processor Unit (GPU) Market - By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Automotive Graphic Processor Unit (GPU) Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Nvidia Corporation

9.2. AMD

9.3. Intel Corporation

9.4. Qualcomm Technologies, Inc.

9.5. Imagination Technologies

Download Sample

Choose License Type

2500

4250

5250

6900