Alcohol Subscription Box Market Size (2024 – 2030)

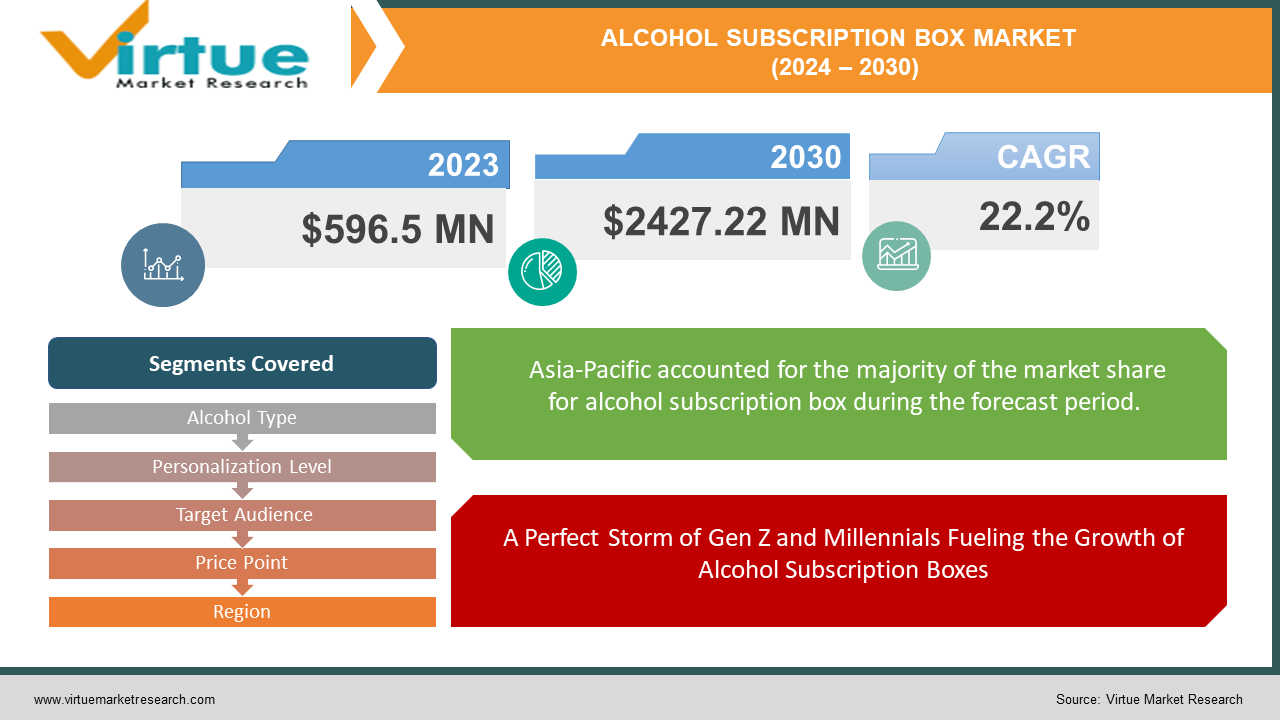

The Global Alcohol Subscription Box Market was valued at USD 596.5 million in 2023 and is projected to reach a market size of USD 2427.22 million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 22.2%.

Subscription boxes for alcohol provide a fun and easy way to try out different beverages. These monthly delivery boxes handpick beers, wines, or spirits according to users' tastes or theme choices. Additionally, the box frequently includes information about the beverages, which makes learning about them enjoyable. They also make thoughtful presents for daring drinkers.

Key Market Insights:

- Generation Z and millennials are propelling the expansion of alcohol subscription boxes. These populations place a high value on convenience and experiences, which is ideal for the service delivery and discovery features.

- Millennials are more likely than baby boomers to be interested in sampling new alcoholic beverages (42% versus 33%). This pattern shows how subscription boxes may serve an increasing number of people who are interested in exploring new things.

- In the market for alcoholic subscription boxes, customization is essential for success. Customers are searching for boxes that suit their preferences and financial constraints. Seventy per cent of customers want their experiences to be tailored by businesses. Customers might be drawn to and kept loyal to subscription boxes that provide alternatives depending on dietary restrictions or preferences.

- The market for subscription boxes containing alcohol is getting more and more competitive. While new competitors compete for market share, established firms are growing their product lines. Customers gain from this rivalry as it encourages creativity and diversity in package themes and options.

- In the last five years, the number of subscription box businesses selling alcohol has increased by nearly 200% alone in the US.

Global Alcohol Subscription Box Market Drivers:

A Perfect Storm of Gen Z and Millennials Fueling the Growth of Alcohol Subscription Boxes

The emergence of Gen Z and millennial customers is a key factor behind the expansion of alcohol subscription boxes. These groups, in contrast to earlier ones, value experiences over material belongings and are addicted to convenience in their everyday lives. Both desires are adequately satisfied by subscription boxes.

By exposing customers to distinctive flavors and varietals they would not have found on their own, they provide the excitement of finding new and intriguing drinks. This feature satisfies their need to explore and their sense of adventure. The convenience element cannot be denied. The days of feeling overwhelmed by large options or stumbling through busy liquor stores are long gone. A selection is hand-picked and sent right to their home by subscription boxes, which are based on themes or tastes. This fits the hectic lifestyles of this tech-savvy generation well by eliminating choice fatigue and saving important time. These groups make up a sizable section of the population, and they are more interested in trying new drinks than prior generations were, thus alcohol subscription boxes have a sizable and fertile target market to work with.

The Revolution of the Alcohol Subscription Box: From Generic Alcohol to Crafted Discovery Personalisation

Nowadays, a one-size-fits-all approach is no longer sufficient. This is particularly true in the market for alcohol subscription boxes, were customization reigns supreme. Generic options are no longer acceptable to customers. They want individualized experiences that satisfy their distinct tastes and inclinations.

Seventy percent of those surveyed said they expected businesses to customize their products. Subscription boxes for alcohol that satisfy this need can be more successful. These boxes make sure clients receive beverages they'll genuinely appreciate by offering selections based on taste preferences (think powerful reds against crisp whites for wine fans, or IPAs versus lagers for beer fanatics).

Furthermore, acknowledging dietary limitations such as gluten-free alternatives allows for a broader audience. Subscription boxes can cultivate deeper client connections through personalization, which in turn encourages consumer loyalty and repeat business.

Unlock Market Insights: Get A FREE Sample Report Today!

Global Alcohol Subscription Box Market Restraints and Challenges:

Notwithstanding the market development for alcohol subscription boxes, there remain obstacles to overcome. State-by-state variations in the complex laws governing the sale and distribution of alcohol cause problems for license applicants and restrict the market reach of some businesses.

Alcohol is a regulated product, thus delivering it logistically is more complicated due to rules for age verification and temperature control. Getting new customers may be costly for businesses that are competing in a crowded industry. It might be difficult to keep subscribers interested even once you've drawn them in.

Companies must continually innovate with new themes and customization choices to minimize churn since the initial joy of discovery might wane. Finally, pricing wars and difficulty standing out among identical offers might result from a saturated market with new entrants fighting for market share.

Global Alcohol Subscription Box Market Opportunities:

The worldwide market for subscription boxes that contain alcohol is full of opportunities and is no longer simply about convenience. Businesses can enter specialized sectors and focus on ardent customers with hobbies. Think of a package filled with natural wines for daring oenophiles or craft beers from the Pacific Northwest for hopheads.

Technology may also become more important. Subscription boxes may become hyper-personalized by using data and past purchases to deliver customers choices they'll genuinely adore and keep them coming back for more. A touch of exclusivity with items not found anywhere else can be added by strategic relationships with well-known businesses like wines or breweries.

Examining alcohol in a different light offers an additional fascinating prospect. A subscription box for craft coffee, artisanal mixers, or non-alcoholic drinks might appeal to customers who are looking for something new or who are health conscious. Lastly, market consolidation through mergers and acquisitions may occur in the future. This may result in a market where a small number of dominant companies reach a larger audience and provide a greater range of subscription boxes.

GLOBAL ALCOHOL SUBSCRIPTION BOX MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

22.2% |

|

Segments Covered |

By Alcohol Type, Personalization Level, Target Audience, Price Point, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Barrel Noir (US), Craft Vines (Australia), Drinks & Co. (China), Firstleaf (US), Flaviar (US), Honest Brew (UK), Naked Wines (US), Sake of the Month Club (Japan), Taster Club (Europe), The Bottle Club (Europe), The Craft Gin Club (UK), The Whisky Club (Asia), Vinothai (Thailand), Virgin Wines (UK), Winc (US) |

CUSTOMIZE THIS FULL REPORT AS PER YOUR NEEDS

GLOBAL ALCOHOL SUBSCRIPTION BOX MARKET SEGMENTATION ANALYSIS

Global Alcohol Subscription Box Market Segmentation: By Alcohol Type

-

Wine

-

Beer

-

Spirits

-

Mixed Boxes

While Mixed Boxes are convenient, Wine is the category in the Global Alcohol Subscription Box Market with the highest volume and quickest rate of growth. This is probably because wine appeals to a broader spectrum of palates than beer, spirits, or even mixed boxes. There is a huge variety of wine varieties, and styles.

While spirits have a devoted following, they are believed to provide less diversity than beer, which has a larger following but may be growing more slowly. Compared to wine-focused subscriptions, Mixed Boxes may not always exactly match individual taste preferences, despite its potential and ability to serve niche markets.

Global Alcohol Subscription Box Market Segmentation: By Personalization Level

-

Curated Boxes

-

Partially Curated Boxes

-

Fully Customized Boxes

In the global alcohol subscription box market, personalization is becoming more and more important, with fully customized boxes emerging as the fastest-growing category. The desire of consumers to have more control over their choices and to make sure they receive exactly what they like is what's behind this spike.

Data innovations enable some personalization even in carefully chosen boxes, but completely customized solutions are the best. This allows customers to create their own package and precisely meets the needs of the increasing number of people with specialized tastes, such as sugar-free drinks or gluten-free beers. The ability for consumers to customize their own distinctive drinking experiences is the key to the future of subscription boxes.

Global Alcohol Subscription Box Market Segmentation: By Target Audience

-

Millennials & Gen Z

-

Wine Enthusiasts

-

Cocktail Lovers

-

Health-Conscious Consumers

Never undervalue the influence of health nuts! Unexpectedly, the sector with the quickest rate of growth in the Global Alcohol Subscription Box Market's target audience segmentation is Health-Conscious Consumers. By providing sugar-free drinks, low-carb beers, or even non-alcoholic beverages, this capitalizes on the rapidly growing health trend.

With an emphasis on healthy alternatives, this appeals to a sizable and quickly expanding audience, expanding the market beyond conventional possibilities and introducing innovative new subscription boxes. Although Gen Z and Millennials are still quite powerful, health-conscious customers are presently leading the way.

Global Alcohol Subscription Box Market Segmentation: By Price Point

-

Budget-Friendly Boxes

-

Mid-Range Boxes

-

Premium Boxes

In the global alcohol subscription box market, the fastest-growing sector in terms of price point is the mid-range. This balance between cost and quality is ideal for a wide range of consumers who want good value without compromising on experience or flavor. While premium choices target a smaller but more affluent audience, budget-friendly boxes may struggle with limited availability. Most buyers find mid-range boxes to be the most enticing balance, which drives their rise.

What's Next for Your Market? Get a Snapshot with FREE Sample Report

Global Alcohol Subscription Box Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the area in the global alcohol subscription box market that is expanding at the quickest rate. Because of the region's thriving economies, a target demographic with discretionary cash is ready to consider subscription boxes. The online character of these services is ideally aligned with the boom in e-commerce adoption that has occurred in Asia-Pacific.

Furthermore, subscription box businesses may explore new and interesting opportunities in Asia-Pacific, unlike the oversaturated markets in North America and Europe, which is contributing to their rapid expansion.

COVID-19 Impact Analysis on the Global Alcohol Subscription Box Market:

The market for alcohol subscription boxes saw a wild ride because of COVID-19. Early on, lockdowns caused supply chain disruptions that hindered the availability of some beverages, particularly imports. Changes in customer behavior also contributed to the closure of bars and the spike in alcohol sales at retailers, which may have caused some to temporarily halt subscriptions.

Maintaining temperature control presented difficulties for logistics, and during lockdowns, age verification became even more important. But the epidemic also brought about long-term changes. Subscription boxes benefited from the stay-at-home constraints that drove an e-commerce boom and made people feel safe purchasing booze online. Convenience became a key selling element as individuals who were confined to their homes loved the simplicity of trying out new drinks that were brought right to their doors.

Businesses responded by focusing on at-home happy hour experiences in their themed boxes or by providing drinks that didn't require a lot of complicated equipment. In conclusion, even though COVID-19 initially created some difficulties, the long-term results seem promising. The subscription box model is well suited to the growing e-commerce, convenience-seeking customer base, and increasing off-premises sales trends, which may pave the way for future expansion.

Recent Trends and Developments in the Global Alcohol Subscription Box Market:

There are a lot of fascinating innovations happening in the worldwide booze subscription box business. Personalization transcends simple curation. Imagine a wine box that utilizes AI and data to select your preferred varietal each month, while also taking your prior purchases and preferences into account to create a genuinely unique and wonderful selection. To meet specialized interests and nutritional demands, the market is also fragmenting. Natural wine boxes, low-sugar drinks, and even craft brews made with certain ingredients, including gluten-free alternatives, are becoming more and more popular.

Additionally, subscription boxes are expanding to include experiences rather than just drinks. Consider gourmet food and themed boxes, cocktail kits with recipe cards and bar accessories, or even online tastings conducted by professionals. This turns the experience from a straightforward transaction into something more captivating and unforgettable.

Another important theme is sustainability. In response, subscription boxes are providing carbon-neutral delivery, using sustainable suppliers, and eco-friendly packaging to appeal to customers who care about the environment.

At last, well-known companies are joining up with subscription services. Larger businesses may eventually reach a bigger audience and provide a greater choice of boxes because of mergers and acquisitions. These patterns show how the market for alcohol subscription boxes is evolving interestingly. To create unforgettable experiences, it goes above and beyond convenience by embracing sustainability, providing individualized experiences, and catering to specialized markets. The future is promising for this creative and quickly expanding sector.

Key Players:

-

Barrel Noir (US)

-

Craft Vines (Australia)

-

Drinks & Co. (China)

-

Firstleaf (US)

-

Flaviar (US)

-

Honest Brew (UK)

-

Naked Wines (US)

-

Sake of the Month Club (Japan)

-

Taster Club (Europe)

-

The Bottle Club (Europe)

-

The Craft Gin Club (UK)

-

The Whisky Club (Asia)

-

Vinothai (Thailand)

-

Virgin Wines (UK)

-

Winc (US)

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Chapter 1. Alcohol Subscription Box Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Alcohol Subscription Box Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Alcohol Subscription Box Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Alcohol Subscription Box Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Alcohol Subscription Box Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Alcohol Subscription Box Market – By Personalization Level

6.1 Introduction/Key Findings

6.2 Curated Boxes

6.3 Partially Curated Boxes

6.4 Fully Customized Boxes

6.5 Y-O-Y Growth trend Analysis By Personalization Level

6.6 Absolute $ Opportunity Analysis By Personalization Level, 2024-2030

Chapter 7. Alcohol Subscription Box Market – By Alcohol Type

7.1 Introduction/Key Findings

7.2 Wine

7.3 Beer

7.4 Spirits

7.5 Mixed Boxes

7.6 Y-O-Y Growth trend Analysis By Alcohol Type

7.7 Absolute $ Opportunity Analysis By Alcohol Type, 2024-2030

Chapter 8. Alcohol Subscription Box Market – By Target Audience

8.1 Introduction/Key Findings

8.2 Millennials & Gen Z

8.3 Wine Enthusiasts

8.4 Cocktail Lovers

8.5 Health-Conscious Consumers

8.6 Y-O-Y Growth trend Analysis By Target Audience

8.7 Absolute $ Opportunity Analysis By Target Audience, 2024-2030

Chapter 9. Alcohol Subscription Box Market – By Price Point

9.1 Introduction/Key Findings

9.2 Budget-Friendly Boxes

9.3 Mid-Range Boxes

9.4 Premium Boxes

9.5 Y-O-Y Growth trend Analysis By Price Point

9.6 Absolute $ Opportunity Analysis By Price Point, 2024-2030

Chapter 10. Alcohol Subscription Box Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Personalization Level

10.1.2.1 By Alcohol Type

10.1.3 By Distribution Channel

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Personalization Level

10.2.3 By Alcohol Type

10.2.4 By Distribution Channel

10.2.5 By Distribution Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Personalization Level

10.3.3 By Alcohol Type

10.3.4 By Distribution Channel

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Personalization Level

10.4.3 By Alcohol Type

10.4.4 By Distribution Channel

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Personalization Level

10.5.3 By Alcohol Type

10.5.4 By Distribution Channel

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Alcohol Subscription Box Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Barrel Noir (US)

11.2 Craft Vines (Australia)

11.3 Drinks & Co. (China)

11.4 Firstleaf (US)

11.5 Flaviar (US)

11.6 Honest Brew (UK)

11.7 Naked Wines (US)

11.8 Sake of the Month Club (Japan)

11.9 Taster Club (Europe)

11.10 The Bottle Club (Europe)

11.11 The Craft Gin Club (UK)

11.12 The Whisky Club (Asia)

11.13 Vinothai (Thailand)

11.14 Virgin Wines (UK)

11.15 Winc (US)

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Alcohol Subscription Box Market size is valued at USD 596.5 million in 2023.

The worldwide Global Alcohol Subscription Box Market growth is estimated to be 22.2% from 2024 to 2030.

The Global Alcohol Subscription Box Market is segmented By Alcohol Type (Wine, Beer, Spirits, Mixed Boxes); By Personalization Level (Curated Boxes, Partially Curated Boxes, Fully Customized Boxes); By Target Audience (Millennials & Gen Z, Wine Enthusiasts, Cocktail Lovers, Health-Conscious Consumers); By Price Point (Budget-Friendly Boxes, Mid-Range Boxes, Premium Boxes) and by region.

The global alcohol subscription box market has a bright future ahead of it. Anticipate AI-driven services that provide recommendations based on users' tastes and purchasing patterns. Health-conscious customers will be served by niche markets such as those for sugar-free cocktails and gluten-free artisan brews. Gourmet food combinations, virtual sampling, and special offers are making the experience more immersive and memorable than merely drinking beverages.

The global alcohol subscription box market was affected by the COVID-19 outbreak in a variety of ways. A long-term boom in e-commerce, convenience, and off-premises sales countered the initial interruptions caused by supply chain concerns and changing customer behavior, all of which favored subscription boxes.